Proper! There we now have it people – the Federal Funds for 2024 has dropped with a bunch of measures that look good for enterprise house owners and people, in addition to some omissions that folks had been searching for in our pre-budget ballot.

After we took a ballot final week to gauge the temperature of small enterprise house owners forward of the Funds, we had been in a position to house in on probably the most and least essential finances inclusions.

To correctly body the 2024 Funds, let’s first take a fast have a look at the federal government’s said intentions and our pre-budget research. From there, we will evaluation a very powerful Funds bulletins which will have an effect on you.

How did the federal government body the 2024 Funds?

Within the curiosity of a short snapshot of the Funds within the authorities’s personal phrases, let’s have a look at the first pillars.

In his Funds speech, Treasurer Jim Chalmers said that the federal government’s essential priorities are:

- serving to with the price of dwelling

- constructing extra houses for Australians

- investing in a Future Made in Australia – and the abilities and universities we’ll have to make it a actuality

- strengthening Medicare and the care economic system

- accountable financial administration, which is about to provide one other surplus and assist battle inflation.

What had been small enterprise house owners searching for forward of the Funds?

It’s value taking a second to see what small enterprise house owners positioned significance upon earlier than the finances was launched, and which subjects had been of little curiosity. Have a fast flick by our pre-budget article to get an excellent grip on enterprise priorities.

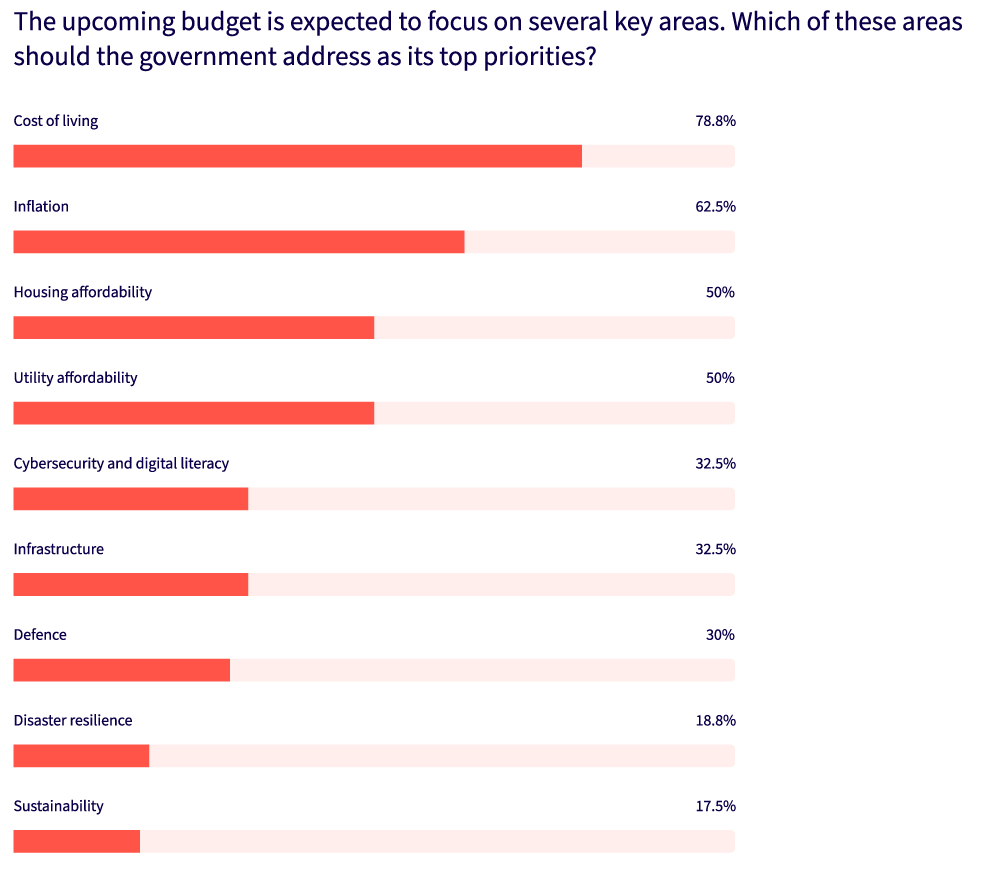

Right here had been the highest priorities for SMEs, with the very best precedence positioned upon value of dwelling (79%), inflation (63%), housing affordability (50%), and utility affordability (50%):

What else did we discover out in our pre-budget enterprise ballot?

- 73% had been searching for private earnings tax cuts

- 86% had been hoping the finances would tackle inflation

- 53% had been asking for an extension to the moment asset write-off

- 86% had been desirous to see measures to bolster cybersecurity

- 51% had been unconcerned with local weather change whereas 15% had been very involved

- 92% don’t consider sufficient is being performed to help the prosperity, development, and resilience of small companies

What had been a very powerful finances measures introduced for small companies?

Now, I don’t assume anybody may say this was a extremely small enterprise targeted finances. There have been definitely a number of omissions right here for a lot of SMEs, and I’m certain many had been hoping for extra direct help.

Nevertheless, there was additionally an honest stage of crossover if you examine the pre-budget want checklist to the precise announcement.

