On September 10, 2024, Analysis Associates will launch its first ETF. Analysis Associates was based in 2002 by Rob Arnott to supply skilled and institutional buyers with revolutionary analysis and product improvement. Mr. Arnott is iconic, having revealed 150 or so analysis articles that obtained each consideration and rewards. His most intensive work is The Elementary Index: A Higher Solution to Make investments (2008). Most conventional indexes are capitalization-weighted, so that they lock in a big/development/momentum bias. Arnott notes that the bias might contaminate efficiency and argues for “elementary” indexes that give choice to corporations which can be, oh, I don’t know, persistently worthwhile and environment friendly. That perception finally will get integrated into what are referred to as “good beta” merchandise.

On September 10, 2024, Analysis Associates will launch its first ETF. Analysis Associates was based in 2002 by Rob Arnott to supply skilled and institutional buyers with revolutionary analysis and product improvement. Mr. Arnott is iconic, having revealed 150 or so analysis articles that obtained each consideration and rewards. His most intensive work is The Elementary Index: A Higher Solution to Make investments (2008). Most conventional indexes are capitalization-weighted, so that they lock in a big/development/momentum bias. Arnott notes that the bias might contaminate efficiency and argues for “elementary” indexes that give choice to corporations which can be, oh, I don’t know, persistently worthwhile and environment friendly. That perception finally will get integrated into what are referred to as “good beta” merchandise.

RAFI’s focus is on “good beta and enhanced indexing, quantitative lively fairness, and multi-asset merchandise” and is pushed by the concept markets usually are not environment friendly and their inefficiencies are predictable and exploitable. Like Leuthold earlier than, their analysis enterprise generated requires them to supply merchandise pushed by analysis (reasonably than, extra generally, by advertising). Up till now, most buyers are uncovered to Analysis Associates by way of their RAFI collaborations with Invesco (for example, Invesco RAFI Strategic US ETF) and PIMCO (as in PIMCO RAFI ESG US ETF, the one fund that must be rendered totally in capital letters). As of June 30, 2024, the agency has over $147 billion in property utilizing methods developed by Analysis Associates.

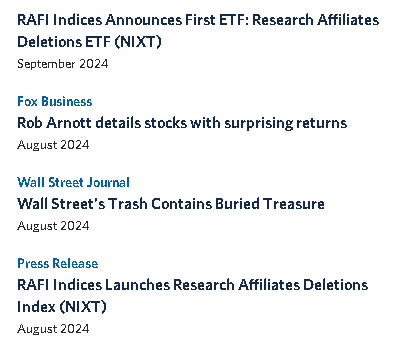

Analysis Associates is about to launch its first straight branded ETF, the Analysis Associates Deletions ETF (NIXT). NIXT will purchase the businesses ejected from massive cap (“the five hundred”) and mid-cap (“the 1000”) indexes. They may maintain these corporations in an equal-weight portfolio for 5 years, rebalancing yearly.

Why? Traders have lengthy identified that the businesses dropped from the S&P 500 are inclined to outperform the S&P 500 (and, specifically, outperform the businesses that changed them). RAFI systematized that remark in a current analysis piece, “Nixed: The Upside of Getting Dumped” (August 2024). They discovered that “shares deleted from market-cap weighted indices have soundly crushed the small cap worth benchmark over the previous 30 years, together with throughout this final tough decade for small-cap worth corporations.” Specifically, they outperform for about 5 years, therefore the fund’s holding interval.

Why? Traders have lengthy identified that the businesses dropped from the S&P 500 are inclined to outperform the S&P 500 (and, specifically, outperform the businesses that changed them). RAFI systematized that remark in a current analysis piece, “Nixed: The Upside of Getting Dumped” (August 2024). They discovered that “shares deleted from market-cap weighted indices have soundly crushed the small cap worth benchmark over the previous 30 years, together with throughout this final tough decade for small-cap worth corporations.” Specifically, they outperform for about 5 years, therefore the fund’s holding interval.

Why would possibly you have an interest? First, it supplies a small cap worth fund that’s going to be very totally different from its friends. Second, it supplies return drivers which can be structural and uncorrelated with the market. Cap-weighted methods rise when, if, and to the extent that, the market rises. Methods with uncorrelated alpha (some lengthy/brief and arbitrage methods, as examples) have the prospect of prospering in flat or falling markets, whereas nonetheless taking part in rising ones.

The fund has its personal web site and advertises an expense ratio of 0.09%.