I’ve pals who use their bank cards overseas for his or her journey spending, with zero clue concerning the additional charges and fees they’re being made to pay. As an alternative, they’re glad concerning the “upsized” miles they’re incomes – “my card provides me 2.2 mpd abroad, Daybreak!”

In case you’ve ever used your bank card to pay in your overseas foreign money transactions (this consists of on-line funds with abroad retailers), do you know that there’s an entire listing of charges that you simply might need unwittingly paid for?

Let’s discuss concerning the charges

Charges and fees associated to FCY transactions embrace:

- Dynamic Foreign money Conversions (DCC): 3%-4%

- FX conversion charges: 3% – 3.5%

- Cross-border SGD charges: 1%

PSA: all your FCY transactions are subjected to a 3% – 3.5% charge by your financial institution or card community.

Your financial institution’s FCY conversion charges

| Issuer | Mastercard & Visa | AMEX |

| Commonplace Chartered | 3.5% | N/A |

| American Categorical | N/A | 3.25% |

| Citibank | 3.25% | N/A |

| DBS | 3.25% | 3% |

| HSBC | 3.25% | N/A |

| Maybank | 3.25% | N/A |

| OCBC | 3.25% | N/A |

| UOB | 3.25% | 3.25% |

| BOC | 3% | N/A |

| CIMB | 3% | N/A |

Dynamic Foreign money Conversion(s) charges

In case you’ve ever paid any abroad service provider in SGD as a substitute of the service provider’s native foreign money, guess what? You is perhaps sufferer of the Dynamic Foreign money Conversions (DCC) charges too, which many label as a rip-off. This can be a widespread manner for retailers to earn extra cash from unsuspecting prospects, because it psychologically feels higher for the shopper to pay in their very own foreign money moderately than a overseas one. I’ve bought my buddy Aaron from the Milelion to thank for shedding the sunshine on sneaky DCC charges.

Do you know? Dynamic Foreign money Conversion (DCC) is a service provided by fee answer suppliers which permits customers to pay of their native foreign money when utilizing their bank cards abroad.The catch? Your foreign money conversion is completed at a price that's largely unfavourable to you, and helps generate extra income unfold which will get break up between the service provider and the fee answer supplier.

You possibly can learn Visa’s advisory on DCC right here, and due to Aaron, I’ve discovered that if anybody needs to strive disputing the cost with their financial institution, you’ll be able to quote the related chargeback codes:

- Visa: Motive Code 76 – Cardholder was not suggested that Dynamic Foreign money Conversion (DCC) would happen. Cardholder was refused the selection of paying within the service provider’s native foreign money

- Mastercard: Motive Code 4846 – The cardholder states that she or he was not given the chance to decide on the specified foreign money during which the transactions was accomplished or didn’t conform to the foreign money of the transaction

FYI, this occurs extra typically than you suppose. You will have encountered it if a service provider bothered to ask you which ones foreign money you like to pay in, however a variety of them don’t – as a substitute, most will robotically select the DCC choice for you, with out your consent.

Even should you suppose you’ve been spared from DCC practices, don’t rejoice so quickly. Even abroad retailers like iHerb, Google Play Retailer, Apple App Retailer and AirBnB can impose DCC on you while you e-book on-line with them, as they robotically convert overseas transactions into the foreign money of your bank card! Some people have referred to as out this as a rip-off, however guess what? You don’t have a say.

Cross-border administrative charge

Whereas it might sound like a good suggestion to understand how a lot you’re paying in SGD precisely, anecdotal observations have famous that the transformed quantity typically comes with a median mark-up of at the least 3%, if no more. What’s worse is that every time you pay in SGD overseas, most Singapore banks additionally levy a cross-border charge of about 1% of your transaction price.

In whole, you’ll simply be paying about 4 – 5% in fees in whole only for that psychological consolation that comes with paying in SGD.

I’ve compiled an inventory of bank cards that give the very best earn charges on FCY spend and are fashionable amongst many travellers.

However there’s a catch. In case you see the half I’ve highlighted in yellow, you’ll discover that every one these miles (or 8% cashback) comes with hefty financial institution FCY charges.

