Operating payroll means staying on prime of your employment tax obligations. Along with withholding earnings and payroll taxes from worker wages, you will need to contribute employer taxes. In contrast to another taxes, state unemployment taxes do not need an ordinary fee. Learn on to reply, What’s my state unemployment tax fee?

About state unemployment tax

When you have staff, it’s good to find out about state unemployment tax and federal unemployment tax. These taxes fund unemployment packages and pay out advantages to staff who lose their jobs by way of no fault of their very own.

Typically, unemployment taxes are employer-only taxes, which means you don’t withhold the tax from worker wages. Nevertheless, some states (Alaska, New Jersey, and Pennsylvania) require that you simply withhold extra cash from worker wages for state unemployment taxes (SUTA tax).

State unemployment tax is a share of an worker’s wages. Every state units a unique vary of tax charges. Your tax fee could be based mostly on components like your trade, what number of former staff obtained unemployment advantages, and expertise.

State unemployment taxes are known as SUTA tax or state unemployment insurance coverage (SUI). Or, they could be known as reemployment taxes (e.g., Florida).

You pay SUTA tax to the state the place the work is happening. In case your staff all work within the state your enterprise is positioned in, you’ll pay SUTA tax to the state your enterprise is positioned in. But when your staff work in several states, you’ll pay SUTA tax to every state an worker works in.

States additionally set wage bases for unemployment tax. This implies you solely contribute unemployment tax till the worker earns above a specific amount.

How you can get your SUTA tax fee

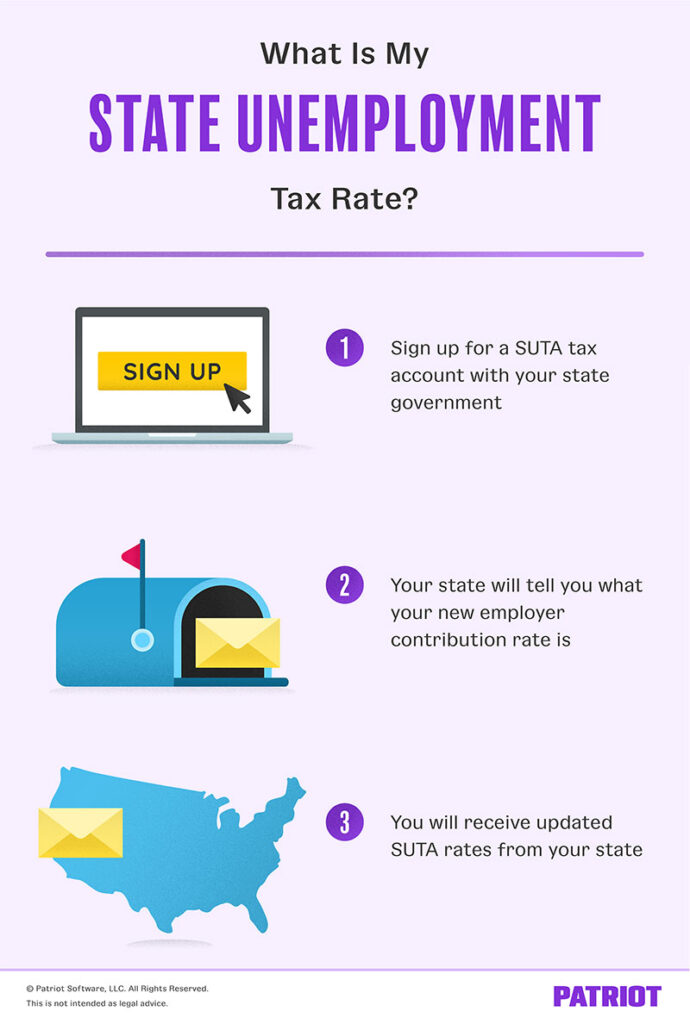

While you grow to be an employer, it’s good to start paying state unemployment tax. To take action, join a SUTA tax account along with your state.

You may register as an employer on-line utilizing your state’s authorities web site. You may additionally be capable to register for an account by mailing a type to your state. Every state has a unique course of for acquiring an account. Test your state’s authorities web site for extra data.

To register for an account, it’s good to present details about your enterprise, akin to your Employer Identification Quantity. While you register for an account, you’ll get hold of an employer account quantity.

Intimidated by the considered state registration? For state tax registration made easy, attempt our accomplice, CorpNet.

As soon as registered, your state tells you what your SUI fee is. And, your state additionally tells you what your state’s wage base is.

Many states give newly registered employers an ordinary new employer fee. The state unemployment insurance coverage fee for brand new employers varies.

Some states break up new employer charges up by building and non-construction industries. For instance, all new employers obtain a SUTA fee of 1.25% in Nebraska, and all new building employers obtain a SUTA fee of 5.4% in 2024.

For those who stay in a state that doesn’t use an ordinary new employer fee, you will need to wait on your state to assign you your beginning fee.

Your state will finally change your new employer fee. The period of time will depend on the state. You could obtain an up to date SUTA tax fee inside one yr or just a few years. Most states ship employers a brand new SUTA tax fee annually.

Typically, states have a variety of unemployment tax charges for established employers. Your state will assign you a fee inside this vary. For instance, the SUTA tax charges in Alabama vary from 0.20% – 6.8%.

