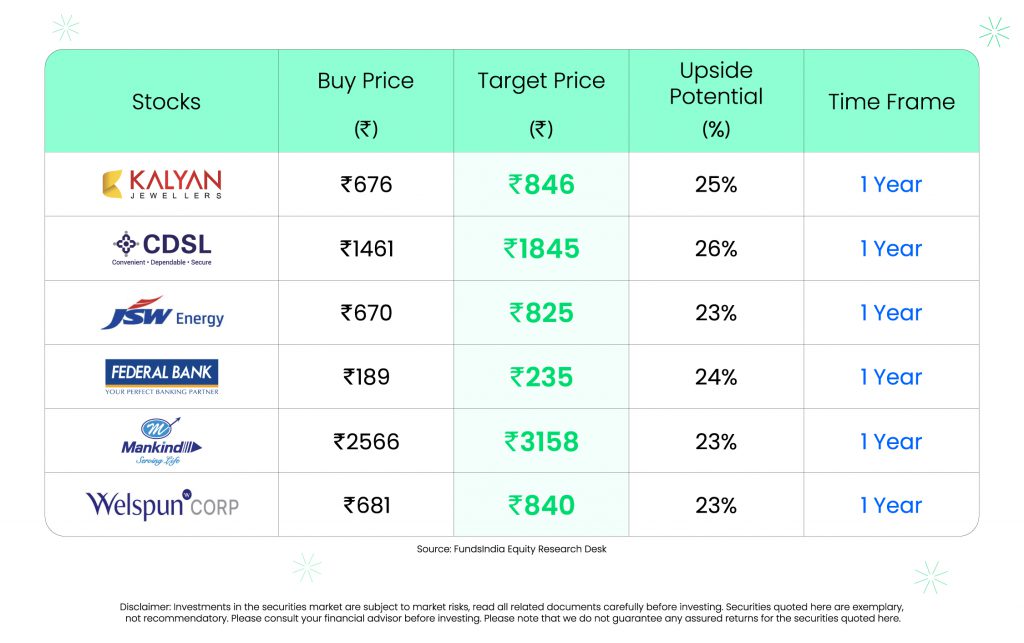

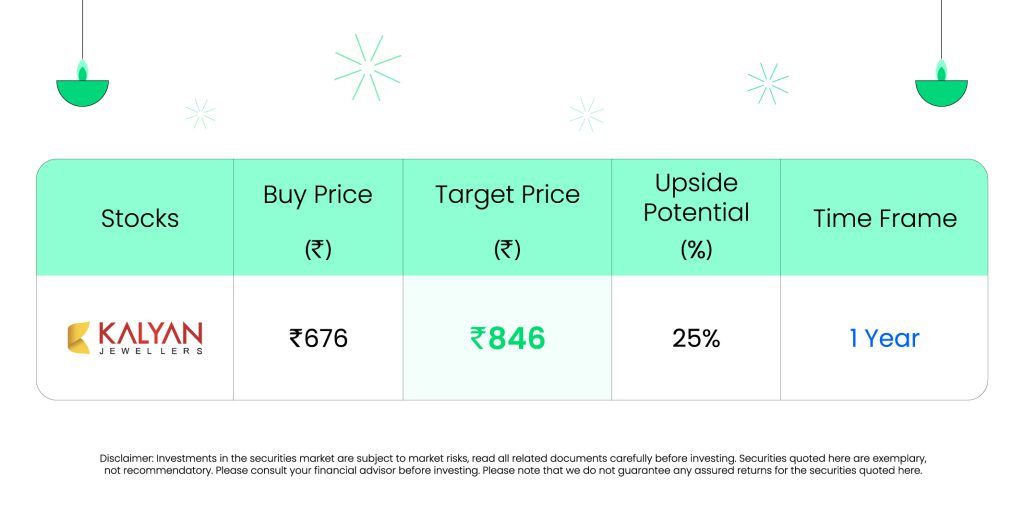

Kalyan Jewellers India Ltd

Based in 1993, Kalyan Jewellers Ltd. is now among the many largest jewelry firms in India. The corporate makes a speciality of designing, manufacturing, and promoting quite a lot of gold, studded, and different jewelry objects throughout varied worth factors. As of Q1FY25, Kalyan operates 241 showrooms in India and 36 within the Center East. With over 12,000 workers, it has a presence in 23 states and union territories in India and 5 nations worldwide.

