Buyers waited impatiently because the Federal Reserve thought of reducing rates of interest. Will it’s 0.25% or 0.5%? They lastly lower charges by 0.5% on September 18th. The S&P 500 is up 20% 12 months thus far as traders contemplated whether or not we might have a recession or handle the elusive comfortable touchdown. There have been three intervals this 12 months the place the market fell 5% or extra. The S&P 500 has been comparatively flat for the previous three months however spiked over 1% after the Fed made the lower.

My survival intuition tells me to promote shares and purchase bonds, however my self-control tells me to stay to the plan labored out over the previous three years with the help of monetary advisors. The economic system is robust, and I hope for a comfortable touchdown. It’s 4 am within the morning so I’ll get one other cup of espresso and chill. I ready for the speed cuts by evaluating if I had sufficient in protected bonds, certificates of deposit, and cash markets to cowl three years of bills. I bought a small quantity of my extra risky funds and acquired bond funds.

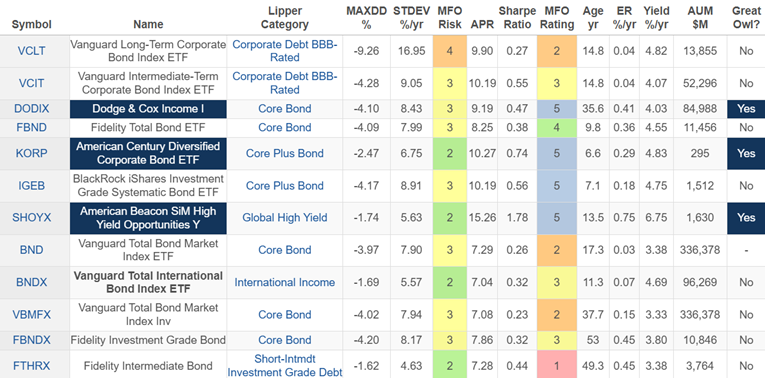

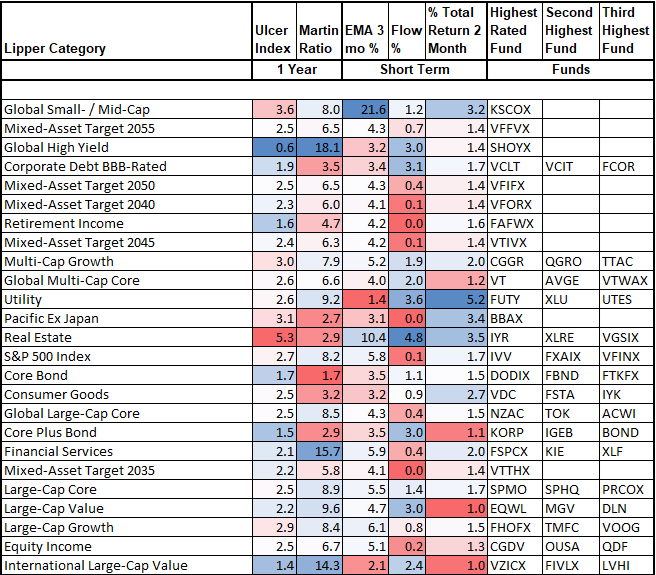

We’re at an inflection level with short-term rates of interest falling and the yield curve uninverting. I hope to realize some perception into the subsequent six to 12 months by taking a look at short-term traits on this article. I observe over eight hundred mutual and exchange-traded funds from roughly 125 Lipper Classes accessible at Constancy and/or Vanguard with out transaction charges or masses. For this text, I downloaded the newest knowledge as of September 21st utilizing the Mutual Fund Observer MultiScreen software. I created a momentum indicator primarily based on an equal weight of 1) August and September returns, 2) three-month exponential shifting averages, and three) fund flows.

This text is split into the next sections:

Supply: Creator Utilizing Mutual Fund Observer

DEFINITIONS:

- Ulcer Index measures each the magnitude and length of drawdowns in worth.

- Martin Ratio is a measure of extra return above a risk-free funding divided by the danger. It’s calculated as (Complete return – Threat-free return) / Ulcer Index.

- return, however relative to its typical drawdown.

- Nice Owl funds have “delivered high quintile risk-adjusted returns, primarily based on Martin Ratio, in its class for analysis intervals of three, 5, 10, and 20 years as relevant”.

