I went on a Bucket Record Journey to Yellowstone Nationwide Park final month and stayed on the historic Outdated Trustworthy Inn inbuilt 1904. We noticed the geysers, the Grand Canyon of Yellowstone with its stunning falls, majestic bison with their calves, highly effective grizzly bears with their cubs, and a coyote crossing by way of a congested intersection with out concern for the site visitors.

I went on a Bucket Record Journey to Yellowstone Nationwide Park final month and stayed on the historic Outdated Trustworthy Inn inbuilt 1904. We noticed the geysers, the Grand Canyon of Yellowstone with its stunning falls, majestic bison with their calves, highly effective grizzly bears with their cubs, and a coyote crossing by way of a congested intersection with out concern for the site visitors.

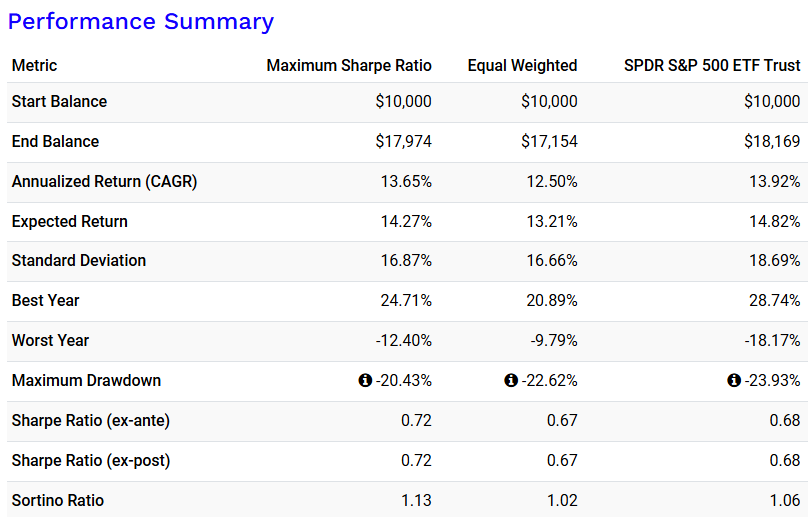

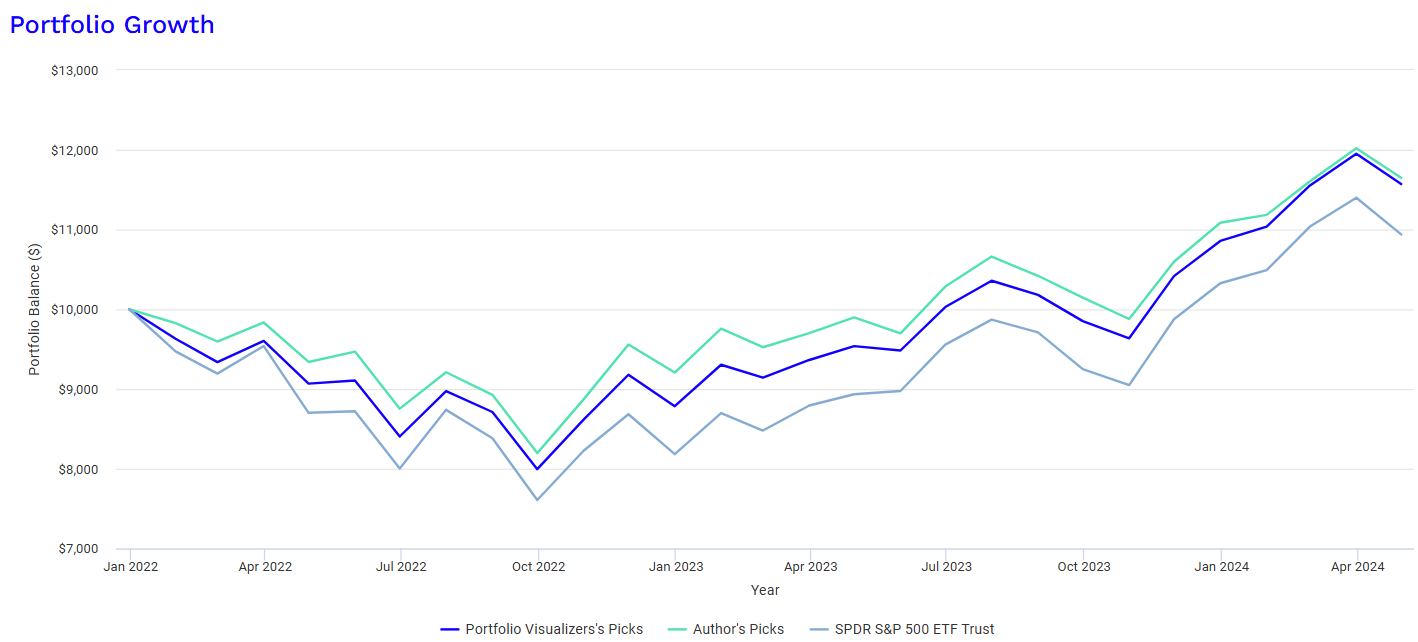

The opposite journey that I went on final month was to take a deeper dive into “Fund Household” efficiency for exchange-traded funds that spend money on home equities, world and worldwide equities, and rising market equities. The idea is to take a position with an asset supervisor that you simply belief within the areas the place they excel with a confirmed monitor file. On this article, I deal with large- and multi-cap U.S. Fairness and Worldwide fairness funds that one would possibly embody as core funds in a portfolio.

This text is split into the next sections:

What Is an ETF? Morningstar’s ETF Information“ at Morningstar, “The primary exchange-traded fund, SPDR S&P 500 SPY, made its debut in 1993. By the tip of 2021, greater than $7 trillion in belongings rested in ETFs… ETFs, or exchange-traded funds, are funds that commerce on exchanges. Like conventional mutual funds, ETFs spend money on a basket of shares, bonds, or some mixture of the 2. However in contrast to conventional mutual funds, shares of ETFs commerce on a inventory alternate, such because the New York Inventory Alternate.”

Ms. Dziubinski describes some great benefits of ETFs over mutual funds:

- ETFs are simple to purchase and promote—and given the price wars within the trade, ETFs have turn into just about free to purchase and promote.

