Pricey buddies,

Welcome to the September (aka “again to high school”) concern of the Mutual Fund Observer. The joyful tumult of which has barely delayed our launch.

Despair is simple. When you ever need an antidote, drop by Augie originally of September. As a lot of , in my day job, I’m a professor of communication research and director of the Austin E Knowlton Honors Program at Augustana Faculty. I’m additionally an advisor to first-year college students. I’ve spent a lot of the final week assembly with and studying about my new prices. I’m amazed by them, defying as they do all the hysterical media headlines about entitled brats utilizing school to shine their social media profile.

Pfeh.

We’re welcoming 766 new Vikings, together with 171 worldwide college students (we now have representatives from extra international locations than US states which is extremely cool as a result of after I first taught at Augie our worldwide pupil inhabitants had been three Swansons and a Johnson, all from Sweden), 162 US college students of coloration and 80 transfers. 42% of our children are eligible for Federal Pell grants, which can be found solely to low-income households. (Chip, whose neighborhood school college students have much more modest backgrounds than ours, fumed briefly at a current New York Occasions article concerning the rise of inside decorators who concentrate on dorm room décor at about $10,000 a pop. Pricey Lord. Not right here. Suppose: Goal.) As we talked I discovered that Alonso, from Arequipa, Peru, has been studying the works of Nazi propaganda minister Joseph Goebbels in German for a year-long highschool venture. Aji, from Nairobi, Kenya, chatted fortunately about finding out in Seoul, South Korea. Collectively their aspirations vary from turning into pediatric surgeons to speech pathologists. They’re humorous, courageous and scared.

What extra about any of us hope for?

On this month’s concern of MFO …

In penance for an article about my portfolio in BottomLine: Private (“The Lazy Man’s Mutual Fund Portfolio: For Each Good Occasions and Dangerous,” 9/1/2024), I suggest two two-fund portfolios applicable for small buyers trying to get began with out trying to babysit. My very own portfolio as outlined within the BottomLine article, is designed, partly, as a software to assist me observe a spread of fascinating potentialities however, at 10 funds, it’s way more sprawling than essential. I attempt to appropriate that by creating two low-risk, versatile portfolios to fulfill the wants of smart youthful buyers via FPA, Intrepid, Leuthold, and RiverPark funds.

In celebration of Warren Buffett’s 94th birthday, our colleague Devesh Shah surveys the maelstrom and guides you thru it to a Buffett-like conclusion: “meh, perhaps a tweak or two, then off to McDonald’s for dinner!”

Charles will stroll via a helpful new characteristic at MFO Premium: ETF Benchmarks. We now provide the information to information all these individuals who ask, “Wouldn’t I be higher off simply shopping for an ETF or ten?”

We additionally current our first near-Launch Alert, for Analysis Associates Deletions ETF. It’s RAFI’s first fund marketed beneath their very own model and it targets an fascinating and protracted market anomaly: corporations booted out of cap-weighted indexes are likely to get pleasure from a five-year run of success following their deletion. There’s a bunch of analysis and a bunch of attainable causes, together with the truth that such corporations are usually small-cap worth, they profit from regression to the imply, they usually had been booted after the worst of their troubles had been behind them. RAFI is speaking concerning the fund at present and also you’ll have the ability to purchase it in every week.

The Shadow, as ever, paperwork the business’s developments, each its brilliance and its occasional cowardice, in Briefly Famous.

