Because the late Nineteen Nineties, the U.S. Treasury has issued debt in two essential varieties: nominal bonds, which give fixed-cash scheduled funds, and Treasury Inflation Protected Securities—or TIPS—which give the holder with inflation-protected funds that rise with U.S. inflation. On the coronary heart of their relative valuation lie market members’ expectations of future inflation, an object of curiosity for teachers, policymakers, and traders alike. After briefly reviewing the theoretical and empirical hyperlinks between TIPS and Treasury yields, this put up, primarily based on a current analysis paper, explores whether or not market perceptions of U.S. sovereign credit score threat may help clarify the relative valuation of those monetary devices.

An Obvious Arbitrage on the Treasury Market

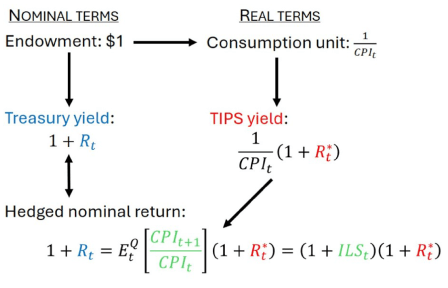

Monetary intermediaries enter lengthy and quick positions on each nominal and inflation-protected Treasuries, which they sometimes hedge with inflation-linked swaps (ILS). No-arbitrage idea implies that it needs to be equal to purchase a TIPS or to assemble an artificial place by shopping for a nominal Treasury invoice and an inflation swap, such that the fastened cashflow is changed by an inflation-adjusted one. Subsequently, in precept, the ILS price needs to be precisely equal to the so-called breakeven inflation price (BEI)—the unfold between the yield of a nominal Treasury and that of a TIPS of similar maturity (see the instance described within the determine beneath).

The Inflation-Linked Swap Price Is Linked to the Nominal and TIPS Price by No-Arbitrage