- ETFs have a fame for being tax-efficient (considerably true).

- ETFs are additionally identified for being low value (not all the time true).

- As a result of lots of the hottest ETFs monitor extensively adopted and clear indexes, there’s no thriller behind their efficiency: It’s often the efficiency of the index minus charges.

- Passive ETFs don’t have any key-person danger: If the supervisor leaves, one other can step in with out a lot ado.

She provides that “ETFs distribute fewer and smaller capital beneficial properties distributions as a result of so many pursue lower-turnover, passive methods”, and that “the ETF construction is extra tax-efficient.”

The overwhelming majority of my belongings are invested in mutual funds, however I preserve a watch out for alternatives amongst exchange-traded funds. Combining decrease expense ratios and tax advantages is an incentive for Fund Households to remain aggressive for traders by switching from mutual funds to ETFs. On this article, I take a look at fund efficiency which is after Fund Household bills.

I gleaned from the Mutual Fund Observer MultiSearch Instrument that there are roughly 2,687 exchange-traded funds with at the very least one yr because the inception date. These are managed by roughly 227 Fund Households. Seventy-five % of the ETFs are managed by simply twenty-nine Fund Households, the biggest of that are BlackRock, Invesco, First Belief, State Road, Innovator, International X, Vanguard, WisdomTree, and Constancy in descending order. The biggest Fund Managers together with mutual funds have eighty % of the Belongings Beneath Administration (AUM): Vanguard, Constancy, BlackRock, American Funds, State Road, JPMorgan, Schwab, Invesco, T Rowe Value.

For example, by my estimates, Vanguard affords 124 mutual funds and 84 exchange-traded funds. Whole Vanguard belongings beneath administration (AUM) are roughly $8.9 trillion {dollars}. There are twenty-one Vanguard funds which have each a mutual fund and exchange-traded fund (share lessons) with a complete AUM of $4.6 trillion {dollars}. The typical expense ratio for the ETF share class of those pairs is 0.055% whereas the common expense ratio of the mutual fund share class is 0.18%.

