Expensive mates,

Welcome to the Samhain / the approaching of the darkish version of the Mutual Fund Observer!

October is an attention-grabbing month. Historically perilous for the monetary markets. It begins with the sullen remnants of summer time and ends with festivals of the harvest (even for these of us in cities) and of the approaching season when nature slips into dormancy. Halloween, whose gross sales now start in August and whose iconic ghouls now glower at Santa Claus in Costco, is rooted in Samhain, a pagan Celtic pageant welcoming the approaching of “the darkish half” of the 12 months.

So, have a good time, whereas we will, “Autumn…the 12 months’s final, loveliest smile.”

(The phrase is usually attributed to the poet William Cullen Bryant (1794-1898) although I can’t for the lifetime of me discover it within the authentic.)

On this month’s concern …

My colleague Devesh had the uncommon alternative to talk with Mohnish Pabrai, a famend Indian investor who embraces lots of Warren Buffett’s rules and had a protracted acquaintance with Charlie Munger. Mr. Pabrai introduced his concentrated type of investing within the US market a 12 months in the past with the launch of his Wagons Fund. Wagons, as in “it’s time to circle the wagons, boys!” wagons. Devesh talks with him in particular depth concerning the six buckets into which just about all of his property move.

We share a Launch Alert for a captivating new fund from CrossingBridge, CrossingBridge Nordic Excessive Earnings Bond Fund, which went stay on October 1. It’s a high-income technique from a singularly profitable adviser in a particular market area of interest that no different fund touches. At base, the Nordic market is giant, clear, rapidly rising … and a venue for smaller European and American issuers to boost capital when different avenues are foreclosed.

Our colleague Lynn Bolin shares two essays this month. Within the first, Lynn notes that “we’re at an inflection level with short-term rates of interest falling and the yield curve” normalizing. He hopes to supply some perception into the subsequent six to 12 months out there by momentum measures within the 800 funds and ETFs he tracks. Within the second, he examined choices for pursuing “Underconsumption Core,” a kind of “cottagecore to your finances” monetary motion that appears to be taking maintain on TikTok. With one thing like 65% to 75% of People residing paycheck to paycheck, he displays on some helpful concepts on easy methods to minimize spending and save extra.

The Shadow, vigilant as ever, chronicles SEC actions towards two well-known companies, a half dozen attention-grabbing choices within the pipeline, bits of fine information for buyers … and a couple of dozen dying notices.

Lastly, I got here very near ending a fund profile for this concern, a course of derailed by:

For you metropolis people, that’s the again of our gardens. And that’s a possum. Most notably, that’s a possum firmly wedged beneath the fence, midway between our yard and Colin’s. In lieu of ending edits on the fund profile, I labored on excavating Peter (or Petra) Possum. Failing at that, I launched myself to my new neighbor Colin, who borrowed a shovel and labored on undercutting P’s hindquarters. (That was about as fashionable as you may think.)

Finally sighting, P was lastly freed from the fence however unable, or disinclined, to extricate itself from its gap. And so, as Chip publishes this concern, I’m going to go supply it a paw-paw.

No, that’s not a cute approach of claiming “high-fiving a possum.” It’s a non-commercial (tasty) fruit native to the Midwest. Simply the factor to take the sting out of a day-long confinement. I hope. Anyway, we’ll share the profile in November! Thanks to your persistence.

Sensible individuals say “hello!”

I had the chance to speak this week with three units of good individuals. The always-engaging David Sherman chatted concerning the peculiar delights of the Nordic high-yield bond market. The outcomes of that chat are chronicled within the Launch Alert for CrossingBridge Nordic Excessive Earnings Bond.

