“On this world nothing is for certain however demise and taxes” mentioned Benjamin Franklin

(Founding father of USA and face on America’s 100 greenback invoice/word).

Advance tax, because the identify implies, is the tax that one pays upfront. Advance tax is the revenue tax that’s payable in case your tax legal responsibility exceeds Rs 10,000 and must be paid in the identical yr during which revenue is obtained. It is usually referred to as as “Pay as you Earn” scheme because you pay the tax in the identical yr during which you earn revenue.

If you’re a Salaried worker and have revenue aside from revenue from wage then you must examine Advance Tax.

If you’re Freelancer, Professionals, companies, YouTuber, Blogger then you need to know and pay Advance Tax

- When you estimate that you’ll owe greater than Rs.10,000 on March 31 in taxes (after deducting TDS) then you must pay advance tax.

- You pay this tax in 4 installments and the due dates with Share of Advance Tax to be paid are 15 June(15%), 15 September(45%), 15 December(75%) and 15 March(100%).

- If the Earnings Tax shouldn’t be payable as per the above schedule, Curiosity is liable to be paid for late fee of tax as follows

- Curiosity underneath part 234B @ 1% per 30 days

- Curiosity underneath part 234C @ 1% per 30 days is payable if 90% of the tax shouldn’t be paid earlier than the top of the monetary yr

- Advance Tax will be paid by submitting a Tax Cost Challan,ITNS 280.Challan

- Tax relevant: For particular person Choose 0021 : INCOME-TAX (OTHER THAN COMPANIES)

- Sort of Cost: Sort of fee will depend on why you’re paying revenue tax. Enter 100 for Advance Tax.

- You could declare Advance Tax whereas submitting Earnings Tax Return ITR

Who has to pay Advance Tax?

The provisions of the Earnings Tax Act make it compulsory for each particular person, self-employed skilled, businessman, and company to pay Advance Tax, on any revenue on which TDS(Tax Deducted at Supply) shouldn’t be paid. Each people, in addition to corporates, should pay this tax.

Advance Tax for Salaried Worker

If a person’s solely revenue is his wage, then the employer will deduct tax from his revenue(TDS) and submit it. In such a case there isn’t any trigger for fear over advance tax fee. The tax deducted shall be made out there to the worker by the employer in Kind 16.

However when a Salaried worker has revenue aside from revenue from wage then he has to fret about Advance Tax. Ex revenue from different sources corresponding to curiosity gained (on saving checking account), capital good points, lottery wins, from home property or from enterprise, then advance tax turns into related.

If one estimates that one will owe greater than Rs.10,000 on March 31 in taxes (after deducting TDS) then you must pay advance tax.

Freelancers, Professionals, companies, YouTuber

Presumptive revenue for Professionals: Unbiased professionals corresponding to docs, legal professionals, architects, and so forth. come underneath the presumptive scheme underneath part 44ADA. They should pay the entire of their advance tax legal responsibility in a single installment on or earlier than 15 March. They will additionally pay the total tax due by 31 March.

Presumptive revenue for Companies: The taxpayers who’ve opted for a presumptive taxation scheme underneath part 44AD should pay the entire quantity of their advance tax in a single installment on or earlier than 15 March. Additionally they have an choice to pay all of their tax dues by 31 March.

Who doesn’t should pay Advance Tax?

Advance Tax is NOT relevant when

- A senior citizen (the resident particular person who’s 60 yrs or extra) who wouldn’t have any revenue from enterprise & occupation, doesn’t should pay advance tax. This variation was launched from AY 2013-14. Extra particulars at Senior Citizen : Earnings and Tax

- If one adopts presumptive taxation then one has to declare revenue on the prescribed charge and no different deductions are allowed. One has to pay your complete advance tax by 15 March. That is relevant for

How one can discover if you need to pay advance tax

As we all know there are 5 sorts of Earnings, Earnings from Wage, Earnings from Home Property(Any residential or business property that you just personal shall be taxed), Earnings from Capital Positive factors (If you promote Mutual Funds, Shares, Bond, Gold, Land or Property, Earnings from Income and Positive factors of Enterprise or Occupation & Earnings from Different Sources. Particulars in our article Perceive Earnings Tax

For advance tax examine

- Earnings from Home Property: In case you have rental revenue.

