THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

In terms of investing, many people resort to conventional investments like shares and bonds.

However there are various different choices on the market to spend money on.

On this put up, I stroll you thru 25 unusual funding concepts that you just won’t have considered.

All of them supply their very own vary of potential returns and related dangers, however are nice for particular person buyers in search of alternate options to the inventory market.

25 Unusual Funding Concepts

#1. Comedian Books

Comedian books are one of the crucial distinctive funding concepts folks don’t consider.

This doesn’t imply that it is best to run out and purchase a bunch of comedian books and anticipate them to extend in worth over time.

But when you will discover older comics, say from 1985 or older, which might be in nice situation, chances are high you may make cash.

You’ll be able to nonetheless purchase newer comedian books as effectively, it’s simply tougher to earn a return on these since they’re mass produced.

If restricted editions or a big problem is launched, it might make sense to purchase it and maintain onto it.

Common Return To Anticipate

That is subjective as a result of all of it comes right down to what somebody is keen to pay for a problem.

With that stated, you’ll be able to simply see returns of 10% or extra.

#2. Toys

Identical to comedian books, toys generally is a nice funding.

The secret is to seek out uncommon or classic gadgets which have been discontinued and are not being manufactured.

These have a tendency to carry their worth higher than newer gadgets and might even improve in worth over time.

For instance, the unique Star Wars figures are value some huge cash immediately.

Make sure to do your analysis on what toys are at present in demand and could possibly be value investing in.

The simplest method to do that is to leap on eBay and seek for varied toys.

Lastly, don’t low cost present toys both.

You could find restricted version toys immediately and maintain on to them for just a few years and promote for a revenue.

Or you’ll be able to promote sooner when the market is scorching.

Take for instance Lego’s.

There’s a big demand of all types of Lego’s, so you should buy these units and resell them shortly for a revenue.

Alternatively, there are fads with toys.

Years in the past, Beanie Infants had been a scorching toy and folks had been making loopy quantities of cash promoting them on-line.

However now there’s little or no demand and the costs got here cratering again down.

Common Return To Anticipate

Once more, that is subjective relying on the toy that you just spend money on.

Nonetheless, if you happen to discover a uncommon or classic toy that’s not being manufactured, it might simply have a return of 20% or extra.

#3. Sports activities Groups

Whereas it’s a dream of many to personal knowledgeable sports activities group, the truth is it’s not doable.

With groups being valued within the billions of {dollars}, even proudly owning a 1% minority stake is off limits.

However this doesn’t imply you’ll be able to’t make your dream a actuality.

You’ll be able to spend money on minor league groups as an alternative.

Baseball and hockey groups are the place there’s probably the most worth.

Nonetheless, there’s plenty of threat as effectively.

It’s because many of those groups battle to usher in followers and want to make use of debt to finance operations.

Common Return To Anticipate

On an annual foundation, you’ll be able to anticipate little to no return, round 1%.

However once you promote, that is the place you’ll be able to earn 20% or extra in your cash.

And whilst you wait to promote, you will have entry to different perks.

You’ll be able to attend the video games without spending a dime, have limitless entry to the stadium, even get to know the gamers on a private stage.

