Capital asset sometimes refers to something that you just personal for private or funding functions. It contains all types of property; movable or immovable, tangible or intangible, fastened or circulating.

Capital belongings are additional categorised as Monetary Belongings and Non-Monetary Belongings. Monetary belongings are intangible and characterize the financial worth of a bodily merchandise.

Shares (Shares) and mutual funds are the very best examples of Monetary Belongings.

The revenue (if any) that you just make in your mutual fund investments once you redeem or promote the MF models is known as Capital Positive aspects. It may be a Brief Time period Capital Acquire (STCG) or a Lengthy Time period Capital Acquire (LTCG) relying upon the ‘Interval of Holding’. The tax that’s relevant on these income is named ‘Capital Positive aspects Tax’.

On this put up allow us to perceive: What are the elements that decide the tax standing of mutual funds? What are the tax implications on mutual fund investments? What are the Price range 2018-19 proposals associated to Mutual Funds Taxation? – Mutual funds taxation & capital beneficial properties tax charges on mutual funds for Monetary yr 2018-2019 (Evaluation yr 2019-2020).

Elements figuring out the tax standing of mutual funds

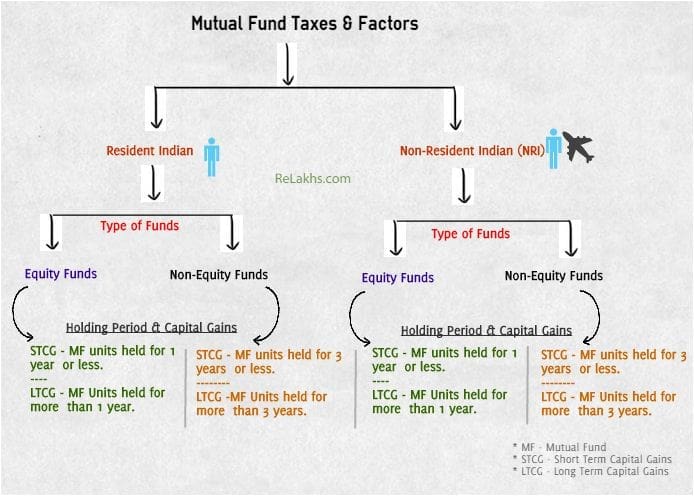

The capital beneficial properties tax on mutual fund withdrawals relies on the elements as under;

- Residential Standing

- Fund Sort (whether or not the fund is an Fairness-oriented fund (or) a Non-Fairness Oriented Fund)

- Holding Interval (Period of your funding)

1. Residential Standing & Mutual Funds Taxation

The capital beneficial properties tax charges are decided based mostly on the residential standing of a person / investor. Residential standing may be both ‘Resident Indian’ or ‘Non-Resident India” (NRI). (Associated article : ‘Residential Standing on-line calculator.’)

2. Sort of Funds & Mutual Funds Taxation

What are Fairness-oriented Mutual Funds? – MF schemes that make investments at the very least 65% of its fund corpus into fairness and fairness associated devices are often known as fairness mutual funds. Examples are : Giant cap, ELSS tax saving funds, Mid-cap, Balanced funds (fairness oriented), Sector funds and so on.,

What are Non-Fairness Mutual Funds? – MF schemes that maintain lower than 65% of their portfolio in equities and fairness associated devices are often known as Non-Fairness Funds / Debt funds. Examples are : Liquid Mutual funds, Cash Market funds, Gold funds, Infrastructure debt funds, MIPs, FMPs, Hybrid funds (Debt oriented) and so on.,

3. Interval of Holding & Capital Positive aspects on Mutual Funds

Capital beneficial properties on Mutual funds might be both long run capital beneficial properties or brief time period capital beneficial properties, relying in your funding horizon.

- Lengthy Time period Capital Positive aspects

- If you happen to make a acquire / revenue in your funding in a Fairness Mutual Fund scheme that you’ve held for over 1 yr, will probably be categorised as Lengthy Time period Capital Acquire.

- If you happen to make a acquire / revenue in your funding in a Non-Fairness Mutual Fund scheme (or in a Debt Fund) that you’ve held for over 3 years, will probably be categorised as Lengthy Time period Capital Acquire.

- Brief Time period Capital Positive aspects

- In case your holding in a Fairness mutual fund scheme is lower than 1 yr i.e. if you happen to withdraw your mutual fund models earlier than 1 yr, after making a revenue, then the revenue might be thought of as Brief Time period Capital Acquire.

- If you happen to make a acquire / revenue in your Debt fund (or apart from fairness oriented schemes) that you’ve held for lower than 36 months (3 years), will probably be handled as Brief Time period Capital Acquire.

Price range 2018-19 & Mutual Fund Taxation

Mutual Funds Capital Positive aspects Taxation Guidelines FY 2018-19 | Newest Mutual Funds Capital Positive aspects Tax Charges AY 2019-20

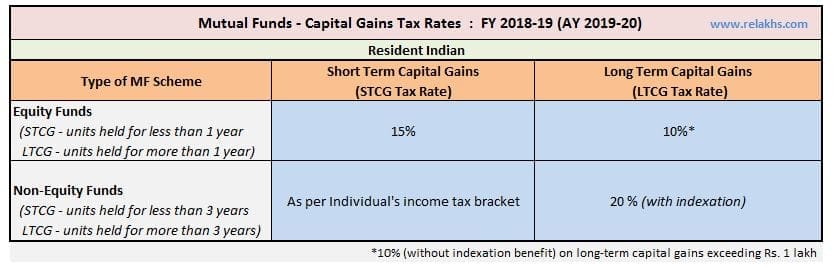

Capital Positive aspects Tax Charges on Mutual Fund Investments of a Resident Indian are as under;

- The STCG (Brief Time period Capital Positive aspects) tax fee on fairness funds is 15%.

