By Wolf Richter, editor of Wolf Road. Initially revealed at Wolf Road.

Lengthy, sluggish erosion of the US greenback’s dominance. China’s renminbi retains shedding floor, many different currencies acquire, as does gold.

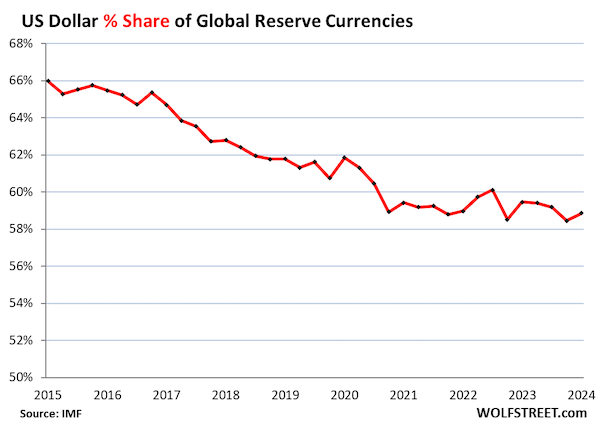

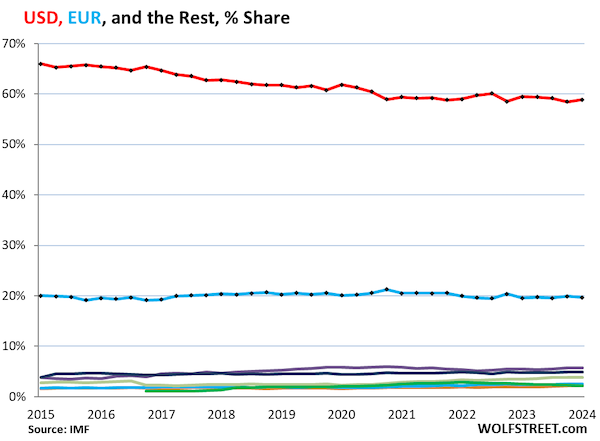

The US greenback remains to be by far probably the most dominant world reserve foreign money, amongst many reserve currencies held by central banks, however its share has been eroding for years, as central banks have been diversifying to different reserve currencies, and in addition to gold. However the course of is sluggish and uneven.

The share of USD-denominated international change reserves ticked as much as 58.9% of complete change reserves in Q1, from 58.4% in This fall, which had been the bottom share since 1994, in keeping with the IMF’s COFER information launched on Friday for Q1 2023.

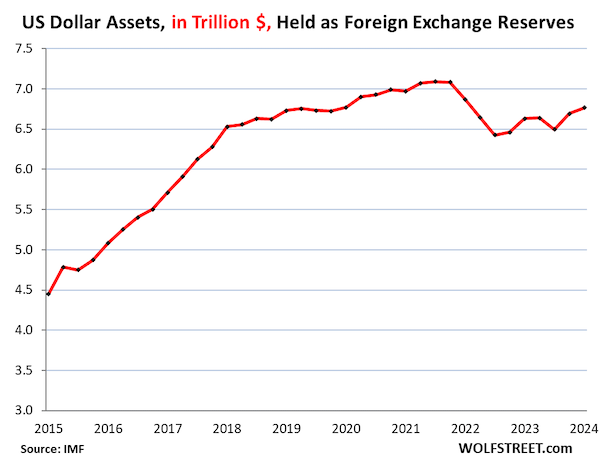

Central banks held complete international change reserves in all currencies of $12.3 trillion in Q1. This included $6.77 trillion in US-dollar denominated property, equivalent to US Treasury securities, US company securities, US government-backed MBS, US company bonds, even US shares.

Excluded are any central financial institution’s holdings of property denominated in its personal foreign money, such because the Fed’s holdings of Treasury securities and MBS, and the ECB’s holdings of euro-denominated property.

In greenback phrases, holdings of USD-denominated property at international central banks rose to $6.77 trillion in Q1.

It’s not that central banks are “dumping” their dollar-assets – in greenback quantities, their dollar-holdings haven’t modified all that a lot. It’s that they tackle property denominated in many different currencies, and as general international change reserves develop, the greenback’s share of the whole shrinks.

