Motion Building Gear Ltd – Lifting India’s Progress

Included in 1995 and headquartered in Haryana, Motion Building Gear Restricted (ACE) makes a speciality of manufacturing cranes, materials dealing with tools, highway development equipment, and agricultural instruments like tractors and harvesters. With manufacturing services in Haryana, ACE provides over 60 merchandise and has a presence in 100+ areas throughout India. Because the world’s largest pick-and-carry crane producer, ACE operates in 37 nations, together with areas within the Center East, Africa, Asia, and Latin America, serving sectors like development, manufacturing, logistics, and agriculture.

Merchandise and Companies

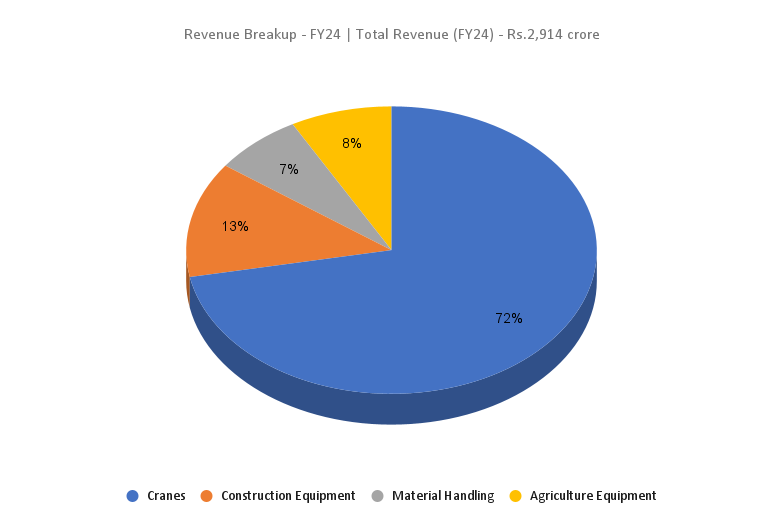

The corporate operates throughout 4 primary segments:

- Cranes: Choose & carry cranes, lorry loaders, tough terrain cranes, crawler cranes, truck cranes, and tower cranes.

- Building Gear: Backhoe loaders, telehandlers, vibratory rollers, motor graders, and entry platforms.

- Materials Dealing with: Forklift vehicles, warehousing tools, and piling rigs.

- Agri Gear: Tractors and monitor harvesters.

Subsidiaries – As of FY24, the corporate has 2 subsidiaries and a partnership agency.

Progress Methods

- Forming a three way partnership with Japan’s Kato Works Restricted to fabricate medium and large-sized cranes for the Indian market, with subsequent plans to focus on export markets.

- Developed India’s first absolutely electrical cell crane, pending authorities approval, with increased pricing reflecting superior effectivity.

- New product lineup, together with 45-ton and 60-ton cranes, is anticipated to drive increased revenue margins.

New Alternatives:

- Aiming to considerably improve export income over the following 2-3 years with revolutionary merchandise just like the Forma Vary of Tractors and “Phantom 4×4” Backhoe Loader.

- Upgrading merchandise to satisfy CEV IV emission norms by January 2025.

- Current launches embrace India’s largest cell crane, aerial work platforms, and next-gen 35-ton 4×4 cranes.

Monetary Efficiency

Q1FY25

- Income reached ₹762 crore, marking a 14% development in comparison with ₹668 crore in Q1FY24.

- EBITDA elevated by 29% to ₹126 crore, up from ₹98 crore in Q1FY24.

- Web revenue grew by 24%, rising from ₹68 crore in Q1FY24 to ₹84 crore this quarter.

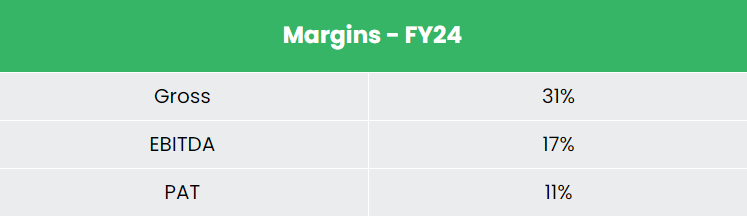

- EBITDA margin improved by 212 bps to 17%, whereas web revenue margin expanded by 107 bps to 11%, pushed by higher value realization, an improved product combine, and environment friendly value management measures.

FY24

- Income reached ₹2,914 crore, reflecting a 35% improve in comparison with FY23.