The corporate has introduced plans to amass a 15% stake of their e-commerce (digital-first jewelry platform) subsidiary Enovate (Candere), making it a 100% wholly owned subsidiary of the corporate. At the moment working 13 Candere showrooms, the corporate goals to develop that quantity to a complete of fifty by the top of the monetary 12 months. It additionally has plans to enter the US market in FY25 by establishing one retailer every in New Jersey and Chicago. Notably, the corporate’s promoters have raised their stake within the firm from 60.59% of Jun 2024 to 62.90% of Sep 2024, indicating a better confidence in firm prospects.

Throughout Q1FY25, the corporate achieved income of Rs.5,536 crore, a rise of 27% in comparison with the Rs.4,376 crore of Q1FY24. Firm EBITDA additionally improved by 16% YoY throughout the quarter to Rs.376 crore. PAT rose by 24% to Rs.178 crore. The corporate has delivered gross sales and revenue CAGR of 29% and 367% respectively, over the past 3 years (FY2021-24). Common 3-year ROE and ROCE is at 12% every. Debt-to-equity is at Rs.1.07.

Outlook:

The corporate is focusing on to open six jewelry showrooms in abroad markets and 130 retailers in India in FY25 (80 Kalyan & 50 Candere). It has given a capex steering of Rs.250 crore for FY25. With scale-up of recent franchise enterprise, steady success in non-Southern enterprise, retailer additions throughout various places, new buyer acquisition pushed by enchancment in studded jewelry share and robust same-store gross sales progress (SSSG) in comparison with its friends, we anticipate the corporate to proceed its business main progress.

Danger:

- Regulatory Danger – The corporate is uncovered to future regulatory actions that will have an effect on its enterprise profile.

- Aggressive depth – The corporate could be pressurised as a result of aggressive depth within the jewelry sector, particularly from the brand new entrants.

