Monetary establishment leaders have prioritized innovation and effectivity efforts in 2024 whereas navigating frequently evolving applied sciences.

This yr, financial institution executives have been tasked with maintaining with generative AI and boosting their cybersecurity efforts in a fraud-ridden atmosphere. And so they have finished so whereas sustaining compliance as they await impending laws.

The yr has required a balancing act — and banks have stepped as much as the problem.

Financial institution Automation Information presents 11 financial institution know-how executives who we anticipate to guide innovation in 2025.

Rohit Dhawan, group director of AI and superior analytics, Lloyds Financial institution

Rohit Dhawan is the primary to tackle the director of AI function at Lloyds Banking Group. He’s accountable for scaling Lloyds’s AI capabilities all through operations whereas main its new AI Centre of Excellence.

Dhawan’s appointment is a part of the financial institution’s efforts to speed up use of digital applied sciences and knowledge to enhance the general buyer expertise, in accordance with an Aug. 5 Lloyds launch. This yr, the financial institution additionally added 1,500 know-how and knowledge specialists to help these tech-driven efforts.

London-based Lloyds Financial institution has been utilizing AI to streamline operations and goals to save lots of $901 million in 2024 by way of tech and AI deployment, in accordance with the financial institution’s second-quarter earnings report. The $1.1 trillion financial institution reported that it has almost 800 AI use circumstances it plans to deploy within the coming quarters.

Earlier than becoming a member of Lloyds, Dhawan served as head of knowledge and AI technique throughout the Asia-Pacific area at Amazon Net Companies.

Ian Eslick, senior vp of infrastructure and know-how technique, SoFi

Ian Eslick returned to his tech roots in August when he started work at $27 billion digital lender SoFi, leaving his function at U.S. Financial institution.

SoFi, one of many largest on-line lenders for pupil and unsecured lending, is investing in its product pipeline, particularly in a decrease price atmosphere, Chief Government Anthony Noto stated earlier this month at Goldman Sachs Communacopia & Know-how Convention 2024, noting that SoFi needs to launch extra core merchandise in monetary providers.

Eslick joins the SoFi crew with an revolutionary and entrepreneurial background. Earlier than his U.S. Financial institution stint, he based a number of startups together with well being care firm Very important Labs and knowledge and analytics firm Compass Labs, which has raised greater than $12 million since its inception, in accordance with Crunchbase.

Steve Hagerman, chief data officer, Truist Monetary

Steve Hagerman will be part of Truist Monetary as its CIO in October from Wells Fargo, the place he served as CIO for client know-how since April 2023.

Hagerman was the “proper individual on the proper time for our enterprise know-how crew,” a Truist spokesperson beforehand instructed BAN, noting that deciding on a brand new CIO was a “thorough course of.”

His transfer to the $511 billion Truist follows turbulence on the financial institution’s management crew because the financial institution misplaced a number of executives prior to now yr, together with former CIO Scott Case, who Hagerman will exchange.

“Steve brings 25 years of broad know-how expertise within the monetary providers trade to Truist and will probably be a key driver in our efforts going ahead,” CEO Invoice Rogers stated throughout Barclays Monetary Companies Convention earlier this month, noting that the financial institution is investing in its digital merchandise with effectivity on the forefront.

At Wells Fargo, Hagerman has his hand within the financial institution’s multi-cloud technique, method to generative AI, and AI and machine studying efforts.

Based mostly on his expertise, Hagerman is predicted to “speed up how we take into consideration our go-to-market technique,” Sherry Graziano, head of digital, consumer expertise, and advertising at Truist, instructed BAN.

Tracy Kerrins, head of client know-how and gen AI crew, Wells Fargo

Tracy Kerrins is main generative AI efforts as Wells Fargo prioritizes bankwide effectivity efforts.

On the $1.7 trillion financial institution, Kerrins will determine how AI might be deployed in every space of enterprise, CEO Charlie Scharf stated in a July 30 Wells Fargo launch.

“Generative AI will help us rework our enterprisees, enhance our buyer and consumer experiences, and improve the way in which we work,” he stated, noting that Kerrins has expertise deploying know-how and modernizing operations.

As Kerrins takes on generative AI, the financial institution has established its personal generative AI council to make sure it approaches the know-how responsibly.

Previous to her July appointment, Kerrins was the financial institution’s CIO for client know-how and enterprise features, in accordance with the discharge.

Lindsay Lawrence, chief working officer, EverBank

The $40 billion, Jacksonville, Fla.-based EverBank is present process a digital overhaul throughout a two-year window led by COO Lindsay Lawrence.

