This publish and the subsequent talk about the distributional results of inflation and inflation stabilization by means of the lenses of a theoretical mannequin—a Heterogeneous Agent New Keynesian (HANK) mannequin. This mannequin combines the options of New Keynesian fashions which have been the workhorse for financial coverage evaluation for the reason that work of Woodford (2003) with inequality in wealth and revenue on the family stage following the seminal contribution of Kaplan, Moll, and Violante (2018). We discover that whereas inflation hurts everybody, it hurts the poor particularly. When the supply of inflation is a provide shock, preventing inflation aggressively hurts the poor much more, nonetheless, whereas the other is true for demand shocks, as mentioned within the companion publish.

The Distributional Penalties of Financial Coverage Shocks

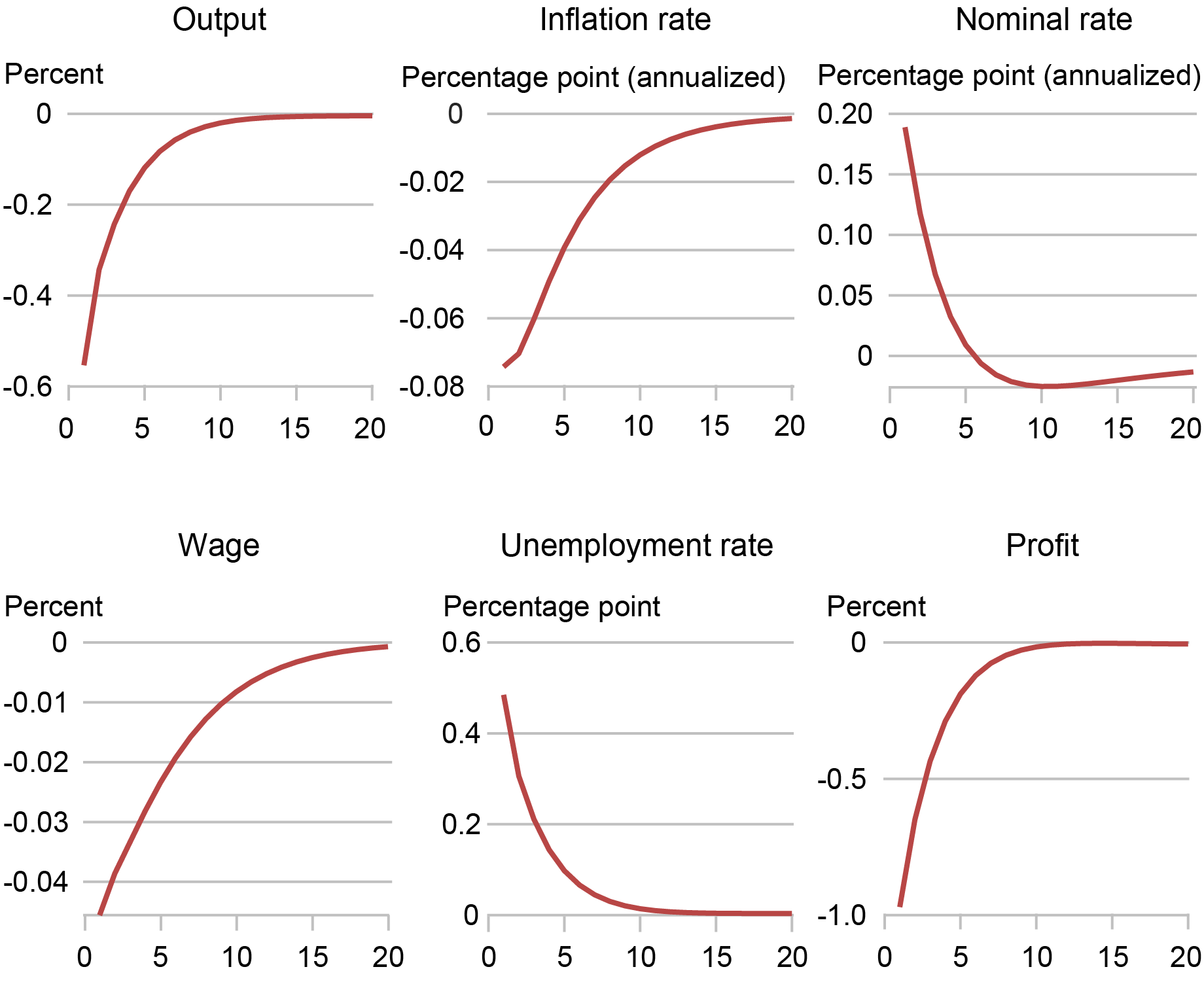

As a warm-up for the instinct of how the mannequin works, we begin by discussing the implications of contractionary financial coverage shocks, proven within the panel chart under. All through the publish, we use the HANK mannequin of Lee (2024), which now we have re-estimated utilizing knowledge up till 2023:Q3. The purpose of the illustration is to point out that the HANK mannequin options pretty normal responses for mixture variables: as nominal rates of interest enhance by about 20 foundation factors on influence, each output and inflation fall, though the response of inflation (8 foundation factors) is small relative to the decline in output (greater than 50 foundation factors) highlighting the truth that the mannequin’s value Phillips curve is somewhat flat. As financial exercise declines, the labor market worsens, with unemployment rising by 0.5 proportion level and actual wages declining barely.

Responses to Financial Coverage Shocks: Mixture Variables

Notes: Time is in quarters on the x-axis.