I had event to be within the Twin Cities to assist my son, Will, transfer to a brand new residence. I took the chance to drop by The Leuthold Group the place I received to speak with long-time confidant Paula Mikl, CIO Doug Ramsay, and portfolio supervisor Chun Wang. We mentioned market valuations (silly excessive, once more), the funding administration enterprise (issues are fairly steady for them, their ETF isn’t cannibalizing property, and so they’re partnered with a Texas agency to increase their distribution community), and Leuthold Core (each the fund and the ETF). The ETF fees 60 bps lower than the fund and has a barely increased yield with minor divergences in efficiency. Each funds have the identical tactical allocation, the distinction is that the ETF implements it by shopping for about 24 ETFs. That makes the technique low cost however “much less granular on the business stage” than the fund. Since inception, each the returns (45.79% vs 45.61%) and volatility are remarkably shut. Among the agency insiders personal the fund, others are shopping for the ETF. Being Minnesota, we had espresso … and I received a very cool cell phone-enabled espresso mug out of the go to!

I had event to be within the Twin Cities to assist my son, Will, transfer to a brand new residence. I took the chance to drop by The Leuthold Group the place I received to speak with long-time confidant Paula Mikl, CIO Doug Ramsay, and portfolio supervisor Chun Wang. We mentioned market valuations (silly excessive, once more), the funding administration enterprise (issues are fairly steady for them, their ETF isn’t cannibalizing property, and so they’re partnered with a Texas agency to increase their distribution community), and Leuthold Core (each the fund and the ETF). The ETF fees 60 bps lower than the fund and has a barely increased yield with minor divergences in efficiency. Each funds have the identical tactical allocation, the distinction is that the ETF implements it by shopping for about 24 ETFs. That makes the technique low cost however “much less granular on the business stage” than the fund. Since inception, each the returns (45.79% vs 45.61%) and volatility are remarkably shut. Among the agency insiders personal the fund, others are shopping for the ETF. Being Minnesota, we had espresso … and I received a very cool cell phone-enabled espresso mug out of the go to!

Lastly, I had an opportunity to speak a bit with Minyoung Sohn and John Fenley. Min managed the $8 billion Janus Progress and Earnings Fund from 2004-07, left Janus to discovered ArrowMark Companions the place he managed Meridian Enhanced Fairness and grew the corporate to a $24 billion agency, after which left ArrowMark to discovered Blue Room Investing.

Lastly, I had an opportunity to speak a bit with Minyoung Sohn and John Fenley. Min managed the $8 billion Janus Progress and Earnings Fund from 2004-07, left Janus to discovered ArrowMark Companions the place he managed Meridian Enhanced Fairness and grew the corporate to a $24 billion agency, after which left ArrowMark to discovered Blue Room Investing.

John’s profession is marked by excellence in worldwide small-cap investing, a technique that he pursued at Hansberger and Denver Investments the place he managed Westcore Worldwide Small Cap which ultimately grew to become a part of Segal, Bryant & Hamill. Whereas there, John grew to become their Director of Basic Worldwide Methods. He joined Blue Room in 2023. Between them, Min and John have a shelf filled with efficiency awards and accolades. The agency is profitable and dedicated to doing good, as a lot as doing nicely. A part of that course of consists of discussions, nonetheless of their infancy, about returning to the ’40 Act world, both with their very own fund(s) or as sub-advisers on a global small-cap or lengthy/quick fairness technique. Given their document and good sense, both improvement can be a serious win for buyers. We’ll preserve you apprised.

Misplaced a long time

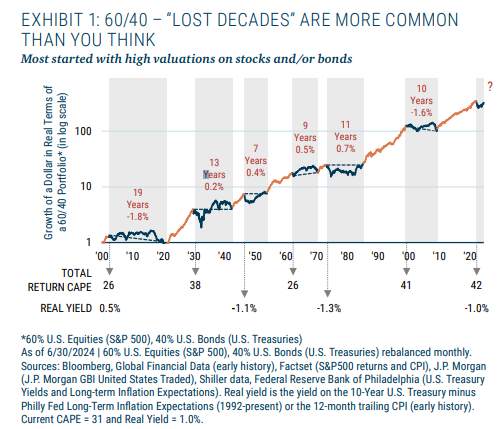

GMO provided an attention-grabbing and sobering reminder to the “the market is my pal” crowd. If you happen to had been born in 1900 and lived till your 85th 12 months, you’ll have spent greater than half of your whole life experiencing “misplaced a long time” within the monetary markets.

