For many of us, saving cash is step one to investing, but 25% to 35% of Individuals reside paycheck to paycheck. This text appears at why persons are dwelling paycheck to paycheck and the way lower- and middle-income Individuals particularly could possibly improve emergency financial savings resulting in saving extra for retirement. The ideas are simply as related to higher-income individuals as effectively.

Along with volunteering at Habitat For Humanity, I additionally volunteer at an area non-profit group, Neighbor To Neighbor, which provides packages in eviction avoidance, utility shut-off avoidance, reasonably priced housing, housing search, foreclosures prevention, and counseling together with monetary teaching, debt consolidation, and reverse mortgages. Lots of the individuals in search of help at Neighbor To Neighbor have skilled an unlucky circumstance comparable to non permanent or everlasting lack of employment, sudden well being difficulty, divorce, lack of a beloved one, hire inflation, or an accident. My position is to prescreen individuals to get the suitable help inside Neighbor To Neighbor and direct them to exterior sources of help.

As a housing alternative useful resource for Northern Colorado, Neighbor to Neighbor (N2N) providers are designed to satisfy every particular person the place they’re now – from homeless and low-income people in search of a spot to dwell; to households needing help to safe their current properties; to potential patrons able to discover the homebuying course of. Our skilled housing professionals help purchasers by means of obstacles and develop customized options to assist them obtain their housing targets.

I hope this text provides some helpful concepts on reduce spending and save extra. It’s divided into the next sections:

USA Details which is rated by Media Bias/Truth Examine as “Least Biased”, “Very Excessive Factual Reporting”, and “Excessive Credibility”. Mr. Balmer gives this fourteen-minute video, “Is The Economic system Robust?” explaining the state of the (2023) financial system in easy phrases. He covers financial development, inflation (fuel, groceries, hire, housing), employment, earnings, taxes, authorities advantages, demographic shifts, and poverty thresholds.

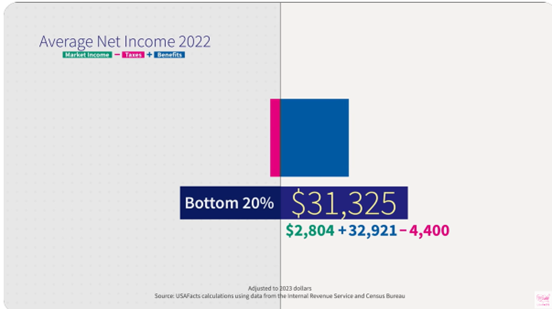

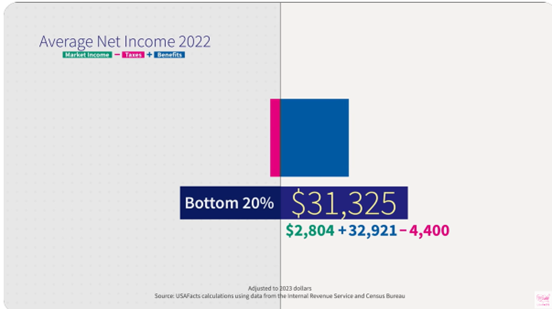

Determine #1 reveals the web earnings of the Backside 20% earnings group which is Market Earnings (Wages, financial savings added to retirement accounts, employer advantages, and earnings from investments) minus taxes (Federal, State, and native) plus authorities advantages (Social Safety, Medicare/Medicaid, meals stamps, tax credit, unemployment advantages…). The online earnings in 2022 of the Backside 20% was $31,325 which was principally authorities advantages, and the web earnings for the Center 20% was $68,575. That was a yr of excessive authorities spending to reduce the impression of the COVID pandemic, and that spending is ending this yr.

Determine #1: 2022 Common Web Earnings for Backside 20% of Earnings Ranges

Supply: USA Details

Mr. Balmer ended on a constructive be aware, he continues “to be amazed on the innovation and dynamism of the U.S. financial system and the work ethic of Individuals. The American employee and American financial system ought to by no means ever be underestimated.”

For my part, the rising nationwide debt will almost definitely lead to increased taxes and/or cuts to authorities spending if Congress fails to deal with the shortfalls. Social Safety was initially created to satisfy the essential wants of older Individuals for meals and shelter throughout the Nice Melancholy. Excessive housing prices and inflation are impacting seniors counting on Social Safety.

15+ American Financial savings Statistics to Know in 2024” in FinMasters by David Moadel:

- Emergency financial savings are saved in reserve to satisfy rapid targets or cowl sudden bills or job loss. They’re sometimes saved in financial savings accounts or different accounts that enable easy accessibility.

- Retirement financial savings are supposed to be used after retirement and are normally invested in an IRA, 401(ok), or brokerage account. These financial savings sorts are equally essential, however information on them are collected individually.

General, 22% of households self-reported having no emergency financial savings, and over a 3rd have some financial savings however can’t cowl three months of dwelling bills. Roughly 40% are safer.

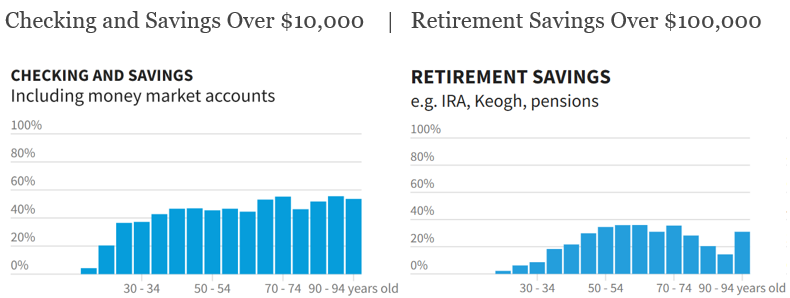

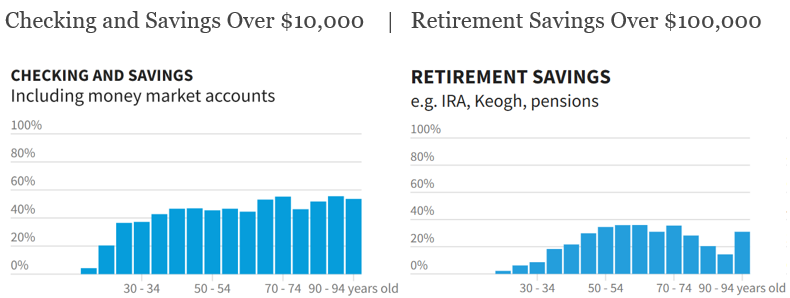

USA Details revealed “Almost half of American households haven’t any retirement financial savings” utilizing the 2022 Survey of Client Funds by the Federal Reserve. They’ve interactive charts for Checking/Financial savings, Retirement Financial savings, Monetary Belongings, and Web Price. In Determine #2, I present the proportion of individuals by age with a minimum of $10,000 of their checking and financial savings accounts together with the proportion of individuals with a minimum of $100,000 of their retirement accounts. About 30% to 50% of individuals match into certainly one of these classes.

