President-elect Trump is selecting his workers appointees who’re perceived by some to be controversial, unqualified, and even extremists. The justification is commonly that they’re disruptors who will problem the established order. The rhetoric is growing about including tariffs, eliminating companies, lowering laws, and chopping Federal spending and workers. Rhetoric strikes markets. This text is about defending our portfolios from chaos throughout occasions of excessive uncertainty.

Throughout the first three years of President Trump’s first time period, Federal spending elevated by 9 % after adjusting for inflation. This was partly as a result of the 2017 tax cuts didn’t generate adequate development to pay for themselves. Throughout the subsequent 4 years with the pandemic-era stimulus, Federal spending elevated by a further seventeen % adjusted for inflation. Federal spending is now roughly $7.1 trillion with a deficit of $1.7 trillion that’s financed by including to the roughly $36 trillion in nationwide debt with curiosity prices of $1 trillion to finance that debt. This isn’t sustainable.

I anticipate gradual development this coming decade as a result of inhabitants development continues to gradual and is a key driver of financial development, Federal spending is a part of the financial system, and chopping it should be offset by different drivers. Tariffs are inflationary, and rates of interest should keep greater for longer to finance the nationwide debt. With inventory evaluations and rates of interest excessive, returns over the intermediate time period favor bonds. One other issue to think about is that the greenback has superior practically 40% since 2011 which has saved import prices low, but in addition seems overvalued.

To guage a Chaos Protected Portfolio, I chosen between 1,600 to three,300 funds from every of the 2000, 2010, and 2020 many years and ranked them based mostly on danger and return metrics. The highest-ranked funds have been mixed and ranked by risk-adjusted efficiency for the Dotcom, Nice Monetary Disaster, and COVID full cycles in addition to the previous twenty-five years.

There are some unfastened similarities between now and the Dotcom Full Cycle from September 2000 to October 2007 as proven under. The tip outcome was that the S&P 500 fell 45% through the Dotcom bear market.

- The S&P 500 price-to-earnings ratio hovered between 27 and 46 throughout 2000 and 2001 in comparison with practically 31 now.

- The greenback fell 25% from 2002 to 2008.

- Inflation hovered between 2.0% and three.5%.

- The Federal Funds price went from 6.5% in mid-2000 to 1% in 2004 and again as much as 5.3% in 2007.

- Actual Gross Home Product went from 4% in 2000 to 1% in 2001 to three.8% in 2004 and again all the way down to 2% in 2007. A gentle recession occurred.

- Gold went from $293 per ounce in 2000 to $696 in 2007. It’s now $2,685.

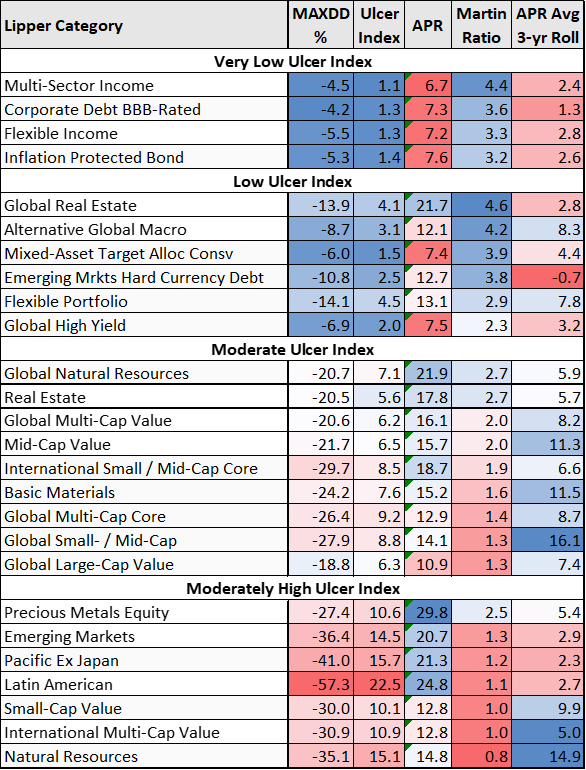

Desk #1 exhibits a few of the best-performing Lipper Classes through the Dotcom full cycle from September 2000 to October 2007. For comparability functions, over the total cycle, the Ulcer Index of the S&P 500 was 22, the annualized % return was 1.9%, and the Martin Ratio was -0.1. The Ulcer Index measures danger because the depth and size of drawdowns, and the Martin Ratio is a measure of risk-adjusted returns.