- The STCG tax fee on Non-Fairness funds (or) Debt funds is as per the investor’s earnings tax slab fee.

- The LTCG (Lengthy Time period Capital Positive aspects) tax fee on fairness funds is 10% on LTCG exceeding Rs 1 Lakh.

- The LTCG tax fee on non-equity funds is 20% (with Indexation profit)

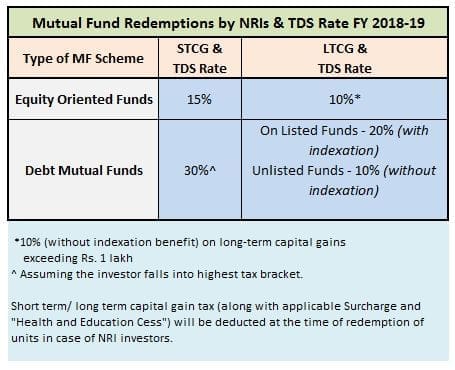

Capital Positive aspects Tax Charges on NRI Mutual Fund Investments for the Monetary Yr 2018-19 (Evaluation Yr 2019-20) are as under;

- The STCG tax fee on fairness funds is 15%.

- In case the short-term capital beneficial properties have been on account of listed fairness shares which have been offered on a inventory alternate or equity-oriented mutual fund, then the provisions for tax calculations as per part 111A of the Earnings Tax Act present that 15% tax is payable by non-residents on a flat foundation with out getting any advantage of the preliminary exemption restrict of Rs 2,50,000. Sadly, the fundamental exemption restrict is accessible just for resident people and HUFs, and never for some other entities. If the short-term capital beneficial properties is just not on account of both of the 2 varieties of sale talked about above, then the good thing about preliminary exemption might be accessible even to non residents.

- The STCG tax fee on Non-Fairness funds (or) Debt funds is as per the investor’s earnings tax slab fee. (Tax Deducted at Supply – TDS @ 30% is relevant)

- The LTCG tax fee on fairness funds is 10%, on LTCG exceeding Rs 1 Lakh.

- The LTCG tax fee on non-equity funds is 20% (with Indexation) on listed mutual fund models and 10% on unlisted funds.

Base Yr & Indexation : As per Price range (2017-18), the bottom yr for calculation of Indexation has been modified to 2001. It has an have an effect on (principally constructive) on investments the place indexation profit is accessible when calculating Capital acquire taxes.

- For instance: Suppose you’re holding on to your investments made in debt funds (or) Property earlier than 2001, the Truthful Market Worth (NAV) as on 1 st April, 2001 might be thought of as value of acquisition for calculating capital beneficial properties. This may assist the investor to cut back the capital beneficial properties taxes.

- As of now, the bottom yr is 1981. To calculate the capital beneficial properties on the time of promoting any Deb fund models / property bought earlier than 1981, its buy value is now calculated on the premise of the honest market worth of 1981. Calculation on the honest market worth of 2001 will improve the price of acquisition and decrease the capital acquire.

(How do you calculate the listed value of buy? The listed value is calculated with the assistance of above desk of value inflation index.

Divide the associated fee at which you bought the Mutual Fund models by the index as on the date of the acquisition. Multiply this by the index as on the date of sale.

For Instance : If buy yr is 2011 and yr of sale is in Monetary Yr 2015. Then listed value of buy can be –

Listed value of buy = (Buy value / 184) * 254.)

Taxation of Mutual Fund Dividends

- Dividends on Fairness Mutual Funds : The dividend acquired within the arms of an unit holder for an fairness mutual fund is totally tax free. Nonetheless, w.e.f. FY 2018-19, the fund homes need to pay 10% Dividend Distribution Tax (DDT) on fairness oriented mutual fund schemes. (Efficient DDT fee is 11.648% inclusive of 12% surcharge & 4% cess.)

- Dividends on Debt Funds : The dividend earnings acquired by a debt fund unit holder can also be tax free. However, the mutual fund firm has to pay a dividend distribution tax (DDT) earlier than distributing this dividend earnings to its Unit-holders. DDT on Debt Mutual Funds is 29.12% (inclusive of surcharge & cess).

NRI Mutual Fund Investments & TDS Price

Beneath are the TDS fee relevant on MF redemptions by NRIs for AY 2019-20.

Hope this put up is informative. Do you test your capital beneficial properties assertion(s) yearly? Do you embrace your capital beneficial properties taxes (if any) in Earnings Tax Returns (ITR). Share your feedback.

Proceed studying :

(Assumption – STT (Securities Transaction Tax) is payable) (Featured Picture courtesy of Stuart Miles at FreeDigitalPhotos.web) (Put up revealed on 01-March-2018)