Determine #2: P.c of Folks with Emergency Financial savings Over $10,000, Over $100,00o in Retirement Financial savings by Age

Supply: USA Details

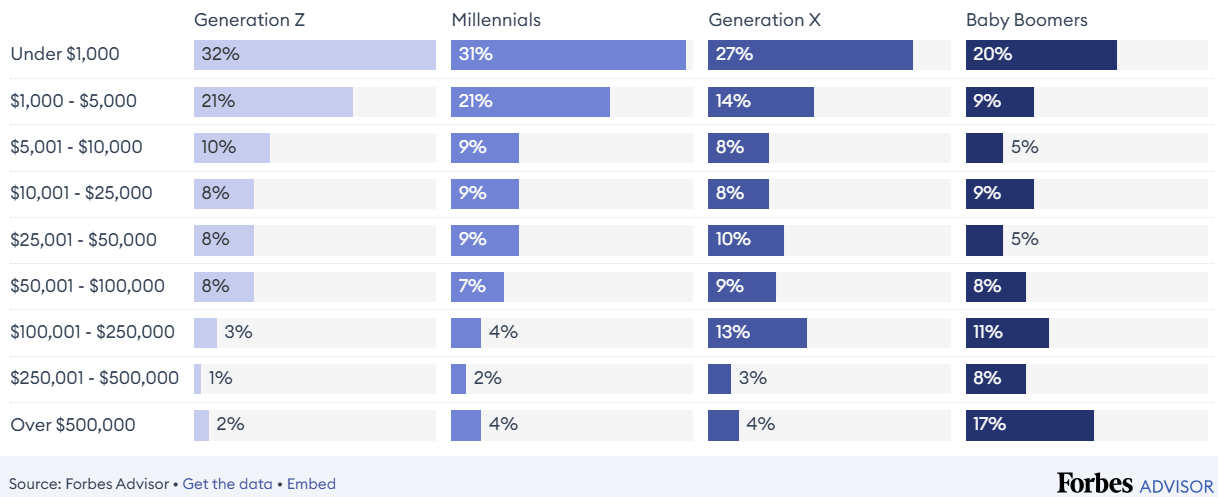

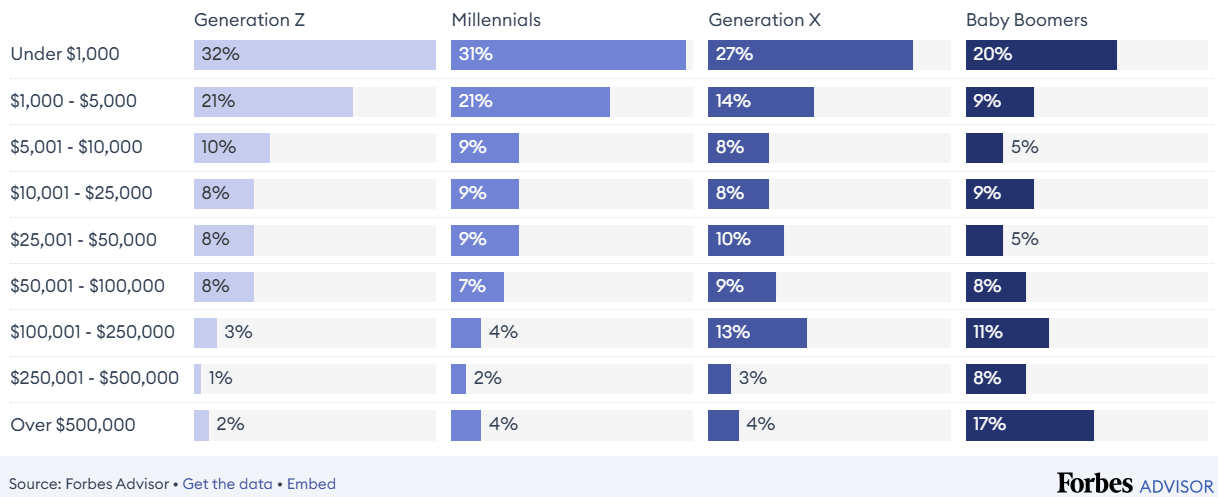

Forbes Advisor’s newest on-line survey of 1 thousand Individuals is summarized by Jamela Adam in “American Financial savings By Era: How Balances And Objectives Range By Age.” Ms. Adam writes, “In accordance with our survey, roughly 28% of Individuals throughout all 4 generations presently have lower than $1,000 in private financial savings, together with emergency funds, non-workplace retirement accounts, and investments.” Determine #3 comprises the entire financial savings from the survey. Within the occasion of an emergency, respondents stated they’d dip into their financial savings (59%), and use debt comparable to bank cards or loans (30%) whereas others stated they’d promote belongings or reduce bills (29%).

Determine #3: Complete Financial savings (together with emergency funds, retirement accounts, and investments) by Age Group

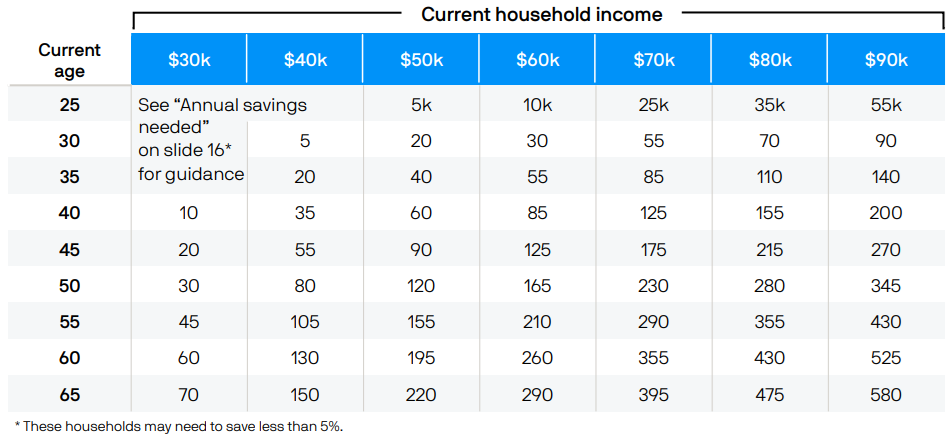

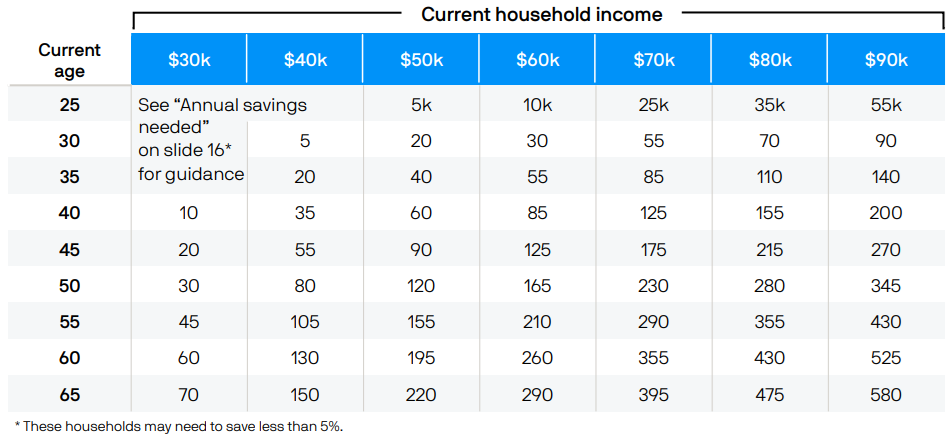

It helps to set targets. JP Morgan’s “2024 Information to Retirement” gives a helpful desk of checkpoints by age and earnings degree based mostly on an assumed contribution charge of 5% and asset allocation of 60% shares/40% bonds previous to retirement. Most individuals can save greater than the desk under by rising their financial savings charge as their earnings rises.