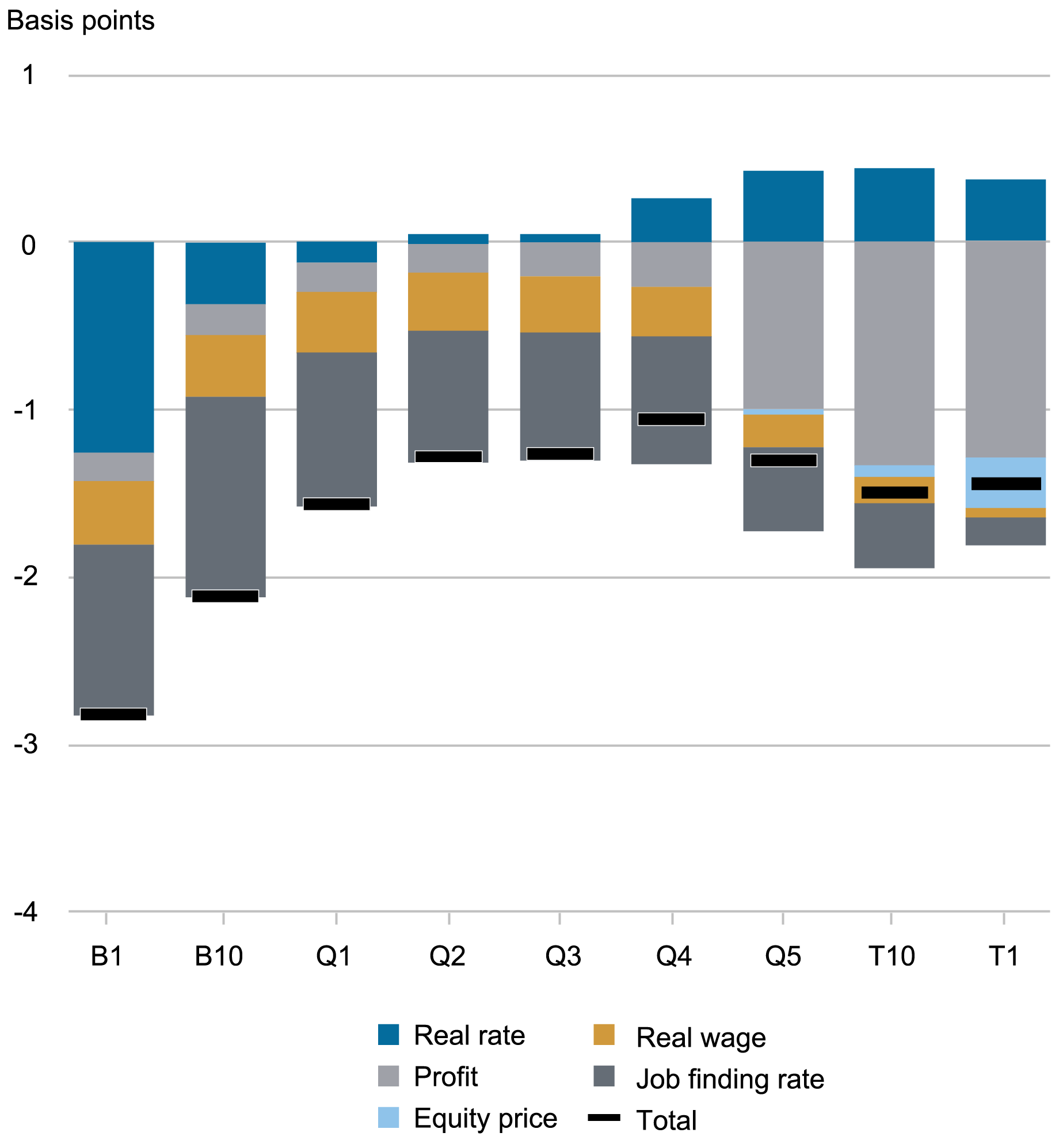

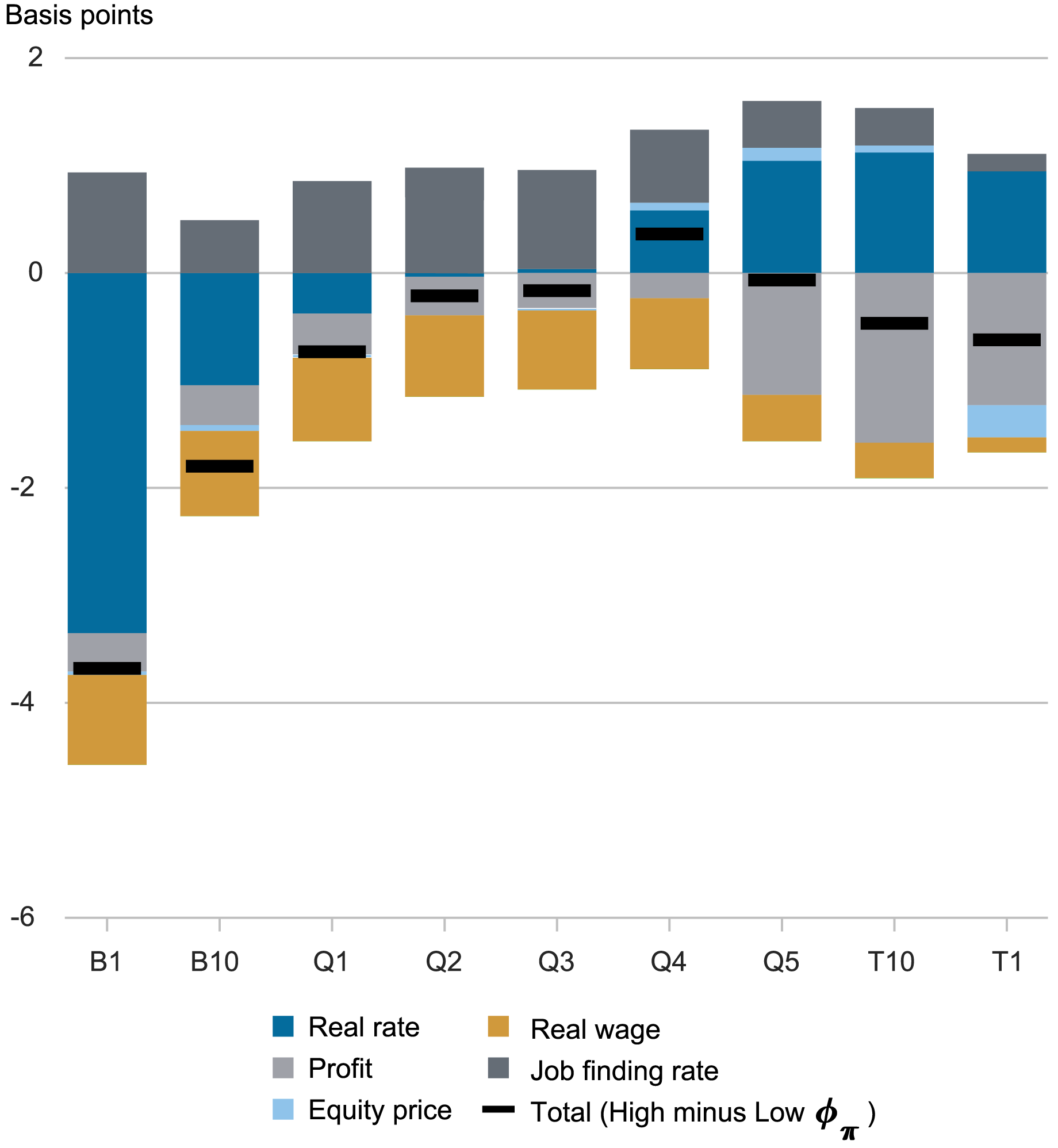

The following chart shows the distributional penalties of the coverage shock, proven for households within the backside (B1 and B10) and prime (T1 and T10) 1 p.c and 10 p.c of the wealth distribution, in addition to for the 5 quintiles (Q1 by means of Q5) of the wealth distribution. For every quantile of the wealth distribution, the impact of the coverage shock on the family’s welfare is measured in consumption equal phrases. That’s, every family belonging to a given quantile of the wealth distribution is requested how a lot consumption they might be keen to forgo endlessly in an effort to keep away from the implications of the shock. The result’s then averaged throughout all households belonging to that quantile. The black strains measure the whole impact, whereas the coloured bars decompose the whole into parts as a result of 1) the rise in the actual rate of interest, and the decline in 2) labor revenue/wages, 3) income, 4) the job discovering price, and 5) fairness costs (see Lee 2024 for particulars on how the decompositions are computed).

The Penalties of Financial Coverage Shocks Are Higher for the Poorest Households

Notes: B1 and B10 and T1 and T10 are the underside and prime 1 p.c and 10 p.c of the wealth distribution, respectively. Q1 by means of Q5 are the underside to prime 5 quintiles of the wealth distribution. The shocks are decomposed into element components.

