“It’s a certain signal of summer time if the chair will get up whenever you do.” Walter Winchell

Walter who? O tempora! O mores!

On the top of his recognition, within the late Nineteen Thirties, 50 million individuals—two-thirds of American adults—learn Winchell’s syndicated column and listened to his 15-minute Sunday-night radio broadcast. He positioned himself as a champion of “Mr. and Mrs. America,” and was essentially the most highly effective – or, at the very least, most feared – particular person in American media. He remained a pressure by the Fifties. Whereas he derided “presstitutes,” his fast-paced, gossip-driven, and politically charged model is the precursor to and mannequin for the media insanity that plagues us right now.

On the upside, he acquired summer time and rocked a imply fedora!

Within the August situation of Mutual Fund Observer …

Every year MFO celebrates the insane warmth of summer time with its summer-light situation, which displays the truth that each our readers and our contributors are scattered on seashores, benches, decks, and boats throughout the northern hemisphere. To which we are saying: good for you, guys!

Devesh friends over the rim of his pina colada to share “Summer time Ideas” on options-based funds (“simply don’t”), asset allocation (“keep residence”), good podcasts, and Berkshire Hathaway within the twilight of Buffett’s care (“keep the course”).

Lynn, who at 69 is about to roll into his prime, has determined to look at “The Knowledge of the Elders” – Warren, Chuck, Howard, and Gary – to see how they may assist us put together for 2025. Individually, he took a break from constructing homes for Habitat and touring, to share “Bits and Items” of what he’s discovered throughout his first yr after leaving full-time work. Only a heads up, IRMAA is searching for you.

The Shadow went past his at all times glorious protection of the trade’s twists and turns to spotlight 4 new funds within the pipeline – Nordic bonds, anybody? – that seemingly deserves your consideration.

And me? As I learn Morningstar’s latest “finest small cap funds” article, I had two robust reactions. (1) That is very non-Morningstar. Rather more like Zacks and Yahoo. How bizarre. And (2) you are able to do hella higher. In “Higher than the Greatest,” we spotlight 17 small cap funds which have crushed their friends at the very least 90% of the time over the previous decade.

We additionally share three Launch Alerts for funds which have come on-line prior to now few months: WPG Choose Hedged (an extended/brief small-cap fund from Boston Companions), Otter Creek Focus ETF (a small- to mid-cap targeted fund with an emphasis on high quality companies and a robust personal file) and T. Rowe Worth Intermediate Municipal Earnings ETF (an affordable method to entry a really T. Rowe Worth-y method to tax-free investing, their first energetic ETF that doesn’t mimic an current fund).

Issues I’ve discovered in summer time …

“The primary week of August hangs on the very prime of summer time, the highest of the live-long yr, like the best seat of a Ferris wheel when it pauses in its turning. The weeks that come earlier than are solely a climb from balmy spring, and people who comply with a drop to the nippiness of autumn, however the first week of August is immobile, and scorching. It’s curiously silent, too, with clean white dawns and obvious noons, and sunsets smeared with an excessive amount of shade.” Natalie Babbitt, the opening strains to “Tuck Eternal” (2002)

-

The Higher Peninsula of Michigan is cool, but it surely makes Maine look city as compared. Chip and I spent 1o days there, sampling whitefish and fudge, listening to “The Wreck of the Edmund Fitzgerald” (it’s omnipresent), meditating on the truth that each household owned at the very least one ATV/UTV, touring the Soo Locks and clambering about lighthouses.

Oh, proper. Helicopter. Had I discussed we went joyriding in a helicopter?

Because of Catch22 for his journey suggestions, and to Andrew and Michelle Foster for the beautiful wine that made stress-free in Adirondack chairs all of the sweeter!

-

Standpoint Multi-Asset Fund (REMIX/BLNDX) is on hearth!

Charles Boccadoro, the maestro of MFO Premium, began the dialogue as he tracked efficiency and asset flows, a comparatively new operate for our Premium website. We profiled this all-weather, long-short, managed futures fund in January 2024, concluding

Life is unsure, and investing much more so. Standpoint is attempting to supply an island of predictability that traders may use to enhance and strengthen their core portfolios. With constructive absolute returns every year, they’ve earned a spot on any wise investor’s due diligence checklist.