Desk #1: Retirement Financial savings Checkpoints by Earnings and Age

Supply: JP Morgan

estimates that roughly 37 million individuals (11%) lived in poverty in 2023. Eighteen million (13.5%) have been meals insecure at a while throughout 2023, in keeping with the U.S. Division of Agriculture. Over 21 million renter households spent greater than 30% of their earnings on housing prices in 2023, representing almost half of the renter households in america for whom hire burden is calculated in keeping with the U.S. Census Bureau.

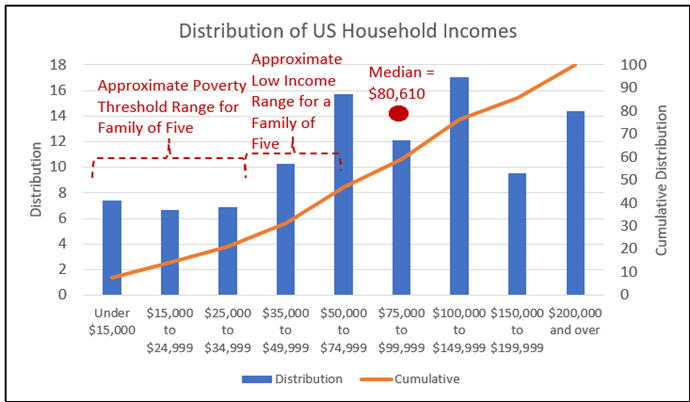

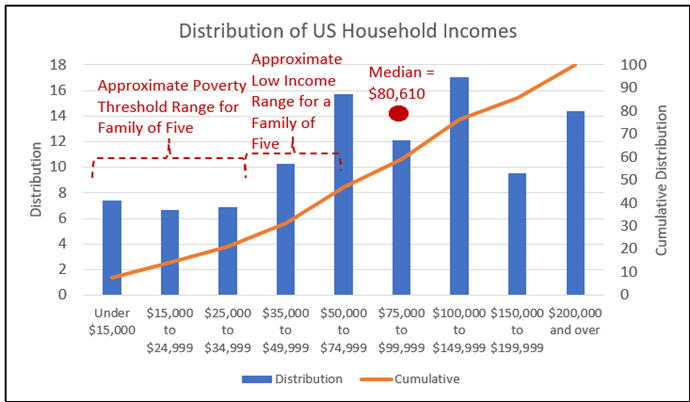

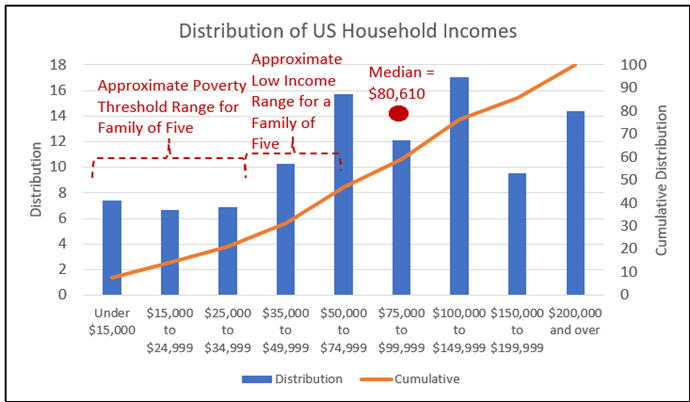

I created the chart under from one other US Census Bureau Report, “Earnings in america: 2023”, displaying the earnings distribution in 2023. The poverty threshold relies upon upon family dimension. The three lowest earnings ranges in Determine #4 symbolize 21% of households. Some individuals will progress from the decrease earnings teams to the upper teams as they acquire expertise, training, and/or abilities. Others could transfer up and down between the degrees based mostly on job stability, job alternatives, well being, or life occasions and preferences.

Determine #4: Distributions of US Family Incomes (2023)

Supply: Creator Utilizing US Census Bureau Report “Earnings in america: 2023”

Gili Malinsky at CNBC explains why persons are dwelling paycheck to paycheck in “Extra Individuals say they’re dwelling paycheck to paycheck this yr than in 2023—right here’s why”. The explanations cited are:

- 69% cite inflation

- 59% cite an absence of financial savings

- 28% cite rising rates of interest

- 33% cite bank card debt

- 28% cite medical or healthcare payments

- 21% cite layoffs or lack of earnings

- 15% cite scholar loans

Having bank card debt is each costly and dangerous. Khristopher J. Brooks wrote “Individuals proceed to rack up bank card debt, hitting a document $1.14 trillion” for CBS Information Cash Watch. He described that U.S. customers collectively owe a document $1.14 trillion in bank card debt. He provides, “About 7.18% of cardholders fell into delinquency within the second quarter, up from 5% within the earlier quarter…” Many adults have extra bank card debt than cash saved in emergency financial savings. The typical bank card rate of interest is now over 24%.

