Editor’s word: Since this put up was first revealed the word on the ultimate chart has been corrected to replicate that, as depicted, gold shares are calculated primarily based on nationwide valuation. (June 3, 2024, 9:00 am)

International central banks and finance ministries held practically $12 trillion of overseas trade reserves as of the top of 2023, with practically $7 trillion composed of U.S. greenback property. Nonetheless, a story has emerged that an noticed decline within the share of greenback property in official reserve portfolios represents the vanguard of the greenback’s lack of standing within the worldwide financial system. Some market members have equally linked the obvious enhance in official demand for gold in recent times to a want to diversify away from the U.S. greenback. Drawing on latest analysis and analytics, this put up questions these narratives, arguing that these noticed mixture tendencies largely replicate the habits of a small variety of international locations and don’t characterize a widespread effort by central banks to diversify away from {dollars}.

Central Financial institution Reserves

International trade reserves are property held by a central financial institution in overseas forex. They typically encompass bonds, deposits, banknotes, and authorities securities, however also can embody commodities like gold and silver. Many world central banks select to carry reserves in overseas trade to help confidence of their financial and trade price insurance policies, together with the capability to intervene in help of the native forex. Because the Worldwide Financial Fund (IMF) discusses, overseas trade reserves also can take in strain on currencies throughout instances of disaster or when entry to worldwide borrowing is curtailed, giving markets higher confidence {that a} nation can meet its exterior obligations.