The outcomes present that the poorest households undergo essentially the most from the rate of interest hike. It’s because the rise in charges will increase their monetary burden to the extent that they’re debtors. Furthermore, poor households’ major supply of revenue is labor, and the decline within the job discovering price and the related enhance in unemployment additionally harm them significantly. As we transfer up the wealth distribution, the impact of upper rates of interest switches signal: it’s near zero for households in the midst of the distribution, as they’ve little wealth, and turns into optimistic for wealthy households. Nevertheless, wealthy households additionally derive a considerable fraction of their revenue from income, and therefore they’re harm by the autumn in income. Actually, the general influence of the shock is (inverted) U-shaped, with poor and really wealthy households being affected essentially the most, though the underside 1 p.c of households are virtually twice as badly affected, in consumption equal phrases, as the highest 1 p.c.

This U-shaped sample is broadly per the rising empirical literature on the distributional impact of financial coverage shocks, which usually finds that expansionary shocks disproportionally profit low-income households, by rising their employment, and the very wealthy, by rising capital revenue, and vice versa for contractionary shocks. Utilizing Swedish knowledge, Amberg et al. (2022) discover that expansionary shocks enhance revenue essentially the most for households within the highest and lowest revenue deciles; that is pushed by labor revenue for the bottom decile, and capital revenue for the best. Utilizing Norwegian administrative knowledge, Holm et al. (2021) discover that contractionary financial coverage shocks lower consumption essentially the most, at two- by means of five-year horizons, for households within the highest and lowest ranges of the liquid wealth distribution.