Greater than half your life. Yikes.

This, in a nutshell, is the argument for diversification – these numbers would look far completely different with a slice of Japanese equities, as an illustration – and for specializing in cheap objectives (my retirement portfolio must earn 6% a 12 months for me to have an affordable prospect of safety after I cease full-time work), cheap time frames (three years isn’t it), and an affordable set of life selections (by no means purchase a brand new automotive, stay within the house you want fairly than the house you need, discover pleasure in individuals fairly than possessions, cook dinner).

What a distinction a field makes

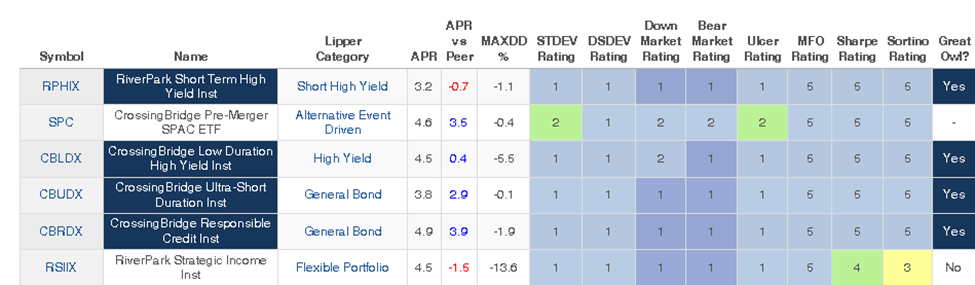

In our Launch Alert for CrossingBridge Nordic Bond, we embrace a desk of the risk-adjusted efficiency for the reason that inception of all of the CrossingBridge Funds. (Brief model: high tier throughout the board.) Every is in comparison with its Lipper peer common.

CrossingBridge founder David Sherman notes that Morningstar and Lipper assign the funds to dramatically completely different peer teams and has some reservations about Lipper’s assignments.

CrossingBridge Pre-Merger SPAC ETF (Monetary Inventory, however previously Small Cap Progress, at Morningstar, Different Occasion-Pushed at Lipper)

I believe the CrossingBridge Pre Merger SPAC ETF must be categorized within the ultra-short length bond class because it meets the length definition backed by US Treasuries in SPAC escrows and the Fund at all times redeems or sells however by no means rolls into offers.

RiverPark Strategic Earnings (Excessive Yield Bond at Morningstar, Versatile Portfolio at Lipper)

RiverPark Strategic Earnings is a versatile conservative high-yield fund. It has the pliability to cut back high-yield publicity and transfer into funding grade when spreads appear overvalued or different situations exist from a bottom-up, worth investor standpoint. Versatile class funds are sometimes top-down funds making calls on rates of interest, time period construction, and financial views.

CrossingBridge Low Length Excessive Yield (Multisector bond at Morningstar, Excessive Yield at Lipper)

CrossingBridge Low Length Excessive Yield (CBLDX) has traditionally been a max of 65% excessive yield and a length mandate of sometimes 2 or much less … so completely different than the normal excessive yield class. These variations are the explanation behind altering the title and refiling a prospectus with SEC for evaluate (nonetheless awaiting feedback) to Excessive Earnings.

All of which is value realizing as a result of the straightforward judgments – “it’s a five-star fund! Purchase!” – are pushed by these sometimes-questionable peer group assignments. The explanation that MFO focuses much less on scores and extra on a supervisor’s technique and impulses is to maintain you from appearing based mostly on “peer-adjusted efficiency” when, nicely, they aren’t really friends.

The 4 questions you want to ask your self

- Do I do know what the supervisor is doing?

- Does my portfolio want what he’s doing?

- Have they managed to do it persistently, amid altering markets?

- Am I comfy with the short-term dangers, together with volatility and peer underperformance, that I’m prone to expertise?

Something lower than 4 “yeses” means “not for me!”

