Yves right here. This submit addresses the query of what all the European political realignments-in-progress would possibly imply for fiscal coverage, as within the degree of deficit spending, and the composition of that spending. There’s been plenty of handwaving about populists, for example, but oddly much less dialogue of what their finances priorities may be This submit considers numerous coverage priorities and the way curiosity funds will put pressures on what may be completed. Surprisingly, or maybe positively, I don’t see elevated army expenditures being handled as a big potential dedication.

By Carlo D’Ippoliti, Professor of Economics, Sapienza College of Rome and Editor, PSL Quarterly Evaluation. Initially revealed at the Institute for New Financial Pondering web site

Essentially the most essential difficulty in European coverage, and one on which no large occasion campaigned and no necessary public dialogue occurred, was the fiscal coverage stance for the following few years.

Many observers assume that the snap elections in France are crucial consequence of the latest European Parliament elections.[1] This conclusion is drawn from the projections that an alliance of the Christian-democrat conservatives (European Individuals’s Social gathering, EPP), the free-market liberals (Renew), and the Socialists and Democrats (SD) would amass 400 seats in a 720-strong European Parliament, having fun with a majority of 45 representatives (MEPs). Apparently, regardless of the massive features for the far-right events,[2] the identical events which have ruled Europe over the past many years will proceed to take action.

On the nationwide degree, the ‘black wave’ has delivered a crushing defeat for the events of Germany’s Chancellor Scholz and France’s President Macron. The latter instantly known as for nationwide elections, which in all chance will result in a collapse of his centrist political motion. This may certainly be a serious political occasion, however a troublesome ‘cohabitation’ between a centrist president and a but unclear majority of various colour(s) will likelihood lead extra to immobility than to dramatic coverage shifts. And because the Italian instance reveals, even a radical occasion as soon as in energy in a big EU nation faces formidable boundaries and checks to Hungary-style authoritarian developments. In the meantime, in Germany, Scholz has refused to topic himself to a confidence vote in parliament, and although his governing alliance has diametrically totally different views on the finances for the brand new 12 months (and the following ones), all its events misplaced large on the EU elections and should not wanting ahead to contemporary ones.

If each France’s and Germany’s (after Italy’s) governments ought to come to be led by far-right events, it may have related penalties. However we’re removed from there but, and within the meantime, there’s a case to be made that many observers are in all probability obsessing an excessive amount of concerning the nationwide penalties of the European vote and never sufficient concerning the EU-wide penalties.

A majority of 45 MEPs may probably be sufficient to (re)elect the brand new European Fee, the chief department of the EU, however it will not be enough to move new acts of consequence, as a result of MEPs are inclined to solid their votes in keeping with nationwide curiosity as a lot as political affiliation. Regardless of widespread manifestos and election platforms, teams within the European Parliament are much less cohesive and influential than political events on the nationwide degree, and a situation by which the three principal events must craft variable alliances in every vote, relying on the difficulty at hand, is just not unlikely. That’s, if they don’t select (and handle) to coopt a fourth occasion within the EU governing coalition within the first place.

Observers are studying the tea leaves of the far-right events’ political-economic preferences, in search of clues on what might be their place in case a few of their votes ought to be wanted in Parliament. However it’s extra helpful to know the factors of inner division inside and between the mainstream events, and the place they might discover assist from the opposite events on the primary points. That is probably a much bigger supply of uncertainty about Europe’s future insurance policies than the extravagance of racist and nationalist events that share little when it comes to European coverage and are even divided into totally different teams within the EU Parliament.[3]

