Firm overview

Hyundai Motor India Ltd. (HMIL) is part of the Hyundai Motor Group, the third largest auto authentic tools producer (OEM) on the earth based mostly on passenger automobiles gross sales in CY23. HMIL is the second largest auto OEM within the Indian passenger automobiles market since FY09 (when it comes to home gross sales quantity). The corporate has a portfolio of 13 fashions of passenger automobile segments by physique varieties equivalent to sedans, hatchbacks, sports-utility automobiles (SUVs) and battery electrical automobiles (EV). The corporate additionally manufactures components, equivalent to transmissions and engines which are used for its personal manufacturing or gross sales. It’s also the nation’s second largest exporter of passenger automobiles. From 1998 to 30 June 2024, the corporate has cumulatively offered greater than 12 million models of passenger automobiles in India and thru exports. The corporate’s manufacturing amenities are situated in Tamil Nadu, with a present manufacturing capability of 824,000 (as of 30 June 2024).

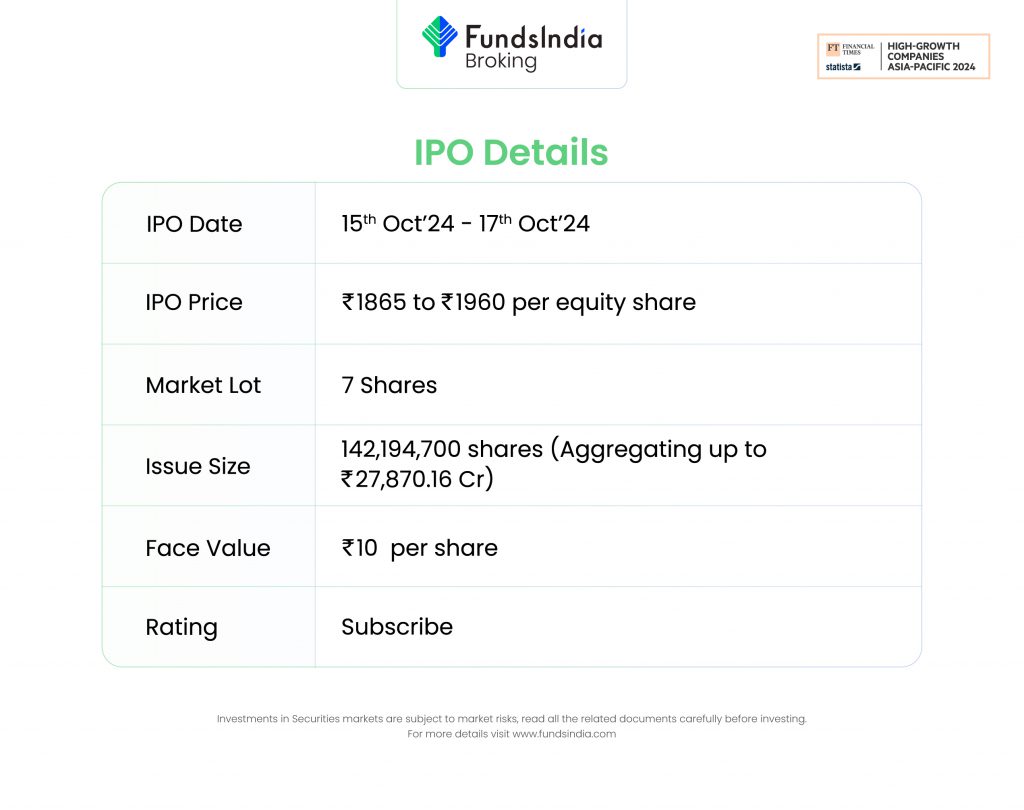

Objects of the supply

- Obtain the advantages of itemizing the Fairness Shares on the Inventory Exchanges.

- Perform supply on the market of as much as 142,194,700 Fairness Shares by the Promoting Shareholders.