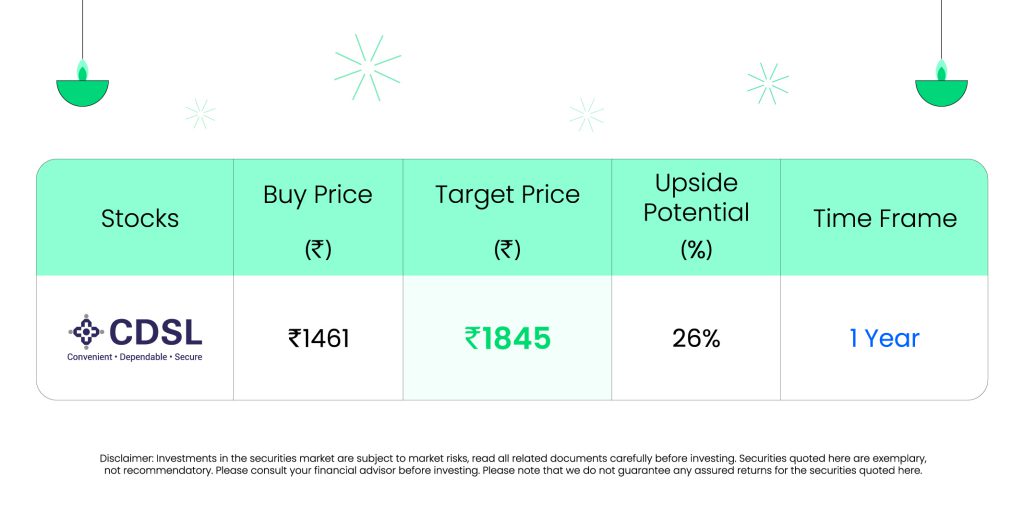

Central Depository Companies (India) Ltd

Based in 1999, Central Depository Companies Ltd. (CDSL) is a Market Infrastructure Establishment (MII), a part of the capital market construction, offering providers to all market individuals – exchanges, clearing companies, depository individuals (DPs), issuers and buyers. It’s a facilitator for holding securities within the dematerialized kind and an enabler for securities transactions. It additionally presents providers to a number of subsectors of the capital markets corresponding to securities, mutual funds, and insurance coverage firms.

CDSL derives its working revenue from fastened annual prices collected from the registered issuer firms and transaction-based charges collected from DPs, account upkeep prices from company account holders, and month-to-month upkeep prices from clearing members for upkeep of settlement accounts. Different constant revenue-generating providers provided by the corporate embrace IPO and company motion prices, KYC prices paid by intermediaries, e-voting, electronic mail handle updation facility for firms/issuers and e-notice providers to registered firms. The corporate is proactively placing efforts into bettering its know-how choices. Throughout the quarter, the corporate launched new multi-lingual eCAS providers, accessible in the popular language of the investor and the multi-lingual chatbot.

Income for Q1FY25 elevated by 65% to Rs.287 crore, up from Rs.174 crores in Q1FY24. Web revenue rose by 81% to Rs.134 crore in comparison with Rs.74 crore within the earlier 12 months. As of Q1FY25, CDSL had 12.5 crore registered accounts opened in comparison with 8.8 crore in Q1FY24, making a 42% YoY improve. Leveraged progress of know-how and in depth presence in Tier 3 and Tier 4 cities has aided within the firm’s progress throughout the interval. The corporate has generated income and internet revenue CAGR of 33% and 28% over the previous 3 years (FY21-24). 3-year ROE and ROCE is at 29% and 37% respectively.

Outlook:

CDSL is actively investing in know-how to enhance its infrastructure, emphasizing {hardware}, utility safety, and top-tier know-how platforms. The swift improve in demat accounts is anticipated to take care of this progress momentum. The corporate holds a monopoly in its sector. Administration is optimistic in regards to the firm’s progress path, fuelled by rising retail participation in capital markets and strategic technological investments. We imagine CDSL is well-equipped to grab upcoming market alternatives.

Danger:

- Regulatory danger – The corporate operates in a sector overseen by regulatory our bodies corresponding to SEBI. Any insurance policies launched that might impede the corporate’s operations could have an effect on its income.

- Monetary market associated danger – Any decline in demat quantity may impression the corporate financials.