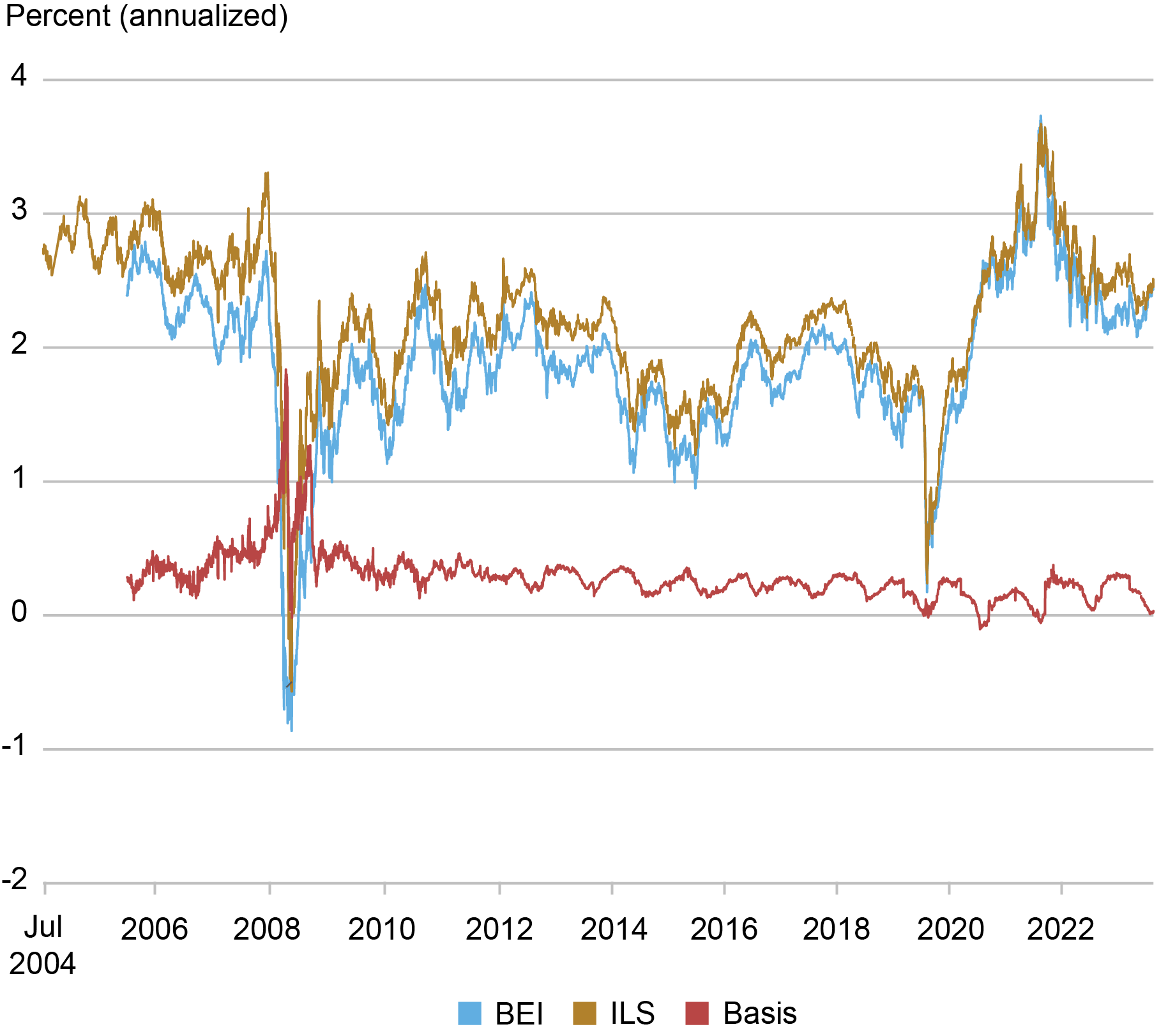

In observe, the ILS has nearly at all times been larger than the BEI, as proven within the chart beneath. The ensuing inflation foundation has averaged roughly 30 foundation factors since 2004, an anomaly that has been referred to as the TIPS-Treasury bond valuation puzzle.

5-12 months Inflation Swap Price Persistently Exceeds 5-12 months Breakeven Inflation Price

Supply: Bloomberg L.P.

Notes: The blue line reveals the five-year maturity breakeven inflation price (BEI), outlined because the unfold between a five-year nominal Treasury yield and a five-year TIPS yield. The gold line is the speed of a five-year zero-coupon inflation-linked swap (ILS). The purple line is the premise, i.e., the unfold between the ILS and the BEI.

Current explanations of the inflation foundation have targeted on limits to arbitrage, and on options and frictions of the TIPS market, whereby the TIPS’ relative cheapness is defined by its poorer liquidity. As an alternative, we focus beneath on the potential of sovereign credit score threat to differentially have an effect on Treasury yields and ILS- and TIPS-based inflation compensation.

There Are No Excellent Measures of Sovereign Credit score Threat

Sovereign credit score threat may be broadly outlined because the likelihood of observing a credit score occasion, which, in keeping with the Worldwide Swaps and Derivatives Affiliation, is every time a authorities both (1) fails to repay, (2) repudiates or imposes a moratorium, or (3) restructures any of its borrowed cash of any quantity.

To evaluate the publicity of nominal Treasuries, TIPS, and ILS to sovereign credit score threat, we have to discover an indicator of the latter that strikes sufficiently over time, thereby excluding credit score rankings, which change occasionally. Since our estimates depend on linear regressions, it’s ample that the indicator correlates with sovereign credit score threat, nevertheless it doesn’t should be excellent.

Our analysis depends on two proxies which have been used extensively within the educational literature. First, Reinhart and Rogoff (2010) counsel that the ratio of a rustic’s excellent debt to GDP is a non-market measure of its fiscal well being. Second, researchers have used the premium paid on U.S. sovereign credit score default swaps (CDS). These are insurance coverage merchandise that give purchasers compensation for bond losses that happen on account of a U.S. credit score occasion in change for a hard and fast premium paid each quarter. Just lately, nevertheless, the reliability of CDS premia as a sovereign credit score threat indicator has been questioned: The amount of excellent contracts has decreased sharply during the last decade—as demonstrated by Boyarchenko and Shachar (2020)—and the obtainable information displays quoted CDS spreads slightly than precise traded spreads.

We discover that each proxies are considerably and positively correlated with the inflation foundation, above and past the a part of the unfold that’s defined by TIPS liquidity and limits to arbitrage. To raised perceive why the unfold is widening, we carry out regressions on the person elements of the unfold—i.e., the ILS, the nominal Treasury yield, and the TIPS yield—individually. Surprisingly, each the ILS and the nominal Treasury yield correlate negatively with the credit score threat proxies, whereas the TIPS correlates positively, if something.