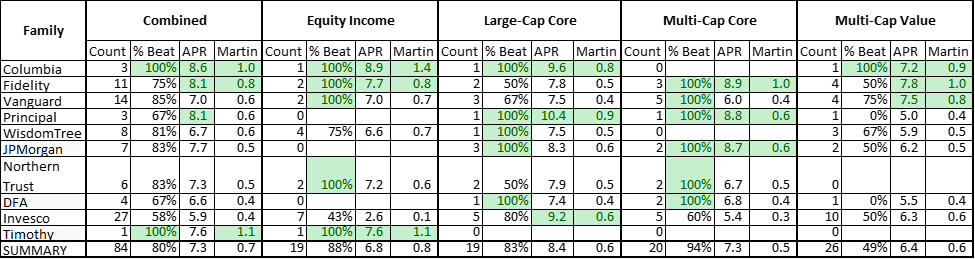

Supply: Creator Utilizing MFO Premium MultiSearch Instrument

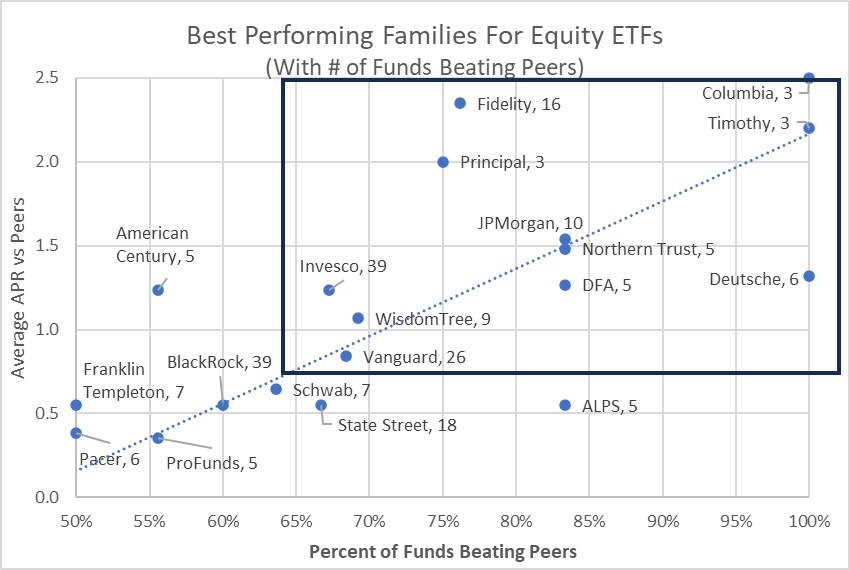

Desk #1 incorporates US Fairness ETFs in Lipper Classes with a lot of funds for comparability functions with metrics masking the previous three years. Whereas all the Fund Households have carried out above common for the Lipper Classes, these on the prime have larger common “% Beating Friends”, common annualized returns, and risk-adjusted returns (Martin Ratio). When narrowed to large- and Multi-Cap U.S. Fairness ETFs, Constancy and Vanguard are the dominant Fund Households whereas Columbia, Principal, Knowledge Tree, JP Morgan, and Northern Belief additionally stand out.

Desk #1: Greatest Performing Fund Households for U.S. Fairness Massive- and Multi-Cap ETFs

Supply: Creator Utilizing MFO Premium database and screener

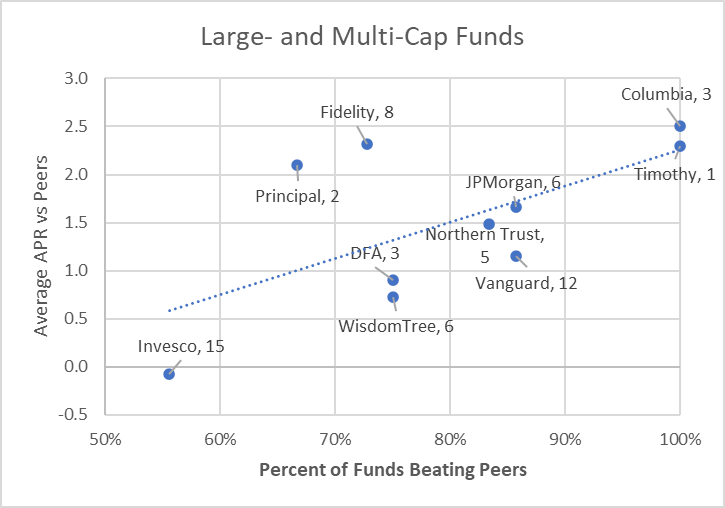

Determine #2 represents these ETFs in Massive- and Multi-Cap Lipper Classes from the desk above in graphical type.