- Earnings from Capital Positive factors: Have you ever bought Mutual Funds, Shares, Bond, Gold, Land, or Property. Tax labeled as Lengthy Time period Capital Achieve Tax(LTCG) and Quick Time period Capital Achieve(STCG) relies on the asset you bought, the time interval you owned the asset. Particulars in our article Capital Achieve Calculator on Sale on Property, Mutual Funds, Gold, Shares

- Earnings from Income and Positive factors of Enterprise or Occupation: The revenue chargeable to tax is the distinction between the credit obtained on operating the enterprise and bills incurred.

- Earnings from Different sources: Test the following revenue. Particulars in our article Earnings From Different Sources

- the curiosity of Saving Financial institution Account,

- Curiosity from Mounted Deposit, Recurring Deposit, Senior Citizen Saving Scheme(SCSS) and so forth

- Curiosity from Earnings Tax Refund

- Household Pension

- Dividend Earnings: Dividend obtained on or after 1 April 2020 is taxable within the palms of the investor/shareholder. Particulars in our article Dividend and Tax

What if we don’t pay Advance Tax?

If you need to pay advance tax and When you fail to pay your Advance Tax or, for those who pay lower than the stipulated tax, you’ll be penalised and must pay additional underneath Sections 234A, 234B, 234C. So there isn’t any escaping Tax. Because the Earnings Tax workplace says “Pay Tax Karo Calm down“

The curiosity is calculated at 1% easy curiosity per 30 days on the defaulted quantity for 3 months. The curiosity penalty would proceed as much as the following deadline. If even after the final deadline of 15 March, the tax shouldn’t be paid, then the 1% could be on the defaulted quantity for a month, till the tax is totally paid.

Why Pay Advance Tax?

Advance tax is among the main instruments utilized by the Govt. to gather tax from the assesses throughout India. This pay as you go type of tax is designed in such a method that an assessee is made to pay tax to the Govt. in a ‘Pay as You Earn Scheme’. This primarily goals at decreasing the last-moment hassles to an assessee for fee of tax legal responsibility which can be due to both scarcity of time or funds.

The intention of the Indian authorities behind establishing the advance tax system was to hurry up the tax assortment. This method additionally allowed the federal government to earn curiosity on the quantity collected as tax, thus rising funds to the federal government coffers.

How is advance Tax Calculated?

Advance tax is computed on revenue that a person would possibly earn through the yr, in that sense, it’s estimated revenue. The tax is calculated utilizing the charges relevant for the monetary yr.

Suppose after paying your first installment of tax on the estimated revenue, your precise revenue elevated attributable to some shares/mutual funds you bought, You’ll need to revise your revenue and accordingly pay the differential within the subsequent installment.

Though Advance Tax is liable to be paid on all incomes together with Capital Positive factors, it’s tough to estimate the Capital Positive factors which can come up in an yr. Due to this fact, in such circumstances, it’s supplied that if any such revenue arises after the due date of any installment, then, your complete quantity of tax payable on such capital achieve (after claiming exemption underneath part 54) shall be paid in remaining installments of Capital Positive factors that are due. If your complete quantity of tax payable is so paid, then no curiosity on late fee shall be levied

Listed under are the steps to calculate advance tax:

- Decide the Earnings: Decide the revenue you obtain aside from your wage. It’s necessary to incorporate any ongoing agreements which may pay out later.

- Minus the Bills: Deduct your bills from the revenue. You may deduct bills associated to your work (freelancing) corresponding to hire of the work place, journey expense, web and telephone prices.

- Whole the Earnings: Add up different revenue that you just would possibly obtain within the type of hire, curiosity revenue, and so forth. Deduct the TDS deducted out of your salaried revenue.

- Whole Advance Tax: If the tax due exceeds Rs.10,000 then you definately’ll should pay advance tax.

Advance tax Charges and Dates

From FY 2016-17 For each particular person and company taxpayers

| Due Date | Advance Tax Payable |

|---|---|

| On or earlier than fifteenth June | 15% of advance tax |

| On or earlier than fifteenth September | 45% of advance tax |

| On or earlier than fifteenth December | 75% of advance tax |

| On or earlier than fifteenth March | 100% of advance tax |

Beneath are the dates and percentages earlier than FY 2016-17.

| Due Date | Installment % of Advance Tax |

| fifteenth September | Up-to 30% |

| fifteenth December | Up-to 60% |

| fifteenth March | Up-to 100% |

For instance, suppose your complete tax legal responsibility(after deducting TDS) for this yr is Rs 1,00,000

So by fifteenth June you will have to pay 15% which involves Rs 15,000

So by fifteenth September you will have to pay 45% which involves Rs 45,00

By fifteenth December you’ll have to cowl 75%, so you will have to pay one other Rs 75,000.