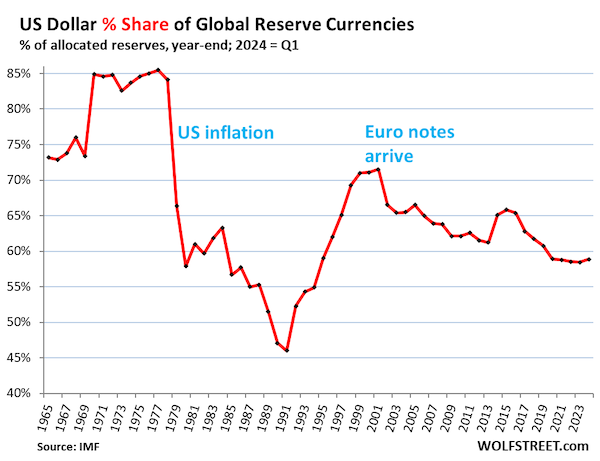

The USD’s share of world reserve currencies has seen a number of turmoil between 1978 by means of 1991, when the share collapsed from 85% to 46%, after inflation exploded within the US within the late Seventies, and the world misplaced confidence within the Fed’s capability or willingness to get this inflation beneath management.

By the Nineties, confidence returned, and central banks loaded up on dollar-assets once more, till the euro got here alongside (share on the finish of the yr, besides 2024 = Q1)

The Different Main Reserve Currencies.

The euro is #2, with a share of 19.7% in Q1. The share has been round 20% for years (blue line within the chart under). The opposite currencies are the colourful tangle on the backside of the chart.

What’s onerous to see on this chart, however simple to see within the subsequent chart, which holds a magnifying glass over the colourful tangle on the backside, is that these different currencies, apart from the Chinese language RMB, have been gaining share, whereas the greenback has been shedding share, and the euro’s share has remained steady. It’s not one foreign money that’s gaining in opposition to the greenback; it’s that a number of “nontraditional reserve currencies,” because the IMF calls them, are gaining share.

The Rise of the “Nontraditional Reserve Currencies.”

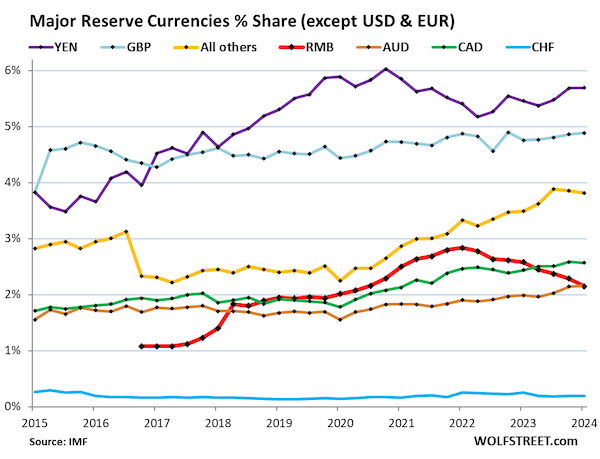

The chart under reveals the opposite currencies magnified. And their shares of the whole have been rising over time.

The exception is the Chinese language RMB. China is the second largest financial system on the earth, but its foreign money performs solely a small and declining function as a reserve foreign money. When the IMF, in 2016, added the RMB to its basket of currencies backing the Particular Drawing Rights (SDR), many had thought that the RMB would shortly change into a menace to the dominance of the USD as world reserve foreign money. However that has turned out to be not the case.

Depicted within the chart under, by their % share of complete international change reserves in Q1 2024:

- Japanese yen, 5.7%, third largest reserve foreign money behind USD and EUR (purple).

- British pound, 4.9%, fourth largest reserve foreign money (blue).

- “All different currencies” mixed, 3.8% (yellow). The RMB was once a part of this group. However in 2016, when the RMB joined the SDR basket, the IMF started displaying it individually, and because of the separation, the share of “different currencies” dropped by the RMB’s share. After that separation, “all different currencies” with out the RMB had a share of two%. This has grown to three.8% by Q1.

- Canadian greenback, 2.6% (inexperienced).