The World Goes Spherical

We word with unhappiness the closing of Rondure World Advisors, a woman-owned funding adviser based in 2016 and headquartered in Salt Lake Metropolis, Utah. Laura Geritz, CFA is Rondure’s founder, co-CIO, and CEO. She started her profession at American Century as a bilingual investor relations consultant, a place that continues to form her eager about her buyers, their wants, and her obligations to them. She moved to the investing aspect in 1999 at American Century and ultimately joined Wasatch Funds in 2006. She has been phenomenally profitable as an expert investor. Lewis Braham, writing in Barron’s about her work at Wasatch Worldwide Alternatives, concluded that she “crushed” her friends (“Ought to You Observe a Star Cash Supervisor?” Barron’s, 9/10/2016). Her sign cost, Wasatch Frontier Rising Small Nations, returned 15 instances what her rivals did. However as she traveled to these challenged and striving international locations, she got here to a poignant and highly effective conclusion:

Someplace alongside the trail of being profitable, I received too busy to do as a lot good as I aspired to.

Founding Rondure was a strategy to return to that want. The agency has three core rules: earn cash for our shoppers, Do Good, and be nice companions.

Within the final week of September 2024, Ms. Geritz penned the “Last Shareholder Letter,” which is each somber and modestly mysterious:

It’s with heavy hearts and considerate consideration that we inform you that the Rondure New World Fund can be liquidated on October 18, 2024, and with this closure, we may even be closing Rondure World Advisors.

The financial panorama of our rising markets-focused methods has been difficult for a while. Our whole group has been devoted to dealing with these challenges with the fixed goal to realize long-term constructive returns for our shoppers and buyers. Sadly, latest unexpected developments inside our enterprise have pressured us to reevaluate our means to proceed. It’s a painful consequence and positively not a choice we anticipated ever having to make, notably once we assume rising markets stay such an attention-grabbing and compelling long-term funding. We didn’t make this determination frivolously, however finally, consideration of the financial and operational realities of continuous the agency have led us to appreciate closing is the perfect consequence for our shoppers.

In a subsequent dialog, Laura pointed to the sudden and sudden confluence of things, unmanageably rising prices and well being challenges, as conspiring to make it inconceivable for Rondure to proceed. Her two priorities now are caring for her employees and her buyers. She is working to make it doable for her shareholders to realize entry to the soft-closed Grandeur Peak Rising Markets Alternatives Fund in the event that they wish to keep publicity to the type and property. That’s a uncommon and considerate gesture however hardly stunning given her character.

We want all concerned godspeed.

Thanks, as ever . . .

To The Few, The Proud, The Ongoing Contributors: Wilson, S&F Funding Advisors, Gregory, William, the opposite William, Stephen, Brian, David, and Doug! Legitimately, thanks, guys.

An distinctive variety of people, and numerous distinctive people, made contributions this month which is able to dramatically develop the alternatives we will pursue. So due to the Suranjan Fund, Dr. Mary of Atlanta Monetary Psychology (thanks for the type phrases! We strive exhausting to persuade common people that they will make sense of the system if they simply have religion and preserve it easy.), Mitchell of Washington, Leah from Cambridge, Frederic of Wisconsin, Rad of California, Andrew from Orefield, Sunny of California, Martin from Columbus, and Mark of Michigan.

And my expensive departed pal Nick Burnett, via the beneficiant intermediation of his spouse, Debbi. Of all of the individuals I’ve recognized, Nick is the one who most earned the accolade, “bigger than life.” Cheers, buddy. Thanks, Debs!

You Matter

Act prefer it.

The youngsters are watching.

And ready, to inherit what we depart them.

The devastation in locations that had been imagined to be idyllic and iconic – locations like Asheville, North Carolina, the place mates have been celebrating retirement – has been a lot on my thoughts. “We have now biblical devastation via the county,” stated Ryan Cole, the assistant director of Buncombe County Emergency Providers. And but Asheville was usually sufficient described as “a local weather haven,” insulated from the worst results of worldwide warming.