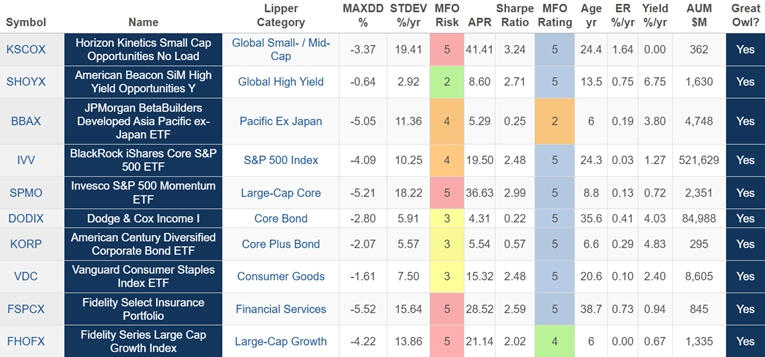

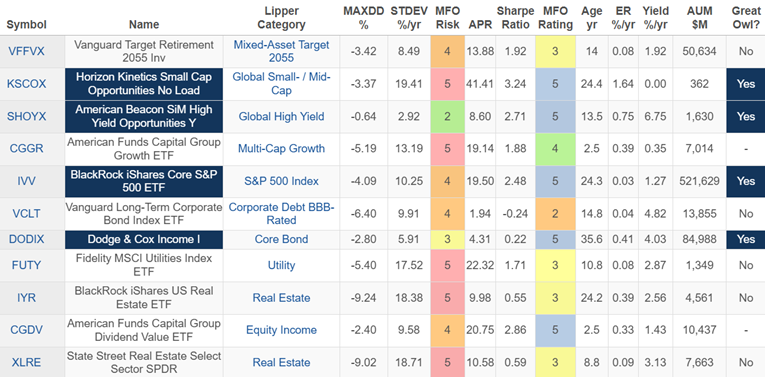

valuations of the S&P 500 stay excessive. With rates of interest more likely to fall over the twelve months or so, American Beacon SiM Excessive Yield Alternatives (SHOYX), Dodge & Cox Earnings (DODIX), and American Century Diversified Company Earnings (Korp) additionally curiosity me. I have a look at these additional in Part #4.

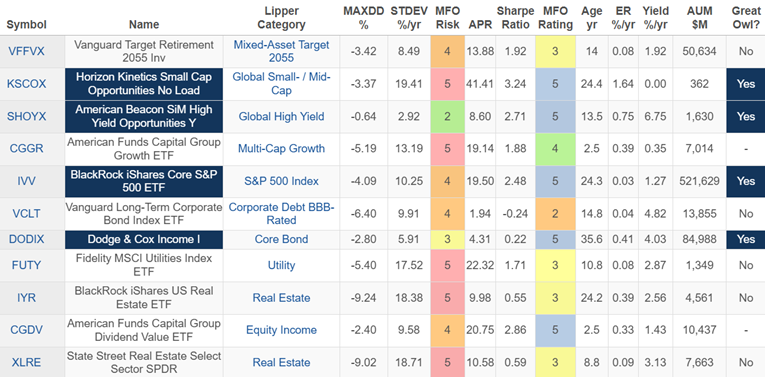

Desk #2: Trending Nice Owl Funds (One-Yr Metrics)

