In the event you’re a savvy client however dislike having to take care of insurance coverage brokers who attempt to exhausting promote or affect you in direction of getting sure merchandise that you understand aren’t nice for you and your loved ones, then take a look at Planner Bee. Other than permitting you to handle your (and your loved ones’s) insurance coverage insurance policies multi functional place, it affords a brand new mannequin of shopping for insurance coverage – the place you and your wants come first, and the agent servicing comes solely on the finish AFTER you’ve made your determination. Can know-how take away the commissions bias that’s inherent within the trade? I’m definitely hopeful, however you may learn on to determine for your self!

what you need to purchase, and head on-line to check quotes on varied on-line aggregators. Then, you uncover that you just’ve run into a number of points:

- Most on-line aggregators provide quotes from solely a restricted variety of insurers, or product varieties (e.g. pet insurance coverage will not be widespread, just a few portals have it)

- When you know what you need, you want to communicate with somebody to ask questions and make clear your issues earlier than you commit, particularly to a long-term plan like life or medical insurance

- You attempt to name up your insurance coverage agent pal for it, solely to grasp that they’re unable to get you quotes from insurers like AIA, Nice Jap or Prudential.

- Generally, your agent is unavailable and doesn’t reply…which makes you marvel, what is going to occur once you want them throughout claims then? Who do you go to in the event that they’re the one contact you might have for that coverage?

The state of the insurance coverage market at present

The insurance coverage trade is fraught with conflicts of curiosity, which regularly implies that shoppers have little to no clue as as to whether their insurance coverage agent is recommending them the perfect coverage that meets their wants, or one that’s higher for the agent’s earnings. From totally different commissions charges abroad journeys for pushing sure merchandise, these incentive buildings are sometimes not made identified to the patron, making it even tougher for them to guage what is actually driving their agent’s suggestions.

I’ve met dozens of insurance coverage brokers, and most fail to actually impress me sufficient to earn my belief. For those who do, I’ve saved them shut through the years, utilizing their suggestions as a second (typically third) opinion to assist validate whether or not my determination is appropriate.

The tell-tale indicators normally seem when your agent is fast to advocate you complete life insurance coverage, investment-linked plans (ILPs) or endowment insurance policies spanning over 20 or 30 years. It’s a indisputable fact that time period life insurance coverage is a much more cost-effective option to defend towards mortality for many shoppers*, whereas investment-linked plans with their excessive charges will hardly enable you to beat the market and most endowment plans have barely saved up with market returns.

*See a case examine of when the opposite argument (complete life over time period life) may maintain true right here, resembling when somebody does NOT need to purchase time period and make investments the remainder.

After my latest article about how insurance coverage brokers are compensated in Singapore, the staff at Planner Bee reached out to me to share their resolution to this downside. As an award-winning fintech app helmed by a staff from insurance coverage and wealth administration backgrounds, Planner Bee was designed to assist shoppers make knowledgeable selections based mostly on their wants reasonably than an agent’s commissions.

And the reality is, until your insurance coverage wants are complicated, you may be higher off planning for your self, so that you could remove all these potential conflicts of curiosity within the first place! That is what I’ve personally finished for the final decade, and I like to recommend that you just take possession of managing your personal insurance coverage insurance policies for your self on this method too.

However as a DIY insurance coverage planner, the place do you go to make sure that you’re heading in the right direction?