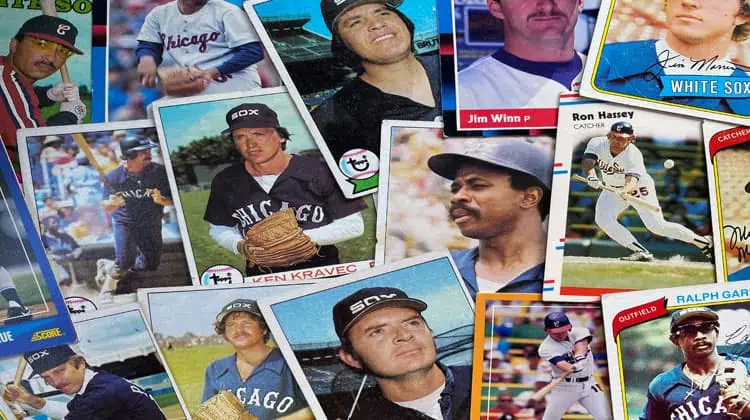

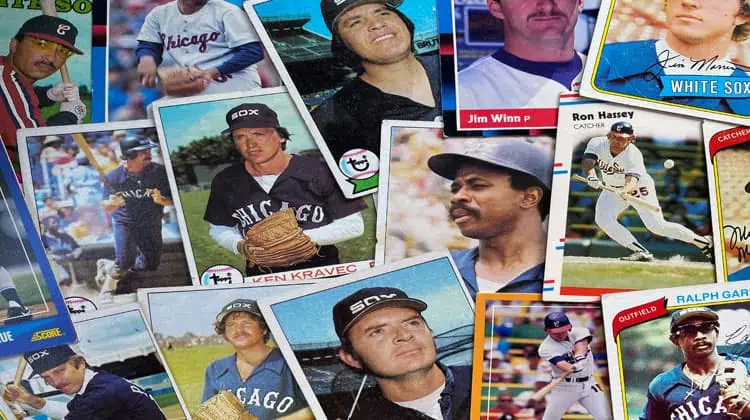

#4. Sports activities Memorabilia

Just like sports activities groups, sports activities memorabilia may also be an awesome funding.

And I’m not simply speaking about baseball playing cards right here.

Sports activities playing cards, jerseys, balls and different gadgets can promote for large bucks.

However it is very important know what you’re shopping for earlier than leaping in.

For instance, autographed baseballs from present gamers aren’t value as a lot as these signed by Babe Ruth or Mickey Mantle.

However a few of immediately’s stars might have their autographs be value hundreds of {dollars} sooner or later.

It is usually necessary to purchase memorabilia that isn’t mass produced.

Whether it is one thing that may be simply reproduced, it gained’t have the identical worth down the street.

Lastly, be sure you purchase memorabilia from a good supply.

You don’t wish to find yourself with a pretend merchandise.

Common Return To Anticipate

This additionally varies relying on what you spend money on, however sometimes you’ll be able to anticipate a return of 20% or extra.

Simply be sure the memorabilia is from a participant or group that’s well-liked and in excessive demand.

#5. Navy Collectibles

One other bizarre funding possibility is army historical past.

Whereas not all artifacts from army historical past are thought of helpful, there are gadgets which might be.

Particularly, gadgets from World Battle II and the Civil Battle.

It’s because these things have gotten tougher to seek out as collectors snatch them up.

If you will discover an merchandise from both of those wars in nice situation, it could possibly be value some huge cash.

Make sure to do your analysis on what’s at present in demand earlier than investing.

Common Return To Anticipate

Once more, that is subjective and will depend on the merchandise that you just spend money on.

Nonetheless, some gadgets have bought for over six figures.

So if you happen to discover a uncommon piece that’s in wonderful situation, it might simply have a return of 20% or extra.

#6. Music Royalties

If you’re in search of a much less dangerous funding or a method to diversify your investments, music royalties are an awesome funding alternative.

It’s because you’re investing in one thing that can all the time have worth.

Music will all the time be round and folks will all the time wish to hearken to it.

Plus, as know-how advances, the alternatives for music royalty progress improve.

You’ll be able to spend money on a music catalog, which is a group of songs which might be owned by a person or firm.

From there, you gather a royalty every time a type of songs is performed.

The extra well-liked the track, the upper the royalty payout might be.

You’ll be able to even purchase royalty streams of well-liked songs.

For instance, you’ll be able to pay a sure sum of money to earn 10% of the income for the subsequent 10 years on “Convey Me To Life” by Evanescence.

Some royalty streams supply the income for all times.

Nonetheless, this funding does include some threat.

You by no means know if a selected track will take off or not.

Additionally, the royalty payout can fluctuate tremendously from one track to a different.

Common Return To Anticipate

That is tough to estimate as a result of all of it comes right down to what number of occasions a selected track is performed and the time period of the royalty settlement.

Nonetheless, if you happen to spend money on a catalog of songs and a minimum of one turns into well-liked, you would see returns of 20% or extra.

#7. Hurricane Choices

Right here is an funding possibility that I’d name extra of a guess than an funding due to the excessive diploma of threat related to it.

You’ll be able to guess on the place or if a hurricane will make landfall.

Costs for the choices fluctuate on a regular basis.