By fifteenth March, 100% of advance tax involves Rs 100,000, you will have to pay one other Rs 25,000.

Penalty on not paying/paying much less Advance Tax: Sections 234A, 234B and 234C

When you owe greater than Rs.10,000(after deducting TDS) whereas submitting your returns, you can be penalized with Curiosity underneath sections 234A , 234 B & 234 C

Below Part 234C, there are three elements. For the primary instalment, the shortfall penalty is calculated for 3 months @1% p.m. Equally, within the second instalment, the shortfall penalty can also be calculated for 3 months @1% p.m and the ultimate instalment is calculated at a flat charge if 1% for 1 month solely.

Below part 234B, penalty arises when the entire quantity of advance tax paid together with the quantity of TDS is lower than 90% of the entire tax legal responsibility. In such a case, curiosity is calculated at 1% per 30 days of the quantity of shortfall for the time interval from April to the month during which the return is filed.

Below part 234A, the legal responsibility arises solely when the return is filed after the due date which for AY 2020-21 is 30 Nov.

Finotax has nice Advance tax calculators. Test it out right here. Let’s have a look at these sections intimately.

Curiosity underneath part 234 C

234 C shall be relevant for those who don’t pay your advance taxes in common installments. As per the Earnings Tax Act, you’re presupposed to pay 15% of advance tax by 15 Jun, 30% of your advance tax by fifteenth Sep, 60% by fifteenth December and 100% by fifteenth March. Let’s see it by means of some examples.

Mr. Khushal is operating a clothes store. Tax Legal responsibility of Mr. Khushal is Rs 45,500. He has paid advance tax as given under:

Rs. 8,000 on fifteenth June, Rs. 11,000 on fifteenth September, Rs. 12,000 on fifteenth December, Rs. 14,500 on fifteenth March. Is he liable to pay curiosity underneath part 234C, if sure, then how a lot?

Any tax paid until thirty first March shall be handled as advance tax. Contemplating the above dates, the advance tax legal responsibility of Mr. Khushal at totally different installments shall be as follows:

1) In first installment: Not lower than 15% of tax payable must be paid by fifteenth June. The tax legal responsibility is Rs. 45,500 and 15% of 45,500 quantities to Rs. 6,825. Therefore, he ought to pay Rs. 6,825 by 15thJune. He has paid Rs. 8,000, therefore, there isn’t any quick fee in case of first installment.

2) In second installment: Not lower than 45% of tax payable must be paid by 15thSeptember. Tax legal responsibility is Rs. 45,500 and 45% of 45,500 quantities to Rs. 20,475. Therefore, he ought to pay Rs. 20,475 by fifteenth September. He has paid Rs. 8,000 on fifteenth June and Rs. 11,000 on fifteenth September (i.e. complete of Rs. 19,000 is paid until 15thSeptember). There’s quick fee of Rs. 1,475 (i.e. Rs. 20,475 – Rs 19,000).

Although there may be quick fee of Rs. 1,475 however Mr. Khushal is not going to be liable to pay curiosity underneath part 234C as a result of he has paid minimal of 36% of advance tax payable by fifteenth September. He has paid Rs. 19,000 until fifteenth September and 36% of 45,500 quantities to Rs. 16,380. Therefore, no curiosity shall be levied in case of deferment of second installment.

3) In third installment: Not lower than 75% of tax payable must be paid by fifteenth December. Tax legal responsibility is Rs. 45,500 and 75% of 45,500 quantities to Rs. 34,125. Therefore, he ought to pay Rs. 34,125 by fifteenth December. He has paid Rs. 8,000 on fifteenth June, Rs. 11,000 on fifteenth September and Rs. 12,000 on fifteenth December (i.e. complete of Rs. 31,000 is paid until 15thDecember). There’s a quick fee of Rs. 3,125 (i.e. Rs. 34,125 – Rs 31,000). Therefore, he shall be liable to pay curiosity underneath part 234C on account of quick fall of Rs. 3,125 (*).

There’s a quick fall of Rs. 3,125 in case of third installment. As a result of quick fall in case of third installment, curiosity underneath part 234C will be levied. Curiosity shall be levied at 1% per 30 days or a part of the month on the quick paid quantity of Rs. 3,100 (i.e. Rs. 3,125 rounded off to Rs. 3,100 as per Rule 119A). Curiosity shall be levied for a interval of three months. In different phrases, curiosity shall be levied on Rs. 3,100 at 1% per 30 days for 3 months. Curiosity underneath part 234C will come to Rs. 93.