Determine #2: Greatest Performing Fund Households for U.S. Fairness Massive- & Multi-Cap ETFs

Supply: Creator Utilizing MFO Premium MultiSearch Instrument

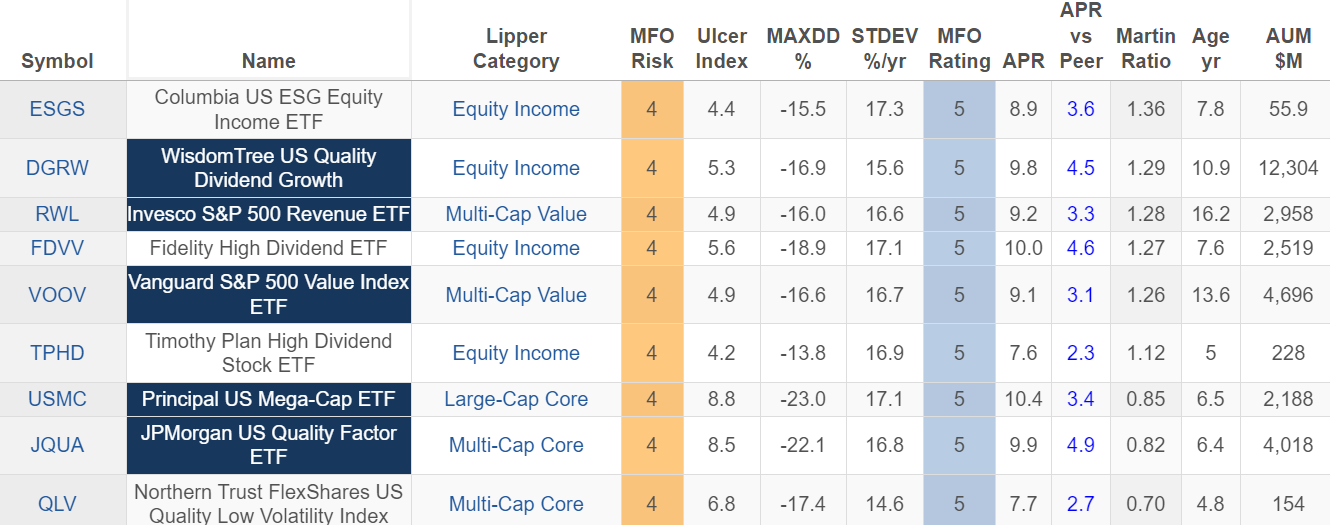

Desk #2 lists a few of the outperforming funds whereas Determine #3 is a graphical illustration.