Through the European parliamentary marketing campaign, nationwide themes took heart stage as ordinary. However this time, quite a lot of European subjects got here to prominence too: not less than migration and refugees, and the inexperienced transition. On these subjects, the massive European political households distributed themselves on a typical left-right dimension. For instance on local weather change, the far proper advocated that there have to be no prices for households and companies (ignoring local weather change deniers right here); the conservatives proposed that the inexperienced transition ought to respect the timing and necessities of European industries (blink blink); the social democrats argued for beefing up the Inexperienced New Deal, and the Greens signaled that they’re able to reelect Ursula von der Leyen as president of the Fee if she doesn’t backpedal on Europe’s local weather commitments. The inexperienced transition is so divisive that the three mainstream events will doubtless resolve to not ask for the general public assist of both the greens or the far proper and can attempt to go alone probably with a ‘little assist’ like 5 years in the past (the election of the Fee president within the EU Parliament occurs by secret poll).[4] It will likely be informative, on this sense, to see who the European Council appoints as candidates for the highest jobs, and the way nicely they’ll do of their affirmation hearings.

Nonetheless, probably probably the most essential difficulty when it comes to European coverage, and one on which no large occasion actually campaigned and no necessary public dialogue occurred, was the fiscal coverage stance for the following few years.[5] This matter is essential for Europe’s skill to protect the welfare state, implement the inexperienced transition, and meet up with the opposite principal financial areas when it comes to innovation, employment, and competitiveness. Suffice to quote one quantity: in keeping with estimates, the EU member states may need to embark on 4 years of fiscal consolidation for as much as 1% of GDP yearly, or for seven years for as much as 0.6% yearly (relying on the nation).

This in a excessive rate of interest setting, by which simply rolling over debt will likely be extra expensive and difficult than up to now decade. Clearly, if that is the way in which the fiscal guidelines will likely be enforced, there will likely be little area for industrial coverage, the inexperienced transition, or the administration of migration flows. And there is a matter of timing too: on July 16 the Financial and Monetary Affairs Council (Ecofin, the board of finance ministers of the EU) will debate which international locations don’t conform to the brand new fiscal guidelines and ought to be put beneath an Extreme Deficit Process (learn: extra austerity);[6] in the identical week, the European Parliament is predicted to vote within the new Fee.

However fiscal coverage can be attention-grabbing as a result of the primary political households are extra internally divided and never simply situated alongside a left-right line. For the one member states, the path of motion was foreshadowed by final winter’s reform of the Stability and Development Pact (that too moved by with out important debate), which reintroduces the specter of austerity after the COVID crisis-induced break for public funds. This motion might be gradual or quick, and the way a lot belt-tightening will likely be required is on the desk.[7]

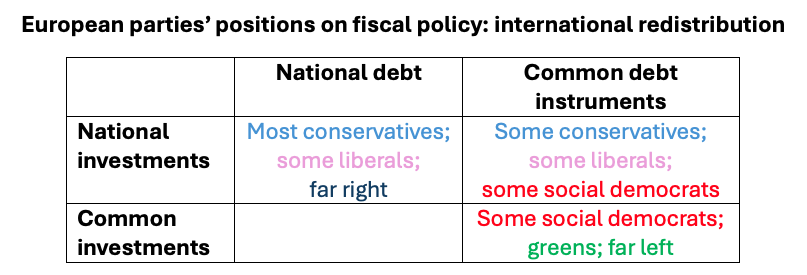

Some flexibility exists on the EU degree, the place the 2020 joint response to the COVID-crisis when it comes to collective debt issuance for the sake of investments and restoration (the “Subsequent Technology EU”) broke with a beforehand untouchable taboo. At present there’s a clear want for investments – from vitality to protection and Ukraine, to innovation and healthcare, to not communicate of the distant however not unattainable occasion of EU enlargement to cash-needy international locations reminiscent of Ukraine and Moldova. And there’s a rising understanding that sooner or later joint debt and expenditure devices will likely be ineluctable. This too, nevertheless, comes with totally different proposals: from new EU-level taxes to the repurposing of legacy devices such because the European Stability Mechanism, created in the course of the earlier euro disaster, or the Restoration and Resilience Facility and the opposite funds created in the course of the COVID-crisis, which have substantial dry powder; to the issuance of latest collective debt devices.