Demise threats towards an organization proprietor in Springfield, Ohio – “family-built, American-owned, making metallic work in America since 1965 … some say American manufacturing isn’t what it was once. Apparently, they haven’t frolicked in Springfield” – who had the temerity to say publicly that his Haitian staff had been good employees, has been on my thoughts. “They arrive to work day-after-day. They don’t trigger drama. They’re on time. I want I had 30 extra.” That led to a voicemail on the corporate answering machine: “The proprietor of McGregor Steel can take a bullet to the cranium and that might be 100% justified.” His kids and 80-year-old mom have additionally been threatened.

Demise threats towards an organization proprietor in Springfield, Ohio – “family-built, American-owned, making metallic work in America since 1965 … some say American manufacturing isn’t what it was once. Apparently, they haven’t frolicked in Springfield” – who had the temerity to say publicly that his Haitian staff had been good employees, has been on my thoughts. “They arrive to work day-after-day. They don’t trigger drama. They’re on time. I want I had 30 extra.” That led to a voicemail on the corporate answering machine: “The proprietor of McGregor Steel can take a bullet to the cranium and that might be 100% justified.” His kids and 80-year-old mom have additionally been threatened.

Jimmy Carter, who improbably celebrated his 100th birthday, on 30 September 2024, has been on my thoughts. Mr. Carter was identified with mind most cancers in 2015. He entered hospice in 2023 and misplaced the love of his life that very same 12 months. That they had been married for 77 years. His household often frames his future when it comes to weeks. And nonetheless, he persists. He was not an amazing president, his expertise and temperament didn’t align with the challenges of the job, however he was arguably the perfect particular person to carry that workplace within the 20th century. I nonetheless keep in mind Mr. Carter’s cumbersome sweaters in winter, and his determination to put in photo voltaic panels on the roof of the White Home. Mr. Reagan had them ripped out. The youthful President Bush quietly put in photo voltaic on a upkeep constructing on the White Home grounds and President Obama restored them to the White Home roof.

Nazi propaganda has been on my thoughts, too. The Nationwide Socialist propaganda had two pretty distinct phases, the “make Germany nice once more” section from about 1932 – 1937 and the “eradicate the enemy inside” section from about 1938 – 1945. Some fascinating new work by students at Cambridge on a not too long ago uncovered British intelligence evaluation from April 1942, apparently unread for 80 years, focuses on Hitler’s rising obsession with “the enemy inside,” which the British speculate was pushed by a rising realization that his trigger was misplaced. As his desperation grew, his underlings accelerated the Last Answer, a section so virulent that focus camp commanders had been persevering with genocide even after they knew the conflict had been misplaced and that Allied forces would seize their camps inside days.

The usage of such rhetoric – “the menace from exterior forces is much much less sinister, harmful and grave than the menace from inside,” descriptions of home opponents as “vermin” and immigrants as “poisoning the blood of the nation,” all at a single Veteran’s Day speech – by an American aspiring to steer the nation, has been on my thoughts. Rather a lot.

That truth that folk cheered, likewise.

The toughest act of religion, typically, is recalling that even in perilous instances, you matter. We’re, every of us, academics. We’re instructing our neighbors what we consider them. We’re instructing kids who they need to turn into. And we’re instructing ourselves, in small each day actions taken and never taken, who we’ll turn into.

The toughest act of religion, typically, is recalling that even in perilous instances, you matter. We’re, every of us, academics. We’re instructing our neighbors what we consider them. We’re instructing kids who they need to turn into. And we’re instructing ourselves, in small each day actions taken and never taken, who we’ll turn into.

Actually, do you wish to be the individuals you see on TV? If not, then don’t act like them. Be a great steward of the world gifted to us. Respect those that most loudly disagree with you, realizing {that a} good coronary heart nonetheless lies beneath many fevered phrases. Be mild along with your flaws. Be stalwart in your willingness to do good: to vote, to encourage others, to cease the doom-scrolling, to talk when it comes to insurance policies fairly than merely personalities, to push those that result in take the devastation wrought by a warming planet severely, to assist these whose lives have been shredded. Channel Jimmy.

Know that touching one life is healthier than touching none. Planting one tree is healthier than leaving the sphere barren.

Know that the kids are watching.

As ever,