Discover and handle your insurance coverage insurance policies in a single place

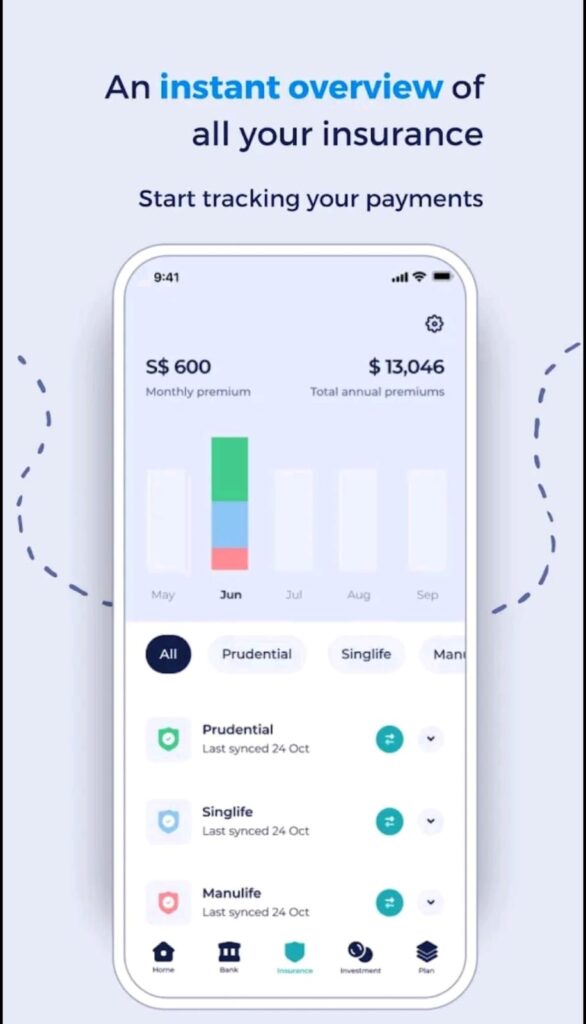

Enter Planner Bee, a cell private monetary software designed by Singaporeans to cater particularly to the wants of insurance coverage patrons right here. Powered by their very own proprietary engine, the app’s dashboard was additionally among the many first in Singapore to supply customers a one-stop overview of their varied insurance coverage insurance policies throughout a number of insurers.

You should use it to handle not simply your personal insurance policies, but in addition that of your loved ones. In a single look, you’ll be capable to monitor:

- What plans you (and your loved ones) have

- The protection provided by every, and in whole

- The premiums and renewal (cost) dates for every coverage

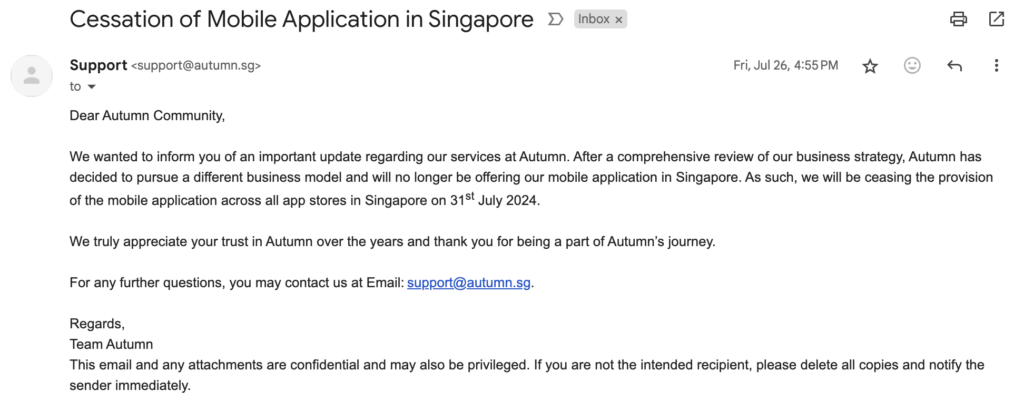

I beforehand beneficial the Autumn app for this objective to lots of you, however after Normal Chartered Financial institution determined to place the brakes on that challenge earlier this yr, I’ve been looking for another resolution – and located it in Planner Bee.

As soon as I had manually keyed within the particulars of my insurance policies (and my complete household’s), I might now see and handle all of them inside the app.