Desk #2: Chosen High Performing Massive- and Multi-Cap U.S. Fairness ETFs

Supply: Creator Utilizing MFO Premium database and screener

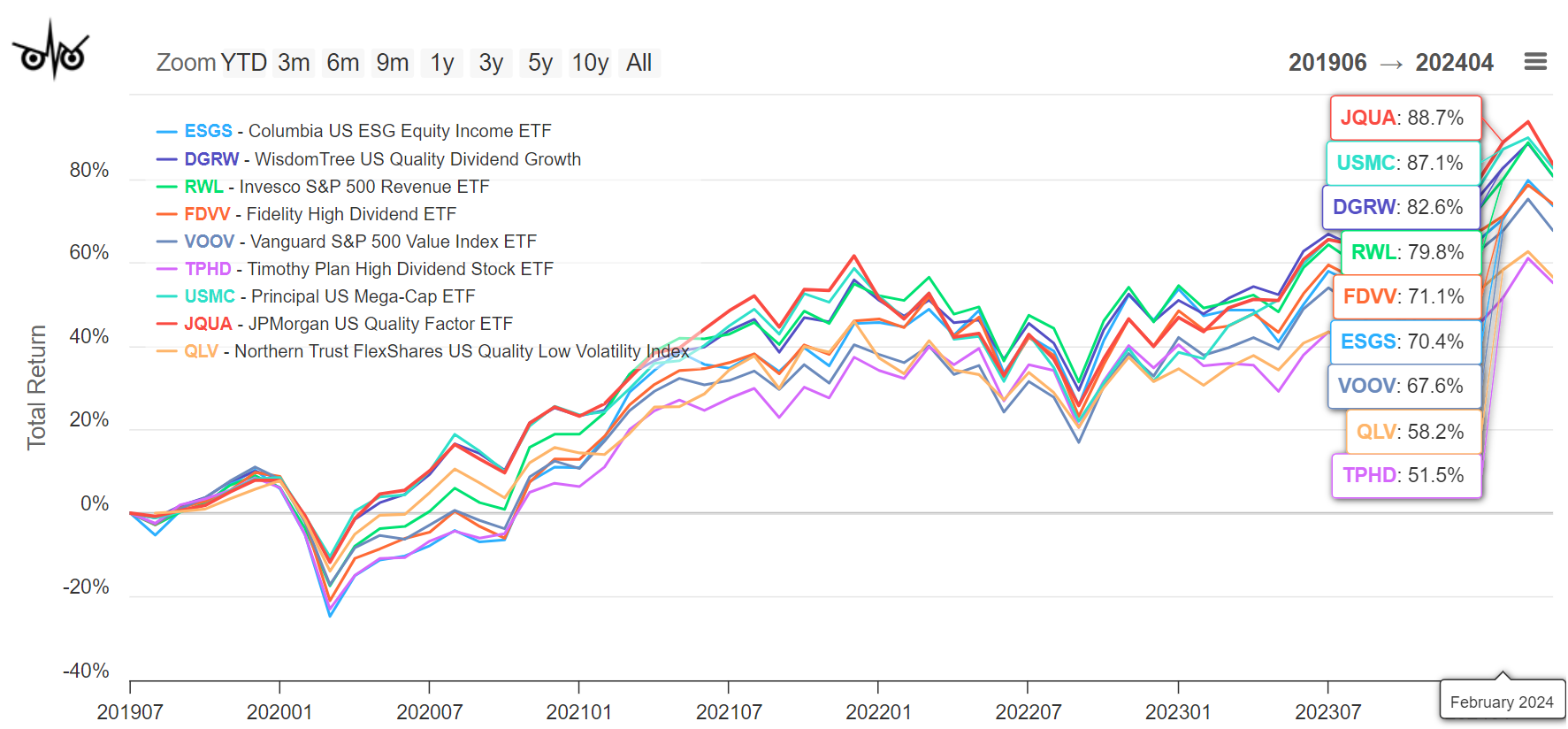

Determine #3: Chosen High Performing Massive- and Multi-Cap U.S. Fairness ETFs