- Chinese language renminbi, 2.1%, lowest since Q2 2020, eighth quarter in a row of declines (purple), amid capital controls, convertibility points, and different points. Central banks look like leery of holding RMB-denominated property.

- Australian greenback, 2.2% (brown).

- Swiss franc, 0.2% (blue).

The IMF present in a 2022 paper that there have been 46 “lively diversifiers” – nations which have no less than 5% of their international change reserves in “nontraditional reserve currencies.” The listing contains main superior economies and rising markets, together with a lot of the G20 economies.

The IMF thought that two main components contributed to the rise of the “nontraditional reserve currencies”:

- The rising liquidity of markets in these currencies, which makes it simpler to commerce these property.

- Chasing greater yielding property elsewhere throughout the 0%-era within the US and Europe.

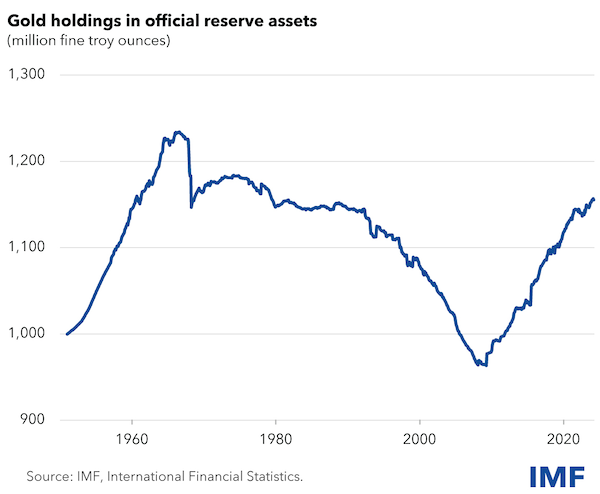

The Rise of Gold as Central Financial institution Reserve Asset.

Gold bullion shouldn’t be included in “international change reserves” of central banks – the info above.

However bullion holdings are within the general “reserve property” of central banks. And central banks, after spending many years shedding their holdings, have been rebuilding them for the previous decade. In response to the IMF, they’re at present at 1.16 billion troy ounces – roughly $2.7 trillion, in comparison with $12.3 trillion in international change reserves (chart by way of the IMF):

USD-Alternate Charges and Overseas Alternate Reserves.

Overseas change reserves are reported in USD. USD holdings are clearly reported in USD, and the holdings in EUR, YEN, GBP, CAD, RMB, and so forth. are translated into USD on the change price on the time. So the change charges between the USD and different reserve currencies change the magnitude of the non-USD property – however not of the USD-assets.

For instance, Japan’s holdings of USD-denominated property are expressed in USD, they usually don’t change with the YEN-USD change price. However its holdings of EUR-denominated property are translated into USD on the EUR-USD change price on the time. So the magnitude of Japan’s holdings of EUR-assets, expressed in USD, fluctuates with the EUR-USD change price, even when Japan’s holdings don’t change.

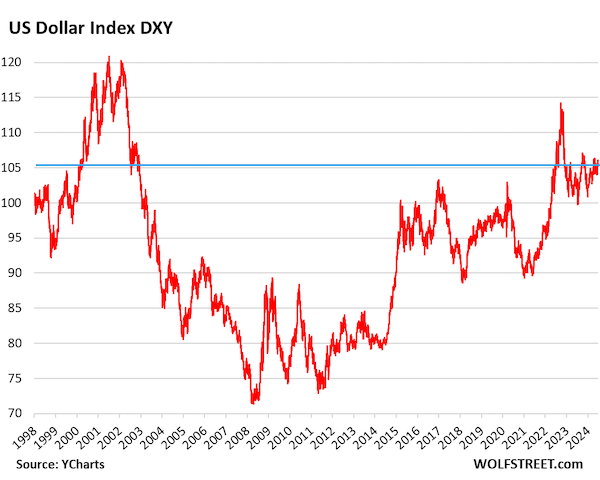

Alternate charges fluctuate wildly. However over the long term, the Greenback Index [DXY], which is dominated by the euro and yen, is again at 101, the place it had been in 1999 (information by way of YCharts):