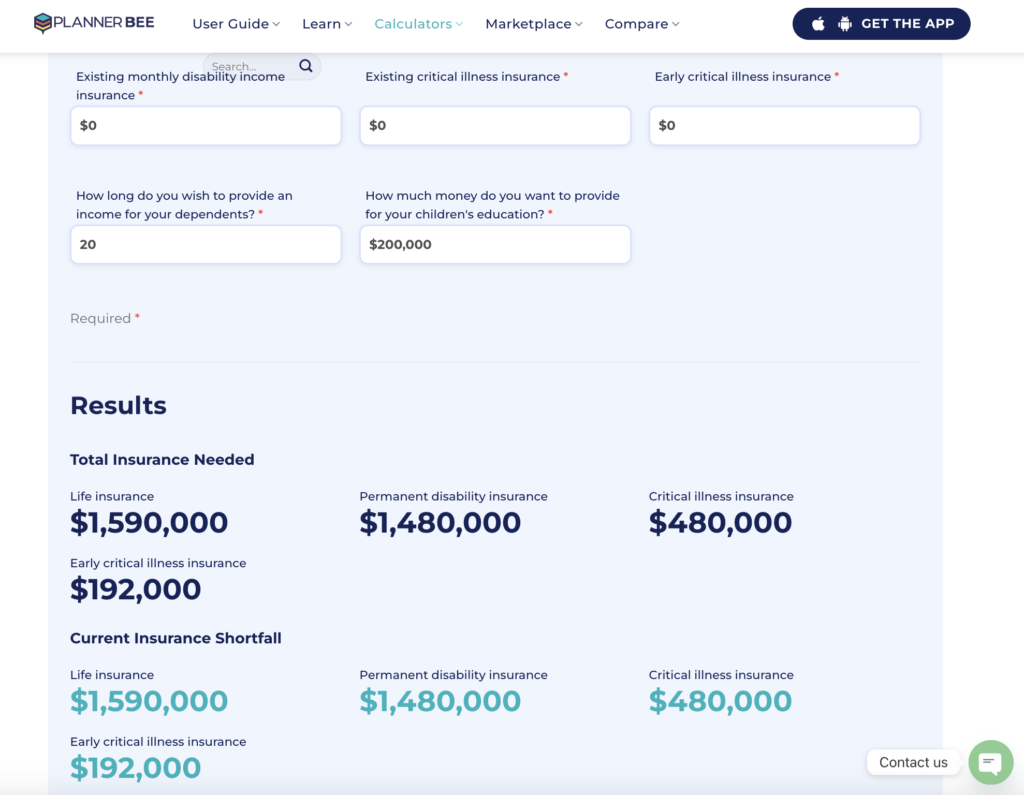

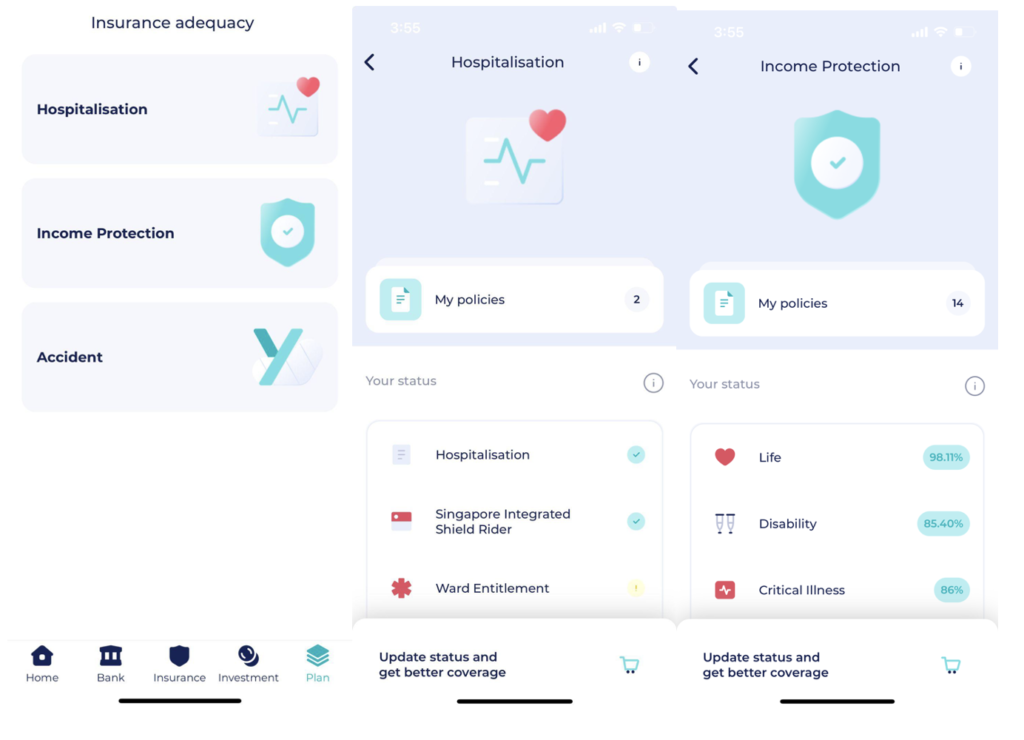

And with instruments resembling an insurance coverage wants calculator, you’ll be guided on determining the overall insurance coverage protection you want and whether or not your present insurance policies adequately defend you.