SUI tax fee by state

So, how a lot is unemployment tax? Here’s a record of the non-construction new employer tax charges for every state and Washington D.C. Word that some states require staff to contribute state unemployment tax.

| State | New Employer Tax Charge 2024 | Employer Tax Charge Vary 2024 |

|---|---|---|

| Alabama | 2.7% | 0.20% – 6.80% |

| Alaska | Commonplace fee 1.66% (Alaska employers who do not need a fee use the usual fee)

0.50% worker share |

1.50% – 5.90% (together with employer share and worker share of 0.50%) |

| Arizona | 2.0% | 0.05% – 14.03% |

| Arkansas | 2.025% (together with 0.125% administrative evaluation) | 0.1% – 5% (+ stabilization tax) |

| California | 3.4% | 1.5% – 6.2% |

| Colorado | 3.05% | 0.64% – 8.68% (+ Assist Surcharge and Solvency Surcharge) |

| Connecticut | 2.5% | 1.1% – 7.8% |

| Delaware | 1% | 0.3% – 5.6% |

| D.C. | The upper of two.7% or the typical fee of all employer contributions within the previous yr | 1.9% – 7.4% |

| Florida | 2.7% | 0.1% – 5.4% |

| Georgia | 2.7% | 0.04% – 8.1% |

| Hawaii | 3.0% | 0.2% – 5.8% |

| Idaho | 1.231% (together with the workforce fee, UI fee, and admin fee) | 0.281% – 5.4% (together with the workforce fee, UI fee, and admin fee) |

| Illinois | 3.950% | 0.85% – 9.0% (together with a 0.55% fund-building surtax) |

| Indiana | 2.5% | 0.5% – 7.4% |

| Iowa | 1.0% | 0.0% – 7.0% |

| Kansas | 2.7% | 0.16% – 6.0% |

| Kentucky | 2.7% | 0.3% – 9.0% |

| Louisiana | Varies | 0.09% – 6.2% |

| Maine | 2.32% (together with the CSSF fee and UPAF fee) | 0.28% – 6.03% |

| Maryland | 2.6% | 0.3% – 7.5% |

| Massachusetts | 1.87% | 0.73% – 11.13% |

| Michigan | 2.7% | 0.06% – 10.3% |

| Minnesota | Varies | Most of 9.0% (together with a base tax fee of 0.10%) |

| Mississippi | 1.0% (1st yr), 1.1% (2nd yr), 1.2% (third yr) | 0.0% – 5.4% |

| Missouri | 1.0% for nonprofits and a pair of.376% for mining, building, and all different employers | 0.0% – 9.0% (doesn’t embody most fee surcharge or contribution fee adjustment) |

| Montana | Varies | 0.00% – 6.12% (plus an AFT fee of 0.18%) |

| Nebraska | 1.25% | 0.0% – 5.4% |

| Nevada | 2.95% | 0.25% – 5.4% |

| New Hampshire | 1.7% (minus any Fund Discount or Plus any Emergency Energy Surcharge in place for the relevant quarter) | 0.1% – 7.5% (together with a 0.5% surcharge) |

| New Jersey | 3.1% (together with the 0.1175% Workforce Growth and Supplemental Workforce Funds)

Worker fee of 0.425% (together with the 0.0425% Workforce Growth and Supplemental Workforce Funds) |

0.6% – 6.4%

Worker fee of 0.425% |

| New Mexico | 1.0% or the trade common fee, whichever is bigger | 5.4% most fee |

| New York | 4.1% (together with the subsidiary tax fee of 0.625% and the reemployment tax of 0.075%) | 2.1% – 9.9% (together with the RSF tax of 0.075%) |

| North Carolina | 1.0% | 0.06% – 5.76% |

| North Dakota | 1.09% (positive-balanced employers) or 6.08% (negative-balanced employers) | 0.08% – 9.68% |

| Ohio | 2.7% | 0.4% – 10.1% |

| Oklahoma | 1.5% | 0.3% – 9.2% |

| Oregon | 2.4% | 0.9% – 5.4% |

| Pennsylvania | 3.822% | 1.419% – 10.3734% |

| Rhode Island | 1.0% (together with the 0.21% Job Growth Evaluation) | 1.1% – 9.7% |

| South Carolina | 0.41% (together with 0.06% Contingency Evaluation) | 0.06% – 5.46% (together with 0.06% Contingency Evaluation) |

| South Dakota | 1.2%, plus 0.55% Funding Charge | 0.0% – 8.8% |

| Tennessee | 2.7% | 0.01% – 10% |

| Texas | 2.7% or the trade common fee, whichever is bigger | 0.25% – 6.25% |

| Utah | Varies | 0.3% – 7.3% |

| Vermont | 1.0% (for many employers) | 0.4% – 5.4% |

| Virginia | 2.5% (plus add-ons) | 0.1% – 6.2% |

| Washington | Varies | 1.25% – 8.15% |

| West Virginia | 2.7% (for many employers) | 1.5% – 8.5% |

| Wisconsin | 3.05% for brand new employers with payroll < $500,000 3.25% for brand new employers with payroll > $500,000 |

0.0% – 12% |

| Wyoming | Varies | 0.09% – 8.5% |

For some states, this SUTA tax fee consists of different taxes. Contact your state for extra data on included and extra assessments.

For extra state-specific data, use our New Employer Data by State for Payroll web page.

How you can pay unemployment tax to your state

You have to report your SUTA tax legal responsibility to your state and make funds. Typically, it’s good to make quarterly funds. Use your employer account quantity to report and deposit your SUTA tax legal responsibility.

Contact your state for extra details about reporting and depositing SUTA tax.

Let Patriot’s payroll companies deal with your payroll calculations, tax filings, and deposits. We’ll deposit your payroll taxes and file the suitable types with federal, state, and native companies. Get began with a free trial!

This text has been up to date from its authentic publication date of July 16, 2018.

This isn’t supposed as authorized recommendation; for extra data, please click on right here.