Lawrence is trying to third-party distributors to replace guide processes, enhance the buyer banking platform and implement an API-first technique on the regional financial institution.

Over the following yr, the financial institution plans to proceed its modernization technique with fintech companions together with fraud prevention software program from Actimize, FIS’ client platform Digital One and fee processing system Finzly, Lawrence beforehand instructed BAN.

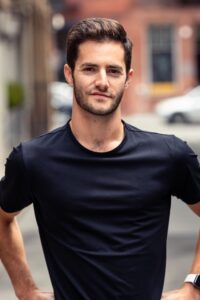

Don Muir, CEO, Arc Applied sciences

Don Muir, of fintech Arc, plans to increase operations within the United Kingdom and the European Union. The fintech at the moment offers banking and monetary providers to small- and medium-sized companies in the US.

The fintech recorded 12 occasions progress in mortgage origination after the Silicon Valley Financial institution collapse in March 2023. The banking disaster “was actually the catalyst and the inflection level for our enterprise and issues haven’t slowed down since that,” Muir instructed BAN.

Based in 2021, Arc has raised a complete of $181 million in funding from Left Lane Capital, Atalaya Capital and others, in accordance with Crunchbase.

Sathish Muthukrishnan, CIO and knowledge and digital officer, Ally Monetary

Sathish Muthukrishnan joined Ally in 2020 as CIO after greater than a decade at American Specific. At Ally, he has been tasked with creating and deploying AI merchandise and methods for the $181 billion financial institution.

Underneath Muthukrishnan’s management, Ally has deployed AI inside buyer relations and advertising, with the goal of launching one new gen AI function every month till the top of 2024.

To make sure an moral method to gen AI, the financial institution not too long ago joined the Accountable AI Institute as its first U.S. financial institution member, in accordance with the institute’s Sept. 18 launch.

“Becoming a member of the Accountable AI Institute reveals our dedication to proceed advocating for top requirements in the usage of AI whereas additionally thoughtfully leveraging its potential providers,” Muthukrishnan stated within the launch.

Shruti Patel, chief product officer of enterprise banking, U.S. Financial institution

As CPO of enterprise banking, Shruti Patel is accountable for delivering an built-in product technique that connects banking, funds and software program for enterprise shoppers with as much as $25 million in income.

Underneath Patel’s management, the $657 billion U.S. Financial institution is creating new applied sciences, comparable to AI-driven monetary insights for SMBs together with quicker and automatic fee channels to handle funds.

Earlier than becoming a member of U.S. Financial institution, Patel served as head of world product partnerships and monetization at Shopify and as head of embedded funds and partnerships at JPMorgan Chase.

Carl Slabicki, co-head of world funds, BNY

Carl Slabicki, of BNY Treasury Companies, is tasked with maintaining with world funds traits.

Slabicki’s crew is accountable for innovating to bridge on the spot fee capabilities throughout networks by way of BNY’s good routing answer , he instructed BAN.

The automated good routing answer determines which funds rail is used for a given transaction. The $428 billion BNY is working to add capabilities to the router to maintain up with the worldwide demand for funds rails, he stated.

Jameson Troutman, head of product for small enterprise, JPMorgan Chase

Small companies want to their monetary establishments to offer digital options that can assist them sustain with evolving market wants and Jameson Troutman, of $3.9 trillion JPMorgan Chase, is intently monitoring small enterprise traits to innovate primarily based on particular wants inside his enterprise unit, he instructed BAN.

To stay present on digital calls for from small enterprise shoppers, Chase for Enterprise, below Troutman, has not too long ago launched the next merchandise:

- A web based fee middle;

- A digital invoicing answer;

- An automatic payroll answer.

Troutman joined JPMorgan in 2002 as an analyst within the personal financial institution and held roles inside Chase Card Companies and the Agile Product Workplace earlier than transferring into his present function, in accordance with LinkedIn.

Jess Turner, head of world banking and API, Mastercard

Jess Turner, of Mastercard, is targeted on driving the worldwide adoption of open banking.

Open banking purposes are on the rise globally. Actually, by 2028 the market worth of open banking is predicted to succeed in $75.4 billion, up from $24.7 billion in 2023, in accordance with the Enterprise Analysis Firm.

To spice up adoption, particularly within the U.S. the place the market awaits a call on the Client Monetary Safety Bureau’s 1033 ruling, Mastercard is tapping AI and open banking for transaction monitoring, knowledge standardization, and fraud and safety efforts, Turner instructed BAN.

Whereas Turner goals to drive adoption, she acknowledges there’s hesitation round open banking and is working to teach monetary establishments about its advantages together with improved entry to knowledge and capital by way of safe APIs.