As soon as you understand what gaps it is advisable fill, you may then navigate their market to check throughout insurers and insurance policies. Planner Bee sources merchandise and quotes from throughout 29 insurers in a single place, which saves you effort and time because you not want to go to a number of suppliers individually. Whether or not you want a private accident plan or a maternity cowl, it is possible for you to to check the advantages throughout totally different plans and insurers in a single view.

As the prices of premiums for a similar plan differ at totally different instances based mostly on the insurers’ reductions, your age and gender, it’s usually tough for shoppers to check simply. Even brokers from FAs that distribute merchandise from a number of insurers could have a tricky time getting these quotes for you, since insurers resembling Nice Jap and Prudential sometimes don’t open up distribution channels with these businesses in an effort to defend their very own tied brokers.

You may get round this by requesting for a personalised quote from Planner Bee; merely submit your particulars, sum of protection wanted and your annual finances for premiums.

Powered by its proprietary suggestion engine, you too can enter your insurance coverage wants and let the Planner Bee platform make personalised and brand-agnostic insurance coverage solutions for you, making it simpler so that you can discover the appropriate coverage with out bias.

Which means whether or not you’re searching for medical insurance to cowl medical prices or life insurance coverage for household safety, Planner Bee brings every part below one roof, making it a simple, one-stop store in your insurance coverage wants.

Are you able to belief Planner Bee?

Planner Bee was based by Ms. Cherie Wang, who’s a licensed Chartered Monetary Guide (ChFC) and Chartered Life Underwriter (CLU) who has ranked within the prime 5% of monetary advisors globally for greater than 10 years.

However regardless of her achievements, Cherie acknowledged a persistent flaw within the system: many monetary advisors in Singapore sometimes function based mostly on commissions, which creates potential conflicts of curiosity. One other problem she confronted was that whereas working in an company, she and her colleagues didn’t all the time have entry to the perfect merchandise inside their distribution community to supply to shoppers.

Many consumers additionally sought her assist in managing their complete portfolios, together with insurance policies she didn’t have direct entry to. With over 20 insurers in Singapore, manually evaluating merchandise throughout the board every time was impractical, and it turned evident that her shoppers wanted a extra clear and environment friendly option to handle their insurance coverage portfolios.

This realisation drove her to work on Planner Bee, which was based with 2 fundamental objectives:

- To assist individuals handle their general funds in a single place.

- To supply an unbiased platform for needs-based monetary product comparability.

As their staff will not be affiliated with any insurance coverage firm, their aim is to help you in planning and buying insurance policies from a number of insurers with none bias or desire in direction of a selected firm.

Immediately, Planner Bee combines the comfort of a market with monetary calculators, an academic library, and personalised steerage from licensed advisors that will help you get lined with confidence. The monetary planning software now connects to 42 monetary establishments so you may consolidate your banking transactions, insurance coverage insurance policies, and funding portfolios multi functional place.

Tip: Keep in mind to all the time ask your advisor for his or her MAS Consultant Quantity, so you may test that they're licensed to deal with your case. Planner Bee gives these to the patron, upon request.

In contrast to aggregators that merely record insurance coverage merchandise, Planner Bee goes one step additional to supply instruments to assist DIY customers consider their very own insurance coverage wants and affords personalised quotations based mostly on these wants.

Your premiums are the identical when shopping for by means of Planner Bee or immediately from the insurance coverage suppliers.

And must you ever really feel caught or confused, you too can choose to seek the advice of a human advisor by means of their on-line session characteristic.

The app additionally categorises your insurance coverage insurance policies for you, so that you keep in mind what you’ve purchased and have already got lined. It additionally reminds you (by way of e mail and WhatsApp) when your renewal dates are nearing, so that you don’t have to fret about any insurance policies lapsing!

How Planner Bee solves for conflicts of curiosity

As an alternative of leaving the suggestions as much as particular person insurance coverage brokers, who could every push for various insurance policies for various causes, Planner Bee opts for a mannequin the place your quotations offered are pushed by the shopper’s necessities reasonably than which insurer is at the moment paying the very best commissions for closing or giving an incentive journey on.

