THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

Whereas a number of financial institution accounts will let you divide your funds, mixing them up is simple when you have got a number of of the identical kind.

Utilizing checking account nicknames helps differentiate between comparable accounts.

It additionally makes the net banking expertise extra visible, benefiting budgets and financial savings objectives.

On this publish, I share the advantages of giving your accounts nicknames and supply some concepts to get you began.

Financial institution Account Nicknames 101

What Is An Account Nickname?

A checking account nickname is just a strategy to make banking simpler for you when you have got multiple account on the identical financial institution or credit score union.

For those who don’t rename your accounts, you will notice an inventory of accounts once you check in like the next:

- Financial savings 4857

- Financial savings 6573

- Financial savings 1039

- Financial savings 0038

Relying in your monetary establishment, you would possibly see your entire account quantity or simply the final 4 digits.

Transferring cash between these can shortly develop into complicated, as you need to attempt to bear in mind the account quantity for every account.

The comfort lies in giving these accounts names.

Now they seem like this:

- Emergency Fund

- Automobile Insurance coverage

- Trip

- Enjoyable Cash

A fast look at your exercise helps you to see precisely the place your cash went.

And in case your financial institution permits, you possibly can add a be aware or memo into the switch subject to remain higher organized.

Why You Ought to Nickname Your Financial institution Accounts

Many individuals have a number of financial institution accounts to make the budgeting course of extra manageable.

Others have varied accounts to assist them keep organized.

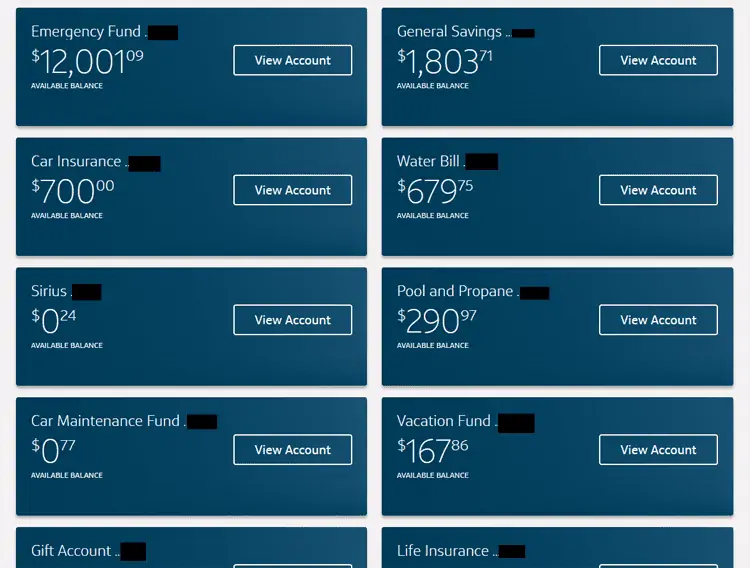

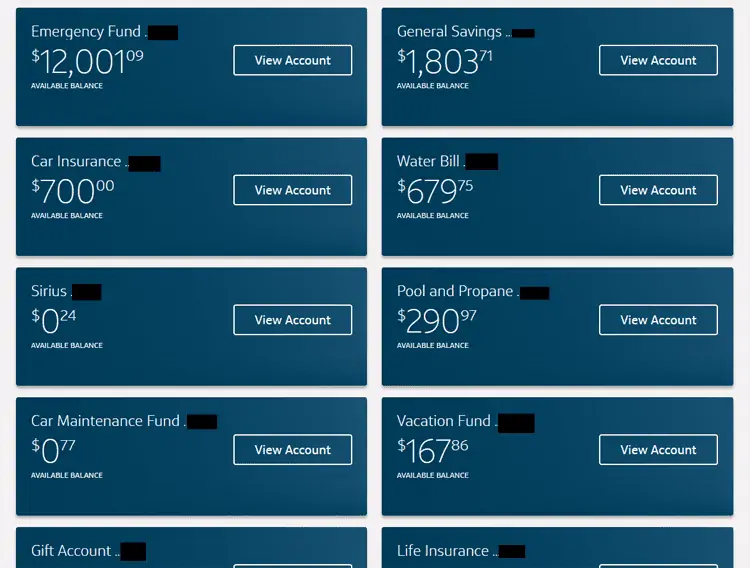

For instance, I use a sinking funds technique with my financial savings accounts.

I’ve separate financial savings for various objectives.

For instance, I’ve an account for my auto insurance coverage premium that I pay each six months.

I’ve one other account for my emergency fund and one other for automotive upkeep.

In whole, I’ve over 20 accounts.