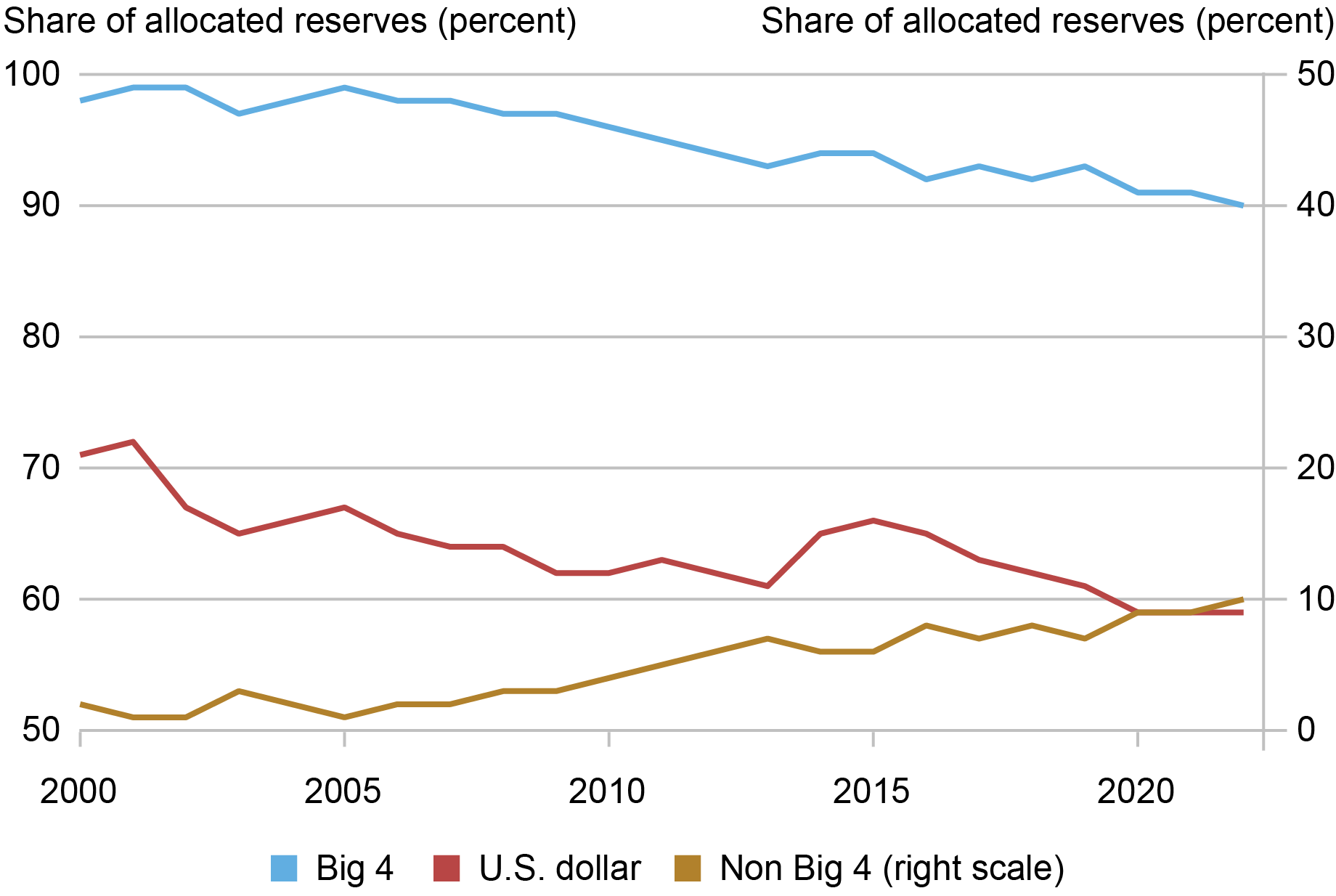

The IMF’s Foreign money Composition of Official International Change Reserves (COFER) information studies aggregates of the forex composition of overseas trade reserves held by central banks. The chart beneath presents the greenback share and the share of the “Large 4” currencies (greenback, euro, yen, and pound), displaying that each peaked in 2001. Following the worldwide monetary disaster, the U.S. greenback share recovered to 65 p.c in 2015, however then noticed a 7 share level decline from 2015 to 2021.

Greenback Share of International Change Reserves Has Declined over Latest Many years

Notes: The chart exhibits world tendencies in central financial institution overseas forex allocations. “Large 4” refers back to the U.S. greenback, Japanese yen, euro, and British pound.

A New (Easy) Decomposition Offers Perspective on Reserve Portfolio Adjustments

New analysis by Goldberg and Hannaoui (2024) exhibits that, conceptually, the modifications within the greenback share of mixture reserves are pushed by two very totally different forces. First, the change in preferences for holding greenback property can evolve on the nation degree and work together with the preliminary reserve steadiness of a rustic. Second, world aggregates can evolve throughout intervals attributable to modifications within the portions of reserves held within the portfolios of nations, interacted with their preliminary greenback portfolio allocation. Thus, international locations that see giant modifications within the measurement of their reserves and with an preliminary greenback weight considerably totally different from the common can contribute considerably to world aggregates of overseas trade forex shares for causes unrelated to modifications in preferences for holding greenback property.

Two varieties of country-level information are used to offer insights that additional unpack the significance of those components: nation overseas trade reserves information (IMF Worldwide Monetary Statistics) and information on the country-level composition of reserves drawn from researcher estimates (Ito and McCauley 2020). Utilizing the latter, one can estimate the parts of the 7 share level decline within the U.S. greenback world reserve share noticed between 2015 and 2021.

The decline is outlined by three components. First, the weighted sum of the preferences for greenback property throughout international locations for which there are estimates for each 2015 and 2021 accounts for 0.3 share factors. In mixture, this summation explains nearly not one of the complete change within the COFER greenback share. Second, the sample of accumulation and declines in reserve portfolios explains 3.8 share factors of the mixture U.S. greenback share decline. The implication of this evaluation is that half of the general greenback share decline will not be attributable to modifications in greenback preferences.

The decomposition permits us to estimate the third half—the portion of the mixture U.S. greenback share decline in complete overseas trade reserves attributed to altering preferences for greenback property by international locations for which estimated portfolio allocations are unavailable. This complete part, dominated by the bigger reserves of China and India, accounts for roughly 2.9 share factors of the 7 share level decline within the U.S. greenback share of the entire. Whereas these particular estimates may change by together with different international locations which are lacking from our analytics however included inside the broader COFER development, the general patterns might be strong.