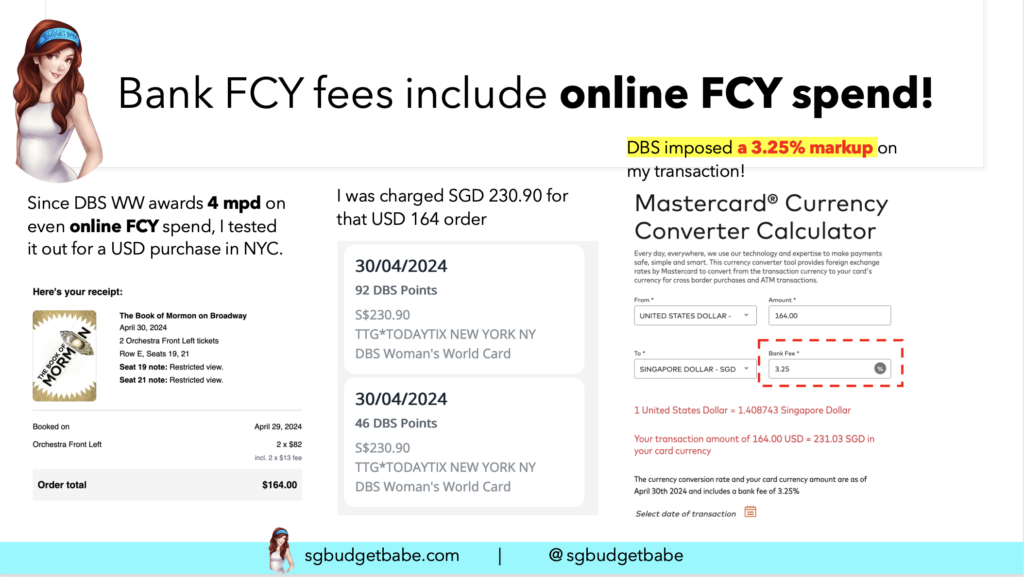

To collect the proof for this, I intentionally examined this with my finest on-line miles card – DBS Lady’s World, 4 mpd – to test after I was in New York final month catching a Broadway Present.

You possibly can see that DBS charged me SGD 230.90 for my USD 164 buy, which confirms the ~3.25% financial institution FCY charge levied on high of my transaction.

Previous to this, I introduced my DBS Vantage Card on all my abroad journeys with me as a result of I used to be attracted by the financial institution’s adverts to earn 2.2 mpd on my FCY spend overseas. After I realised this, I took my DBS Vantage out of my abroad pockets for good.

This begs the query:

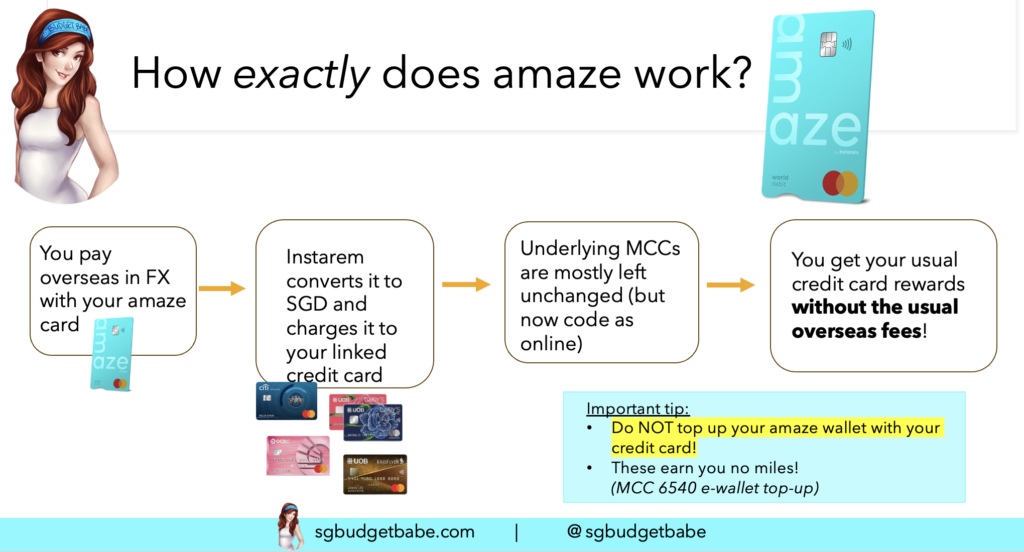

Why pay financial institution FCY charges to get miles when there’s amaze?

Figuring out there’s a workaround for me to get 4 mpd and bypass the excessive(er) financial institution charges, why ought to I accept 2.2 mpd AND pay DCC or awful FX charges by swiping my precise bank card in any respect?

I’ve raved concerning the amaze card since 2019 and until date, it stays my best choice for an abroad card. Every time I fly and even drive into JB, I faucet my amaze card in every single place I’m going.