Ben Carlson: assuming the world goes to hell, your portfolio …

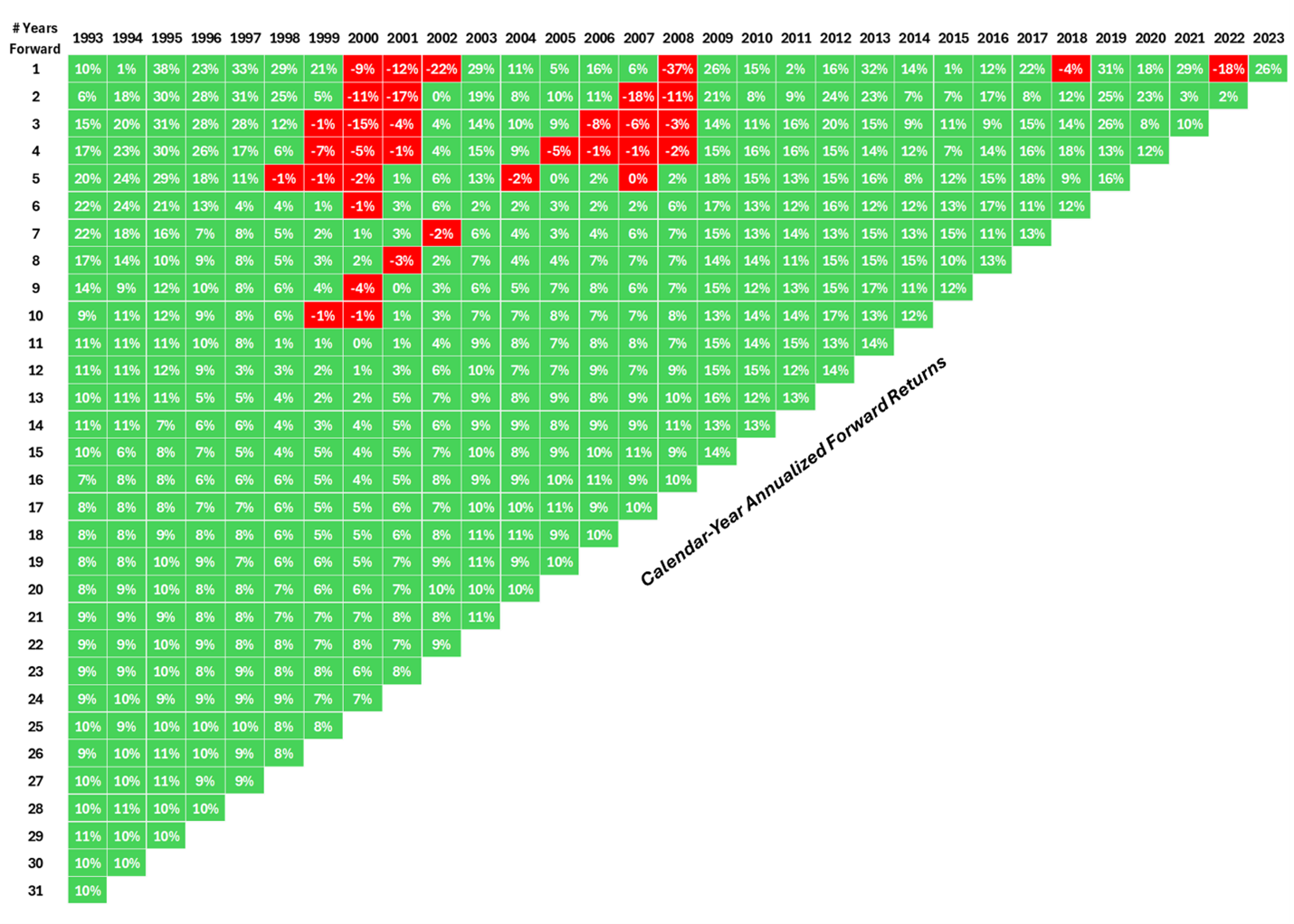

…will in all probability make about 10%.

Mr. Carlson, who manages portfolios for establishments and people at Ritholtz Wealth Administration LLC, writes the distinctive Wealth of Frequent Sense weblog. On this month’s entry, he addresses our common jitters concerning the inventory market by … the inventory market. Specifically, he calculated the typical annual returns for investments made in every of the previous 30 years.

So, for instance, should you have a look at the column labeled 2000 – a largely sucky yr available in the market – then the row labeled 15, you’d see {that a} notably poorly timed funding made in 2000 would have returned about 4% yearly over the next 15 years. Unhappy, however not an apocalypse.

