We all know that an inverted yield curve is usually a harbinger of a recession adopted by a market sell-off. However what does an inverted yield curve imply for bonds, that are speculated to be the “secure” part in your portfolio? Particularly, how do they act earlier than, throughout, and after the yield curve upends itself? Let’s take a better look.

What Occurs Throughout a Recession?

Earlier than a recession, the fairness market usually strikes proper alongside. Since 1980, the S&P has been up 8.2 %, on common, within the yr earlier than a recession. In the meantime, within the trailing 12 months after a recession, shares normally exhibit just about flat efficiency. Within the pre-recession section, it might appear to make sense to make use of danger belongings like high-yield, reasonably than safer intermediate-term methods that might be useful after a recession. Throughout a recession (the common size being 15 months), traders hope to see their bonds act as a ballast in opposition to falling shares. So, what if we might decide how shares did, how bonds did, and whether or not there’s a most well-liked allocation throughout these time frames?

To assist reply these questions, I first decided a time-frame to check. To maintain it easy, I used the 12 months earlier than an inversion (outlined by a detrimental 10–2 unfold) and the 12 months after. Then, I annualized the time through the inversion to get the very best apples-to-apples comparability.

Benchmark Return Take a look at: Which A part of the Curve Is Most Affected?

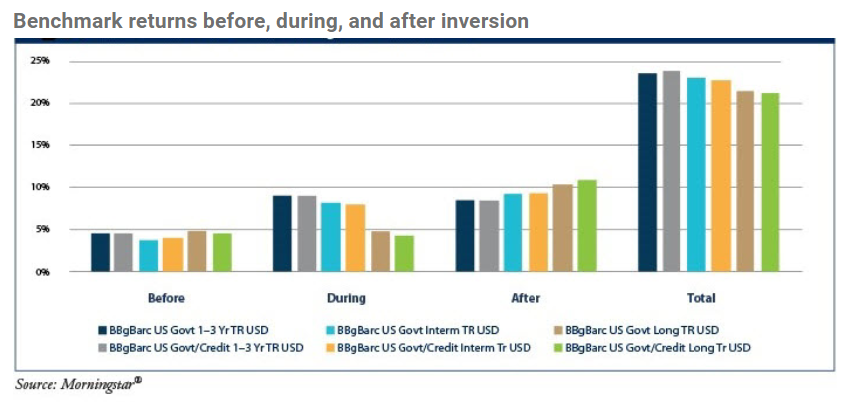

Within the broadest sense, the primary take a look at was to find out which a part of the yield curve is most affected by an inversion. To take away particular fund efficiency and supervisor expertise from the equation, I used the Bloomberg Barclays U.S. Authorities and the Bloomberg Barclays U.S. Authorities/Credit score indices for short-, intermediate-, and long-term parts of the curve.

The U.S. authorities indices are principally U.S. Treasuries. The federal government/credit score indices add a 50 % allocation to investment-grade company bonds.

The very first thing to notice within the chart above is that the bonds did their job and held up: all three intervals have been constructive. The addition of the credit score part to the benchmark did little to have an effect on the return. The federal government/credit score indices outperformed the government-only indices by about 25 bps over the total 36 months of the commentary interval.

Earlier than inversion: No change in maturity efficiency. Earlier than the curve inverts, it flattens (i.e., the lengthy finish falls relative to the brief finish). On common, the three maturities in our take a look at behaved roughly the identical over the previous yr. Conceptually, this habits is sensible. At this level, the curve could be flat, and bonds throughout the maturity spectrum would have the identical yield.

Quick carried out greatest throughout inversion. As soon as the curve inverted, the brief finish had the very best efficiency, with the longer indices lagging. This development reversed as soon as the curve normalized. This efficiency, too, is sensible. The curve is inverted when shorter-maturity bonds yield greater than longer-dated paper; subsequently, investing within the highest yield would obtain the very best return. Over the total course of the inversion cycle, the short-term holdings returned 24 %; the intermediate- and long-term holdings returned 23 % and 21 %, respectively. However what we’re most involved in is whether or not they would offset the fairness sell-off. The reply? A convincing sure.