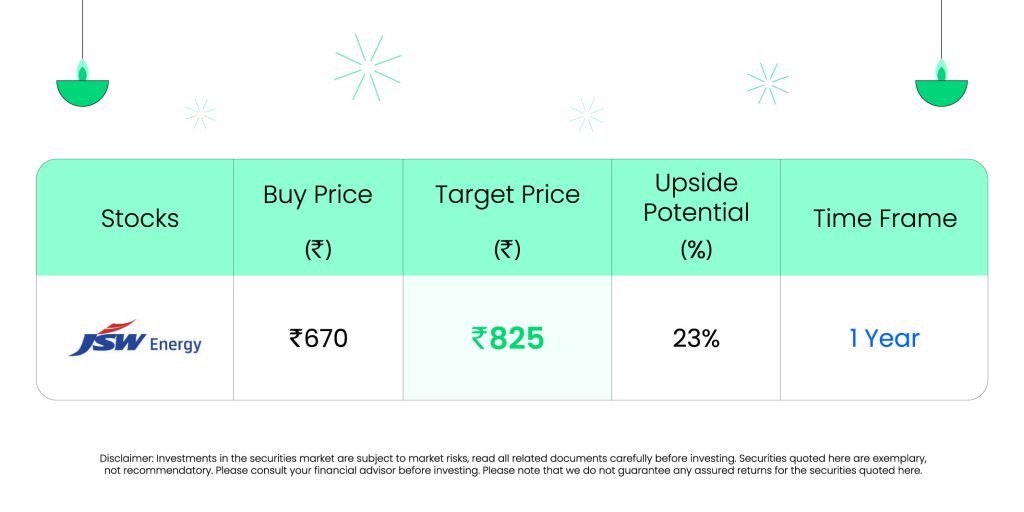

JSW Vitality Ltd

JSW Vitality Ltd. is amongst India’s main unbiased energy producers with a locked-in platform capability of 13.2 GW. The corporate holds 54% capability in thermal, 33% in renewables, 11% in hydro and a couple of% in nuclear power.

The corporate has signed a 25-year settlement to supply a complete of 1,200 MW of solar-wind power to the Maharashtra discom and has additionally partnered with Gujarat Urja Vikas Nigam Ltd. to ship 192 MW of hybrid power beneath an identical 25-year contract. It additionally signed a PPA with NTPC for a 700 MW ISTS/STU-connected photo voltaic challenge, anticipated to be commissioned in June 2026. The corporate can be setting up Asia’s largest battery power storage system (1 GWh capability).

Throughout the quarter, income improved marginally to Rs.3,043 crore from Rs.3,013 crore in Q1FY24. EBITDA elevated by 21% to Rs.1,581 crore in comparison with the Rs.1,307 crore of Q1FY24. The corporate reported a internet revenue of Rs.958 crore, which is a progress of 29% from the corresponding interval within the earlier 12 months. YoY, EBITDA margin has improved from 43% to 52% and internet revenue margin improved from 25% to 31%. Throughout the quarter, renewable power technology elevated by 44% YoY, hydro technology by 61% and thermal technology by 4% leading to an total 18% enchancment in internet technology. The corporate has generated income and PAT CAGR of 18% and 29% over the interval of three years (FY21-24). The typical 3-year ROE & ROCE is round 9% every for the FY 21-24 interval. The corporate has a debt-to-equity ratio of 1.52.

Outlook:

The corporate has a goal of reaching technology capability of 20 GW & power storage of 40 GWh earlier than 2030. Administration is optimistic in regards to the progress alternatives offered by the evolving energy sector panorama. The rising variety of orders boosts confidence within the firm’s skill to strengthen its market place and keep its progress momentum. We anticipate that the corporate will carry out strongly in response to the rising power demand.

Danger:

- Regulatory danger – Evolving insurance policies and laws can impression energy technology, pricing, and market dynamics.

- Execution danger – Delay within the execution of renewable power initiatives may decelerate the corporate’s progress.

