We’ve had an excellent run with the amaze card, which was THE finest abroad card to make use of for anybody eager to earn miles however but unwilling to pay 3% – 3.5% of additional charges (on prime of awful financial institution alternate charges). Domestically, the amaze card was additionally an effective way for us UOB cardholders to avoid UOB$ retailers (which affords reductions however with the trade-off being a horrible rewards earn charge).

As of yesterday, 1 October, UOB has formally nerfed the amaze hack.

DBS first did this in 2022, and now UOB is the subsequent child on the block to comply with swimsuit.

However all will not be misplaced.

There stays a number of choices that we will nonetheless use to pair with the amaze card, particularly:

- Citi Rewards

- OCBC Rewards / Titanium

Each playing cards will nonetheless yield you 4 miles per greenback (mpd) and right here’s how you should utilize them.

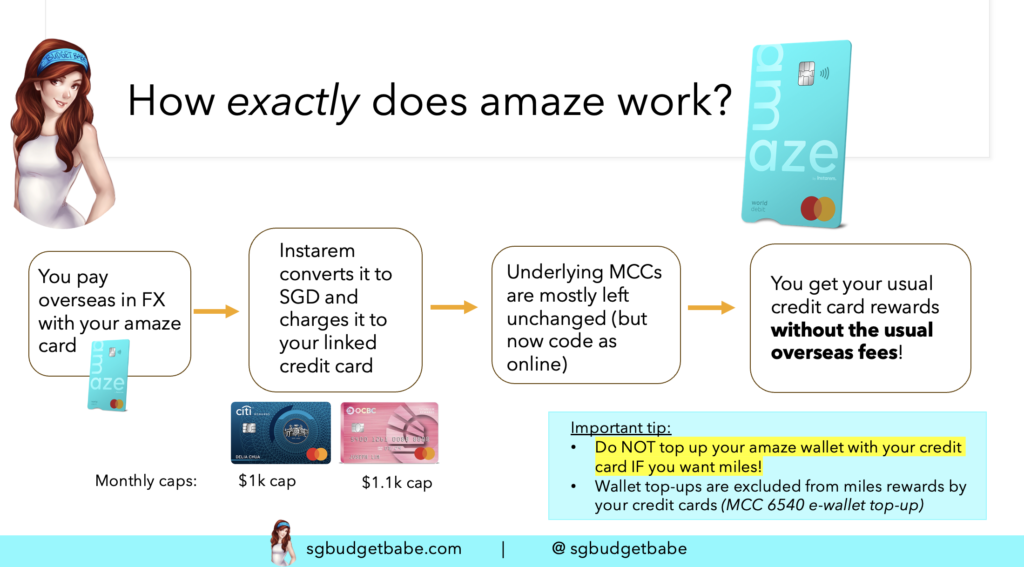

Notice that once you pair your bank cards with amaze, it allow you to save on the FCY transaction charges however since quantities are transformed into SGD, your rewards shall be primarily based on the native SGD earn charge as an alternative.

Between paying the ~2% markup on amaze and earn on the native mpd charge, vs. paying ~3.5% in FCY conversion charges and a awful alternate charge for abroad mpd earn charges, the previous is mathematically a greater choice.

Click on right here to examine pesky FCY charges once you use your bank card to pay overseas.

Utilizing the bare Citi Rewards card by itself will solely offer you 4 mpd for on-line transactions. Sadly, this meant that tapping your bodily card and utilizing cell in-app funds (Apple Pay, Google Pay, Samsung Pay) wouldn’t qualify.

However there’s a loophole: you may merely hyperlink your Citi Rewards card with amaze, and faucet your amaze card or use it to pay together with your cell in-app fee.

This allowed Citi Rewards cardholders to earn 4 mpd on even native spend, resembling in-person eating, groceries, procuring and transport (e.g. taxis and ride-hailing).

Amaze converts all transactions into on-line spend, which signifies that when paired with the Citi Rewards Card, you may earn 4 mpd – capped to your first S$1,000 per thirty days.

The one exception is for travel-related transactions (resembling air tickets, motels or rental automobiles), that are particularly excluded from incomes the 4 mpd charge by Citi.

OCBC Rewards x amaze

Notice: The previous identify is OCBC Titanium, if you happen to’re a legacy cardholder like me.

OCBC Rewards offers 4 mpd for sure shopping-related transactions like shops. Pairing it with the amaze card then makes it an ideal mixture for paying at abroad departmental shops – resembling Lotte Responsibility Free, and even procuring retailers resembling Lululemon or Louis Vuitton – at any time when we journey.

I’ve used this combo to earn loads of miles on my US and Korea journeys, for example.

The one factor you gotta be careful for is to ensure the procuring service provider you’re spending at falls underneath the whitelisted record or classes on your OCBC Rewards playing cards. As an illustration, you is perhaps inclined to suppose that you just’ll earn 4 mpd with this card once you sohop at IKEA, Greatest Denki, Courts or Harvey Norman…however that’s not the case.

Don’t have the amaze app (or card) but? Enroll right here to get yours!

Workaround options for abroad spend

The best technique to cope with this is able to be to make use of the next playing cards on this order:

- amaze x Citi Rewards: for nearly all the things besides travel-related transactions (so don’t use this to pay on your lodge or practice tickets!)

- amaze x OCBC Rewards: for all my procuring (ensure you test that the service provider will not be inside the exclusion class first!)

- Your finest basic spending FCY card, such because the UOB PRVI Miles (2.4 mpd) or DBS Vantage (2.2 mpd).

If you wish to maximise your miles additional, you could possibly additionally contemplate including these 2 playing cards into your stack:

- UOB Visa Signature Card: if you happen to can hit not less than S$1,000 in FCY in that month. Notice that this card is just for the richer of us, resulting from its min. revenue requirement of $120k to use.

- Maybank World Mastercard: provided that you may clock a min. of S$4,000 per thirty days, for an uncapped 3.2 mpd on FCY spend

I personally wouldn’t trouble, since I don’t journey usually sufficient or spend that a lot in FCY annually to justify the additional trouble of getting 1 – 2 extra new playing cards only for this workaround. Nonetheless, if you happen to journey usually for work or holidays, and also you’re wealthy sufficient to satisfy the minimal revenue threshold or hit the minimal spend, then this is perhaps value contemplating.

Youtrip vs. amaze: which is best? Click on right here to learn! Spoiler: amaze for miles, Youtrip if you happen to don’t care about incomes rewards otherwise you have a tendency to make use of money whereas abroad.

Is the amaze card nonetheless value preserving?

For now, my reply remains to be a sure – I received’t be cancelling my amaze card but. There isn’t a robust sufficient purpose to take action, since you should utilize it with Citi Rewards and OCBC Rewards to nonetheless clock $2,100 and get 8,400 miles every month.

The difficulty is that I used to rely closely on the amaze x UOB Woman’s mixture to pay for all my abroad meals and drinks, in addition to the amaze x UOB Krisflyer pairing for any large ticket spending or my leftover bills as soon as my different spending caps have been hit. These will now not work from now.

We’ve had an excellent run with amaze, and it’s value preserving a watch out to see if any banks get impressed to comply with UOB and DBS of their therapy of amaze.

The worst nerf that might occur subsequent could be if Citibank decides to nerf amaze too. If that takes place, then it would very effectively kill off amaze, which can go away us customers worse off.

I definitely hope not.

With love,

Daybreak