Supply: Creator Utilizing Mutual Fund Observer

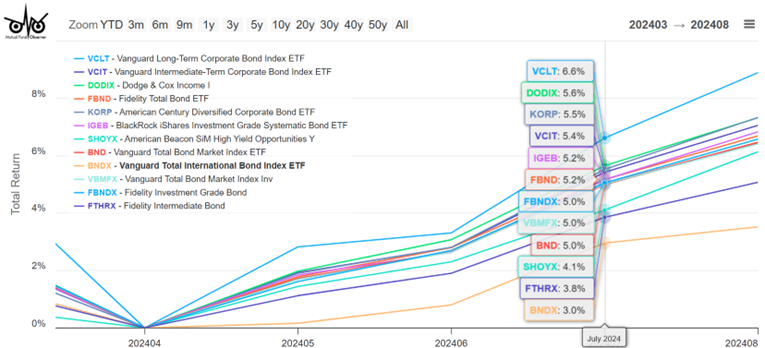

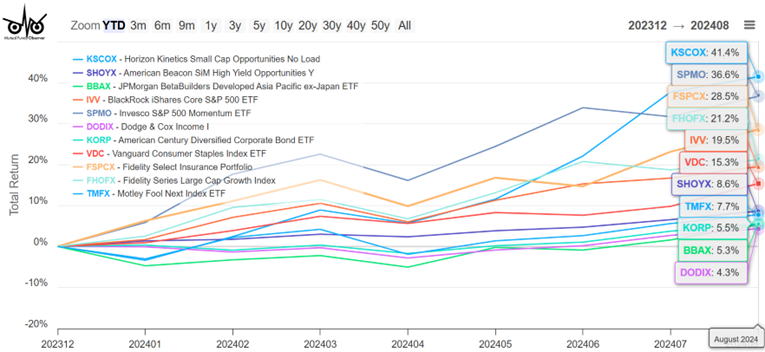

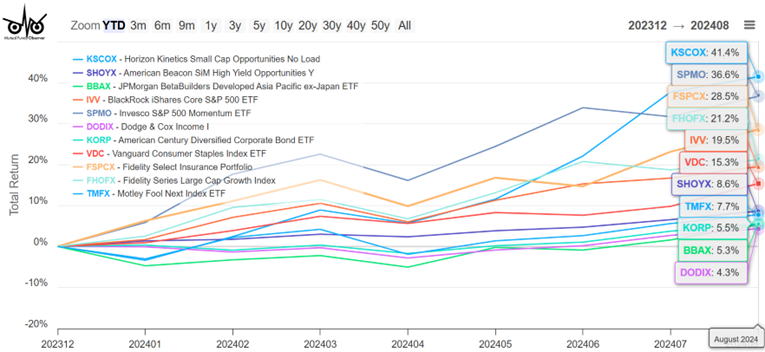

Determine #1 reveals that Vanguard Shopper Staples (VDC) and American Beacon SiM Excessive Yield Alternatives (SHOYX) have had comparatively regular returns over the previous a number of months. In a market downturn, they might carry out higher than diversified fairness funds.

Determine #1: Trending Nice Owl Funds

Supply: Creator Utilizing Mutual Fund Observer

Supply: Creator Utilizing Mutual Fund Observer

Supply: Creator Utilizing Mutual Fund Observer

Supply: Creator Utilizing Mutual Fund Observer

Supply: Creator Utilizing Mutual Fund Observer

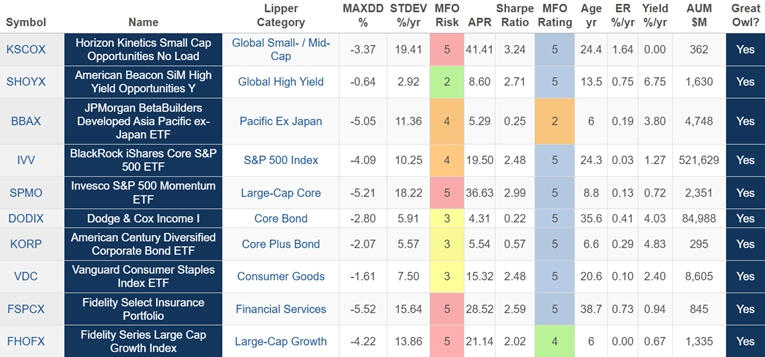

Amongst fairness, American Funds Capital Group Dividend Worth (CGDV) stands out for constant efficiency. For individuals who need a one-stop fund, the Vanguard Goal Retirement 2055 (VFFVX) fund has performed properly, however traders ought to have a look at the suitable goal date. Lastly, State Avenue Actual Property Choose Sector (XLRE) responded strongly to the speed lower.

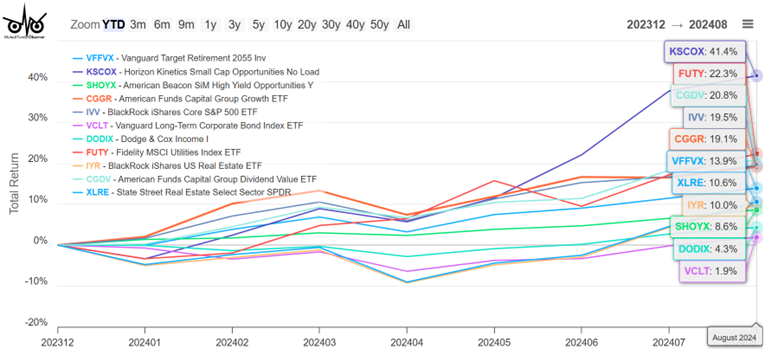

Determine #2: Prime Mixed Funds from Trending Lipper Classes

Supply: Creator Utilizing Mutual Fund Observer