Wanting extra carefully throughout country-level information, a small set of nations performed a big position within the mixture statistics. Switzerland—having raised complete reserves by nearly half a trillion {dollars} throughout this era—contributed practically 1.8 share factors to the worldwide allotted U.S. greenback share decline. The noticed impact contributed by Switzerland is because of its accumulation of euros, largely on account of a financial coverage framework that at instances limits actions within the euro–Swiss franc pair. This contribution is, then, a narrative of Swiss financial coverage, and never certainly one of a declining choice for greenback property. Russia additionally noticed vital overseas trade reserve development from 2015 to 2021, rising its reserve steadiness by over $150 billion whereas concurrently reducing its share of greenback property by 29 share factors. This led to a contribution of 1.8 share factors to the 7 share level decline within the mixture greenback share.

The information on estimated portfolio shares present a mixture of each optimistic and unfavorable modifications in U.S. greenback asset portfolio shares throughout international locations. It’s due to this fact not the case that international locations are shifting away from {dollars} en masse. Certainly, rising U.S. greenback shares from 2015 to 2021 have been a characteristic of thirty-one of the fifty-five international locations for which there are estimates. The decline within the greenback preferences of a small group of nations (notably China, India, Russia, and Turkey) and the massive enhance within the amount of reserves held by Switzerland clarify a lot of the decline within the mixture greenback share of reserves.

Do Relative Returns on Property and Geopolitical Issues Drive Portfolio Shifts?

We use regression analytics to discover the contributions of ordinary determinants of the U.S. greenback share of nation reserves. The usual determinants embody using forex pegs; nation bilateral commerce shares with the U.S., euro space, and Japan; and the forex denomination and degree of exterior debt. Our analysis finds that the primary drivers of portfolio allocations proceed to be the standard ones that stress forex pegs, proximity to the euro space in commerce, and debt exposures.

The primary new conjecture examined is whether or not the greenback share might be decrease when different reserve currencies have greater returns. To get at the concept that components of the portfolio is perhaps managed with totally different methods, official reserve portfolios are interpreted as composed of a liquidity tranche—wanted to fulfill some short-term targets within the occasion of a funding market disruption—and an funding tranche. Liquidity tranche proxies are alternatively outlined as three months of nation items and companies imports or a rustic’s short-term liabilities, each of that are approaches to defining minimal reserve balances as offered in steerage from the IMF. The funding tranche is outlined as the surplus of complete official reserves relative to liquidity wants. Accordingly, we additionally check whether or not this portfolio tilt from forex returns could be magnified in a low U.S. rate of interest setting, and when central banks have a bigger funding tranche.

Our analysis means that relative returns on sovereign property—for conventional and nontraditional reserve currencies—haven’t performed a big position within the greenback share of official reserves. Low rate of interest and nil decrease certain intervals didn’t considerably enlarge or tilt the consequences of relative returns on sovereign property. As well as, relative to previous evaluation, we discover a stronger impact of proximity to the euro space on tilting some portfolios away from {dollars}.

The second conjecture is that the greenback share could be decrease for international locations which are geopolitically much less aligned with the U.S., not less than in comparison with greenback shares that may in any other case be recommended by their patterns of commerce, debt finance, and forex regimes. One a part of the reason is perhaps that these forces are stronger when central financial institution reserves are bigger than their liquidity wants—permitting reserve managers to chase yields. Assessments of this conjecture use nation voting settlement with the U.S. on the United Nations Basic Meeting, launched in steady type or in discrete classes of settlement (low, medium, or excessive). Our analysis finds that geopolitical issues do play a job in greenback shares, although, surprisingly, they scale back the greenback share primarily when nation reserve portfolios are already giant sufficient to fulfill their potential overseas forex liquidity wants.