How does know-how take away the bias? Most citation techniques at present require a human agent to key in particulars and choose the coverage that they want to get quotes for. In distinction, the citation techniques at Planner Bee doesn't have in mind commissions (because it doesn't have the knowledge within the system within the first place for it to be biased), and gives quotations solely based mostly on buyer’s necessities, finances and advantages or wants.

To offer you full visibility and management over your decisions, Planner Bee’s citation system kinds insurance policies by its profit options and premium charges. This basically guidelines out any biases that may favour insurance policies delivering greater commissions, serving to to make sure that prospects are getting the perfect worth for his or her cash.

Get your questions on any coverage answered by scheduling a Zoom name, or ship messages by way of WhatsApp to debate the offered quotations. When you’ve determined to buy, a video name (by way of Zoom) can be organized with a salaried licensed advisor, who will clarify the phrases and circumstances and confirm if the insurance policies chosen actually match your wants, so you should buy with a peace of thoughts.

Who ought to use Planner Bee?

In the event you already handle your personal insurance coverage insurance policies and also you’re merely searching for quotes and help with out having to take care of an agent exhausting promoting you, then you’ll love the Planner Bee expertise.

You get full management over your personal shopping for expertise with out the affect of any agent bias, but nonetheless have entry to ask the Planner Bee staff if it is advisable make clear any phrases or issues on the insurance policies you’re inspecting.

Other than its trendy digital insurance coverage planning interface for shoppers, a core advantage of Planner Bee is that it affords entry to over 500 insurance coverage merchandise throughout 29 insurers.

That is exhausting – or near unattainable – for many brokers or businesses to duplicate. It’s a well-known reality that you would be able to solely get Prudential insurance policies from a Prudential agent, as an example, which is why most on-line comparability portals or aggregators usually are not in a position to pull quotes for you from a model with solely tied brokers both.

No tied agent or unbiased monetary advisory group has entry to that many, nor can a single human go for ample product coaching on to turn into an knowledgeable in so many alternative merchandise. That’s the reason Planner Bee pulls from the power of their staff as one, with totally different individuals specialising in their very own strengths, model(s) or product portfolio. They mix the data and expertise to information the know-how interface and quotations, however the licensed advisor is just assigned on the finish after the patron has determined which product or insurer they want to go together with.

So when you’re snug with utilizing on-line instruments and need to save effort and time evaluating insurance policies from varied insurers, the app affords a seamless approach so that you can handle your well being and life insurance coverage wants – not only for your self, however in your complete household.

You should use their insurance coverage wants calculator or the cell app to analyse your present protection:

However whereas savvy insurance coverage patrons will discover the app and instruments helpful, Planner Bee can be much less appropriate for people who find themselves clueless on their insurance coverage wants, or when you’re not sure on even the kind and performance that every insurance coverage coverage performs in our life.

In such a state of affairs, you’ll in all probability be higher off with an in-person session with an insurance coverage agent, who can sit down to teach you and advise you based mostly on their suggestions.

Sponsored Message from Planner Bee:

Tips on how to purchase insurance coverage by way of Planner Bee

One of the simplest ways to make use of Planner Bee can be to gauge your personal monetary wants first and evaluate to see which coverage’s advantages would serve you finest.

Then, get a personalised quote by way of their on-line type which you’ll obtain by way of e mail.

In the event you want, you might request for an obligation-free session on-line or by way of a telephone name to run by means of the totally different choices.

When you’ve determined in your alternative of plan, you may apply for a scheduled name to undergo any questions you might have and e-sign the digital varieties to use for the insurance policies that you just want.

As soon as your plan is permitted, you’re going to get a affirmation from the Planner Bee staff by way of e mail and WhatsApp.

Within the occasion that it is advisable make any claims, you may merely attain out to the identical WhatsApp quantity or e mail in your comfort, and their devoted customer support staff will help you together with your claims or servicing issues.

Try Planner Bee for your self right here.

To get a reduction, quote DISCOUNTPLEASE to get the next affords:

- Built-in Defend plans: $50 cashback in your first yr premium

- Time period Life plans: 15% low cost in your first yr premium

- Entire Life plans: 10% low cost in your first yr premium

Reductions legitimate inside the subsequent 12 months.

Disclosure: This put up was written in partnership with Planner Bee Pte Ltd.