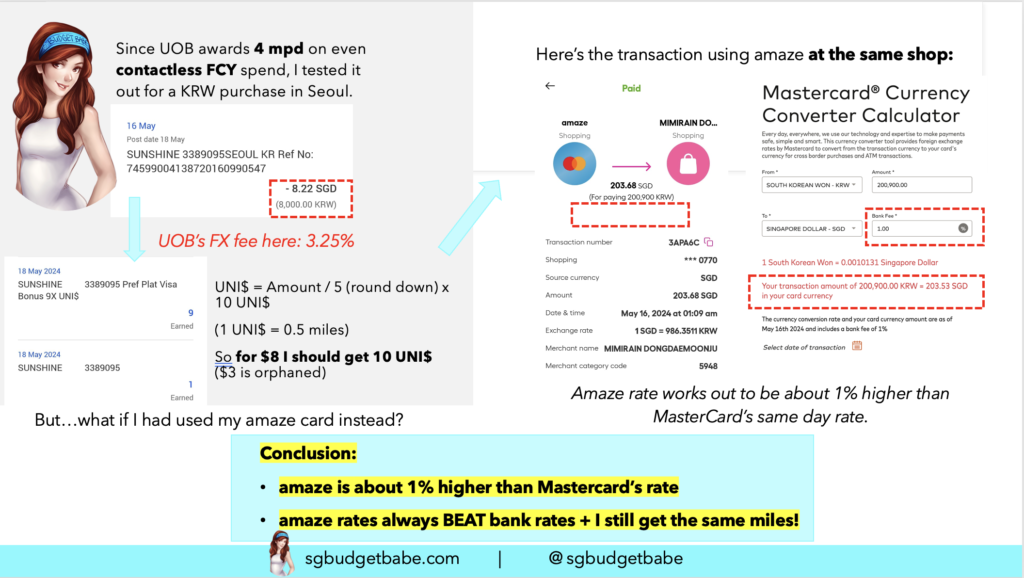

And since I used to be sharing about this amaze hack on my Instagram throughout my current Korea journey, I had some skeptics who didn’t imagine that amaze was actually higher…so I went to get proof once more.

Under you’ll see 2 transactions on the identical store in Korea, the place the charges work out to be:

- Paying direct with my UOB card = 3.25% financial institution FCY charges

- Paying by way of amaze = 1% above Mastercard’s price

I don’t find out about you, however I’d a lot moderately pay 1% than 3.25% to get the identical reward of 4 mpd.

Funds Babe

How does amaze evaluate to YouTrip?

I’ve misplaced depend of how many individuals DM-ed to ask me whether or not amaze is healthier than YouTrip. In case you’re questioning that too, you’re evaluating it mistaken as a result of each playing cards are good for serving completely different functions

With multi-currency pockets playing cards like YouTrip or Revolut, their elementary function is to cut back the price of your FCY transaction as a lot as attainable. The mechanics subsequently contain you changing currencies as you go, which additionally means many travellers take care of leftover foreign exchange on the finish of their journey that they should convert again – at a special day’s price. You don’t earn any miles for a single greenback of your spend on YouTrip, Revolut and even Clever.

With amaze, the concept is to allow you to earn rewards whereas paying lower than a standard bank card. And since no bank card affords the Google / XE / mid-market charges, your appropriate foundation of comparability must be the Mastercard charges as a substitute. My expertise with amaze exhibits that the amaze’s price is roughly about 1+% larger.

However Daybreak, I need to pay the bottom charges AND get my miles!

Positive, I hear you. Sadly there’s no such answer out there right this moment, however what’s stopping you from inventing one? Let me know when you do, so I can shoutout on this weblog about it too.

Therefore, your selection boils down to picking one of many following choices. Would you moderately

- Pay the financial institution’s 3.25 – 3.5% FCY charges and get their FCY miles earn price (often 2+ mpd)? or

- Pay by way of amaze (1+% larger than Mastercard) and get native SGD miles earn price? or

- Pay by way of YouTrip / Revolut / Clever and get zero miles (for each topping up the pockets and for spending)?

Personally, I exploit amaze as my main mode of fee abroad, but additionally maintain a multi-currency pockets choice like YouTrip / Revolut / Clever helpful as backup – that’s for all of the occasions after I could have to withdraw money overseas as a result of sure locations (e.g. avenue distributors) don’t settle for card funds.

Don’t neglect, amaze additionally awards InstaPoints (IP) every time you transact with them, which work virtually as cashback:

- As of June 2024, customers earn 0.5 IP for each S$1 (in FX equal)

- Max cap of 500 IP earned per thirty days

- 2000 IP = $20 pockets credit score

I can simply spend my InstaPoints pockets credit like money, by merely altering the fee supply for my amaze card to deducting it from the pockets as a substitute of my linked bank card.

This can be a bonus, though none of us who use amaze have usually counted within the cashback as a characteristic anyway. It’s extra of a bonus than anything (ooh yay I’ve some extra cash free of charge!).

With the max cap, this implies you’ll be able to solely earn amaze cashback on a most of S$1,000 of your FCY bills. There’s a straightforward workaround although – get 2 amaze playing cards should you’re travelling with a associate, and front-date your transactions for automotive leases or actions, or basically anything you’ll be able to pre-book forward of going in your journey.