The Distributional Penalties of Inflationary Value Push Shocks

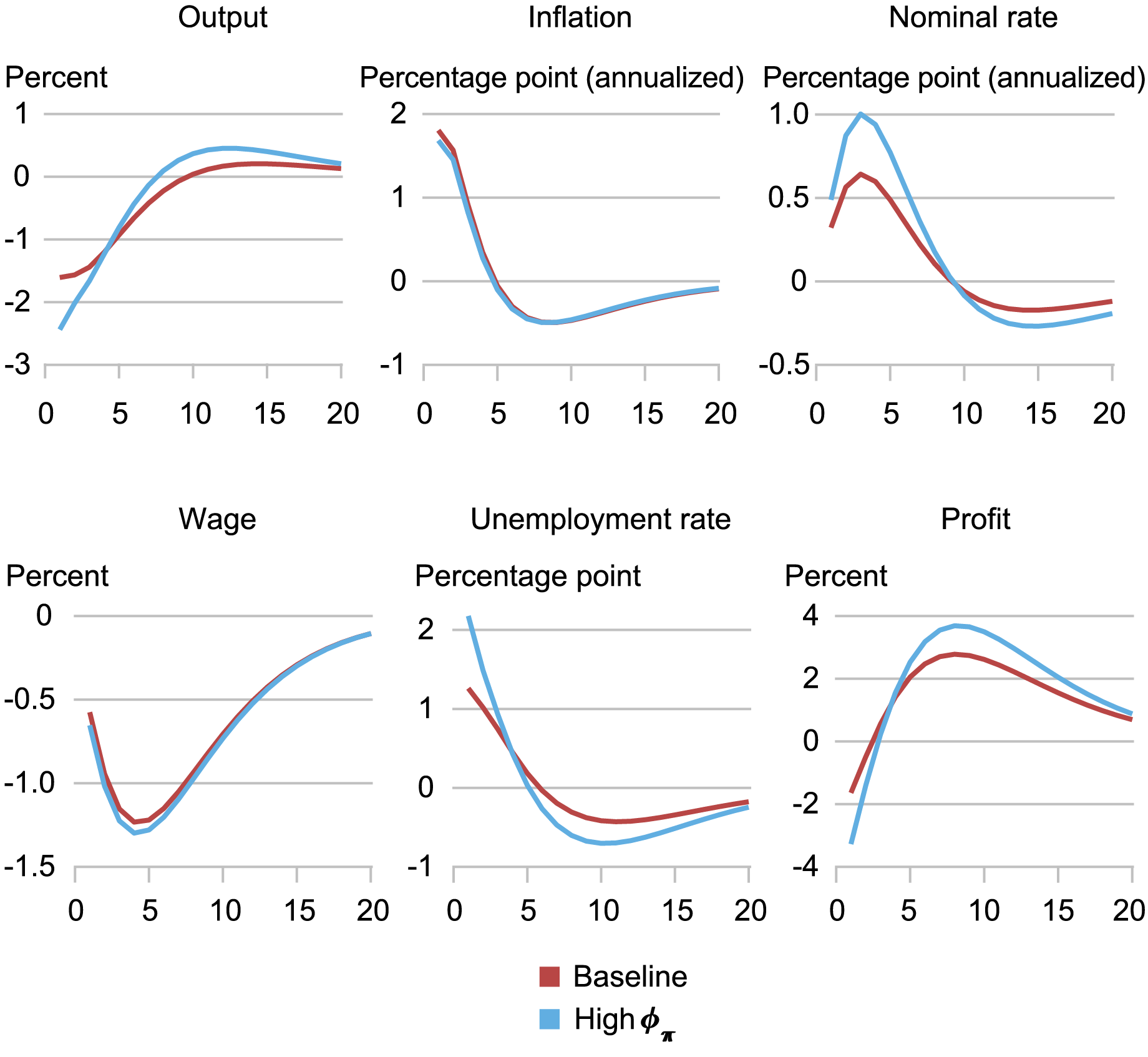

The chart under exhibits the responses of mixture variables to a one normal deviation inflationary price push shock. As normal within the New Keynesian literature, we mannequin this shock as a rise in companies’ desired markup originating from a decline within the substitutability throughout merchandise. This fall in competitiveness results in costs rising. The pink strains present the response below the estimated coverage response perform, and the blue strains present the responses obtained below an alternate response perform that responds extra aggressively to inflation.

Responses to Value Push Shocks: Mixture Variables

Notes: Time is in quarters on the x-axis. The baseline inflation coefficient is 1.8. It rises to 3.0 within the excessive φπ situation.