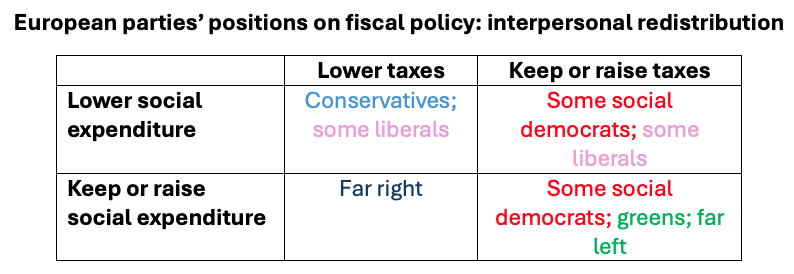

In Europe, one should at all times take into account each redistribution amongst people and amongst international locations. Regarding interpersonal redistribution, allow us to take into account two dimensions: events’ positions on taxes (and social contributions, and different revenues generally, each nationwide and pan-European), and on expenditures, with a concentrate on the welfare state.[8]One can then find the primary European households as within the desk beneath.

The conservatives – the most important group in Parliament – will doubtless attempt to attraction to the liberals by proposing to not improve any spending program, and to woo the far proper (and liberals) by opposing new taxes. Why this type of settlement ought to attraction in any respect to the social democrats is an effective query, however sadly many will embrace it, not simply settle for it. Within the earlier legislature, social democrats and the greens exacted a “Inexperienced New Deal” in alternate of this form of settlement, making an attempt to make use of (inadequate) EU assets to spice up employment creation in new inexperienced industries. However the numbers in Parliament (and within the EU Council) had been totally different then, and anyway, they had been solely profitable after COVID produced the worst disaster in a century.

The positions set out within the desk principally mirror these on the general fiscal stance, as a result of there’s a extensive, although not unanimous, settlement that taxation may be very excessive in Europe, and the one concrete proposals to extend public revenues concern quantitatively small gadgets reminiscent of worldwide digital and monetary transactions taxes, minimal taxes on multinationals, carbon taxes or import duties, and in some international locations, property or inheritance taxes. Whereas essential components of fairness and equity, all these are unlikely to lift enough income to fulfill the expenditure necessities of the day. Regarding expenditures, there’s even much less flexibility: debt service goes to extend; protection spending must improve whatever the final result of the US elections; and when Subsequent Technology EU elapses in 2026, nationwide funds must not less than partly compensate for these vanishing EU investments. There’ll hardly be scraps for help to Ukraine (aside from what may be squeezed from frozen Russian belongings) and investments for the inexperienced transition or innovation.

We thus have two fronts: on the primary diagonal, between the conservatives and liberals for a small authorities, and the left and greens for large authorities; and on the antidiagonal, between the so-called populists for larger deficits and liberals and (alas) some social democrats for decrease deficits.

The primary query will probably be selected an issue-by-issue foundation, generally because of a convergence of the left and the far proper in an try to protect social expenditure and shield the welfare state. However ranges of public deficits and money owed are a macroeconomic difficulty and have to be determined as soon as, not less than for an entire 12 months. Right here there’s much less scope for improvisation and suppleness, besides in transferring between the nationwide and the EU ranges.

As proven within the desk beneath, we are able to anticipate some fiscal austerity on the nationwide degree and probably some fiscal stimulus (in all probability not too quickly nor an excessive amount of) on the EU degree – however in all probability not earlier than plenty of social and financial ache and a great deal of soul-searching, EU-style. On the EU-level finances, the standard political households are much more divided alongside ideological and nationwide traces than on most different subjects.

The conservatives historically oppose widespread debt due to worry of ethical hazard, however over time a myriad of proposals have been put ahead, of joint bonds that don’t essentially indicate risk-sharing; and a few conservatives are beginning to settle for the concept, e.g. if debt may be bought to their voters as an funding in safety and protection. The liberals are historically much more against debt (public debt, that’s), however with Macron steering in the other way within the identify of Europe, it must be seen what occurs now that he’s significantly weakened.