Our empirical estimates are laborious to reconcile with financial instinct. The nominal Treasury yield could be anticipated to have a constructive correlation with sovereign credit score threat since a U.S. credit score occasion would seemingly result in a loss for bondholders. In the identical vein, since ILS are collateralized, we’d anticipate their publicity to credit score threat to be minimal slightly than damaging.

A Concept of Differential Publicity by means of Inflation Dynamics

What forces would possibly clarify our outcomes? We first rule out the chance that the market believes in a selective reimbursement of nominal Treasuries versus TIPS, the place the latter would undergo extra by means of, for instance, the cancellation of inflation indexation. Intuitively, such a channel can not rationalize the damaging obvious publicity of nominal Treasuries and ILS to credit score occasions.

Alternatively, the existence of an interconnection between inflation and the perceived probability of sovereign credit score occasions can clarify our empirical patterns. We establish two necessary relationships. First, the ILS damaging correlation with sovereign credit score threat may be rationalized if anticipated inflation decreases when market views of sovereign creditworthiness deteriorate. This was notably the case following the 2008 monetary disaster within the U.S., when a drop in realized inflation and inflation expectations coincided with the next sovereign credit score threat. This channel impacts each the ILS and the nominal Treasury in the identical manner since they each require a compensation for inflation.

Second, the bigger damaging publicity of the nominal Treasury yield turns into believable if we assume that realized inflation would bounce upon the set off of a credit score occasion. Whereas hyperinflation within the wake of a default isn’t unusual in rising international locations, this assumption is extremely speculative within the case of the U.S. since no such episode has arisen within the U.S. in nearly 100 years.

This second channel provides an extra damaging publicity to the nominal credit score unfold. To know, think about {that a} nation’s worth index jumps after a credit score occasion has been noticed. The true worth of all nominal securities excellent, no matter their defaultable nature, declines considerably. In different phrases, any promised money fee buys much less of a consumption basket. Consequently, the nominal credit score unfold decreases because the probability of a sovereign credit score occasion will increase.

In distinction, TIPS are nearly unaffected by inflation dynamics on condition that their money flows are in actual phrases. Nevertheless, a credit score occasion may result in investor losses, as with nominal Treasuries, due to potential failure by the federal government to repay totally its promised liabilities. TIPS publicity to credit score threat is thus, if something, constructive.

Intricate Joint Dynamics of Inflation and Sovereign Credit score Threat Are Supported Empirically

We assess the empirical plausibility of our theoretical channels by estimating an asset pricing mannequin geared toward collectively becoming the time period construction of ILS charges, nominal Treasury and TIPS yields, and CDS spreads. Our framework encompasses the potential for sovereign credit score occasions triggering CDS funds, in addition to free correlations between anticipated inflation and sovereign credit score threat and between realized inflation and credit score occasions. We additionally embed liquidity drivers of TIPS and CDS to seize various attainable explanations of the inflation foundation.

Our estimates present help for each interactions between inflation and credit score occasion dynamics. We discover that, on common, the inflation response to a credit score occasion could be the biggest driver of the inflation foundation. Our framework additionally permits for a time sequence decomposition of the significance of sovereign credit score threat in explaining the inflation foundation. We present that credit score threat issues develop with a lag after 2008, such that the spike noticed within the chart above is generally on account of poor TIPS liquidity, consistent with earlier findings. Publish-2009 dynamics are, nevertheless, dominated by sovereign credit score threat issues, consistent with our idea.

Guillaume Roussellet is a analysis economist in Macrofinance Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

The best way to cite this put up:

Guillaume Roussellet, “Exploring the TIPS‑Treasury Valuation Puzzle,” Federal Reserve Financial institution of New York Liberty Avenue Economics, July 1, 2024, https://libertystreeteconomics.newyorkfed.org/2024/07/exploring-the-tips-treasury-valuation-puzzle/.

Disclaimer

The views expressed on this put up are these of the writer(s) and don’t essentially mirror the place of the Federal Reserve Financial institution of New York or the Federal Reserve System. Any errors or omissions are the duty of the writer(s).