His biggest optimism comes from studying alongside the jagged edge: the long-term returns for each funding interval. “The 31-year annual return from 1993 via 2023 was round 10% per yr, proper on the long-term averages.” That regardless of:

An rising markets forex disaster in 1998, the Lengthy-Time period Capital Administration blow-up, the dot-com bubble, 9/11, the housing bubble, the Nice Monetary Disaster, the European Debt Disaster, the pandemic, and the best inflationary spike in 4 many years.

We additionally sprinkled in a number of recessions, two large market crashes, two bear markets, and ten double-digit corrections.

His advice, which tracks ours: “No matter what returns the inventory market produces sooner or later, pondering and performing for the long-term stays essentially the most sane technique for buyers.”

Purchase high quality. Maintain high quality. Get on with life!

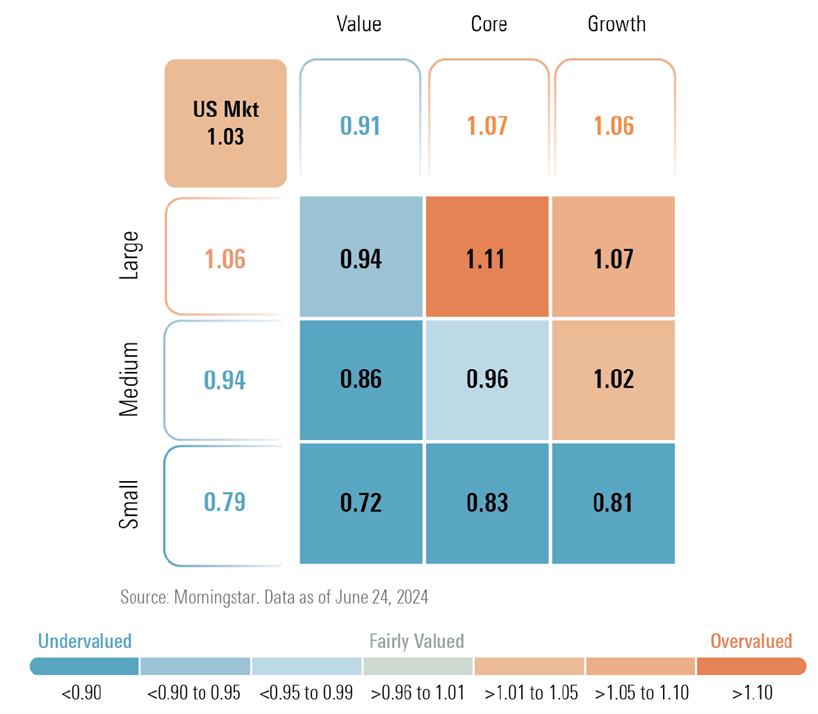

Morningstar: It’s time to contemplate US giant cap worth, US small caps and rising markets

Bryan Armour, director of passive methods analysis for North America and editor of Morningstar ETFInvestor e-newsletter, is pushing for people to look within the unloved, left-behind corners of the market. He’s declared, “alarm bells are ringing for me (8/27/2024).” Among the many triggers:

Collectively, Microsoft, Apple, and Nvidia symbolize 12% of all the world fairness market.

Apple and Nvidia are each virtually totally reliant on a single product line (iPhones and information middle merchandise, respectively)

By market cap, Nvidia is valued at greater than all the shares within the Russell 2000 index (which have 30 occasions Nvidia’s income) mixed, or all the shares within the UK, Germany, and Canada mixed.

So the people who find themselves out of favor are means out of favor.

The place to look? We screened for funds which have earned each a FundAlarm Honor Roll designation (for outperformance over the previous 3- and 5-year) intervals and MFO Nice Owls (for distinctive risk-adjusted efficiency) then sorted by Sharpe ratio (an alternate risk-adjustment software), diversification (we gained’t suggest a fund that concentrates on a single rising market, resembling Taiwan, no matter its current document) and accessibility.