These Hurricane Threat Landfall Choices, or HuRLOs, commerce on the Chicago Mercantile Change.

You’ll be able to commerce them as much as in the future earlier than a hurricane makes landfall.

The most important draw back is that these investments are restricted to buyers with a minimum of $5 million {dollars} of web value.

Common Return To Anticipate

There are not any printed returns for these HuRLOs, so I can’t say with confidence the return you would anticipate to earn with this funding.

#8. Parking Spots

Parking spots are a scorching commodity in most main cities.

It’s because the provision of parking continues to lower.

In some instances, individuals are keen to pay extra for a parking spot than they’re for an condominium.

As with every good funding, there’s threat concerned when buying a parking spot.

The spot could possibly be taken by another person, the town might begin to cost for parking within the space, or the worth of the spot might lower.

Nonetheless, if you’ll be able to buy a parking spot in a fascinating location and maintain on to it for just a few years, you’ll be able to see vital returns.

In some instances, folks have been in a position to promote parking spots for double and even triple the quantity they paid for them.

Common Return To Anticipate

It’s tough to estimate a mean return as this will depend on so many elements, equivalent to location and time of buy.

Nonetheless, if you’ll be able to maintain onto a spot for just a few years, you would see returns of 100% or extra.

#9. Classic Automobiles

One other of the choice investments that has the potential for top returns is classic vehicles.

The worth of those vehicles will increase over time as they change into increasingly more uncommon.

In some instances, folks have been in a position to promote classic vehicles for thousands and thousands of {dollars}.

And it isn’t restricted to simply classic vehicles both.

There are vehicles from the 1980’s and 1990’s which have change into well-liked with automobile lovers as effectively.

Due to this, among the fashions are promoting for 50% or greater than just some years in the past.

The keys listed here are to maintain the automobile in wonderful situation and to have low miles on it.

However even with this, there’s nonetheless the prospect that the automobile you suppose will recognize in worth solely depreciates.

Common Return To Anticipate

Like toys and comedian books talked about earlier, the return you get might be based mostly on the curiosity of different consumers.

This makes it arduous to nail down returns for traditional vehicles.

General you’ll be able to anticipate 30% or extra return in your funding.

#10. Superb Wine

Superb wine is one other funding that has the potential to offer excessive returns.

The explanation for it is because nice wine is a finite commodity.

There’ll solely be a lot of it made and, as time goes on, it turns into increasingly more uncommon.

This makes the value of nice wine go up over time.

In some instances, folks have been in a position to promote nice wine for thousands and thousands of {dollars}.

The important thing right here is to purchase wine that’s in good situation and has been saved correctly.

You additionally want to pay attention to the classic of the wine you’re buying.

Some wines from earlier vintages are value much more than wines from later vintages.

Common Return To Anticipate

Once more, it’s arduous to estimate a mean return as this may fluctuate relying on the wine you buy.

Nonetheless, if you buy wine that’s in good situation and has been saved correctly, you’ll be able to anticipate a return of fifty% or extra.

#11. Superb Artwork

Artwork is one other good thought to spend money on that has the potential to offer excessive returns.

The explanation for it is because artwork is a finite commodity.

There’ll solely be a lot of it made and, as time goes on, it turns into increasingly more uncommon.

This makes the value of artwork go up over time.

In some instances, folks have been in a position to promote artwork for thousands and thousands of {dollars}.

The important thing right here is to purchase artwork that’s in good situation and has been saved correctly.

You additionally want to pay attention to the artist you’re buying from.

Some artists are extra well-liked than others and their artwork will promote for the next worth.

The simplest method to get began on the earth of artwork investing is with a agency like Masterworks.

They let you personal a proportion in excessive finish art work.

This lets you make investments a smaller sum of money and nonetheless benefit from the return in your cash.

Common Return To Anticipate

Once more, it’s arduous to estimate a mean return as this may fluctuate relying on the artwork you buy.

Nonetheless, if you buy artwork that’s in good situation and has been saved correctly, you’ll be able to anticipate a return of 15% or extra.

#12. Luxurious Watches

Do you know there’s a marketplace for luxurious watches?

There are individuals who gather excessive finish watches after which resell them for a revenue.

In some instances, folks have been in a position to promote luxurious watches for thousands and thousands of {dollars}.