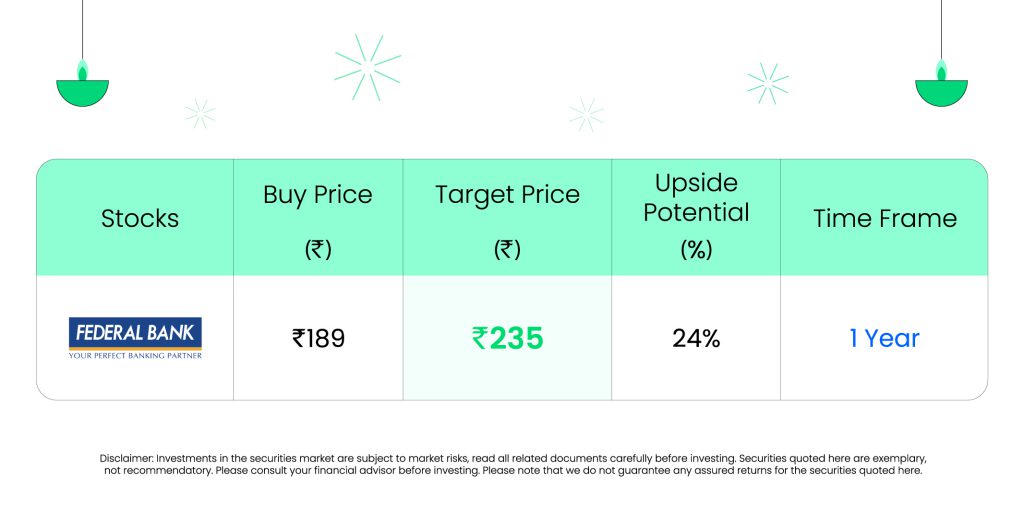

Federal Financial institution Ltd

Headquartered in Aluva, Kerala, Federal Financial institution Ltd. is a number one private, NRI, enterprise banking associate catering to a rising expanse of buyer base, each in city and rural areas. With a buyer base of over 18.1 million, the corporate had 1,504 workers and a couple of,015 ATM/money recyclers (as of FY24).

The corporate is gaining market share on deposits. It’s increasing its geographical footprint, having opened 14 new retailers throughout Q1FY25. The corporate’s fastened deposit (short-term) and certificates of deposits benefit from the highest CRISIL ranking in that class. The financial institution received featured within the Financial Instances listing of “Future Prepared Organizations 2024-25 (Massive Scale Enterprises)”, additional enhancing the boldness in firm prospects.

Throughout Q1FY25, internet curiosity revenue elevated by 4% YoY to Rs.2,292 crore in comparison with the corresponding interval within the earlier 12 months. Working revenue elevated by 15% to Rs.1,501 crore and internet revenue surged by 18% to Rs.1,010 crore. Deposits and advances grew by 20% every YoY to Rs.2,66,065 crore and Rs.2,20,807 crore respectively. Gross non-performing property (GNPA) improved from 2.38% to 2.11% and internet non-performing property (NNPA) improved from 0.69% to 0.60% YoY, indicating higher asset high quality. Return on Property (RoA) was at 1.27% and ROE was at 13.64%. Web curiosity margin (NII) is at 3.16%.

Outlook:

Firm’s excessive yielding segments corresponding to bank cards and micro finance have improved its proportionate contribution throughout the quarter. The corporate added 140 branches throughout FY24. It has a goal so as to add 100 branches throughout FY25. The corporate’s skill to maintain its progress trajectory and place within the business beneath the brand new Managing Director is a key issue to lookout for.

Dangers:

- Rate of interest modifications – Any modifications in rate of interest (repo price) could have an effect on the margins of the financial institution and therefore the operation matrix.

- Competitors danger – Rising depth of competitors within the banking business may pose a danger to the corporate’s progress momentum sooner or later.