So should you’re spending large {dollars} contributing to a overseas nation’s economic system when you’re away from house and spend something north of these limits, then too unhealthy, however hey, at the least you’re nonetheless incomes your bank card miles by way of amaze!

What playing cards can you employ with Amaze?

As a reminder, Amaze can solely be paired with bank cards on the Mastercard community and permits you to hyperlink as much as 5 playing cards.

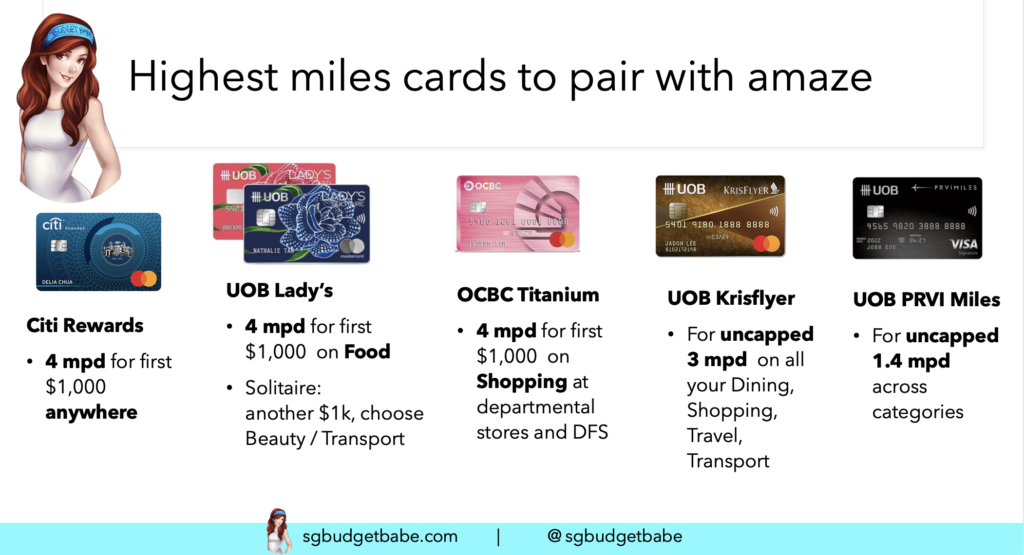

My suggestions are to:

- Use the Citi Rewards as your main Amaze pairing, capped at S$1,000

- Use the UOB Girl’s Solitaire Card for eating and journey (the 2 classes we’re more than likely to spend on when abroad) capped at S$2,000

- Use the OCBC Titanium Rewards for buying, capped at S$1,100

- As soon as maxed out, change to make use of UOB Krisflyer (uncapped) for eating, buying, journey and transport

- Alternatively, change to UOB PRVI Miles for 1.4 mpd (uncapped) and throughout extra classes

Reminder: the UOB Krisflyer Card requires you to spend a minimal of S$800 on Singapore Airways, Scoot, Kris+ or KrisShop inside the yr to be eligible for the upsized 3 mpd. In case you fail to fulfill this requirement, you’ll solely be getting 1.2 mpd.This requirement is pretty straightforward to get round – simply cost your air tickets to the cardboard, or taxes and surcharges on a KrisFlyer award redemption, and even paying for add-on providers with Scoot like baggage, seat choice and meals. The accelerated Miles shall be awarded on these transactions from the beginning of your membership yr, not simply from the time the minimal spend was met, so you'll be able to technically begin spending on the cardboard first earlier than you clock your SIA Group $800 spend for the yr.

However should you’re not a fan of ready for UOB Krisflyer to publish your accelerated miles (takes anyplace between 2 – 14 months), then the UOB PRVI Miles could be a greater match, albeit at a downsized 1.2 mpd.

These 5 playing cards must be greater than sufficient to cowl most of your abroad spending, although it undoubtedly requires some switching forwards and backwards on the amaze app to maximise it.

Conclusion: why I exploit my amaze card after I journey

I hope this text serves as a wake-up name for anybody who hasn’t been monitoring their card transactions and didn’t realise you’re really being levied charges on all of your FCY spend.

Extra importantly, I extremely advocate that you simply get the amaze card for while you journey overseas – and I hope this publish helps you perceive the trade-offs you’re settling for while you select some other choice aside from amaze.

In case you want to transform on the lowest charges and earn no miles, or to pay your financial institution charges to earn the identical (if not lesser) miles in your FCY spend, that’s cool.

I’m Funds Babe although, so I want to go for an choice the place I get to earn miles for the least charges.

Want a referral code for amaze? Use DAWNBB to get welcome InstaPoints which you can later convert into money for spending in your amaze card.

In case you discovered this information helpful, go forward and share it with others!

With love,

Daybreak