Specializing in the pink strains first, we see that the shock generates a large response of inflation, which rises by virtually 2 proportion factors, a 1.5 p.c decline in output, and a deterioration within the labor market, with unemployment rising multiple proportion level and actual wages falling by greater than 1 p.c after one yr and remaining depressed all through the forecast horizon. Whereas unemployment rises on influence and for the primary yr after the shock, it falls under regular state afterwards as a result of actual wages are low and companies due to this fact discover it engaging to publish vacancies. Income decline on influence despite the upper desired markup due to the autumn in financial exercise. Income rebound quickly after, nonetheless, as a result of labor prices stay low. As we are going to see, the trail of income is vital for understanding the distributional influence of price push shocks. The blue strains present the influence below a extra aggressive response to inflation: particularly, the coefficient on inflation φπ within the Taylor-like response perform is raised from its estimated worth of 1.8 to 3.0. When coverage responds extra aggressively to inflation, inflation rises much less following the fee push shock, however the variations are small as a result of very flat Phillips curve. The output and labor market prices of containing inflation are conversely massive, with output falling by virtually 1 p.c greater than below the baseline rule and unemployment additionally rising by about 1 proportion level extra.

The following chart exhibits the distributional penalties of price push shocks. The message from the illustration is evident: most households aside from the very wealthy lose considerably following a optimistic price push shock. This loss is because of the truth that actual wages fall considerably within the aftermath of the shock and this hurts households, particularly if they’re hand-to-mouth. Arguably, this what Fed Chair Jerome Powell has been referring to in his press conferences over the previous couple of years, resembling in June 2024, when stating that “excessive inflation imposes important hardship because it erodes buying energy, particularly for these least capable of meet the upper prices of necessities….” Very wealthy individuals acquire from the shock, nonetheless. It’s because they accrue all the additional revenue that the low price of labor implies after the primary few quarters.

The Distributional Penalties of Value Push Shocks

Notes: B1 and B10 and T1 and T10 are the underside and prime 1 p.c and 10 p.c of the wealth distribution, respectively. Q1 by means of Q5 are the underside to prime 5 quintiles of the wealth distribution. The shocks are decomposed into element components.