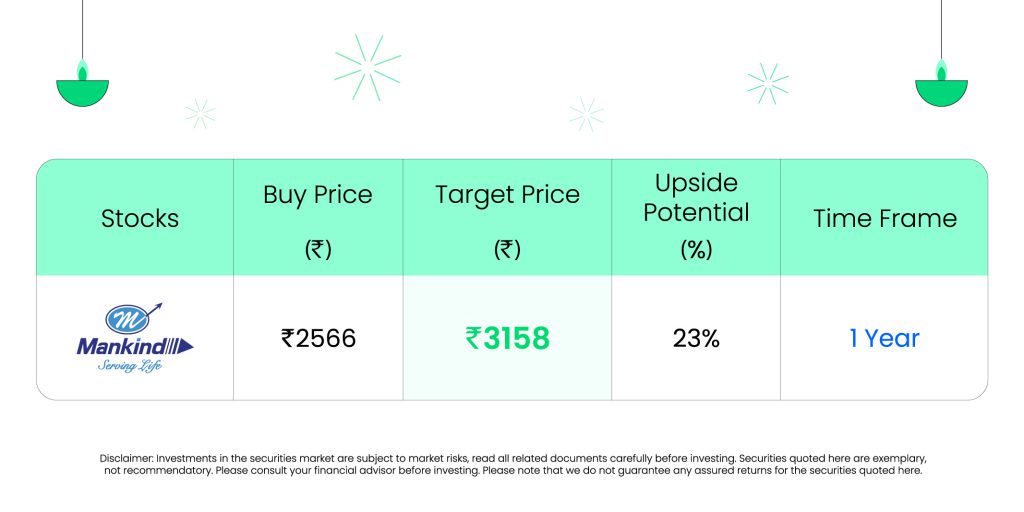

Mankind Pharma Ltd

Mankind Pharma Ltd. makes a speciality of growing, producing, and advertising and marketing a variety of prescription drugs for acute and persistent circumstances, in addition to shopper healthcare merchandise. It presents varied dosage varieties, together with tablets, capsules, gentle and arduous gels, eye drops, contraceptives, syrups, lotions, and so forth. Initially targeted on delivering high quality medicines to rural areas, the corporate regularly expanded into peri-urban areas after which into metropolitan and Tier-1 cities. The corporate has 30 manufacturing amenities (75% in-house manufacturing), able to producing 43.5 billion models yearly, and operates 6 R&D facilities which have developed 23 model households.

Mankind has acquired 100% stake in Bharat Serums and Vaccines Ltd. (BSV) for an enterprise worth of Rs.13,768 crore. BSV specializes within the tremendous specialty section, specializing in ladies’s well being, fertility, and demanding care. To help future progress, the corporate can be establishing a brand new manufacturing facility in Genome Valley. Diversifying its product combine, the corporate is coming into the analgesic market with the launch of Nimulid Sturdy, a gel and spray for neck ache, and has launched self-test kits to handle well being challenges corresponding to dengue, UTIs, and early menopause in India.

In Q1FY25, Mankind reported income of Rs.2,893 crore, a 12% improve from Rs.2,579 crore in Q1FY24. Working revenue rose 5% to Rs.686 crore, up from Rs.655 crore, whereas internet revenue elevated by 10% to Rs.543 crore, in comparison with Rs.494 crore in Q1FY24. The corporate has achieved a income CAGR of 18% and a PAT CAGR of 14% over the previous three years (FY21-FY24). Its common ROE and ROCE stand at 22% and 27%, respectively, with a robust capital construction mirrored in a debt-to-equity ratio of 0.02.

Outlook:

With the acquisition of the excessive entry barrier tremendous speciality enterprise of BSV with little to no competitors, that covers all the ladies’s well being spectrum, Mankind is focusing on to be a market chief within the gynecology-fertility section. The corporate’s technique of continually evolving its enterprise technique – ranging from rural markets and enlargement to metro cities & product combine diversification from persistent to shopper well being care merchandise appears to be like promising.

Danger:

- Regulatory danger – The business faces vital regulatory scrutiny, together with potential limitations or bans on merchandise by companies just like the USFDA, which may impression income and operations.

- Patent danger – Enterprise operations might be impacted by the shortcoming to defend patent challenges or third-party agreements.