Since then Standpoint has climbed steadily towards $1 billion AUM and its fifth consecutive yr of top-tier returns.

The MFO dialogue board is everywhere in the story. It’s best to be part of them.

-

Morningstar has 17 new prospects for you

Morningstar maintains a type of checklist of “Not Prepared for Prime-Time” funds, and their Prospects. These are “up-and-coming or under-the-radar funding methods” that they’re monitoring as candidates for analyst protection. The newbies:

- Alpha Architect 1-3 Month Field ETF BOXX makes use of a novel choices technique to ship Treasury yields with favorable tax remedy.

- American Century Excessive Earnings’s AHIIX skilled and well-resourced group focuses its bottom-up method on debt with robust financials.

- American Funds Multi-Sector Earnings’s RMDUX skilled group employs a considerate method inside the multisector bond Morningstar Class.

- Artisan Worldwide Explorer ARHBX brings the agency’s in depth worldwide experience to this concentrated overseas small-cap technique.

- Ashmore Rising Markets Fairness’s EMFIX well-resourced group makes use of a radical and affordable method to investing in emerging-markets equities.

- Capital Group Dividend Growers ETF CGDG actively picks dividend-paying, world market leaders.

- Capital Group Worldwide Fairness ETF’s CGIE veteran managers search for non-US firms with robust administration, strong stability sheets, and regular dividends.

- Dimensional Core Fastened Earnings ETF DFCF quantitatively selects bonds that are likely to outperform in response to Dimensional’s analysis.

- Constancy Fund FFIDX sports activities a rising star on the agency and is one to observe.

- John Hancock Disciplined Worth Worldwide Choose ETF JDVI is a extra concentrated model of distinguished John Hancock Disciplined Worth Worldwide JDVIX.

- Lazard US Systematic Small Cap LUSIX employs a extremely differentiated systematic course of utilizing synthetic intelligence.

- Osterweis Alternative’s OSTGX compact however skilled group takes a daring but wise method to discovering small-cap development shares.

- North Sq. Dynamic Small Cap ORSIX advantages from an skilled group and a repeatable systematic method.

- Rowe Worth World Multi-Sector Bond’s PRSNX seasoned group has a novel method to foreign currency echange.

- Voya Goal Retirement 2040 VTRKX has robust underlying holdings and below-average charges.

- WisdomTree US Worth ETF WTV makes use of high quality and shareholder yield to seek out sound companies.

Two notes. First, Morningstar appears particularly smitten with 4 of the funds: Artisan Worldwide Explorer, T. Rowe Worth World Multi-Sector Bond Fund, Voya Goal Retirement Funds/Trusts, and WisdomTree US Worth.

Second, MFO has already profiled two of the funds.

Artisan Worldwide Explorer, which invests in high-quality, undervalued companies with the potential for superior threat/reward outcomes. The portfolio is usually 25-50 holdings. We concluded: Artisan Worldwide Worth Technique works. Demonstrably, repeatedly, over time, and throughout market cycles. Mr. Samra and his colleagues have demonstrated that on the enormous, closed Artisan Worldwide Worth Fund since 2002. In Artisan Worldwide Explorer, you get publicity to what Worldwide Worth was in its first years: a small, agile portfolio that may profit from positions in small, obscure, badly mispriced shares.

Osterweis Alternative, which pursues top quality, small- to mid-cap firms with the power to generate fast, sustainable income development. The fund, previously named Rising Alternative, is managed by Jim Callinan who started his profession as an fairness analyst within the mid-80s and was a small-cap development portfolio supervisor by the mid-90s. He’s managed by 4 market crashes and two of the longest bull markets in American historical past. He’s managed each personal partnerships and public funds and has dealt with as a lot as $6.8 billion in property. We concluded that small development firms “are dangerous, although doubtlessly rewarding. Our first advice is to depend on a supervisor who’s succeeded by each the nice instances and the exhausting ones. Our second advice is so as to add Osterweis Alternative to the due-diligence checklist for traders and advisers searching for sustained, risk-conscious excellence.”