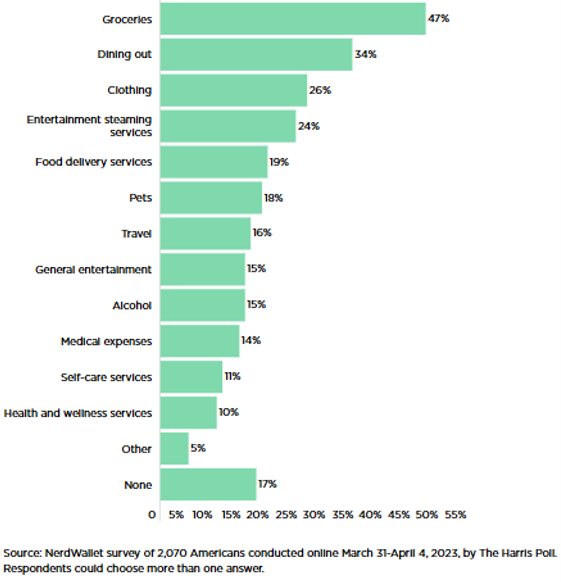

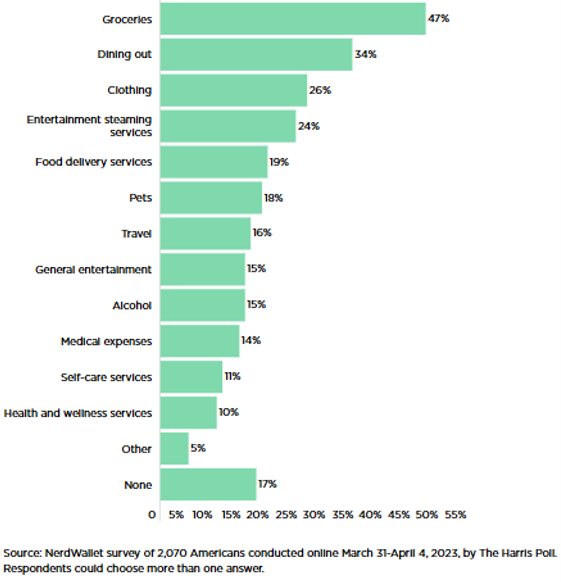

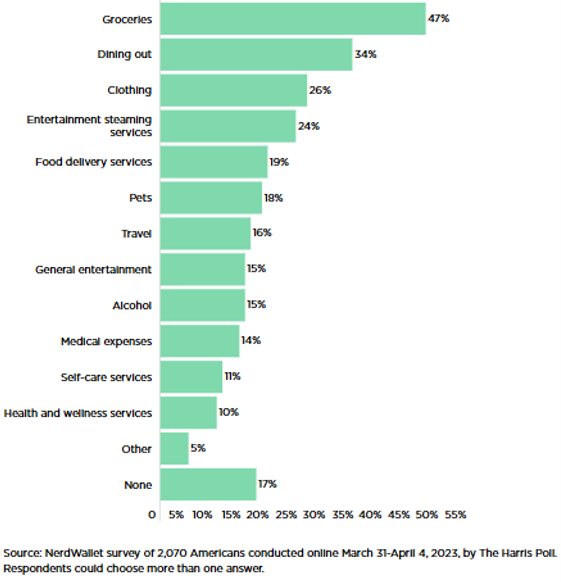

Most Individuals Have a Month-to-month Funds, however Many Nonetheless Overspend”. He provides that near half of Individuals say they need to prioritize emergency financial savings. Determine #5 reveals the classes the place respondents overspend. These classes symbolize alternatives for individuals to economize by adhering to their finances.

Determine #5: Overspending Classes

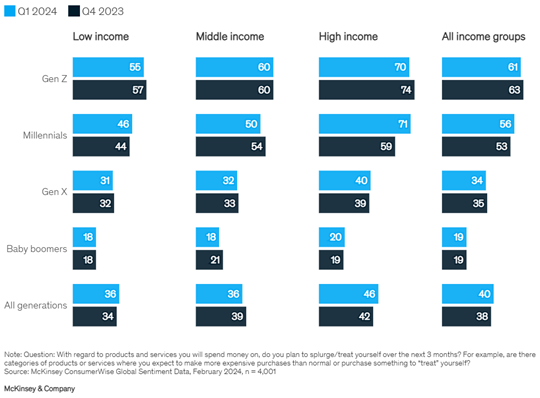

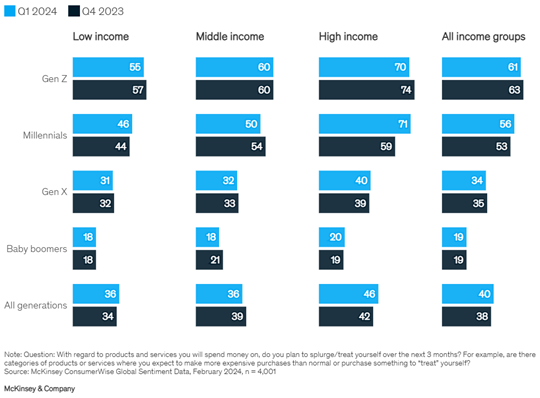

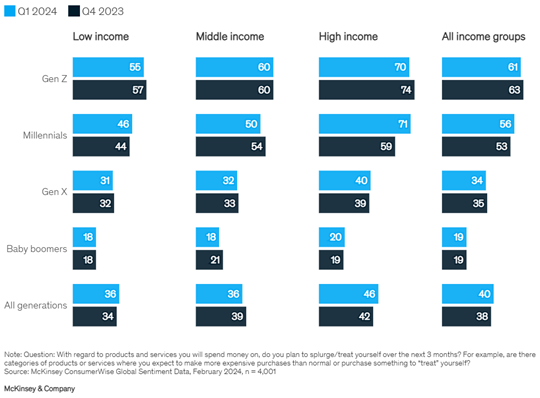

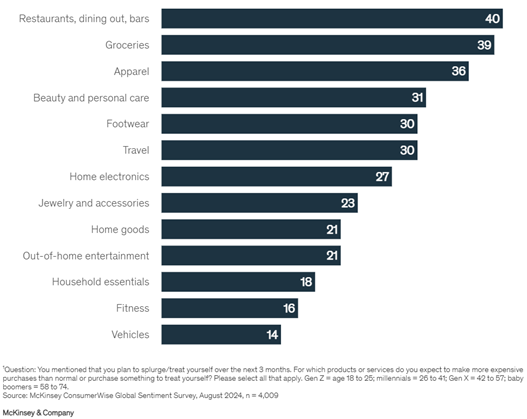

The McKinsey & Firm article, “An replace on US shopper sentiment: Client optimism rebounds—however for the way lengthy?” by Becca Coggins, Christina Adams, Kari Alldredge, and Warren Teichner finds that persons are spending extra on most of the above classes. Pessimism concerning the financial system has declined over the previous three years. Over a 3rd of the “respondents say that stabilizing inflation has made them really feel extra optimistic concerning the financial system”. The factors that I took away are:

- Youthful individuals are likely to splurge greater than older generations.

- Customers indicated they deliberate to extend their spending on most important, semi-discretionary, and discretionary gadgets over the subsequent three months.

- Seventy-six % of customers report buying and selling down—that’s, altering the kind or amount of purchases for higher worth and pricing…

- Customers report buying and selling down whereas on the similar time signaling their intent to splurge. Within the third quarter, extra customers throughout earnings and age teams indicated an intent to splurge in contrast with the earlier quarter.

Determine #6: Share of Respondents Desiring to Splurge in 2024, by Demographic, %

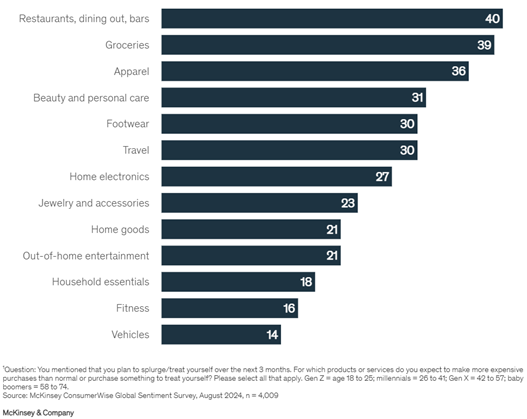

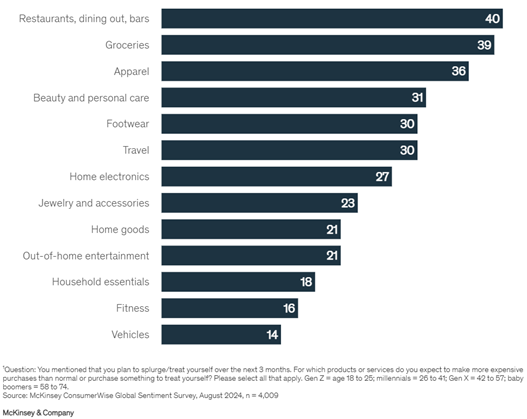

Determine #7: Classes The place Customers Intend to Deal with Themselves, % of All Respondents with Intent to Splurge

The above article describes spending rising due to shopper optimism. Right here is one other article, “Gen Z and millennials are more and more ‘doom spending.’ Right here’s what it’s and cease it” by Sawdah Bhaimiya at CNBC which describes youthful individuals spending extra as a result of they’re pessimistic concerning the financial system and their future. When some persons are depressed, they have an inclination to spend extra to select themselves up. For example, due to the excessive worth of properties, some individuals could quit shopping for a house, and spend the cash as a substitute of saving for a down fee. One resolution Ms. Bhaimiya provides is to extend the “ache of shopping for” comparable to driving to the shop as a substitute of the convenience of on-line buying. Ask your self, “Do I really want this?”