In small worth, the 2 prime funds are Brandes Small Cap Worth (BSCAX) and PIMCO RAE US Small Fund (PMJAX). Brandes is a bottom-up, contrarian worth type of operation with a small, compact portfolio and a 98.5% energetic share. RAE alerts Analysis Associates Fairness. PMJAX is a quant fund whose mannequin overlays conventional worth metrics alongside high quality indicators, momentum alerts, and different related information factors after which “dynamically rebalances” as circumstances evolve. Fairly persistently five-star in addition to an MFO Nice Owl.

| 5-year APR | APR versus friends | Danger versus friends | Rankings | |

| Brandes SCV | 17.6 | 5.0 | Low | 5 star, Nice Owl |

| PIMCO RAE US Small | 17.3 | 4.7 | Above common | 5 star, Nice Owl |

In giant cap worth, test any of the flavors of Constancy Giant Cap Inventory (FLSCX). It’s the one giant worth fund to cross our display, although it does so in a number of totally different flavors together with Constancy Collection, K6, Advisor, and Common. Mr. Fruhan has been operating the technique for 19 years. He appears to be like for corporations that exhibit sturdy potential for earnings and dividend progress over a two to three-year horizon. The fund goals to capitalize on perceived mispricing available in the market by conducting a radical bottom-up basic evaluation. Our different choose, glorious in its personal proper, is FPA Queens Highway Worth (QRLVX). Mr. Scruggs pursues a type of “high quality worth” technique: he seeks high-quality corporations (sturdy stability sheets and powerful administration groups) whose shares are undervalued (based mostly, initially, on worth/earnings and price-to-cash stream metrics). They promote very not often which is mirrored in a single-digit turnover ratio.

| 5-year APR | APR versus friends | Danger versus friends | Rankings | |

| Constancy Giant Cap Inventory | 16.7 | 4.7 | Common | 4 star, Nice Owl |

| FPA Queens Highway Worth | 13.7 | 1.7 | Common | 5 star |

In rising, PIMCO RAE Rising Markets Fund (PEIFX) has the identical heritage and charms because the Small Fund we mentioned above. Oceans of knowledge + a multi-layer choice display = win. Roughly. Fairly deep-value, a fairly large cap. GQG Companions Rising Markets Fairness (GQGIX) is the flagship fund of one of many world’s most profitable EM buyers. Rajiv Jain has an obsessive deal with high quality and a document of spectacularly profitable funds. They aim high-quality corporations characterised by monetary energy, sustainability of earnings progress, and high quality of administration. The objective is to handle draw back danger whereas offering sturdy long-term returns.

| 5-year APR | APR versus friends | Danger versus friends | Rankings | |

| PIMCO RAE Rising Markets Fund | 10.9 | 6.1 | Common | 5 star, Nice Owl |

| GQG Companions EM Fairness | 9.9 | 5.1 | Low | 5 star, Nice Owl |

Our personal preferences have a tendency towards “top quality” and “low danger” portfolios. The screener at MFO Premium, although, would help you take a look at an enormous number of investments in opposition to an enormous number of metrics throughout an enormous number of time frames.

Thanks, as ever …

In response to our (barely unhappy) word that we’d ended our fiscal yr within the purple, a number of of us stepped up with contributions for which we’re deeply grateful. Because of Craig from Delaware, Lee of San Antonio, OJ, Paul from Florida, Jeroen of Anchorage (We do our greatest!), Michael from DMS, and naturally, our common crew, Wilson, S&F Funding Advisors, Gregory, William, William, Stephen, Brian, David, and Doug.

Because of George C from San Pablo for his considerate suggestions on the “Indolent Portfolio” article in BottomLine and on some points with how the positioning works for him.

And, most particularly, to our colleague Lynn Bolin. Lynn, just lately retired, spends time touring, with household and in serving to the Loveland, Colorado, Habitat for Humanity. Habitat just lately celebrated Lynn, and we wished to share their temporary story with you:

We made a (matched) contribution to Habitat in Lynn’s honor this month. We urge you to do likewise, both on to Lynn’s Loveland, Colorado chapter of Habitat or to your native Habitat chapter. Higher but, comply with the instance set by Lynn, Jimmy Carter, Jon Bon Jovi, Garth Brooks, Trisha Yearwood, and others, choose up a hammer and make the world only a bit higher.

We face thrilling occasions. When you get an opportunity, smile on the subsequent individual you meet and inform them they appear good. By way of such small gestures, communities are constructed.

Take care,