Funding Rationale

- Sturdy parentage of Hyundai – The corporate positive aspects important benefits from its robust affiliation with Hyundai Motor Firm (HMC). It advantages from varied operational points, together with administration, analysis and improvement, design, product planning, manufacturing, provide chain improvement, high quality management, advertising and distribution, model worth, and financing. Moreover, HMC’s intensive gross sales community, masking 190 nations, enhances the corporate’s export alternatives, that are very important for income. The corporate harness world insights and R&D capabilities to combine expertise, design, and aesthetics into passenger automobiles particularly tailor-made for the Indian market.

- Progress methods – To handle the growing demand, the corporate is scaling its manufacturing capability. As of June 30, 2024, it operates two manufacturing amenities in Tamil Nadu, with an annual manufacturing capability of 824,000 models, operating at practically full capability. Throughout FY24, the corporate acquired the Talegaon Manufacturing Plant from Common Motors India, to be operational in phases, with the primary section anticipated to be operational in H2FY26. The Talegaon Manufacturing Plant is an built-in passenger automobile and engine manufacturing facility throughout roughly 300 acres of leased land allotted by the commercial improvement company premises. The corporate expects the annual manufacturing capability throughout all of the manufacturing vegetation in mixture to extend to 994,000 models when the Talegaon Manufacturing Plant is partly operational and to 1,074,000 models as soon as the Talegaon Manufacturing Plant is totally operational. With the addition of Talegaon plant, the corporate is aiming to spice up manufacturing quantity and speed up economies of scale to match its provide chain capabilities according to the rising demand in home in addition to worldwide markets.

- Monetary Observe Document – The corporate reported a income of Rs.69,820 crore in FY24 as in opposition to Rs.60,308 crore in FY23, a rise of 16% YoY. The income has grown at a CAGR of 21% between FY22-24. The EBITDA of the corporate in FY24 is at Rs.9,133 crore and EBITDA margin is at 13%. The PAT of the corporate in FY24 is at Rs.6,060 crore and PAT margin is at 9%. The CAGR between FY22-24 of EBITDA is 29% and PAT is 45%. The Return on Web Price and Return on Capital Employed of the corporate stands at 12.26% and 13.69% as of 30 June 2024, respectively.

Key dangers

- OFS danger – The IPO consists of solely an Provide for Sale of as much as 142,194,700 Fairness Shares by the Promoting Shareholders, Hyundai Motor Firm. Your complete proceeds from the Provide for Sale shall be paid to the Promoting Shareholders and the Firm is not going to obtain any such proceeds.

- Macroeconomic elements – Any slowdown within the family earnings attributable to macroeconomic elements may affect the demand and thereby the corporate turnover.

- Tech adjustments – The shortcoming of the corporate to adapt to the quickly evolving world automotive trade, resulting in adjustments in expertise utilization, may adversely have an effect on the market share the corporate at present holds.

Outlook

The corporate advantages from the robust parentage of Hyundai Motors. The corporate has gained market place from (i) extensive product choices, (ii) stakeholder relationships and operations; (iii) the robust Hyundai model in India; (iv) potential to leverage new applied sciences to reinforce operational and manufacturing effectivity; and (v) potential to increase into new companies equivalent to EVs by means of innovation. In keeping with RHP, Maruti Suzuki India Ltd, Tata Motors Ltd and Mahindra & Mahindra Ltd are the one listed competitor for Hyundai Motor India. The friends are buying and selling at a median P/E of 23.57x with the very best P/E of 29.96x and the bottom being 11.36x. On the larger worth band, the itemizing market cap of Hyundai Motor India shall be round ~Rs.1,59,258 crore and the corporate is demanding a P/E a number of of 26.28x based mostly on submit difficulty diluted FY24 EPS of Rs.74.58. In comparison with its friends, the problem appears to be totally priced in (pretty valued). Primarily based on the above views, we offer a ‘Subscribe’ ranking for this IPO for a medium to long-term Holding.

Different articles chances are you’ll like

Publish Views:

81