Like nice wine, you want to pay attention to what you’re shopping for and ensure it’s in good situation.

You additionally must be conscious that some watches are extra helpful than others.

For instance, a Rolex watch is value much more than a Timex watch.

Lastly, you will have to have the ability to spot counterfeit watches.

The very last thing you wish to do is make investments hundreds of {dollars} right into a watch that could be a pretend.

Due to this, it is best to solely make investments on this market in case you are obsessed with watches and might spot the little issues that make them distinctive.

Common Return To Anticipate

Identical to with different investments, the return you get will rely upon what you purchase and the way effectively it has been taken care of.

Nonetheless, you’ll be able to anticipate a return of fifty% or extra on a luxurious watch.

#13. Purses

One other of the bizarre investments is purses.

Many individuals gather excessive finish baggage after which resell them for a revenue.

In some instances, folks have been in a position to promote purses for hundreds of {dollars}.

Identical to with different luxurious gadgets, you want to pay attention to what you’re shopping for and ensure it’s in good situation.

You additionally must be conscious that some hand baggage are extra helpful than others.

For instance, a Chanel bag is value much more than a Coach bag.

And like luxurious watches, you additionally must know that there are plenty of counterfeit baggage on the market.

What makes this funding difficult is the pretend baggage are getting near not possible to identify.

There are many experiences of the pretend baggage being made in the identical factories as the true baggage.

How is that this doable?

Since manufacturing is transferring abroad, the factories will produce a hand bag, then produce just a few hundred extra that they promote for a lower cost.

The very last thing you wish to do is spend money on a knock-off purse.

Common Return To Anticipate

Proper now, this funding is scorching.

Consequently, you’ll be able to see returns of fifty% or extra.

However just some years in the past, you’d be taking a look at a 20% return.

For sure, there’s cash to be made by investing in hand baggage.

#14. Sneakers

One of many greatest crazes proper now’s sneakers.

There’s even an occasion, SneakerCon, the place you should buy, promote, and commerce sneakers.

However in case you are in search of the most effective methods to speculate outdoors the inventory market, this could possibly be it.

There are restricted launch sneakers hitting the market on a regular basis that consumers snatch as much as resell.

Mix the restricted provide with the overrated demand and you’ve got critical investing returns.

However as a result of the sneakers are launched on-line, you’re competing with consumers around the globe.

Common Return To Anticipate

For prime finish restricted version sneakers, you’ll be able to earn upwards of two,000% in your cash.

That isn’t a typo.

The issue is being fortunate sufficient to get your palms on a pair throughout the launch.

For different sneakers, you’ll be able to earn 100% or extra in your funding.

#15. Hashish

As marijuana and CBD change into extra mainstream and extensively accepted, hashish demand will solely improve.

So how do you make investments on this crop?

Some states have legalized the rising of the crop, so in case you are a state that enables this, having a farm is a method to earn a critical sum of money.

In case you don’t dwell in one in all these states, the best route for you is to spend money on hashish firms which might be traded on the inventory market.

A variety of firms are publicly traded, you simply need to do your homework to seek out those that meet your funding aims.

Common Return To Anticipate

In case you can spend money on a farm, you will note the best doable return, simply over 20% yearly.

In case you determine to spend money on these shares, you would see an 8% return.

Nonetheless, perceive that these shares are very dangerous.

If a rustic retains marijuana a criminal offense, the shares gained’t return as a lot.

But when nations start to legalize it, these shares might take off.

#16. Fairness Crowdfunding Actual Property

Up to now, if you happen to wished to strive actual property investing, you wanted to purchase out rental properties.

Not solely was this plenty of work, however you wanted some huge cash too.

Due to know-how, there’s a new method to spend money on actual property.

Crowdfunding.

Right here, a bunch of buyers pool their cash collectively to spend money on a property.

This lets you get began in the true property business with small quantities of cash.

They then earn a month-to-month earnings based mostly on their possession p.c.

And when the property sells, they earn a share of the capital achieve as effectively.

There are a few companies that assist you get began with crowdfunded actual property.

The primary is Arrived Properties.

They let you decide the precise residential properties you wish to spend money on and you may make investments with as little as $100.