Supply: Creator Utilizing MFO Premium database and screener

Supply: Creator Utilizing MFO Premium database and screener

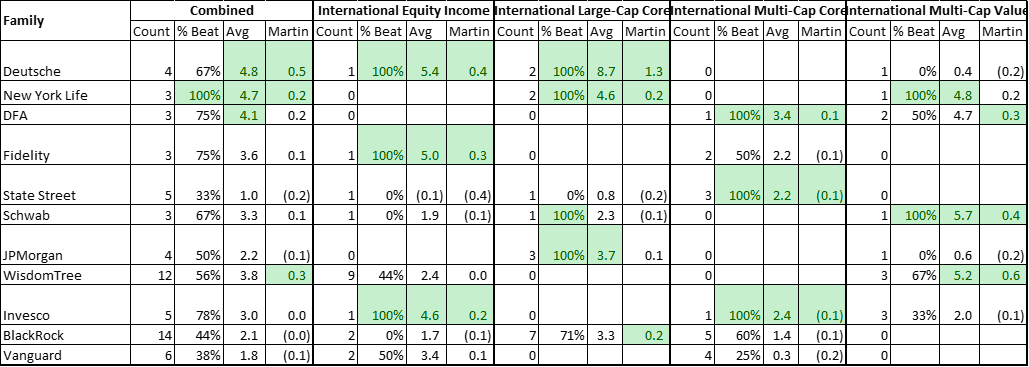

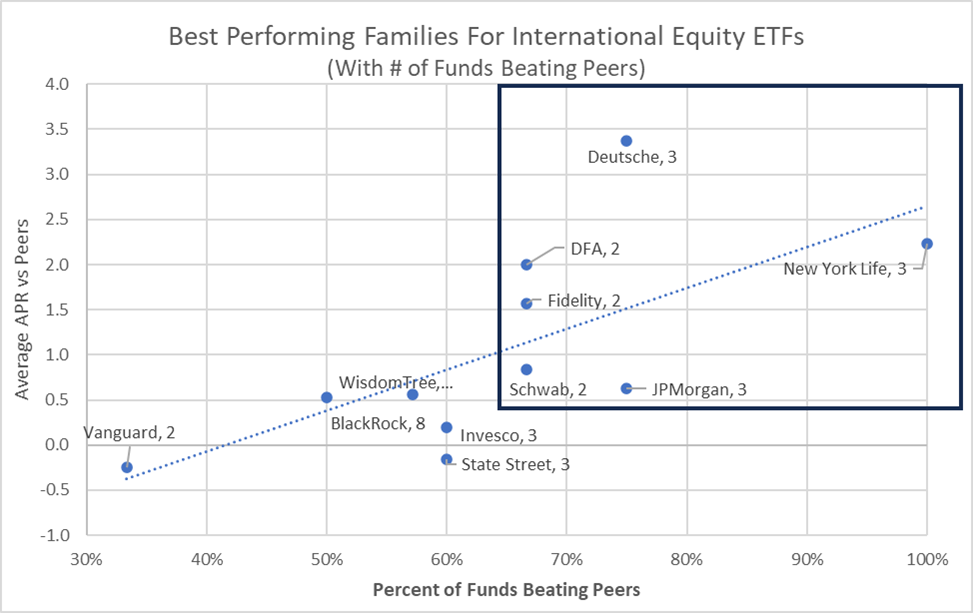

Determine #4: Greatest Performing Fund Households for Worldwide Massive- and Multi-Cap ETFs