- Working revenue surged by 83% to ₹480 crore.

- Web revenue climbed 90% YoY, reaching ₹328 crore.

Monetary Efficiency (FY21-24)

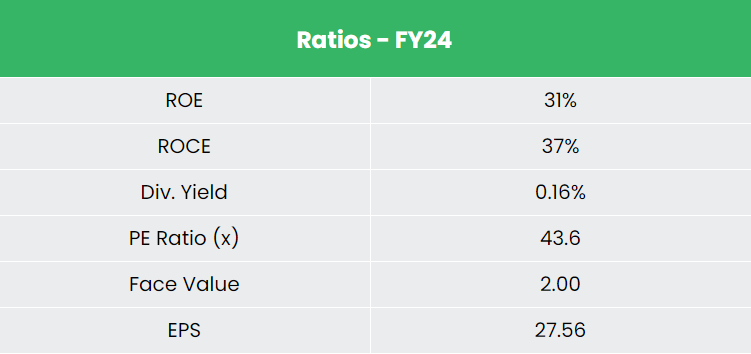

- The corporate’s income and PAT CAGR over the previous 3 years (FY21-FY24) are roughly 33% and 63%, respectively.

- The three-year common ROE and ROCE stand at round 23% and 30%, respectively.

- The corporate maintains a debt-free capital construction, showcasing its monetary prudence and robust fundraising capabilities.

Business outlook

- India has tripled its capital expenditure over the previous 4 years, considerably boosting financial development and job creation.

- Demand for development equipment and tools surged, resulting in a 26% improve in manufacturing gross sales, reaching 135,650 items in FY24.

- Ongoing infrastructure tasks, together with airports, railways, ports, and metro methods, proceed to strengthen the development market, indicating a promising future for the trade.

Progress Drivers

- Capital funding outlay of ₹11.11 lakh crore (US$ 133.86 billion) for infrastructure within the Interim Price range 2024-25, marking an 11.1% improve.

- 100% Overseas Direct Funding (FDI) permitted in key sectors like roads and highways, railways, ports & harbours, and concrete growth tasks.

- Authorities initiatives resembling Atmanirbhar Bharat Abhiyaan, Metro Rail growth, and Pradhan Mantri Awas Yojana (PMAY) are anticipated to spice up demand for development tools in India.

Aggressive Benefit

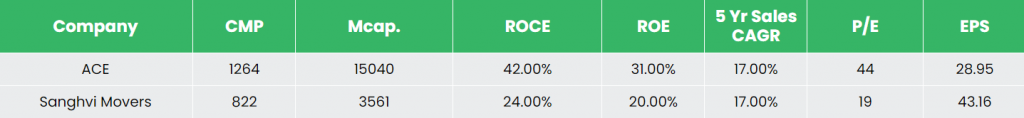

Sanghvi Movers is the one listed competitor of ACE working in related enterprise and comparable market cap. In comparison with its competitor, the corporate has higher return ratios and secure income development, indicating the corporate’s monetary stability and its effectivity in producing earnings and returns from the invested capital.

Outlook

- The corporate is well-positioned to develop additional throughout various industries.

- FY25 steerage consists of 15-20% top-line development with further margin growth.

- Anticipated development charges: 20% in cranes, materials dealing with, and agri portfolios; 30-40% within the development phase.

- The three way partnership with Kato is anticipated to create new enterprise alternatives.

- Ongoing give attention to analysis and growth for revolutionary merchandise is a key energy.

- Evolving product combine, capability growth, and export market alternatives help continued development momentum.