-

Wealthy Guys Screwing Up, episode 1246: Invoice Ackman’s “Fund for the plenty”

Hedge fund billionaire … and, actually, we might in all probability cease there, shake our heads, and transfer on … Invoice Ackman wished to launch a fund for normal traders. Which he determined wanted to be a closed-end fund. With a 2% annual administration charge for himself. And a 1.5% gross sales charge. And the very actual prospect that the fund would promote at a reduction to NAV, at 80% of what closed-end autos do, which signifies that he may purchase $100 value of inventory however solely be capable to promote them at 95% of their face worth. None of which turned out to be wildly enticing. The estimable Jason Zweig chronicles the story in “What Ackman Bought Flawed together with his Bungled IPO” (WSJ.com, 8/3/24, respect their paywall!).

As you may think, the parents on the MFO Dialogue Board had a celebration.

-

The variety of households proudly owning mutual funds has spiked!

Working from Funding Firm Institute information, the Monetary Occasions stories that “the variety of US households invested in mutual funds has grown, whilst long-term mutual funds skilled outflows …In whole, 68.7 million households, or simply over half of US households, had been invested in mutual funds in 2023, up from 58.7 million households in 2020” (“Variety of US households that personal mutual funds jumps,” 8/1/2024, and sure, they do know the distinction between mutual funds and ETFs).

Youthful traders, nonetheless, are more and more drawn to crypto.

-

Ben Carlson has been questioning in the event you understand how wealthy you actually are?

Mr. Carlson manages cash for Ritholtz Wealth Administration LLC and publishes the extraordinary A Wealth of Commonsense weblog. Mr. Carlson lately shared “seven questions I’m pondering” (7/30/2024), which embrace reflections on the happiness of youthful Individuals and the underappreciated delight of fireplaces.

One fantastic query that he’s pondering is “Do Individuals understand how wealthy they’re?”

He checked out latest information from dozens of nations and dozens of states earlier than observing that “Mississippi has greater common wages than Germany.” He admits to the complexity of the comparisons however does spotlight the paradox of one of many richest nations on the earth convincing itself that it’s poor and faltering.

-

The S&P 500 has modified for the more serious

Derek Horstmeyer, a finance professor at George Mason, and his analysis associates have frolicked wanting on the evolution of the S&P 500 over the previous 50 years. For folk in search of a diversified portfolio, the information will not be good. The index is extra concentrated than ever in tech and financials, which have excessive rate of interest sensitivity and has tripled its historic correlation with different developed market equities.

They conclude: “In all, the present-day S&P 500 is top-heavy on tech and extremely correlated with different world indexes – with excessive sensitivity to charges and with out the sturdy dividend of yore. Which means that the 60-40 portfolio that labored within the Seventies to handle diversification points now not works as properly – and it’ll not lengthy work to simply add worldwide shares for diversification” (“The S&P 500 isn’t as numerous because it was once. Right here’s why that issues,” WSJ.com, 7/8/2024).

His conclusion: you’re going to want to vary additional afield – into personal property, commodities, and elsewhere – in case your core is an S&P 500 index.

-

“Index fund” and “rational” aren’t the identical factor

One threat, particularly, is that the Russell indexes are laden with junk. The WSJ’s Spencer Jakab warns that “firms gaming the system, or simply being of low high quality, create an imperceptible drag that has price traders a whole bunch of proportion factors of good points over time.” He factors out that the S&P 600 small cap index has outperformed the Russell 2000 by 700 foundation factors, largely as a result of the S&P index is extra cautious about who they let in. (“The Shock in Index Funds,” WSJ, 7/27/2024).

Go re-read “The High quality Anomaly” (MFO, 5/2024) earlier than you make investments. Each of those items assist the argument we’ve been making: high quality shares are undervalued and overperform, yr and yr, decade after decade.

-

Local weather change goes to drive infrastructure investing.

We’ve been toiling away, researching infrastructure investing, its drivers, and your choices. Considered one of our early suspicions was that we had delayed so lengthy in attempting to restrict local weather change that we’re now trapped spending trillions – usually in sudden locations – attempting to adapt to it. Analysis by the Wall Avenue Journal reaches the identical unhappy conclusion:

Efforts to handle the reason for local weather change have fallen brief thus far. That’s resulting in a giant push to deal with the signs. Authorities and personal cash is pouring into plans to manage flooding, deal with excessive warmth and shore up infrastructure to resist extra extreme climate attributable to local weather change.