Why are individuals spending extra when many reside paycheck to paycheck or have little financial savings? “Contained in the Psychology of Overspending and How one can Cease” by Jessica Walrack in U.S. Information and World Report describes why some individuals overspend. She lists 5 widespread causes specialists say Individuals are overspending:

- Social Stress: Shopping for what you see others shopping for as a strategy to sign you could afford it, too.

- Life-style Creep: When your bills unintentionally creep up as your earnings will increase.

- Emotional Impulse Spending: A research experiences that buying enhances emotions of non-public management, which suggests it’s prone to alleviate unhappiness.

- Not Accounting for Inflation: For those who don’t modify your finances to account for value will increase, you’ll probably end up overspending every month.

- Credit score Misconceptions: The reality is that you must pay again each greenback, plus curiosity and charges.

What Is A Monetary Counselor?” for Forbes Advisor.

Jean Folger gives a “Information to Hiring a Monetary Counselor“ in Investopedia. She lists typical assist and steerage offered as:

- Construct financial savings

- Create (and stick with) a finances

- Create a plan to pay down debt

- Cope with a direct monetary disaster

- Decide when you’re eligible for tax credit

- Enhance your credit score rating

- Handle strains of credit score

- Handle scholar loans

- Modify ineffective cash habits

- Navigate obtainable public advantages and neighborhood sources

- Set and notice monetary targets

- Perceive fundamental monetary ideas

- Enhance your general monetary well being

- Refer you to an funding advisor or monetary planner whenever you’re prepared

- Some monetary counselors have additional coaching in different areas

Ms. Folger says that the value charged by a monetary counselor is normally decrease than when working with a monetary advisor or licensed monetary planner. “Monetary counselors who work in non-public observe could provide a free preliminary session after which cost a flat price for any subsequent conferences. Others could cost an hourly charge or a month-to-month subscription,” she provides.

Dwelling Paycheck To Paycheck Statistics 2024” in Forbes Advisor, a “2023 survey carried out by Payroll.org.” When requested how individuals dwelling paycheck to paycheck plan to economize, respondents cited three main methods.

- Almost 63% of respondents say making meals at dwelling and packing meals when going out is their major approach of saving cash.

- The second commonest strategy to save was slicing again on nonessential bills (57%).

- The third is buying secondhand (50%).

Non-profit organizations like Habitat For Humanity, Goodwill, Salvation Military, and The Arc increase cash by means of donations to their second-hand shops. There are a lot of bargains. If you wish to downsize or clear out your attic think about donating to a worthy group.

To cease dwelling paycheck to paycheck by yourself, Julia Kagan suggests in “Dwelling Paycheck to Paycheck: Definition, Statistics, How one can Cease” at Investopedia you could:

- Evaluation your finances. Budgeting depends on monitoring your bills towards your earnings… Take a look at each greenback you spend over a month to see if you will discover out what could have elevated your spending.

- Ensure you are saving. Dwelling paycheck to paycheck typically precludes saving. If in case you have little to no financial savings, begin small—put aside 1% of every paycheck ($10 for each $1,000 you earn). And automate it so that you just aren’t tempted to spend it.

- Repay your debt. One draw back of getting no monetary cushion is counting on bank cards with excessive APRs to cowl emergencies of various sizes. Relying in your state of affairs, there are quite a few methods to pay down bank card debt, together with utilizing a debt snowball technique to repay the smallest debt first, utilizing a stability switch on a bank card with 0% curiosity for a yr or extra, or getting a private mortgage or a debt consolidation mortgage.

- Enhance your earnings. Whether or not meaning beginning a facet hustle, asking for a increase or a promotion, or discovering a better-paying job, the additional money may also help you begin setting apart extra financial savings and/or paying off your debt quicker.

Think about a non-profit monetary counselor just like the Nationwide Basis for Credit score Counseling (NFCC) which was based in 1951 and works with customers by means of one-on-one monetary evaluations. The press launch, Nationwide Basis for Credit score Counseling Warns of Skyrocketing Client Monetary Stress, describes a “essential degree of economic pressure the place households are slicing again on meals bills and private financial savings”.

Neighbor To Neighbor’s (the place I volunteer) Monetary Teaching consists of 1) Private Credit score Rating Evaluation & Mortgage Choices, 2) Personalised Budgeting Plan, and three) Referrals for lenders, brokers & different housing professionals. As a part of the teaching, the supervisor helps purchasers analyze their spending habits to grasp the place they’re spending their cash.

Roughly two-thirds of employers provide 401(ok) financial savings. Elizabeth Gravier says in an article at CNBC, “A 401(ok) match is like free cash — right here’s the way it works” that “98% of corporations that supplied a 401(ok) in 2023 matched their workers’ contributions to some extent”. The everyday match is 3 to five%. That is a further incentive to avoid wasting a minimum of the minimal quantity to get the employer-matching contribution. If an worker contributes 5% and the employer contributes 3% then the financial savings charge is 8%.

For individuals with low and average incomes, the Retirement Financial savings Contributions Credit score, also referred to as the Saver’s Credit score, permits an individual “to take a tax credit score for making eligible contributions to your IRA or employer-sponsored retirement plan”. The utmost contribution quantity is $2,000 ($4,000 if married submitting collectively), making the utmost credit score $1,000 ($2,000 if married submitting collectively).

Closing

I consider within the “Pay your self first” philosophy the place you lower your expenses as a precedence earlier than you spend it. I additionally consider in sustaining emergency financial savings as a precedence earlier than investing. Life may have its challenges and emergency financial savings stands out as the distinction between monetary hardship and touchdown in your toes. If an individual resides paycheck to paycheck then it could be worthwhile to go to a Monetary Counselor/Coach.

Supply: USA Details

- Emergency financial savings are saved in reserve to satisfy rapid targets or cowl sudden bills or job loss. They’re sometimes saved in financial savings accounts or different accounts that enable easy accessibility.

- Retirement financial savings are supposed to be used after retirement and are normally invested in an IRA, 401(ok), or brokerage account. These financial savings sorts are equally essential, however information on them are collected individually.

General, 22% of households self-reported having no emergency financial savings, and over a 3rd have some financial savings however can’t cowl three months of dwelling bills. Roughly 40% are safer.

USA Details revealed “Almost half of American households haven’t any retirement financial savings” utilizing the 2022 Survey of Client Funds by the Federal Reserve. They’ve interactive charts for Checking/Financial savings, Retirement Financial savings, Monetary Belongings, and Web Price. In Determine #2, I present the proportion of individuals by age with a minimum of $10,000 of their checking and financial savings accounts together with the proportion of individuals with a minimum of $100,000 of their retirement accounts. About 30% to 50% of individuals match into certainly one of these classes.