Supply: Creator Utilizing MFO Premium database and screener

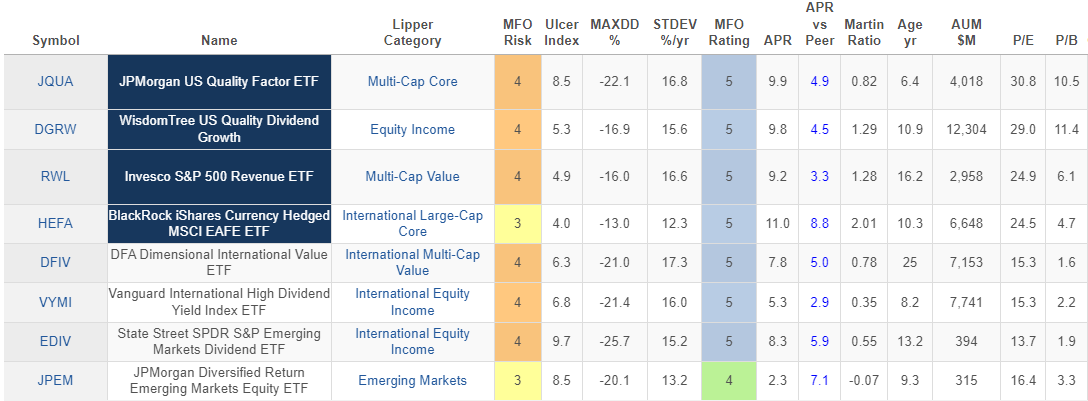

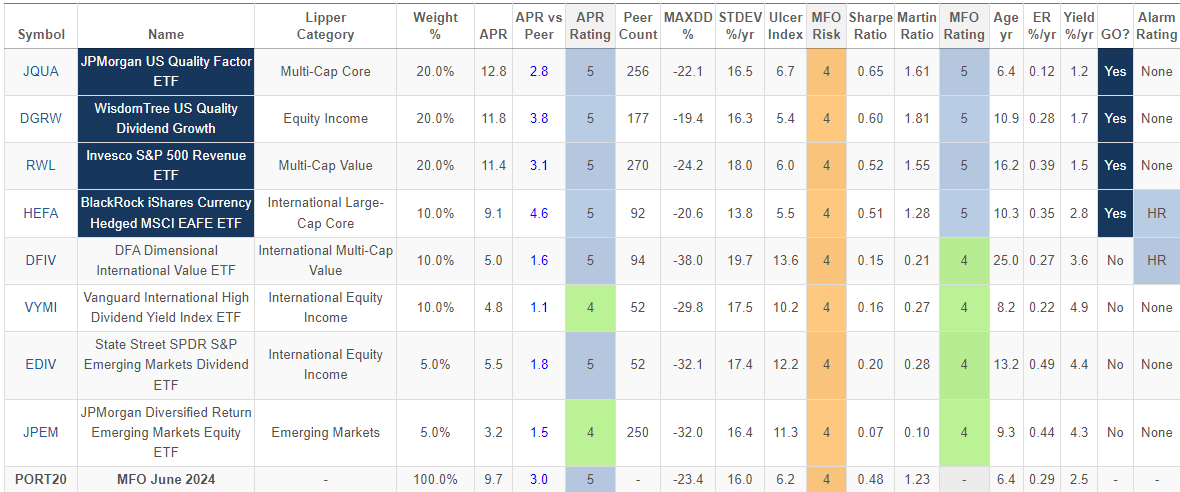

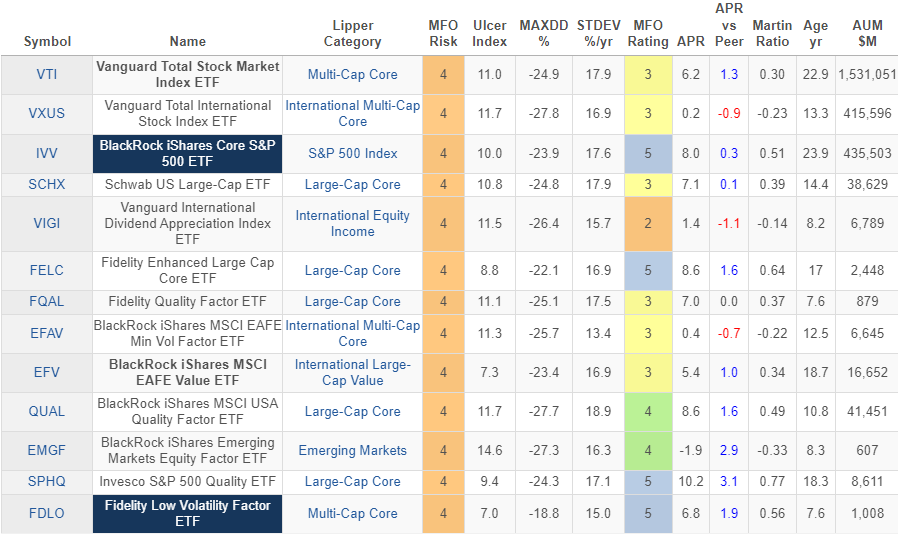

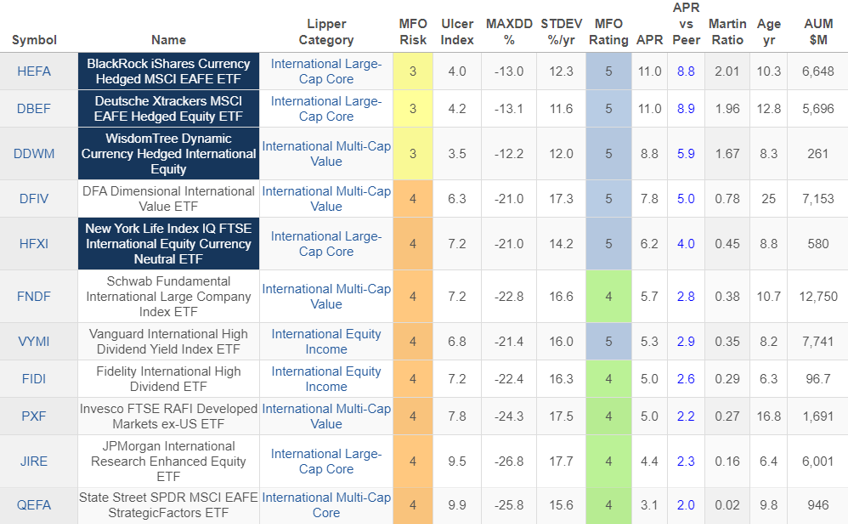

Desk #4 incorporates instance ETFs that outperform from these Fund Households with excessive efficiency within the Massive- and Multi-Cap Worldwide ETF area. Determine #5 represents the identical funds in graphically.

