Nationwide Pension System (NPS) is a outlined contribution retirement financial savings scheme. The NPS has been designed to allow systematic financial savings through the subscriber’s working life. It’s an try in direction of discovering a sustainable answer to offer ample retirement revenue to each citizen of India. NPS is just like the 401k plan provided for workers within the US. This text covers all details about NPS, provides overview of NPS, returns of NPS, open eNPS account, Tax Advantages on NPS.

Particulars of NPS

Hyperlink to Following articles covers the subject intimately.

Overview of NPS

The NPS was launched on the first of January 2004 and was aimed toward people newly employed with the central authorities, however not together with ones within the armed forces. From the yr 2009 nevertheless, the NPS was made open to each Indian citizen between the age of 18 and 60 . Even NRIs can spend money on NPS.

- You contribute a sure sum each month throughout your working years, which is then invested based on your choice.

- You possibly can then withdraw the cash whenever you retire, which is presently set at 60 years outdated.

- Funding is based on investor choice, It imply one can choose from totally different choices

- Beneath the NPS, a person’s financial savings is pooled in a pension fund.

- These funds are invested by Pension Fund Regulatory and Improvement Authority (PFRDA) regulated skilled fund managers as per the authorized funding pointers within the diversified portfolios comprising of presidency bonds, payments, company debentures, and shares.

- Distinctive Everlasting Retirement Account Numbers (PRAN) is allotted to every subscriber underneath the NPS on the time of their becoming a member of.

- Subscribers are additionally allotted two accounts, which they’ll entry at any time

- Tier I Account – Beneath this account, withdrawals should not allowed. It’s solely meant for financial savings after the subscriber’s retirement.

- Tier II Account – Beneath this account, a subscriber is free to make as many withdrawals as she or he likes at any time, just like an everyday financial savings account.

- These contributions would develop and accumulate over time, relying on the returns earned on the funding made.

- On the time of a traditional exit from NPS, the subscribers can withdraw solely 60%. 40% needs to be used to buy a life annuity from a PFRDA empanelled life insurance coverage firm.

- NPS offers seamless portability throughout jobs and throughout places, not like all present pension plans.

- NInvestment in NPS is unbiased of your contribution to any Provident Fund or some other pension fund.

- NPS is distributed via licensed entities known as Factors of Presence (POP’s) . One may also transact in NPS on-line solely.

- The contribution for NPS and curiosity earned are eligible for deduction whereas withdrawals are taxable.

The Nationwide Pension System (NPS) has managed to generate first rate returns in 2016. Though its fairness plans remained lacklustre, it was compensated by a very good efficiency by the federal government bond plan and the company debt plan. If one assumes an asset allocation of fifty% fairness, 25% authorities bond and 25% company debt, the typical NPS returns for 2016 work out to be 9.47%, higher than some other competing merchandise.

The NPS was in a position to outperform its benchmarks and in addition related mutual fund schemes. For instance, the typical one-year returns for the fairness plan is 3.75%, increased than 2.16% generated by the benchmark index, Nifty , and 1.88% by the large-cap fairness funds. The same sample is seen with the federal government bond plan and the company debt plan.

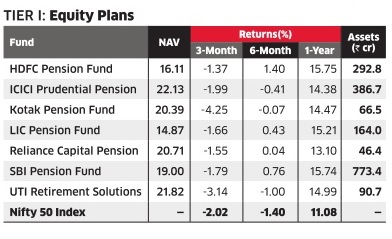

There are solely seven NPS fund managers at current and the desk beneath compares their efficiency for Fairness Plans. For extra on NPS returns please test our article Returns of NPS

NPS Returns of Tier 1 Fairness Plans

Negatives of funding in NPS

- Liquidity is without doubt one of the necessary aspects of any funding. Within the NPS you won’t be able to withdraw till the age of 60 besides when you contract a important sickness or are shopping for or establishing a home.

- Your complete revenue stream from the NPS, the lump sum, and the pension is totally taxable, besides the portion really used to buy the annuity. Moreover, annuity payouts i.e pension are additionally totally taxable. Evaluating this with investments in fairness and fairness mutual funds which at the very least at current are exempt from the long-term capital good points tax. The PPF additionally doesn’t endure any tax on withdrawals.