Determine #2: P.c of Folks with Emergency Financial savings Over $10,000, Over $100,00o in Retirement Financial savings by Age

Supply: USA Details

Forbes Advisor’s newest on-line survey of 1 thousand Individuals is summarized by Jamela Adam in “American Financial savings By Era: How Balances And Objectives Range By Age.” Ms. Adam writes, “In accordance with our survey, roughly 28% of Individuals throughout all 4 generations presently have lower than $1,000 in private financial savings, together with emergency funds, non-workplace retirement accounts, and investments.” Determine #3 comprises the entire financial savings from the survey. Within the occasion of an emergency, respondents stated they’d dip into their financial savings (59%), and use debt comparable to bank cards or loans (30%) whereas others stated they’d promote belongings or reduce bills (29%).

Determine #3: Complete Financial savings (together with emergency funds, retirement accounts, and investments) by Age Group

It helps to set targets. JP Morgan’s “2024 Information to Retirement” gives a helpful desk of checkpoints by age and earnings degree based mostly on an assumed contribution charge of 5% and asset allocation of 60% shares/40% bonds previous to retirement. Most individuals can save greater than the desk under by rising their financial savings charge as their earnings rises.

Desk #1: Retirement Financial savings Checkpoints by Earnings and Age

Supply: JP Morgan

estimates that roughly 37 million individuals (11%) lived in poverty in 2023. Eighteen million (13.5%) have been meals insecure at a while throughout 2023, in keeping with the U.S. Division of Agriculture. Over 21 million renter households spent greater than 30% of their earnings on housing prices in 2023, representing almost half of the renter households in america for whom hire burden is calculated in keeping with the U.S. Census Bureau.

I created the chart under from one other US Census Bureau Report, “Earnings in america: 2023”, displaying the earnings distribution in 2023. The poverty threshold relies upon upon family dimension. The three lowest earnings ranges in Determine #4 symbolize 21% of households. Some individuals will progress from the decrease earnings teams to the upper teams as they acquire expertise, training, and/or abilities. Others could transfer up and down between the degrees based mostly on job stability, job alternatives, well being, or life occasions and preferences.

Determine #4: Distributions of US Family Incomes (2023)

Supply: Creator Utilizing US Census Bureau Report “Earnings in america: 2023”

Gili Malinsky at CNBC explains why persons are dwelling paycheck to paycheck in “Extra Individuals say they’re dwelling paycheck to paycheck this yr than in 2023—right here’s why”. The explanations cited are:

- 69% cite inflation

- 59% cite an absence of financial savings

- 28% cite rising rates of interest

- 33% cite bank card debt

- 28% cite medical or healthcare payments

- 21% cite layoffs or lack of earnings

- 15% cite scholar loans

Having bank card debt is each costly and dangerous. Khristopher J. Brooks wrote “Individuals proceed to rack up bank card debt, hitting a document $1.14 trillion” for CBS Information Cash Watch. He described that U.S. customers collectively owe a document $1.14 trillion in bank card debt. He provides, “About 7.18% of cardholders fell into delinquency within the second quarter, up from 5% within the earlier quarter…” Many adults have extra bank card debt than cash saved in emergency financial savings. The typical bank card rate of interest is now over 24%.

Most Individuals Have a Month-to-month Funds, however Many Nonetheless Overspend”. He provides that near half of Individuals say they need to prioritize emergency financial savings. Determine #5 reveals the classes the place respondents overspend. These classes symbolize alternatives for individuals to economize by adhering to their finances.

Determine #5: Overspending Classes

The McKinsey & Firm article, “An replace on US shopper sentiment: Client optimism rebounds—however for the way lengthy?” by Becca Coggins, Christina Adams, Kari Alldredge, and Warren Teichner finds that persons are spending extra on most of the above classes. Pessimism concerning the financial system has declined over the previous three years. Over a 3rd of the “respondents say that stabilizing inflation has made them really feel extra optimistic concerning the financial system”. The factors that I took away are:

- Youthful individuals are likely to splurge greater than older generations.

- Customers indicated they deliberate to extend their spending on most important, semi-discretionary, and discretionary gadgets over the subsequent three months.

- Seventy-six % of customers report buying and selling down—that’s, altering the kind or amount of purchases for higher worth and pricing…

- Customers report buying and selling down whereas on the similar time signaling their intent to splurge. Within the third quarter, extra customers throughout earnings and age teams indicated an intent to splurge in contrast with the earlier quarter.

Determine #6: Share of Respondents Desiring to Splurge in 2024, by Demographic, %

Determine #7: Classes The place Customers Intend to Deal with Themselves, % of All Respondents with Intent to Splurge

The above article describes spending rising due to shopper optimism. Right here is one other article, “Gen Z and millennials are more and more ‘doom spending.’ Right here’s what it’s and cease it” by Sawdah Bhaimiya at CNBC which describes youthful individuals spending extra as a result of they’re pessimistic concerning the financial system and their future. When some persons are depressed, they have an inclination to spend extra to select themselves up. For example, due to the excessive worth of properties, some individuals could quit shopping for a house, and spend the cash as a substitute of saving for a down fee. One resolution Ms. Bhaimiya provides is to extend the “ache of shopping for” comparable to driving to the shop as a substitute of the convenience of on-line buying. Ask your self, “Do I really want this?”

Why are individuals spending extra when many reside paycheck to paycheck or have little financial savings? “Contained in the Psychology of Overspending and How one can Cease” by Jessica Walrack in U.S. Information and World Report describes why some individuals overspend. She lists 5 widespread causes specialists say Individuals are overspending:

- Social Stress: Shopping for what you see others shopping for as a strategy to sign you could afford it, too.

- Life-style Creep: When your bills unintentionally creep up as your earnings will increase.

- Emotional Impulse Spending: A research experiences that buying enhances emotions of non-public management, which suggests it’s prone to alleviate unhappiness.

- Not Accounting for Inflation: For those who don’t modify your finances to account for value will increase, you’ll probably end up overspending every month.

- Credit score Misconceptions: The reality is that you must pay again each greenback, plus curiosity and charges.

What Is A Monetary Counselor?” for Forbes Advisor.

Jean Folger gives a “Information to Hiring a Monetary Counselor“ in Investopedia. She lists typical assist and steerage offered as:

- Construct financial savings

- Create (and stick with) a finances

- Create a plan to pay down debt

- Cope with a direct monetary disaster

- Decide when you’re eligible for tax credit

- Enhance your credit score rating

- Handle strains of credit score

- Handle scholar loans

- Modify ineffective cash habits

- Navigate obtainable public advantages and neighborhood sources

- Set and notice monetary targets

- Perceive fundamental monetary ideas

- Enhance your general monetary well being

- Refer you to an funding advisor or monetary planner whenever you’re prepared

- Some monetary counselors have additional coaching in different areas

Ms. Folger says that the value charged by a monetary counselor is normally decrease than when working with a monetary advisor or licensed monetary planner. “Monetary counselors who work in non-public observe could provide a free preliminary session after which cost a flat price for any subsequent conferences. Others could cost an hourly charge or a month-to-month subscription,” she provides.

Dwelling Paycheck To Paycheck Statistics 2024” in Forbes Advisor, a “2023 survey carried out by Payroll.org.” When requested how individuals dwelling paycheck to paycheck plan to economize, respondents cited three main methods.

- Almost 63% of respondents say making meals at dwelling and packing meals when going out is their major approach of saving cash.

- The second commonest strategy to save was slicing again on nonessential bills (57%).

- The third is buying secondhand (50%).