Find out how to Interpret the Sharp Rise in Central Financial institution Holdings of Gold

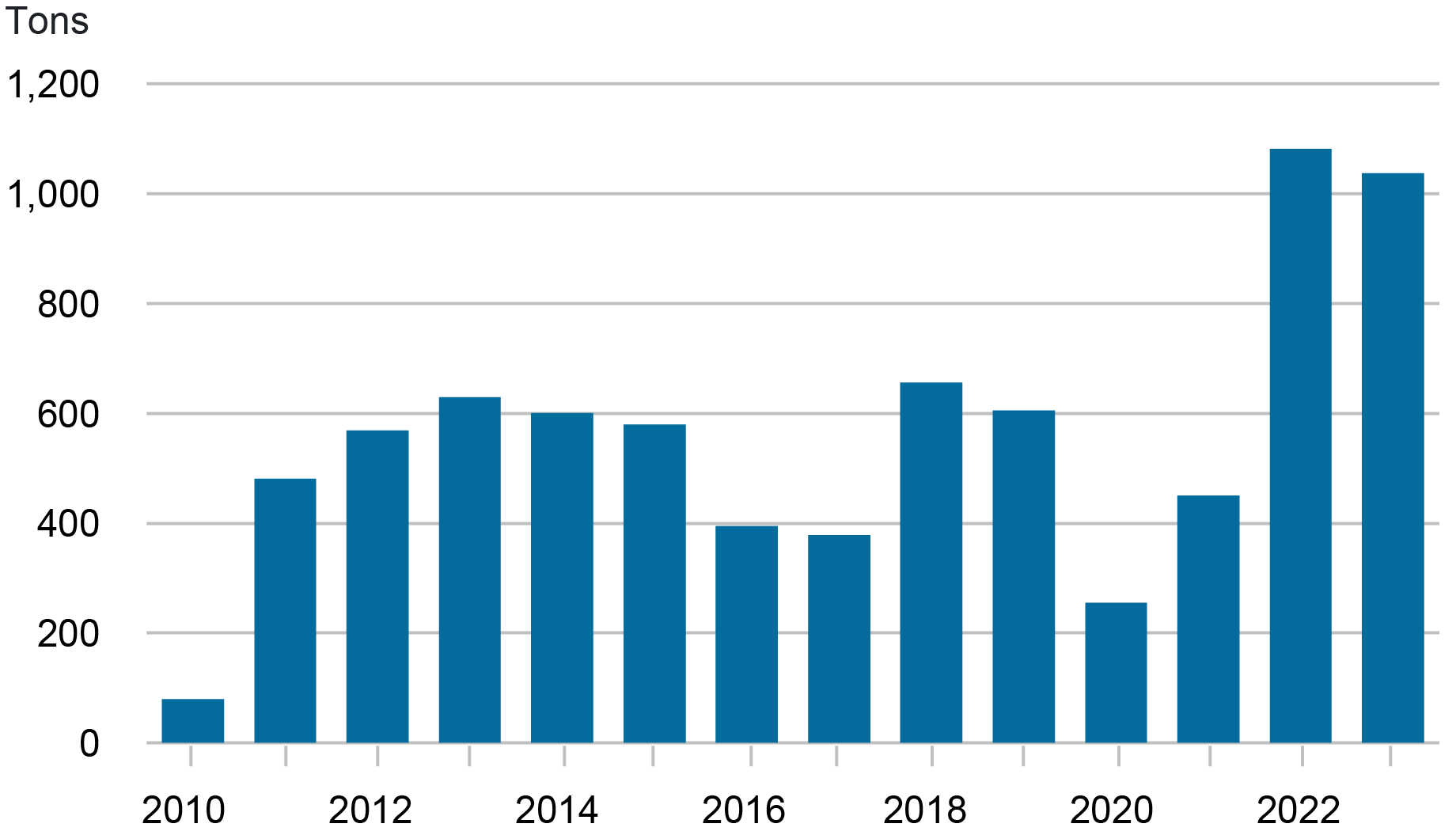

Central banks have elevated their gold purchases notably for the reason that world monetary disaster, and this development seems to have accelerated just lately. In line with World Gold Council information, world central banks bought over 1,100 tons of gold in 2022—greater than double the acquisition quantities of the earlier yr—and maintained an analogous buy degree in 2023, as proven within the chart beneath.