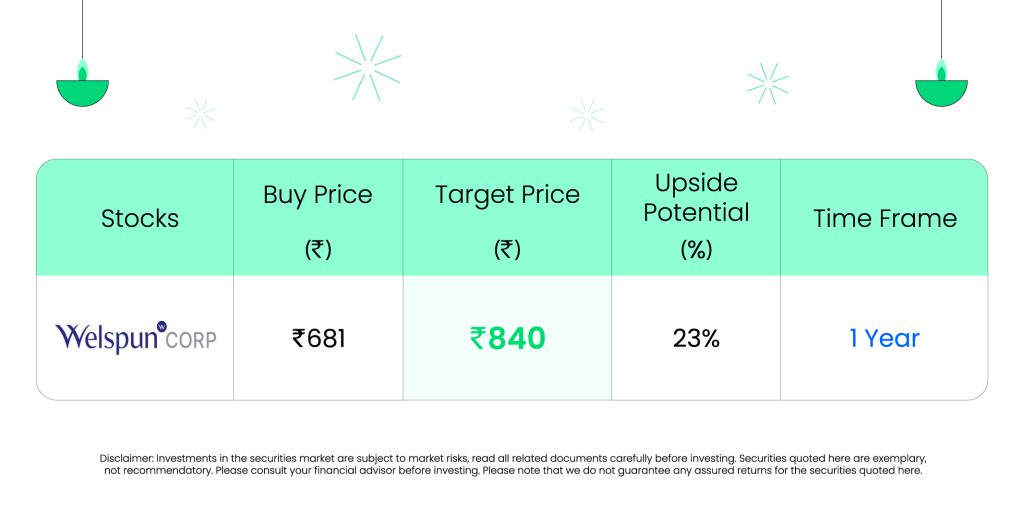

Welspun Corp Ltd

Integrated in 1995, Welspun Corp Ltd. (WCL) is a market chief in line pipes, together with different strains of enterprise in infrastructure, pipe options, constructing supplies, warehousing, retail, superior textiles & residence options, and flooring. The flagship firm of the multinational conglomerate Welspun Group, WCL is likely one of the largest producers of enormous diameter pipes globally and has established a world footprint throughout 6 continents and 50 nations delivering customised options for onshore and offshore functions.

The corporate has made the choice to amass 100% of Weetek Plastics Personal Ltd (WPPL). WPPL makes a speciality of manufacturing plastic pipes (CPVC, UPVC, SWR), fittings, and water storage tanks, boasting a mixed capability of 19 KMTPA. Notably, a brand new plant is being established to boost manufacturing. This transfer is anticipated to speed up the corporate’s entry into the plastic pipes market. Moreover, the corporate plans to speculate $100 million to boost its high-frequency induction welding pipe manufacturing and coating capabilities within the US, aiming to counterpoint its product portfolio.

Throughout Q1FY25, income declined by 23% to Rs.3,180 crore. EBITDA remained flat at Rs.416 crore whereas internet revenue improved by 50% to Rs.248 crore. EBITDA margin improved from 10% to 13% and internet revenue margin improved from 4% to eight% YoY. The corporate achieved these enhanced margins because of a extra favorable product combine and contributions from new companies. It has generated income and internet revenue CAGR of 34% and 18% over the interval of three years (FY21-24). Common 3-year ROE & ROCE is round 12% and 13% for FY21-24 interval. The corporate has a sturdy capital construction with a debt-to-equity ratio of 0.35.

Outlook:

The corporate boasts a robust order e book, indicating a constructive enterprise outlook. Its new ventures are performing properly, considerably enhancing margins and increasing the order e book. The strategic acquisition of WPPL will expedite its entry into India’s plastic pipes market. Rising demand in oil and fuel distribution, river interlinking, irrigation pipelines, and authorities initiatives just like the Jal Jeevan Mission create a sturdy demand pipeline for the piping section. Adopting a conservative stance for FY25, the corporate has set steering of Rs.17,000 crore for topline, Rs.1,700 crore for EBITDA, and a 20% ROCE.

Danger:

- Foreign exchange danger – The corporate has vital operations in overseas markets and therefore is uncovered to foreign exchange danger. Any unexpected motion within the foreign exchange market can adversely have an effect on the corporate.

- Socio-economic danger – Any socio-economic instability that might lead to a rise in enter prices corresponding to uncooked materials, freight prices, and so forth. may negatively impression the margins and profitability.

Disclaimer

Word: to learn the Disclaimer and Disclosure, click on right here.

Different articles it’s possible you’ll like

Publish Views:

54