Desk #1: Lipper Classes for the Chaos Protected Portfolio (Full Cycle September 2000 to October 2007)

Supply: Creator Utilizing MFO Premium fund screener and Lipper world dataset.

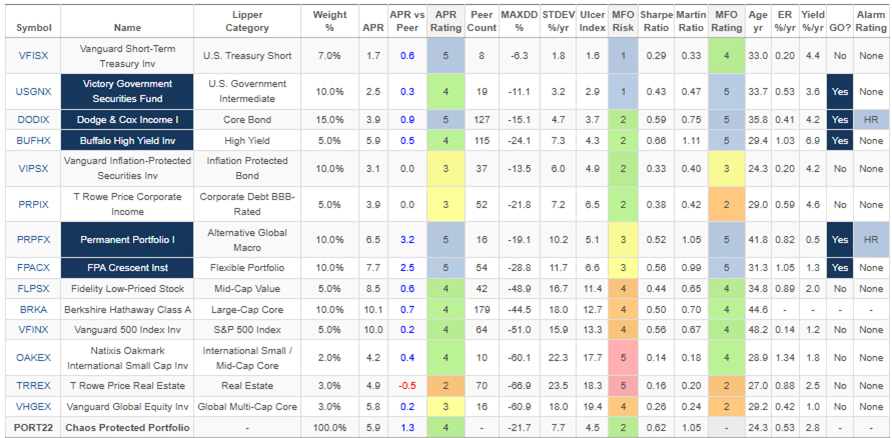

I created an all-weather portfolio for the previous twenty-five years as proven in Desk #2. There’s a tradeoff between danger and return. A youthful me aggressively invested a hundred percent in shares, whereas an older and extra conservative me now holds a standard 60% inventory to 40% bond allocation based mostly on matching withdrawal wants with time horizons utilizing the Bucket Strategy. The Chaos Protected Portfolio displays my private biases that one ought to keep diversified portfolios, and within the coming decade, I anticipate bonds to carry out higher than shares on a risk-adjusted foundation. The Chaos Protected Portfolio would have returned 5.9% with a most drawdown of twenty-two% over the previous twenty-five years in comparison with a return of 10% for the S&P 500 with a most drawdown of 51%. MFO Danger for the Chaos Protected Portfolio is estimated to be “2” for Conservative, and the APR ranking is Above Common.

Desk #2: Chaos Protected Portfolio (25.8 Years)

Supply: Creator Utilizing MFO Premium fund screener and Lipper world dataset.

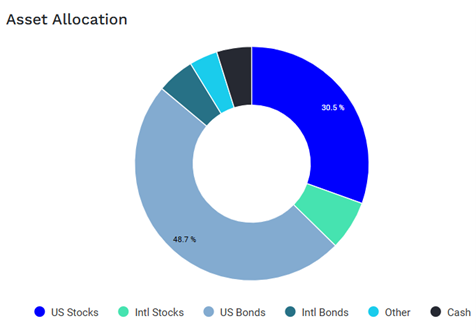

I used Portfolio Visualizer to see the present asset allocation of the portfolio which is about 37% shares with seven % allotted to worldwide shares.