Will increase in International Central Financial institution Gold Holdings

Market members have attributed this elevated demand to 3 components: (1) gold’s perceived worth as an inflation hedge amid rising issues round central financial institution credibility and independence, (2) gold’s use as a threat hedge, given elevated financial and monetary uncertainty, and (3) gold’s use as a sanctions hedge because it has no issuing authorities.

Gold’s seeming security from sanctions has been extensively seen as a very salient issue behind official gold purchases since Russia’s invasion of Ukraine in 2022 and the G7 international locations’ subsequent resolution to freeze the overseas trade reserves of Russia’s central financial institution and forbid their banks from doing most enterprise with Russian counterparts. Arslanalp, Eichengreen, and Simpson-Bell (2023) present proof of the applying of multilateral sanctions as a driver for rising market and creating international locations. Central banks themselves have famous sanctions issues as a driver of gold purchases and of elevated vaulting of gold domestically in latest reserve supervisor surveys. Furthermore, we discover that international locations which are geopolitically much less aligned with the U.S.—as proxied with their voting settlement with the U.S. within the United Nations—have tended to be the most important gold purchasers in recent times (although low voting alignment with the U.S. will not be a powerful predictor of gold accumulation total).

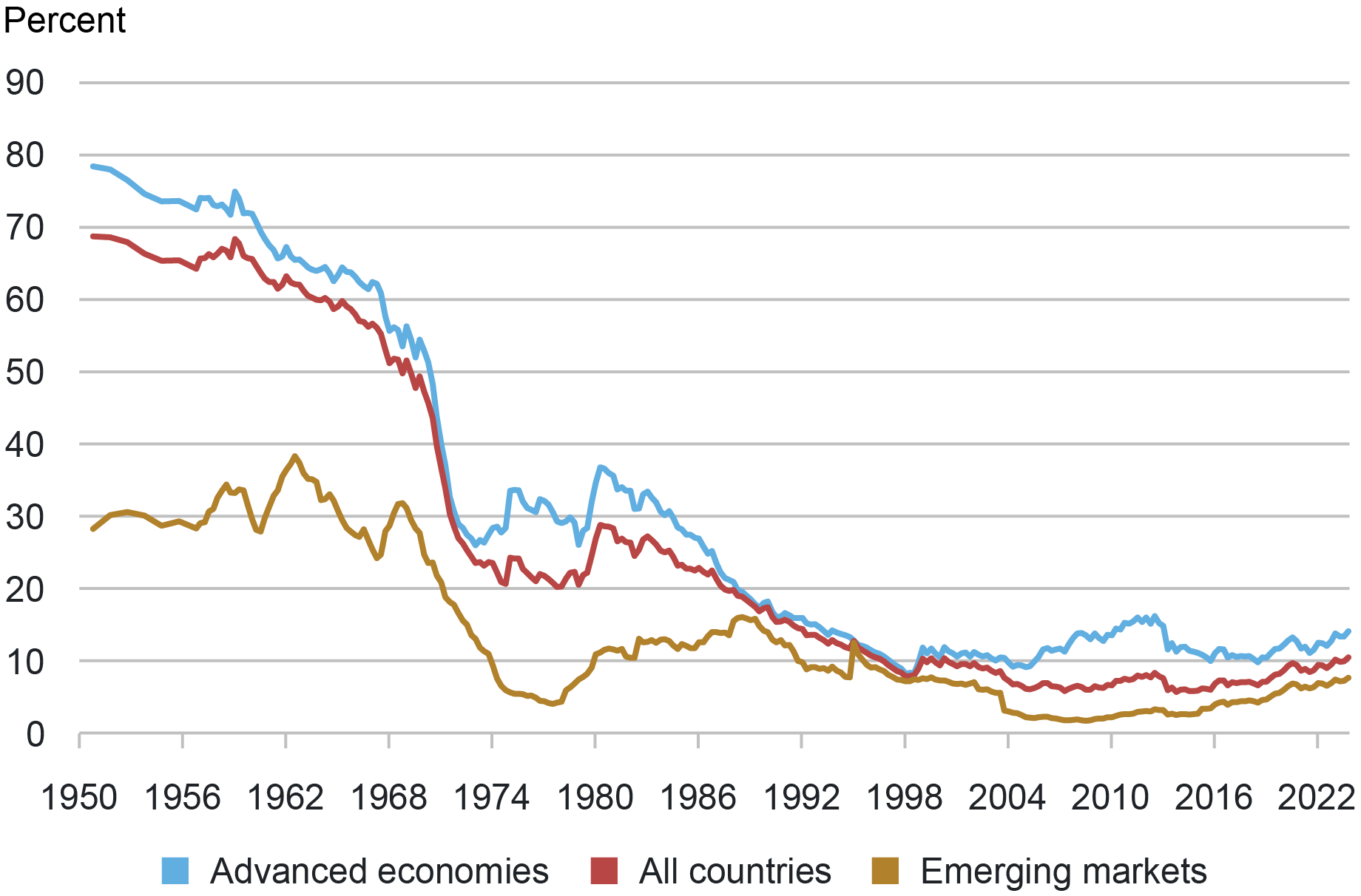

Whereas these gold purchases are actually notable, the broader implications for central banks are restricted. First, gold’s share of mixture reserves stays modest at about 10 p.c (or 15 p.c primarily based available on the market valuation of gold), roughly its degree within the early 2000s, as proven within the chart beneath. Second, IMF country-level information counsel that a lot of the enhance in official gold holdings has come from just some central banks. Greater than half of reported gold accumulation since 2009 was from China and Russia, with one other quarter coming from a handful of rising market central banks (Turkey, India, Kazakhstan, Uzbekistan, and Thailand). Lastly, gold retains necessary shortcomings as an alternative choice to fiat currencies. It bears no curiosity and, as a bodily asset, is troublesome to make use of in transactions, to say nothing of its excessive transportation, warehousing, and safety prices.