It’s an awesome possibility for brand spanking new actual property buyers to get began.

An alternative choice is Diversyfund.

The principle distinction is you don’t have management over what you spend money on.

Diversyfund picks the properties, each residential and business properties, and also you sit again and earn a passive earnings.

Common Return To Anticipate

With actual property typically, you’re looking at a mean annual return of 10%.

If the property sells for a achieve, this return might be along with the ten% return.

#17. Farmland

If you’re in search of one other secure funding, farmland could possibly be possibility.

Up to now, farmland was seen as a secure funding as a result of folks all the time must eat.

And with inhabitants progress and the rise of the center class in growing nations, that also holds true immediately.

That is what has led to a rise in costs for farmland.

Up to now, you would decide up a farm for $100 an acre.

Now, that very same farm would price you $1,000 or extra per acre.

However don’t let that scare you away from this funding.

The costs are solely going to proceed to extend because the inhabitants grows and the necessity for meals will increase.

How do you get began?

There are firms on the market that let you spend money on farmland, like FarmTogether and AcreTrader.

Common Return To Anticipate

The return you’ll be able to anticipate when investing in farmland varies.

Nonetheless, on common, you’ll be able to anticipate to earn between 6-10% in your cash.

The excellent news is if you happen to make investments with the websites talked about above, they gives you their projected return and time horizon earlier than you make investments, so you understand what to anticipate.

#18. Burial plots

One unusual funding is burial plots.

Folks have been investing in them for hundreds of years as a result of they’re a secure funding and include a assured return.

The way it works is you purchase the plot upfront after which resell it to somebody who’s inquisitive about being buried in that location.

Since we will’t create extra land, the value of the plot normally goes up over time, so you may make a pleasant revenue in your funding.

The upside with this funding is the Child Boomer era is now retiring and might be passing away quickly.

That is might result in a rise within the demand for burial plots.

On the flip aspect, if these folks select to not be buried, the demand dries up and together with it, the return you’ll be able to obtain.

Common Return To Anticipate

On common, you’ll be able to anticipate to earn an annual return of 12-15% in your funding in burial plots.

#19. Tax Liens

When a property proprietor doesn’t pay their taxes, the federal government can place a lien on the property.

That is principally a declare towards the property till the taxes are paid.

In some instances, if the proprietor nonetheless doesn’t pay, the federal government will public sale off the lien to buyers.

That is the place you are available in.

You should purchase the lien for a fraction of what the property is value after which look ahead to the proprietor to pay you off.

In the event that they don’t, you’ll be able to foreclose on the property and take it your self.

It’s a dangerous funding, but when finished appropriately, may be very worthwhile.

Common Return To Anticipate

The common return you’ll be able to anticipate from a tax lien funding is 16%.

Nonetheless, there isn’t any assure you’ll make this return.

All of it will depend on how lengthy it takes for the proprietor to repay the lien and whether or not or not you foreclose on the property.

#20. Non-public Mortgages

If shopping for burial plots or crowdfunded actual property doesn’t curiosity you, and you’ve got an honest amount of money, you’ll be able to make investments your cash in non-public mortgages.

With this funding, you’re basically loaning somebody cash to purchase a property.

They may then pay you again with curiosity over a set time period.

In different phrases, you act because the financial institution providing a mortgage.

This generally is a riskier funding, but when finished appropriately, can supply excessive returns.

Common Return To Anticipate

On common, you’ll be able to anticipate to earn a return of 12-15% in your funding in non-public mortgages.

The explanation for the excessive return is you take on all the chance and generally, you’re coping with folks with under common credit score scores.

As soon as once more, this isn’t a assured return and will depend on the success of the borrower’s buy and their potential to repay the mortgage.

#21. Financial institution Accounts

You can make the argument that opening financial institution accounts isn’t actually an funding.

However since many banks supply beneficiant enroll bonuses, it’s a secure method to earn an honest return.

Actually, some banks supply bonuses as excessive as $200.

All you must do is open a checking and/or financial savings account and preserve a minimal steadiness.

In some instances, chances are you’ll must arrange a direct deposit or use your debit card a sure variety of occasions a month.

Then, after just a few months, the financial institution will deposit the bonus into your account.