Non-profit organizations like Habitat For Humanity, Goodwill, Salvation Military, and The Arc increase cash by means of donations to their second-hand shops. There are a lot of bargains. If you wish to downsize or clear out your attic think about donating to a worthy group.

To cease dwelling paycheck to paycheck by yourself, Julia Kagan suggests in “Dwelling Paycheck to Paycheck: Definition, Statistics, How one can Cease” at Investopedia you could:

- Evaluation your finances. Budgeting depends on monitoring your bills towards your earnings… Take a look at each greenback you spend over a month to see if you will discover out what could have elevated your spending.

- Ensure you are saving. Dwelling paycheck to paycheck typically precludes saving. If in case you have little to no financial savings, begin small—put aside 1% of every paycheck ($10 for each $1,000 you earn). And automate it so that you just aren’t tempted to spend it.

- Repay your debt. One draw back of getting no monetary cushion is counting on bank cards with excessive APRs to cowl emergencies of various sizes. Relying in your state of affairs, there are quite a few methods to pay down bank card debt, together with utilizing a debt snowball technique to repay the smallest debt first, utilizing a stability switch on a bank card with 0% curiosity for a yr or extra, or getting a private mortgage or a debt consolidation mortgage.

- Enhance your earnings. Whether or not meaning beginning a facet hustle, asking for a increase or a promotion, or discovering a better-paying job, the additional money may also help you begin setting apart extra financial savings and/or paying off your debt quicker.

Think about a non-profit monetary counselor just like the Nationwide Basis for Credit score Counseling (NFCC) which was based in 1951 and works with customers by means of one-on-one monetary evaluations. The press launch, Nationwide Basis for Credit score Counseling Warns of Skyrocketing Client Monetary Stress, describes a “essential degree of economic pressure the place households are slicing again on meals bills and private financial savings”.

Neighbor To Neighbor’s (the place I volunteer) Monetary Teaching consists of 1) Private Credit score Rating Evaluation & Mortgage Choices, 2) Personalised Budgeting Plan, and three) Referrals for lenders, brokers & different housing professionals. As a part of the teaching, the supervisor helps purchasers analyze their spending habits to grasp the place they’re spending their cash.

Roughly two-thirds of employers provide 401(ok) financial savings. Elizabeth Gravier says in an article at CNBC, “A 401(ok) match is like free cash — right here’s the way it works” that “98% of corporations that supplied a 401(ok) in 2023 matched their workers’ contributions to some extent”. The everyday match is 3 to five%. That is a further incentive to avoid wasting a minimum of the minimal quantity to get the employer-matching contribution. If an worker contributes 5% and the employer contributes 3% then the financial savings charge is 8%.

For individuals with low and average incomes, the Retirement Financial savings Contributions Credit score, also referred to as the Saver’s Credit score, permits an individual “to take a tax credit score for making eligible contributions to your IRA or employer-sponsored retirement plan”. The utmost contribution quantity is $2,000 ($4,000 if married submitting collectively), making the utmost credit score $1,000 ($2,000 if married submitting collectively).

Closing

I consider within the “Pay your self first” philosophy the place you lower your expenses as a precedence earlier than you spend it. I additionally consider in sustaining emergency financial savings as a precedence earlier than investing. Life may have its challenges and emergency financial savings stands out as the distinction between monetary hardship and touchdown in your toes. If an individual resides paycheck to paycheck then it could be worthwhile to go to a Monetary Counselor/Coach.

Supply: Creator Utilizing US Census Bureau Report “Earnings in america: 2023”

Determine #5: Overspending Classes

The McKinsey & Firm article, “An replace on US shopper sentiment: Client optimism rebounds—however for the way lengthy?” by Becca Coggins, Christina Adams, Kari Alldredge, and Warren Teichner finds that persons are spending extra on most of the above classes. Pessimism concerning the financial system has declined over the previous three years. Over a 3rd of the “respondents say that stabilizing inflation has made them really feel extra optimistic concerning the financial system”. The factors that I took away are:

- Youthful individuals are likely to splurge greater than older generations.

- Customers indicated they deliberate to extend their spending on most important, semi-discretionary, and discretionary gadgets over the subsequent three months.

- Seventy-six % of customers report buying and selling down—that’s, altering the kind or amount of purchases for higher worth and pricing…

- Customers report buying and selling down whereas on the similar time signaling their intent to splurge. Within the third quarter, extra customers throughout earnings and age teams indicated an intent to splurge in contrast with the earlier quarter.

Determine #6: Share of Respondents Desiring to Splurge in 2024, by Demographic, %

Determine #7: Classes The place Customers Intend to Deal with Themselves, % of All Respondents with Intent to Splurge

The above article describes spending rising due to shopper optimism. Right here is one other article, “Gen Z and millennials are more and more ‘doom spending.’ Right here’s what it’s and cease it” by Sawdah Bhaimiya at CNBC which describes youthful individuals spending extra as a result of they’re pessimistic concerning the financial system and their future. When some persons are depressed, they have an inclination to spend extra to select themselves up. For example, due to the excessive worth of properties, some individuals could quit shopping for a house, and spend the cash as a substitute of saving for a down fee. One resolution Ms. Bhaimiya provides is to extend the “ache of shopping for” comparable to driving to the shop as a substitute of the convenience of on-line buying. Ask your self, “Do I really want this?”

Why are individuals spending extra when many reside paycheck to paycheck or have little financial savings? “Contained in the Psychology of Overspending and How one can Cease” by Jessica Walrack in U.S. Information and World Report describes why some individuals overspend. She lists 5 widespread causes specialists say Individuals are overspending:

- Social Stress: Shopping for what you see others shopping for as a strategy to sign you could afford it, too.

- Life-style Creep: When your bills unintentionally creep up as your earnings will increase.

- Emotional Impulse Spending: A research experiences that buying enhances emotions of non-public management, which suggests it’s prone to alleviate unhappiness.

- Not Accounting for Inflation: For those who don’t modify your finances to account for value will increase, you’ll probably end up overspending every month.

- Credit score Misconceptions: The reality is that you must pay again each greenback, plus curiosity and charges.

What Is A Monetary Counselor?” for Forbes Advisor.

Jean Folger gives a “Information to Hiring a Monetary Counselor“ in Investopedia. She lists typical assist and steerage offered as:

- Construct financial savings

- Create (and stick with) a finances

- Create a plan to pay down debt

- Cope with a direct monetary disaster

- Decide when you’re eligible for tax credit

- Enhance your credit score rating

- Handle strains of credit score

- Handle scholar loans

- Modify ineffective cash habits

- Navigate obtainable public advantages and neighborhood sources

- Set and notice monetary targets

- Perceive fundamental monetary ideas

- Enhance your general monetary well being

- Refer you to an funding advisor or monetary planner whenever you’re prepared

- Some monetary counselors have additional coaching in different areas

Ms. Folger says that the value charged by a monetary counselor is normally decrease than when working with a monetary advisor or licensed monetary planner. “Monetary counselors who work in non-public observe could provide a free preliminary session after which cost a flat price for any subsequent conferences. Others could cost an hourly charge or a month-to-month subscription,” she provides.

Dwelling Paycheck To Paycheck Statistics 2024” in Forbes Advisor, a “2023 survey carried out by Payroll.org.” When requested how individuals dwelling paycheck to paycheck plan to economize, respondents cited three main methods.