Ratio of Gold to Official International Change Reserves Stays Low

Notice: Gold shares are calculated primarily based on nationwide valuation of gold.

Conclusion

Total, our analysis means that the narratives about declining greenback shares in official reserves, and rising roles for gold holdings by central banks, inappropriately generalize the actions of a small group of nations. The decline within the greenback share of reserves will not be even at all times about greenback preferences. Our findings add insights to the messages of the ECB’s 2023 report on the Worldwide Position of the Euro, whereby a cautious survey of key bulletins of nation intent to shift the forex composition of their reserves was not accompanied by materials modifications in key indicators of worldwide roles of the greenback.

Patrick Douglass is a capital markets buying and selling principal within the Federal Reserve Financial institution of New York’s Markets Group.

Linda S. Goldberg is a monetary analysis advisor for Monetary Intermediation Coverage Analysis within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Oliver Z. Hannaoui is a analysis analyst within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Find out how to cite this put up:

Patrick Douglass, Linda S. Goldberg, and Oliver Z. Hannaoui, “Taking Inventory: Greenback Property, Gold, and Official International Change Reserves,” Federal Reserve Financial institution of New York Liberty Avenue Economics, Could 29, 2024, https://libertystreeteconomics.newyorkfed.org/2024/05/taking-stock-dollar-assets-gold-and-official-foreign-exchange-reserves/.

Disclaimer

The views expressed on this put up are these of the creator(s) and don’t essentially replicate the place of the Federal Reserve Financial institution of New York or the Federal Reserve System. Any errors or omissions are the duty of the creator(s).