“Adaptation has been the unpopular child on the occasion for a very long time. That’s beginning to change,” mentioned Jay Koh, managing director on the Lightsmith Group, an funding agency with one of many few adaptation funds … The price of adaptation is immense, notably if mitigation efforts are delayed. The longer society waits to handle local weather change, the extra it can spend to fend off the impression of hotter, wetter climate” (“Local weather Money Pivots to New Actuality of a Hotter, Wetter Planet,” WSJ.com, 8/1/2024)

Extra in September!

-

Meals on the Iowa State Truthful is getting extra … umm, fantastic yearly.

Iowa’s annual end-of-summer ritual runs this yr from August 8-18 in Des Moines. It’s a gathering that celebrates the state’s agricultural heritage and economic system … and it provides Iowans a chance to style an ever-wider array of food-on-a-stick and different culinary improvements.

Final’s years “Individuals’s Alternative Award” went to “Deep-Fried Bacon Brisket Mac-n-Cheese Grilled Cheese.”

Final’s years “Individuals’s Alternative Award” went to “Deep-Fried Bacon Brisket Mac-n-Cheese Grilled Cheese.”Yep: grilled cheese sandwich. Add mac & cheese. Add bacon brisket. Dip in batter. Deep-fry.

This yr sees the debut of no fewer than 84 new delights, together with the Bacon Cheeseburger Egg Roll, Barbie Period Funnel Cake, Beer Stomach Fries, and BLT on a Stick (drooling but?) in addition to Butter Beer Ice Cream, Deep Fried Bubble Gum, Deep Fried PB&J and the Maple Bacon Bliss Sundae.

Tickers – and defibrillators – are nonetheless out there!

Thanks, as ever …

To Frank from Delaware (it’s good to make your acquaintance, sir!) and our devoted month-to-month contributors Wilson, S&F Funding Advisors, Gregory, William, William, Stephen, Brian, David, and Doug.

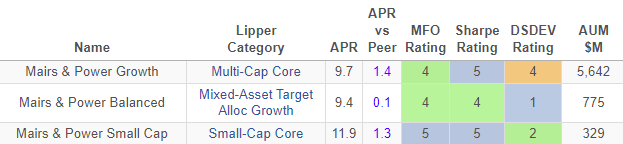

And to the nice people at Mairs & Energy. I entered a raffle for his or her primo “Made in Minnesota” present basket whereas I used to be at Morningstar… and gained!

They’re sort of just like the T. Rowe Worth of Minnesota. Quietly, persistently glorious. I’ll attempt to drop by the subsequent time I’m visiting my son Will within the Twin Cities.

Efficiency since inception, by 07/2024

We ended our fiscal yr modestly within the purple, which isn’t deadly however isn’t an amazing mannequin for the long term. In the event you’d wish to make a tax-free contribution (I do know, adjustments within the tax code have made that much less compelling but it surely nonetheless makes a distinction), take a look at the right way to Help Us!

We want you peace within the month and season forward. It’s exhausting, I do know. The best advice that, as a scholar, I could make is “disconnect.” Our brains can’t accommodate the flood of effluvia flowing by our telephones. Very wealthy individuals know the right way to turn into richer: get you to obsess and doom-scroll whereas they promote your private life to different wealthy people. Books are a lot safer, gardens higher nonetheless, and time working with these you like, better of all.

Past that, a psychologist showing on the WBUR program “Right here and Now,” factors out an enchanting discovering: the extra you find out about politics, the extra careworn you’re … until you turn into concerned. That’s, the one finest method to defend your self from emotions of doom is to do one thing about it. Political events of all stripes want you, need you, and might empower you. From being a ballot employee to stuffing envelopes, your coronary heart will thanks for merely getting up and placing your beliefs into motion. (“How to deal with political anxiousness this election season,” 8/1/2024).

For September, we’ll be some fascinating bond fund choices: Nordic, disciplined, multi-sector, and in any other case. Additionally, we’re hoping to share our long-incubating work on infrastructure investing!

As ever,