- Almost 63% of respondents say making meals at dwelling and packing meals when going out is their major approach of saving cash.

- The second commonest strategy to save was slicing again on nonessential bills (57%).

- The third is buying secondhand (50%).

Non-profit organizations like Habitat For Humanity, Goodwill, Salvation Military, and The Arc increase cash by means of donations to their second-hand shops. There are a lot of bargains. If you wish to downsize or clear out your attic think about donating to a worthy group.

To cease dwelling paycheck to paycheck by yourself, Julia Kagan suggests in “Dwelling Paycheck to Paycheck: Definition, Statistics, How one can Cease” at Investopedia you could:

- Evaluation your finances. Budgeting depends on monitoring your bills towards your earnings… Take a look at each greenback you spend over a month to see if you will discover out what could have elevated your spending.

- Ensure you are saving. Dwelling paycheck to paycheck typically precludes saving. If in case you have little to no financial savings, begin small—put aside 1% of every paycheck ($10 for each $1,000 you earn). And automate it so that you just aren’t tempted to spend it.

- Repay your debt. One draw back of getting no monetary cushion is counting on bank cards with excessive APRs to cowl emergencies of various sizes. Relying in your state of affairs, there are quite a few methods to pay down bank card debt, together with utilizing a debt snowball technique to repay the smallest debt first, utilizing a stability switch on a bank card with 0% curiosity for a yr or extra, or getting a private mortgage or a debt consolidation mortgage.

- Enhance your earnings. Whether or not meaning beginning a facet hustle, asking for a increase or a promotion, or discovering a better-paying job, the additional money may also help you begin setting apart extra financial savings and/or paying off your debt quicker.

Think about a non-profit monetary counselor just like the Nationwide Basis for Credit score Counseling (NFCC) which was based in 1951 and works with customers by means of one-on-one monetary evaluations. The press launch, Nationwide Basis for Credit score Counseling Warns of Skyrocketing Client Monetary Stress, describes a “essential degree of economic pressure the place households are slicing again on meals bills and private financial savings”.

Neighbor To Neighbor’s (the place I volunteer) Monetary Teaching consists of 1) Private Credit score Rating Evaluation & Mortgage Choices, 2) Personalised Budgeting Plan, and three) Referrals for lenders, brokers & different housing professionals. As a part of the teaching, the supervisor helps purchasers analyze their spending habits to grasp the place they’re spending their cash.

Roughly two-thirds of employers provide 401(ok) financial savings. Elizabeth Gravier says in an article at CNBC, “A 401(ok) match is like free cash — right here’s the way it works” that “98% of corporations that supplied a 401(ok) in 2023 matched their workers’ contributions to some extent”. The everyday match is 3 to five%. That is a further incentive to avoid wasting a minimum of the minimal quantity to get the employer-matching contribution. If an worker contributes 5% and the employer contributes 3% then the financial savings charge is 8%.

For individuals with low and average incomes, the Retirement Financial savings Contributions Credit score, also referred to as the Saver’s Credit score, permits an individual “to take a tax credit score for making eligible contributions to your IRA or employer-sponsored retirement plan”. The utmost contribution quantity is $2,000 ($4,000 if married submitting collectively), making the utmost credit score $1,000 ($2,000 if married submitting collectively).

Closing

I consider within the “Pay your self first” philosophy the place you lower your expenses as a precedence earlier than you spend it. I additionally consider in sustaining emergency financial savings as a precedence earlier than investing. Life may have its challenges and emergency financial savings stands out as the distinction between monetary hardship and touchdown in your toes. If an individual resides paycheck to paycheck then it could be worthwhile to go to a Monetary Counselor/Coach.

- Almost 63% of respondents say making meals at dwelling and packing meals when going out is their major approach of saving cash.

- The second commonest strategy to save was slicing again on nonessential bills (57%).

- The third is buying secondhand (50%).

Non-profit organizations like Habitat For Humanity, Goodwill, Salvation Military, and The Arc increase cash by means of donations to their second-hand shops. There are a lot of bargains. If you wish to downsize or clear out your attic think about donating to a worthy group.

To cease dwelling paycheck to paycheck by yourself, Julia Kagan suggests in “Dwelling Paycheck to Paycheck: Definition, Statistics, How one can Cease” at Investopedia you could:

- Evaluation your finances. Budgeting depends on monitoring your bills towards your earnings… Take a look at each greenback you spend over a month to see if you will discover out what could have elevated your spending.

- Ensure you are saving. Dwelling paycheck to paycheck typically precludes saving. If in case you have little to no financial savings, begin small—put aside 1% of every paycheck ($10 for each $1,000 you earn). And automate it so that you just aren’t tempted to spend it.

- Repay your debt. One draw back of getting no monetary cushion is counting on bank cards with excessive APRs to cowl emergencies of various sizes. Relying in your state of affairs, there are quite a few methods to pay down bank card debt, together with utilizing a debt snowball technique to repay the smallest debt first, utilizing a stability switch on a bank card with 0% curiosity for a yr or extra, or getting a private mortgage or a debt consolidation mortgage.

- Enhance your earnings. Whether or not meaning beginning a facet hustle, asking for a increase or a promotion, or discovering a better-paying job, the additional money may also help you begin setting apart extra financial savings and/or paying off your debt quicker.

Think about a non-profit monetary counselor just like the Nationwide Basis for Credit score Counseling (NFCC) which was based in 1951 and works with customers by means of one-on-one monetary evaluations. The press launch, Nationwide Basis for Credit score Counseling Warns of Skyrocketing Client Monetary Stress, describes a “essential degree of economic pressure the place households are slicing again on meals bills and private financial savings”.

Neighbor To Neighbor’s (the place I volunteer) Monetary Teaching consists of 1) Private Credit score Rating Evaluation & Mortgage Choices, 2) Personalised Budgeting Plan, and three) Referrals for lenders, brokers & different housing professionals. As a part of the teaching, the supervisor helps purchasers analyze their spending habits to grasp the place they’re spending their cash.

Roughly two-thirds of employers provide 401(ok) financial savings. Elizabeth Gravier says in an article at CNBC, “A 401(ok) match is like free cash — right here’s the way it works” that “98% of corporations that supplied a 401(ok) in 2023 matched their workers’ contributions to some extent”. The everyday match is 3 to five%. That is a further incentive to avoid wasting a minimum of the minimal quantity to get the employer-matching contribution. If an worker contributes 5% and the employer contributes 3% then the financial savings charge is 8%.

For individuals with low and average incomes, the Retirement Financial savings Contributions Credit score, also referred to as the Saver’s Credit score, permits an individual “to take a tax credit score for making eligible contributions to your IRA or employer-sponsored retirement plan”. The utmost contribution quantity is $2,000 ($4,000 if married submitting collectively), making the utmost credit score $1,000 ($2,000 if married submitting collectively).

Closing

I consider within the “Pay your self first” philosophy the place you lower your expenses as a precedence earlier than you spend it. I additionally consider in sustaining emergency financial savings as a precedence earlier than investing. Life may have its challenges and emergency financial savings stands out as the distinction between monetary hardship and touchdown in your toes. If an individual resides paycheck to paycheck then it could be worthwhile to go to a Monetary Counselor/Coach.