When you don’t must nickname your financial institution accounts, taking the time to do that may also help immensely by:

- Separating comparable accounts

- Budgeting by distributing funds into named accounts

- Watching your financial savings accounts develop for particular objectives

Nicknaming your checking account is a better strategy to navigate on-line banking visually.

Just like the envelope technique, the named accounts will let you separate funds and take note of the place your cash goes.

Separating Related Accounts

You probably have a number of accounts of the identical kind, you’ll perceive how tough it may be to inform them aside when they’re with the identical financial institution or monetary establishment.

Naming your accounts on third-party budgeting apps and inside your on-line banking platform will assist you to differentiate between every account.

For instance, you’ll have two financial savings accounts along with your financial institution, one for minor emergencies and one other to cowl your bills for just a few months.

By giving every financial savings account a distinct nickname, it’s simpler to switch to the proper one and guarantee you have got the correct quantity.

For those who’re managing a number of accounts, it’s important to grasp the distinction between transaction and financial savings accounts to make sure you’re utilizing the precise one on your particular wants.

Beneath is a screenshot of my accounts at Capital One 360.

As you possibly can see, having nicknames makes it simple to search out the account you might be in search of and this helps you keep motivated to save lots of.

Budgeting

For those who can open a number of checking accounts with out incurring charges, you possibly can create totally different sections in your financial institution to funnel into your funds.

Beforehand, you needed to write down each transaction, and monitoring spending in particular areas was way more manageable.

Now, with every little thing lumped collectively, there isn’t any clear separation.

This course of is much like the envelope system that helps you visualize your funds, nevertheless it works for on-line banking and doesn’t require you to mark down or stability your totals.

Financial savings

It’s difficult to save lots of for a particular aim, even when your coronary heart is in it.

Separating your funds and naming the aim will increase your probabilities of following by means of and assembly that want.

You’ll be able to have a separate account for every little thing wanted or desired, akin to:

- A 6-month emergency fund

- Holidays funds

- A brand new automobile

- School funds

As a substitute of clumping all of your financial savings collectively, separating and naming them helps you to see which objectives want extra consideration and may also help you cowl the requirements first.

Drawbacks Of Naming Your Financial institution Account

There generally is a few drawbacks to renaming your accounts.

With that stated, I really feel the advantages outweigh the disadvantages and nonetheless suggest it.

#1. Time Consuming

It is going to take time to rename all of the accounts, particularly when you’ve got so much.

However it is a one-time dedication and shouldn’t cease you from doing it.

#2. Cellular Banking Glitches

I’ve had just a few points the place though I entered a reputation after I would signal on to my account, some accounts wouldn’t have the nickname.

If I logged out and logged again in, the difficulty went away.

This glitch could be irritating, however fortunately it has solely occurred twice.

#3. Outdated Banking Software program

You would possibly identify your account and make transfers between accounts.

However then, once you take a look at your transaction historical past, you see the switch went to Financial savings 0036 as an alternative of claiming, Emergency Fund.

Fortunately that is uncommon, however it’s one thing to remember.

Methods to Change Financial institution Account Nicknames

Log into your checking account and choose the account you wish to change the identify on.

Go into the accounts settings, view your account info, after which select “nickname account.”

The positioning ought to give you a textual content field to alter the account nickname.

Choose one thing that will help you establish the account shortly, then click on save.

It’s best to return to your foremost cell banking web page to make sure the change holds.

Some banks don’t will let you change the checking account nickname.

You probably have points determining learn how to change the identify, contact your financial institution’s help staff.

They are going to let you recognize if that is attainable and information you thru the method whether it is.

107 Financial institution Account Nickname Concepts

Whether or not you want a generic nickname or one to suit a particular funds, now we have some concepts to get you began.

You may as well use this checklist to encourage methods to make use of a number of accounts.

You should utilize these concepts for checking account nickname concepts or financial savings account nickname concepts.

Generic and Miscellaneous

Generic and miscellaneous nicknames accommodate among the extra obscure makes use of for a checking account.

They will also be enjoyable identifiers on your accounts in third-party budgeting apps.

#1. Swear Jar

#2. Enjoyable Cash

#3. Birthdays

#4. Unaccounted Money

#5. Secure to Spend

#6. Further Dough

#7. Buffer Cash

#8. His Cash

#9. Her Cash

#10. Miscellaneous Cash

Youngsters

You should utilize totally different accounts to separate funds on your youngsters’s bills, or you should use them to create financial savings for the longer term.