It’s not going to make you wealthy, nevertheless it’s a straightforward method to make some more money with out an excessive amount of effort.

Common Return To Anticipate

You’ll be able to anticipate to earn a mean return of $100 from checking account bonuses.

And seeing as how you are able to do this with a variety of banks in a 12 months, you would make $1,000 or extra for not a lot work.

Once more, this isn’t an enormous return, nevertheless it’s passive earnings you can get with out doing an excessive amount of work.

#22. Credit score Playing cards

If opening financial institution accounts doesn’t supply a excessive sufficient return for you, look no additional than bank cards.

Opening new bank card accounts for the enroll bonus, additionally known as churning, may be very well-liked.

Actually, some folks make a full-time residing from it.

All you must do is open a brand new account, meet the minimal spending necessities, after which shut the account after you’ve acquired the bonus.

Repeat this course of as many occasions as you need and watch your checking account develop.

Whereas most bank card firms are OK with churning, many have redefined what is taken into account a brand new buyer.

Consequently, you’ll be able to solely make the most of among the bonuses each few years.

However don’t let this cease you.

If finished strategically, you’ll be able to nonetheless revenue handsomely from this enterprise.

Common Return To Anticipate

On common, you’ll be able to anticipate to earn a return of $500 from churning bank cards.

In some instances with journey reward bank cards, you’ll be able to earn free flights or resort stays simply from the enroll bonus alone.

#23. Gear Leasing

An out of doors the field funding is that of leasing tools.

This can be a nice possibility in case you have some cash to speculate.

It really works by having you purchase tools after which leasing it, or renting it to companies.

This tools may be something from workplace furnishings to building instruments.

The great thing about this funding is that there isn’t any long-term dedication required.

You merely lease the tools for a set period of time after which it’s returned to you.

Common Return To Anticipate

Whenever you lease tools, you’ll be able to earn between 10-20%.

The quantity you earn will rely upon the kind of tools as some issues will go for greater than others.

#24. Small Companies

An alternative choice for these in search of a extra hands-on funding is to spend money on small companies.

This may be finished by both lending the enterprise cash or shopping for shares within the firm.

One of many advantages of this kind of funding is that you just get to be concerned with the corporate and see it develop.

On the draw back, there’s extra threat concerned.

That is very true since many small companies fail.

However if you happen to do your homework, the potential rewards are excessive.

Common Return To Anticipate

When investing in a small enterprise, you’ll be able to anticipate to make a return of wherever from 25-100%.

This quantity will fluctuate relying on a variety of elements equivalent to the corporate’s monetary stability and the way good your funding is.

#25. Worthy Bonds

If the concept of investing in small companies pursuits you however you don’t have the time or need to seek out companies to spend money on, you’ll be able to strive Worthy Bonds.

This firm loans small companies cash to fund their stock.

Worthy expenses curiosity on this mortgage and also you as an investor earn a secure 5% in your cash.

I’ve been investing with them for just a few years now and it’s a straightforward method to safely earn above common returns on my cash.

Greatest Approach To Earn Passive Earnings

Worthy Monetary

Seeking to safely earn the next return in your cash? Worthy Bonds gives 5% 7% curiosity in your cash. Spend money on small companies and earn a return for doing so. New customers get a $10 bonus when buy your first bond.

Get Began

Learn My Evaluation

We earn a fee if you happen to make a purchase order, at no extra price to you.

Common Return To Anticipate

The return you get is 5% it doesn’t matter what.

In comparison with financial savings accounts that pay round 1%, it’s a good way to spice up your returns on a secure funding.

Ultimate Ideas

As you’ll be able to see, these are the very best unusual investments concepts to think about investing in.

It’s necessary to notice these are usually not get rich-quick schemes, however precise methods to speculate your cash.

Every of them has the potential to earn you a excessive return in your funding.

However bear in mind, with any funding, there’s all the time threat concerned.

Do your homework earlier than investing and be sure you perceive what you’re stepping into.

I’ve over 15 years expertise within the monetary companies business and 20 years investing within the inventory market. I’ve each my undergrad and graduate levels in Finance, and am FINRA Collection 65 licensed and have a Certificates in Monetary Planning.

Go to my About Me web page to study extra about me and why I’m your trusted private finance knowledgeable.