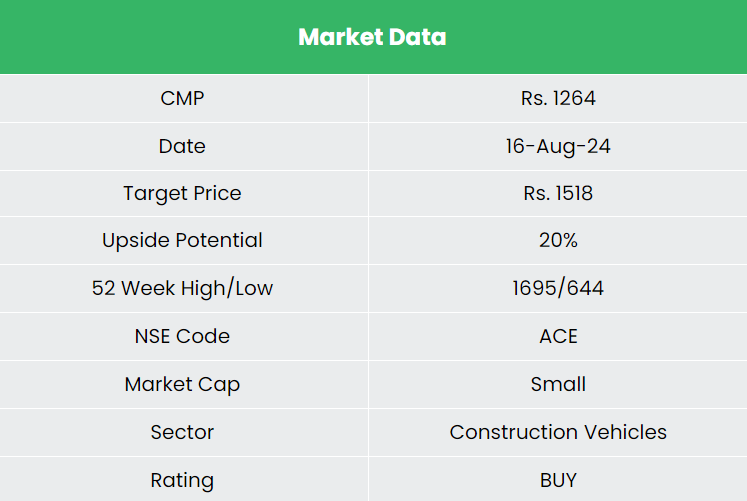

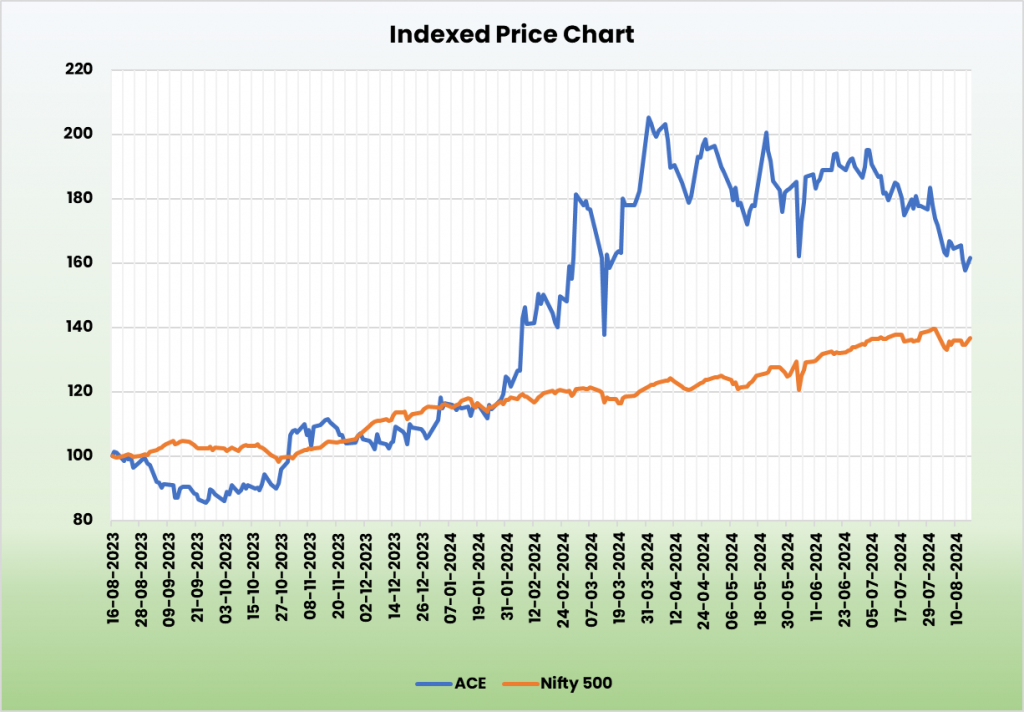

Valuation

Authorities’s ongoing give attention to infrastructure spending and ACE’s robust model popularity present clear income visibility for the medium to long run. We advocate a BUY ranking for the inventory with a goal value (TP) of ₹1,518, representing 33x FY26E EPS.

Dangers

- Slowdown in Economic system: An financial downturn might result in lowered capital expenditure on infrastructure tasks, probably impacting the corporate’s turnover.

- Uncooked Materials Value Volatility: Fluctuations in uncooked materials costs and demand might have an effect on earnings and money circulation.

Notice: Please be aware that this isn’t a suggestion and is meant just for instructional functions. So, kindly seek the advice of your monetary advisor earlier than investing.

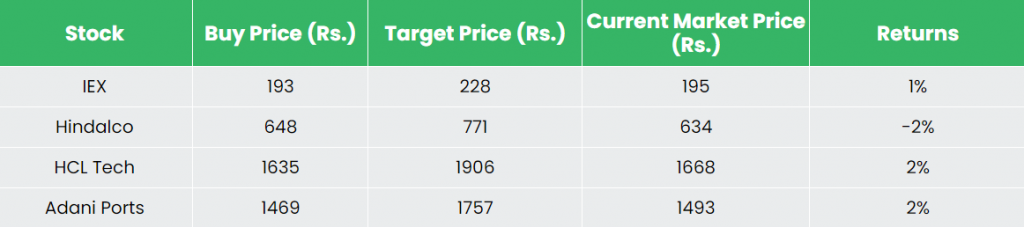

Recap of our earlier suggestions (As on 16 August 2024)

Indian Vitality Trade Ltd

Hindalco Industries Ltd

HCL Applied sciences Ltd

Adani Ports & Particular Financial Zone Ltd

Different articles chances are you’ll like

Put up Views:

55