#11. Youngster’s Identify

#12. Allowances

#13. Babysitting and Daycare

#14. Date Evening Babysitter

#15. Child Provides

#16. Children Actions

#17. Toy Funds

#18. Youngster Help

#19. Child Requirements

Private Care

Setting apart cash for private care ensures you pay your self first, prioritizing self-care and minor splurges.

#20. Deal with Your self

#21. Spa Day

#22. Hair Care

#23. Dry Cleansing

#24. Laundry

#25. Make-up Cash

#26. Self Care

#27. Lower and Coloration

#28. New Me

Financial savings

Any accounts you utilize to put aside funds ought to have an acceptable identify to establish your aim.

This identify lets you recognize what the funds are for and may encourage you as you get nearer to your objectives.

#29. Emergency Fund

#30. Retirement Fund

#31. Not Secure to Spend

#32. Investing

#33. Don’t Contact This

#34. Wet Day

#35. Life Insurance coverage

#36. Taxes

#37. Determine Objective Financial savings

Items and Donations

Having cash available for charitable donations ensures you possibly can contribute to the causes that imply essentially the most to you, particularly in an emergency.

#38. Charity or Group

#39. Philanthropy

#40. Tithes

#41. Gifting

#42. Give Away

#43. Christmas

#44. Holidays

#45. Birthdays

#46. Anniversary

#47. Weddings

Transportation

Guaranteeing you have got cash to help transportation protects your commute and your means to discover.

#48. Gasoline/Gas

#49. Automobile Registration

#50. Upkeep

#51. Automobile Cost

#52. Automobile Insurance coverage

#53. Get to Work

#54. Public Transportation

#55. Uber

Dwelling Associated

Dwelling-related bills can catch you abruptly.

An account devoted to those charges helps you to establish the price of renting or proudly owning your private home, and you may higher put together for the longer term.

#56. Property Taxes

#57. Mortgage/Hire

#58. Dwelling Enchancment

#59. Transform

#60. Landscaping

#61. Garden and Backyard

#62. Furnishings and Decor

Payments And Utilities

Setting apart cash for payments and utilities can preserve the lights on and make sure you don’t miss a cost.

It additionally helps you arrange autopay with out worrying about chopping into different funds.

#63. Month-to-month Payments

#64. Electrical Invoice

#65. Cell Telephone and Web

#66. Subscriptions

#67. Water Invoice

#68. Sewer Invoice

#69. Scholar Loans

#70. Further Credit score Card Funds

#71. Tuition

Purchasing

Everybody loves having some cash for buying, and an account devoted to your favourite expenditures prevents you from dipping into the money you want.

#72. Particular Retailer

#73. Clothes

#74. Sporting Items

#75. Pastime Fund

#76. Toys

#77. Amazon Prime Price

Leisure

Setting apart cash for the issues that entertain you enriches your life and helps you work together with the tradition and particulars that imply essentially the most to you.

#78. Ebook Haul

#79. Theater Fund

#80. Amusement

#81. Music

#82. Artsy

#83. Netflix and Chill

Well being And Health

An account for well being and health will set you up for future success.

It ensures you have got cash for emergencies, and you may take cost whereas investing in your situation.

#84. Well being Insurance coverage

#85. Dental Insurance coverage

#86. Dentist Fund

#87. Physician Fund

#88. Eye Care

#89. Fitness center

#90. Pharmacy

#91. Seaside Physique

#92. An Apple a Day

#93. Sports activities Fund

Trip

Whether or not you wish to take a highway journey or fly abroad, a trip account helps you fund your getaway.

#94. Vacation spot Identify

#95. Tenting

#96. On the Street Once more

#97. Resort Fund

#98. Journey

#99. Automobile Rental

#100. Airline

#101. Getting Round in Vacation spot Identify

Pet Care

For some folks, their pets might have their full-blown funds.

For others, a separate account for vet charges and pet care is sufficient.

#102. Pet’s Identify

#103. Furry Buddy Fund

#104. Vet Payments

#105. Grooming

#106. Spoiling Pet’s Identify

#107. Companion Care

Remaining Ideas

Nicknaming your financial institution accounts makes it simple to go looking by means of and establish prices and separate funds for various sections of your funds as an alternative of memorizing varied account numbers.

So long as your financial institution affords a number of free accounts, this is likely one of the best methods to automate the categorization of your expenditures with out reverting to pen and paper.

And the extra time it can save you right here, the extra free time you’ll have to do different belongings you take pleasure in.

I’ve over 15 years expertise within the monetary companies trade and 20 years investing within the inventory market. I’ve each my undergrad and graduate levels in Finance, and am FINRA Sequence 65 licensed and have a Certificates in Monetary Planning.

Go to my About Me web page to be taught extra about me and why I’m your trusted private finance knowledgeable.