The far proper, as talked about, has a menu of latest expenditures and decrease taxes and will subsequently favor any easing of the financing constraint for member states.[9] Nonetheless, they largely find yourself rejecting widespread debt, resulting from their nationalist and anti-European stance. Lastly, Eurobonds and customary investments are the spine of left financial platforms in Europe, however not all social democrats fortunately soar on board. So until (or till) a brand new disaster hits, regardless of all of the speak about existential disaster and a “mortal” European Union, the almost definitely situation stays extra of the identical: that’s, tight controls on nationwide funds, and delicate and inadequate growth on the EU degree. Amongst different issues, this means that the EU continues not less than for some time to not compete significantly with the USA and China, not investing in industrial coverage or the inexperienced transition.

On this entrance, the far proper might be a principal threat issue, however in each instructions. A robust affirmation of Le Pen in France and a good cope with Italy’s Meloni may shift a number of votes in Parliament in favor of widespread debt issuance, however a authorities disaster in Germany may result in a brand new authorities much more to the suitable and extra against Eurobonds than the present one. Finally, since most issues on the street to Eurobonds have emerged within the EU Council, the place nationwide pursuits are extra strongly defended than in Parliament, and because the French elections won’t doubtless shift Macron’s place on this level within the path of extra opposition to the concept, it nonetheless appears that the mainstream events’ positions stay the most important issue to contemplate right here.

In conclusion, it’s essential to know what far proper events and particularly their voters need, because the latest elections look very very similar to a vote for a change and one thing radically totally different from the established order. However to foretell the course of coverage, it’s extra helpful to take a look at the realignments inside and between the mainstream events.

Notes

[1] This conclusion is probably impressed by a typical undervaluation of the scope, attain, and significance of the European Union, in addition to of the proportion of latest laws and norms that its member states enact immediately as a consequence of, or implementing, EU guidelines. The Union is successfully on a gradual however regular path towards changing into a fully-fledged federal entity, and after the euro and Brexit, this path might be irreversible.

[2] Cut up into two totally different teams: the euro-skeptic Conservatives and Reformists, ECR, led by Italy’s Meloni, and the super-euro-skeptic Id and Democracy, ID, dominated by France’s Le Pen.

[3] Certainly, the concentrate on the far proper is main each markets and policymakers to overreact. The Financial institution of France governor’s phrases, “it is going to be necessary that, regardless of the final result of the vote, France can rapidly make clear its financial technique and specifically its budgetary technique” are very ambiguous in a democracy. However they had been clearly prompted by the market’s nervous response to the announcement of snap elections. By the way, markets’ overreaction is a characteristic of the European economic system, which by design lacks an efficient central authorities and likes to tie the palms of its central financial institution as a lot as doable.

[4] Within the European Council, which proposes the President for affirmation by Parliament, the greens and much left should not represented, whereas the far proper has one vote or extra, relying on how one defines it. Even in case of a far-right win in France, Mr. Macron as President of the Republic would nonetheless symbolize France inside the Council.

[5] Figuring out that the European Central Financial institution will then take the other stance: persevering with to cut back rates of interest if governments minimize their deficits, and holding and even elevating them in the event that they don’t.

[6] The Fee simply established that seven international locations (Belgium, France, Italy, Hungary, Malta, Poland, and Slovakia) have an extreme deficit. The Ecofin will vote on which of those ought to be topic to the extreme deficit process. Amongst different issues, a few of the operational standards of the brand new fiscal guidelines haven’t but been finalized (e.g. the trail of “web expenditure”) offering but some extra flexibility on this transitory part.

[7] The brand new guidelines enable for a minimal diploma of flexibility – although much less so for probably the most indebted international locations, which occur to be massive Eurozone international locations with economies which might be extra pushed by inner demand than the others.

[8] The welfare state, that’s, for EU residents. The welfare chauvinism of far proper and red-brown events that suggest to chop entitlements for immigrants is a severe matter of id and racism however of little consequence for the general public purse.

[9] Italy’s and France’s far proper much more so, given the burden on their international locations’ nationwide public funds.