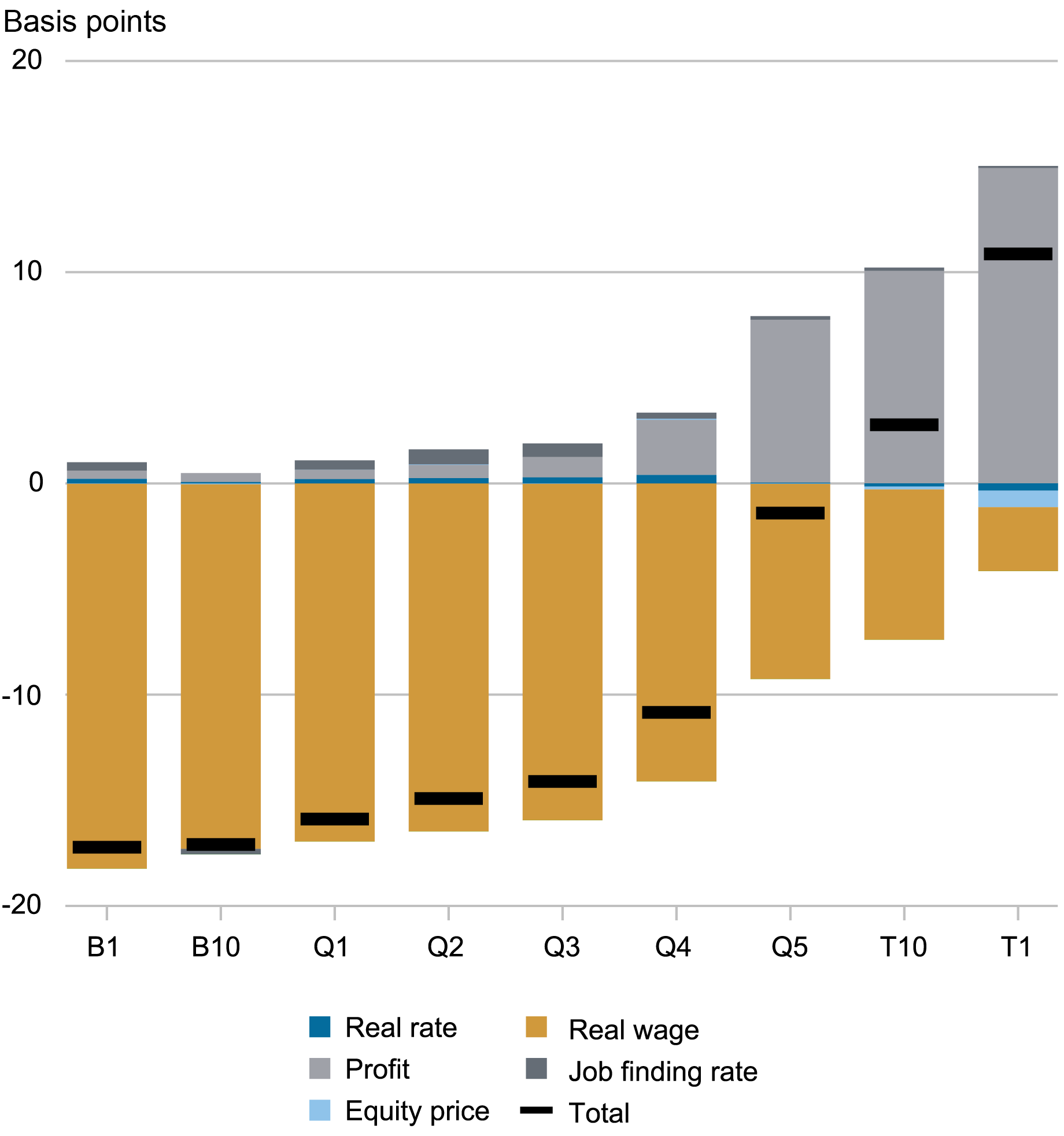

The chart under exhibits the distributional penalties of a stronger coverage response to price push shocks, that’s, the distinction between the distributional penalties of those shocks (computed as above) below φπ equal to three and φπ equal to 1.8. The lesson from this illustration is that if poor households are these which can be most negatively affected by the fee push shock, they’re much more negatively affected if the central financial institution tries to combat inflation extra aggressively. It’s because the extra aggressive coverage implies greater rates of interest, which hurts households which can be in debt. Households with wealth conversely profit from the rise in actual charges. On the entire, these households will not be a lot affected by the extra aggressive coverage as their greater monetary revenue is offset by decrease labor revenue. Nonetheless, very wealthy households are additionally harm by the extra aggressive response to inflation as this reduces income.

The Distributional Penalties of a Stronger Coverage Response to Value Push Shocks

Notes: B1 and B10 and T1 and T10 are the underside and prime 1 p.c and 10 p.c of the wealth distribution, respectively. Q1 by means of Q5 are the underside to prime 5 quintiles of the wealth distribution. The shocks are decomposed into element components.

Summing Up

The distributional results of inflation, when the supply of inflation is a value push shock, are very uneven throughout the wealth distribution: the poor lose whereas the very wealthy profit. The supply of those losses and positive factors is the decline in actual wages which hurts hand-to-mouth households particularly, because it interprets virtually one to 1 right into a decline in consumption. On the similar time, the falling labor prices translate into will increase in company income and profit the very wealthy who obtain these income.