Now that we all know, on essentially the most fundamental stage, that our bond portfolio helps returns, is there a greatest sector to be in?

Class Returns Take a look at: How Did Morningstar® Maturity Classes Do?

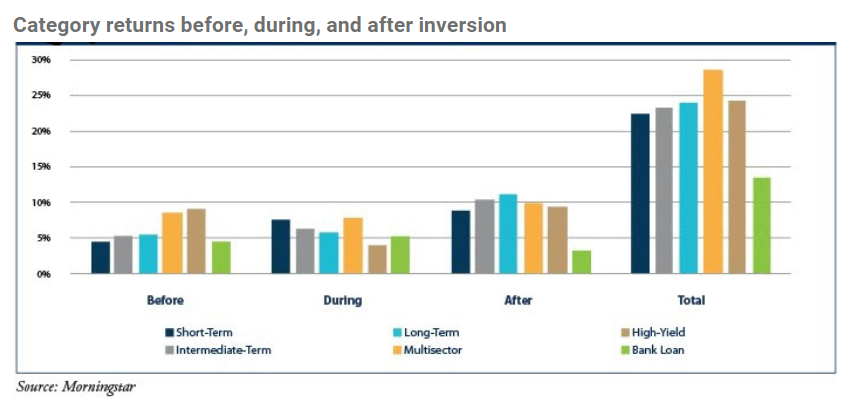

After all, you possibly can’t make investments immediately in benchmarks. To discover whether or not a extra diversified method would produce greater returns, I used the Morningstar brief, intermediate, and lengthy classes. I additionally added unfold classes: multisector, high-yield, and financial institution loans. This method launched credit score danger and supervisor potential, though supervisor potential was considerably muted through the use of your complete class.

As you possibly can see within the chart under, brief once more outperformed lengthy through the inversion, at 24 %. Lengthy was the very best performer total for the time period sectors. Quick and intermediate returned 22 % and 23 %, respectively.

Unfold sectors fared in a different way. Multisector—with its flexibility by way of length and asset allocation that might profit in numerous yield environments—was constantly among the many prime performers. It returned 5 % greater than every other class through the 36-month marketing campaign. Regardless of its typical quarterly resets and low length, the financial institution mortgage class couldn’t capitalize on greater front-end charges. It produced the bottom return among the many six classes examined.

High quality outperformed. One predominant takeaway from this take a look at, nonetheless, is that each one three high quality holdings—brief, intermediate, and lengthy—carried out almost in addition to high-yield and much better than financial institution loans with much less volatility. This was one other indication that, in mounted earnings investing, rate of interest sensitivity (measured as length) isn’t the one main danger. We additionally have to be cognizant of credit score danger. As a result of inversions precede recessions—through which lower-quality credit score sectors usually wrestle—the introduction of a detrimental 10–2 unfold could be a sign to maneuver up in high quality alongside a hard and fast earnings portfolio.

What Have We Realized?

Ought to we shorten up length and cargo up on unconstrained funds within the face of an inverted yield curve? To evaluate the impact of curve positioning, I cherry-picked the best- and worst-possible performers within the fund class take a look at to find out what the distinction in return could be. What’s the distinction between being precisely proper and precisely incorrect?

If selecting accurately, an investor would maintain long-term funds when the unfold is tightening, short-term funds throughout an inversion, and long-term funds as soon as the curve began to steepen once more (i.e., after a positive-sloping curve had been reestablished). The profitable investor’s return could be 25 % over three years. If selecting incorrectly, the return could be 20 %. If purchased and held, all three maturity-based classes could be lower than 3 % away from the “good allocation.” There’s little level in making an attempt to time the market.

Stability and Range Are Key

The form of the yield curve is one thing we want to concentrate on. However throughout an inversion, even the worst curve positioning yields a constructive return and isn’t as detrimental a part in mounted earnings investing as we have now been led to consider. As at all times, it’s necessary to be a balanced and diversified investor. And this time round, it gained’t be any totally different.

Editor’s Word: The unique model of this text appeared on the Unbiased Market Observer.