Let’s do a fast recap of what was on this 12 months’s finances for enterprise house owners.

1) The moment asset write-off has been prolonged

In a transfer that can delight those that want to buy new gear for his or her companies, the moment asset write-off has been prolonged for one more 12 months.

With 53% of our survey respondents searching for this, many enterprise house owners will probably be happy by the extension.

If your corporation has a turnover of lower than $10 million, your means to instantly deduct the total value of eligible bills, costing as much as $20 000, will proceed. Which means that SMEs can write off a number of items of latest enterprise gear instantly.

As Chalmers commented,

“We would like Australian small companies to share within the large alternatives forward as nicely, that’s why we’re extending the $20,000 instantaneous asset write-off till 30 June 2025, offering $290 million in money move help for as much as 4 million small companies.”

2) Vitality rebates for households and eligible small companies

One of many larger bulletins within the finances was the rebates for electrical energy prices. With 50% of small companies searching for higher utility affordability, this must be a welcomed transfer.

Additional than monetary reduction, the rebate is estimated by the federal government to “instantly scale back headline inflation by round 1/2 of a proportion level in 2024–25 and isn’t anticipated so as to add to broader inflationary pressures.”

This could go some approach to appeasing the 86% of small companies that wished to see measures to handle inflation.

The brand new energy invoice reduction will imply:

- each family (round 10 million) will obtain a $300 energy invoice rebate

- eligible small companies (round 1 million) will even obtain a $325 rebate on their energy payments all year long.

3) Tax cuts for all Australians

The beforehand introduced, and revised, stage three tax cuts at the moment are in play. This could please the 73% of small enterprise house owners (significantly sole merchants) who had been searching for private earnings tax cuts.

From 1 July, all 13.6 million Australian taxpayers will obtain a tax reduce, with new guidelines to cowl extra earners throughout the spectrum.

The federal government will even now:

- scale back the 19% tax price to 16%

- scale back the 32.5% tax price to 30%

- improve the 37% tax price earnings threshold from $120,000 to $135,000

- improve the 45% tax price earnings threshold from 180,000 to $190,000.

3) Measures to handle the price of dwelling and inflation

With the price of dwelling on the forefront of enterprise proprietor’s minds – coming in as the one most essential finances measure (79%) Australians had been definitely searching for significant reduction to rampant dwelling value pressures.

In line with the said goal of the finances, as framed by Jim Chalmers,

“The primary precedence of this authorities and this Funds helps Australians with the price of dwelling,” Chalmers instructed Parliament.

“Accountable reduction that eases strain on folks and instantly reduces inflation.”

With a variety of initiatives aimed to ease inflation in addition to dwelling prices, on prime of a $9.3 Billion finances surplus, the intent is evident. Nevertheless, with this goal in thoughts, not everybody agrees that the Funds delivers on its promise.

For instance, shadow treasurer, Angus Taylor, has accused Labor of providing up a “windfall surplus” that was constructed by “larger tax receipts from low unemployment and powerful commodity costs, reasonably than by fiscal astuteness”.

There are additionally a bunch of dissenting voices within the financial world who’ve various opinions on how nicely the finances really addresses inflation.

The foremost measures meant to scale back inflation and assist alleviate the price of dwelling embrace:

- energy invoice reduction

- earnings tax cuts

- housing and lease help

- cheaper medication

- pupil debt reduction

- inspecting grocery store pricing and competitors

- power transition help.

5) Addressing housing pressures

With 49% of surveyed companies itemizing housing affordability as a prime precedence, these enterprise house owners could also be happy to see a variety of inclusions right here.

Though, it should be stated there’s no silver bullet right here, and far of the allotted funds will probably be aimed toward these experiencing extreme, not average, housing stress.

To handle housing affordability the federal government has introduced:

- $6.2 billion invested in current housing initiatives. Such initiatives embrace additional enlargement to the Nationwide Housing Accord, Housing Australia Future Fund and Social Housing Accelerator.

- Assist for extra houses. An extra $1 billion will probably be offered to states and territories to assist ship extra housing and related utilities and roads.

- Extra lease help. Virtually $2 billion will probably be injected into including an extra 10% to the Commonwealth Lease Help program, constructing on the earlier 15% rise made in 2023.

- Extra help for susceptible Australians. $9.3 billion will probably be invested in a brand new 5 12 months Nationwide Settlement on Social Housing and Homelessness by working with states and territories.

6) The push for a ‘Future Made in Australia’

In information that can primarily have an effect on the bigger companies in Australia – and people extra particularly in manufacturing, uncommon mineral mining, and renewable power – there’s loads up for grabs.

The federal government has pledged nearly $23 billion for a variety of measures that look to spice up Aussie manufacturing, attain web zero extra shortly, help inexperienced power comparable to hydrogen, and capitalise on important minerals for merchandise like batteries.

In line with Chalmers, “Australian power can energy it, Australian sources can construct it, Australia’s areas can drive it, Australian researchers can form it and Australian staff can thrive in it. Our $22.7bn Future Made in Australia package deal will assist make us an indispensable a part of the worldwide economic system.”

In fact, this will probably be a politically contentious proposition, with the opposition labelling a lot of it a ‘handout to billionaires’.