Determine #1: Chaos Protected Portfolio Asset Allocation

Supply: Creator Utilizing Portfolio Visualizer – Backtest Portfolio Asset Allocation

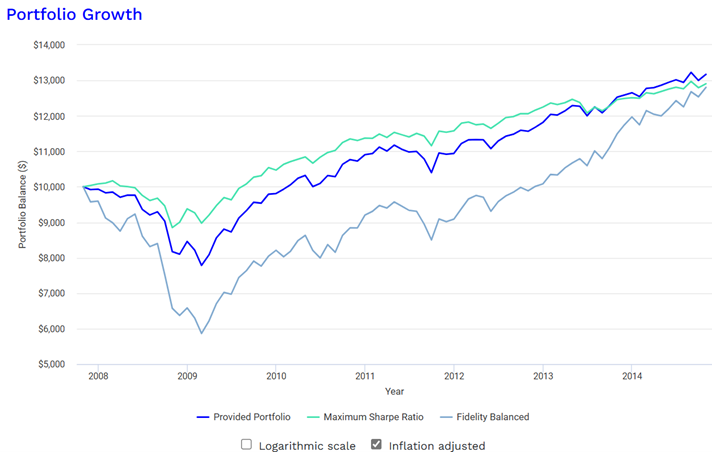

Determine #2 exhibits how the Chaos Protected Portfolio would have carried out through the Nice Monetary Disaster in comparison with the identical funds that maximized the Sharpe Ratio and to the Constancy Balanced fund. The returns are adjusted for inflation. It might have taken seven years for the Constancy Balanced Portfolio to catch as much as the extent of the Chaos Protected Portfolio. This is named “sequence of return danger”.

Determine #2: Chaos Protected Portfolio Efficiency Throughout the Nice Monetary Disaster

Supply: Creator Utilizing Portfolio Visualizer – Portfolio Optimization – Nice Monetary Disaster

I’m at present studying Tips on how to Retire: 20 Classes for a Glad, Profitable, and Rich Retirement by Christine Benz, Director of Private Finance and Retirement Planning for Morningstar which was launched in September. There’s a wealth of knowledge in it even for these of us already in retirement. She factors out that sources of withdrawals must be based mostly on market situations, and blended asset funds might not be as advantageous as a mix of inventory and bond funds for choosing the place to withdraw funds. She advocates allocating ten % to money as a result of in some years each shares and bonds could carry out poorly. One other level that I discover helpful is to construction your portfolio to be versatile with withdrawals and match discretionary spending to market situations.

Extending tax cuts are prone to have a optimistic impact on shares in 2025 and maybe 2026 however with excessive valuations, returns will most likely be dampened. Excessive commonplace deductions and decrease tax charges will assist retirees. There will probably be winners and losers in tariff wars. Deregulation will assist monetary establishments, however improve danger.

I take advantage of Constancy to handle a portion of my belongings utilizing the enterprise cycle strategy, and Vanguard to handle a portion utilizing a low-cost buy-and-hold strategy. I handle the remainder based mostly on my expectations. I’ve adjusted a part of my portfolio together with the ideas on this Chaos Protected Portfolio article and the Bucket Strategy advocated by Ms. Benz. By small changes and rebalancing, my allocation to shares has been lowered by about three proportion factors. I view this as taking slightly danger off the desk after the current rise within the inventory market. I focus danger in my Bucket #3 for long-term development and to reduce taxes.

I keep diversified bond funds in my conservative tax-advantaged accounts. With rates of interest excessive and a mushy touchdown seemingly, I lately elevated allocations to reasonably riskier actively managed bond funds together with Vanguard World Credit score Bond (VGCIX), Vanguard Intermediate-Time period Funding-Grade (VFICX), Vanguard Multi-Sector Earnings Bond (VMSIX), and Constancy Advisor Strategic Earnings (FADMX/FSIAX). That is in keeping with this text of constructing a Chaos Protected Portfolio. I desire these funds to Excessive Yield funds.

I’ve appointments arrange with my advisors subsequent 12 months to withdraw from extra aggressive tax-advantaged accounts as an alternative of conservative accounts to additional pull slightly danger off the desk whereas replenishing Bucket #1 for dwelling bills.

Take pleasure in a protected and completely happy vacation season!