- The worst clause is whenever you withdraw after the age of 60, 40% of that corpus needs to be compulsorily used to buy an annuity from a life insurance coverage firm. However, if withdrawal is finished earlier than that, then a staggering 80% of the collected capital should compulsorily be used to purchase a life annuity and the stability of 20% may be utilised by the account holder for any objective. Annuities are high-cost, low-return merchandise of life insurance coverage firms, glorious for the brokers and firms that promote them.

- Even for a really very long time horizon, a most of solely 50% allocation to fairness is permitted, even when the investor needs a better fairness allocation.

- Whereas a lot is fabricated from the very low fund administration cost, there are multi-level expenses at varied places of work and ranges of the NPS system, the cumulative impact of which make the NPS is a much more costly system than seems at first look.

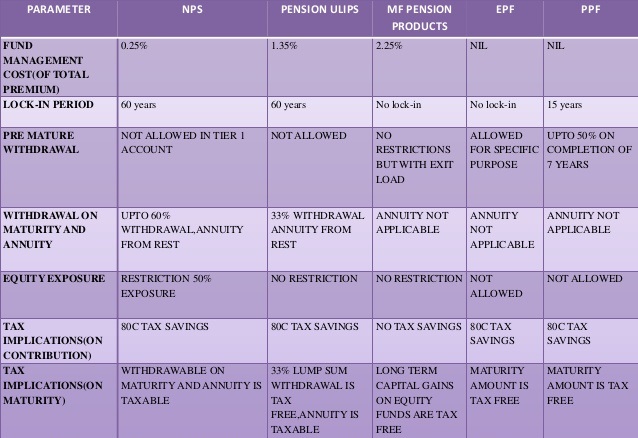

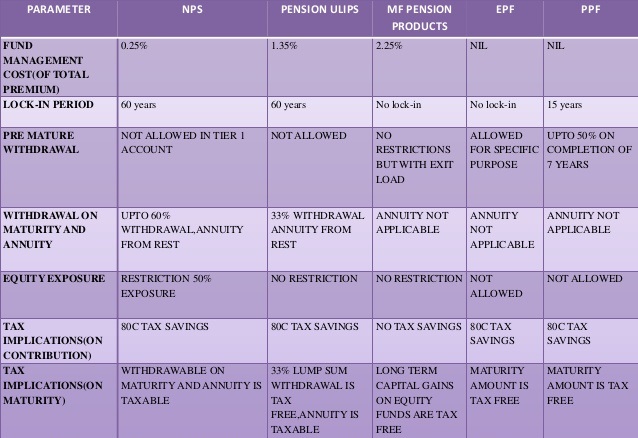

Evaluating NPS with EPF, PPF, Pension Plans

New Pension scheme being a retirement plan one find yourself evaluating with varied different authorities pension schemes(like EPF,PPF) and linked pension schemes(personal pension linked merchandise) obtainable available in the market. Outlined profit scheme means a specific amount of profit is outlined firstly whereas in outlined contribution schemes, a sure contribution is outlined by each employer and workers The given desk reveals the varied parameters on which the totally different pension schemes obtainable within the market are differentiated.

Evaluate NPS with EPF PPF Pension

NPS Tier 2 Account

NPS comes with two accounts: Tier I and Tier II. Tier I is the retirement account which will get a number of tax breaks, whereas NPS Tier II is a voluntary account is sort of a mutual fund, that means there isn’t any lock-in until retirement and cash may be withdrawn any time thus providing higher flexibility.

The fund administration expenses of NPS Tier II plans are barely 1% of the price of the typical direct plan. For managing an funding of Rs 1 lakh

- An everyday mutual fund expenses Rs 1,500-2,500 per yr

- A direct mutual fund cost 0.75-1.5%—or Rs 750-1,500 per yr

- However NPS Tier II cost solely 0.01%—or Rs 10 per yr for managing an funding of Rs 1 lakh.

The ultra-low prices imply increased returns for traders. NPS Tier II plans have outperformed mutual funds of the identical classic by .7-2% throughout totally different time frames.

Regardless of the apparent benefit of upper returns, only a few traders have put cash in NPS Tier II plans

Our article NPS Tier 2 or Tier II Account: Efficiency, open,Withdraw discusses Tier II account of NPS scheme, its distinctive options, professionals and cons of investing in NPS Tier II,taxation and withdrawal on Tier II account, together with returns from funding in NPS Tier 2 account.

Associated Articles :