But whereas inflation hurts the poor essentially the most when seen by means of a distributional lens, disinflationary insurance policies harm them much more. That’s, an aggressive coverage response to a price push shock results in an additional deterioration within the labor market along with greater rates of interest, which make debt costlier. If the Phillips curve is flat, as it’s on this estimated mannequin, the positive factors in taming inflation are restricted and don’t reverse these disadvantages for households on the backside of the wealth distribution.

Marco Del Negro is an financial analysis advisor in Macroeconomic and Financial Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Keshav Dogra is a senior economist and financial analysis advisor in Macroeconomic and Financial Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Pranay Gundam is a analysis analyst within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Donggyu Lee is a analysis economist in Macroeconomic and Financial Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Brian Pacula is a analysis analyst within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

cite this publish:

Marco Del Negro, Keshav Dogra, Pranay Gundam, Donggyu Lee, and Brian Pacula, “On the Distributional Results of Inflation and Inflation Stabilization,” Federal Reserve Financial institution of New York Liberty Road Economics, July 2, 2024, https://libertystreeteconomics.newyorkfed.org/2024/07/on-the-distributional-effects-of-inflation-and-inflation-stabilization/.

Disclaimer

The views expressed on this publish are these of the creator(s) and don’t essentially replicate the place of the Federal Reserve Financial institution of New York or the Federal Reserve System. Any errors or omissions are the duty of the creator(s).