Desk #4: Chosen High Performing Massive- and Multi-Cap Worldwide Fairness ETFs

Supply: Creator Utilizing MFO Premium database and screener

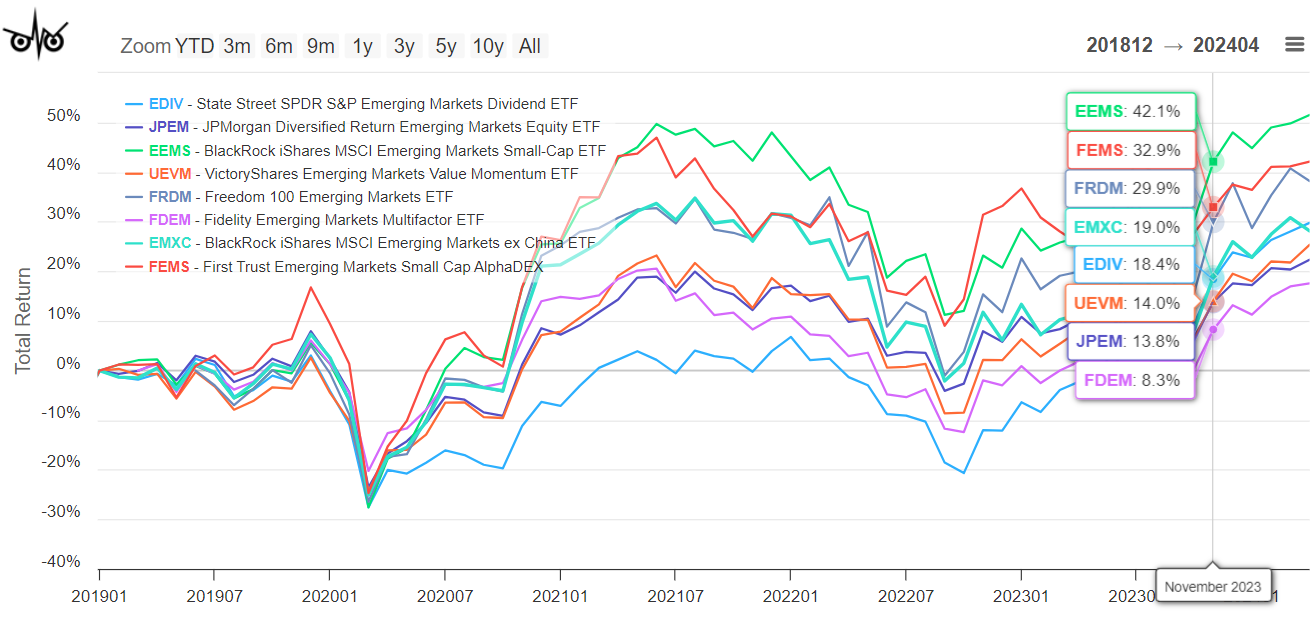

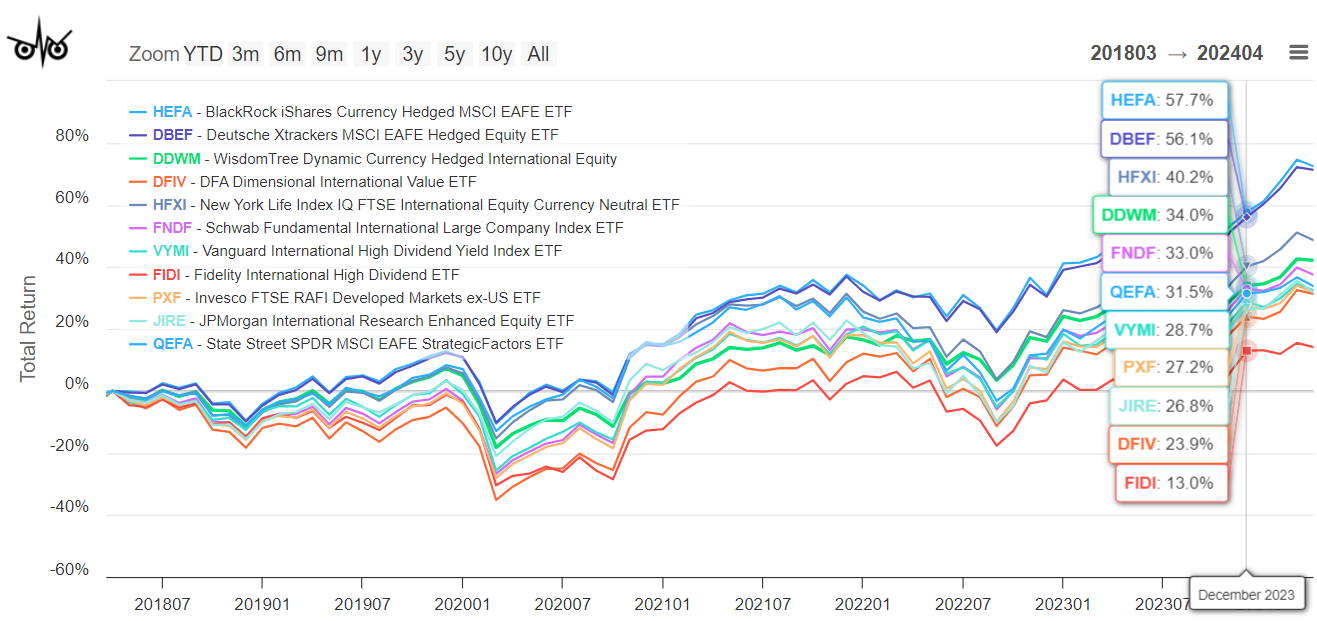

Determine #5: Chosen High Performing Massive- and Multi-Cap Worldwide Fairness ETFs

Supply: Creator Utilizing MFO Premium database and screener

Supply: Creator Utilizing MFO Premium database and screener