4) In final installment: 100% of tax payable must be paid by fifteenth March. The entire tax legal responsibility of Rs. 45,500 is paid by Mr. Khushal by fifteenth March (i.e. 8,000 on fifteenth June, Rs. 11,000 on15th September, Rs. 12,000 on fifteenth December and Rs 14,500 on fifteenth March). Therefore, there isn’t any quick fee in case of final installment. Thus, Mr. Khushal is not going to be liable to pay curiosity underneath part 234C in case of final instalment.

Curiosity underneath part 234 B

234 B shall be relevant when the entire advance tax paid is lower than 90 % Tax Payable. This shall be charged at 1% per 30 days until you pay your remaining taxes. Let’s work it out by means of an Instance:

Mr. Suraj is a businessman. His tax legal responsibility as decided underneath part 143(1) is Rs. 28,400. He has not paid any advance tax however there’s a TDS credit score of Rs. 10,000 in his account. He has paid the steadiness tax on thirty first July i.e. on the time of submitting the return of revenue. Will he be liable to pay curiosity underneath part 234B, if sure, then how a lot

On this case, the tax legal responsibility (after permitting credit score of TDS) of Mr. Suraj involves Rs. 18,400 (i.e. Rs. 28,400 – Rs. 10,000) which exceeds Rs. 10,000 and therefore, he shall be liable to pay advance tax. He has not paid any advance tax and therefore, he shall be liable to pay curiosity underneath part 234B. Curiosity underneath part 234B shall be levied at 1% per 30 days or a part of the month. In this case, Mr. Suraj has paid the excellent tax on thirty first July and therefore, curiosity underneath part 234B shall be levied for the interval from 1st April to thirty first July i.e. for 4 months. Curiosity shall be levied on unpaid tax legal responsibility of Rs. 18,400. Curiosity at 1% per 30 days on Rs. 18,400 for 4 months will come to Rs. 736.

When you pay our taxes in between April – July interval then curiosity @1% shall be utilized solely on the steadiness tax payable .

On-line Advance Tax Calculators(Free)

Video on Advance Tax

This 8:32 video explains Advance Tax.

This video talks about the right way to Calculate Advance Tax

How one can pay advance Tax?

You may pay advance tax in India by means of two strategies: on-line or offline. Right here’s a breakdown of each:

On-line Cost:

- Go to the Earnings Tax Division’s e-payment web site: [income tax e payment ON Income Tax Department portal.incometax.gov.in]

- Enter your PAN and cellular quantity and proceed after verification with OTP.

- Choose the Evaluation Yr (2024-25 for present state of affairs) and select “Advance Tax (100)” underneath Sort of Cost.

- Fill within the challan particulars like State Code, circle code (refer web site for particulars).

- Select the fee methodology (web banking or debit card) and your financial institution.

- Preview the challan for accuracy and click on “Pay Now” to finish the fee.

Offline Cost:

- Obtain Challan 280 kind from the Earnings Tax Division web site.

- Fill the challan with particulars like your PAN, evaluation yr, tax sort (100 for Advance Tax).

- Point out the installment quantity (will depend on the due date).

- Submit the finished challan at any financial institution approved to gather tax funds.

Extra Ideas:

- Use an advance tax calculator to estimate your tax legal responsibility for correct fee.

- Make a copy of the challan (on-line fee receipt or Challan 280 copy) for record-keeping throughout ITR submitting.

- The final date for the present installment (March 2024) is March fifteenth, so make sure you pay earlier than the deadline to keep away from curiosity penalties.

Advance Tax will be paid by submitting a Tax Cost Challan,ITNS 280.Challan, at designated branches of banks empanelled with the Earnings Tax Division. Branches of ICICI, HDFC and SBI settle for Advance Tax Cost Challans. Alternatively, people may pay Advance Tax on-line by means of the Earnings Tax Dept / NSDL web site. e-Cost facilitates fee of direct taxes on-line by taxpayers. To avail of this facility the taxpayer is required to have a net-banking account with any of the Approved Banks.

Video on How one can Pay Advance Tax

https://www.youtube.com/watch?v=uyS00Ofc6og

Confirm Advance Tax in Kind 26AS

Half C of Kind 26AS has particulars of Tax Paid (aside from TDS or TCS). In case you have paid Advance Tax or Self Evaluation Tax it will seem on this part. Please confirm that advance tax or self evaluation tax particulars are displaying up in Kind 26AS, In the event that they don’t match along with your particulars please contact the Financial institution.

Present Advance Tax in ITR

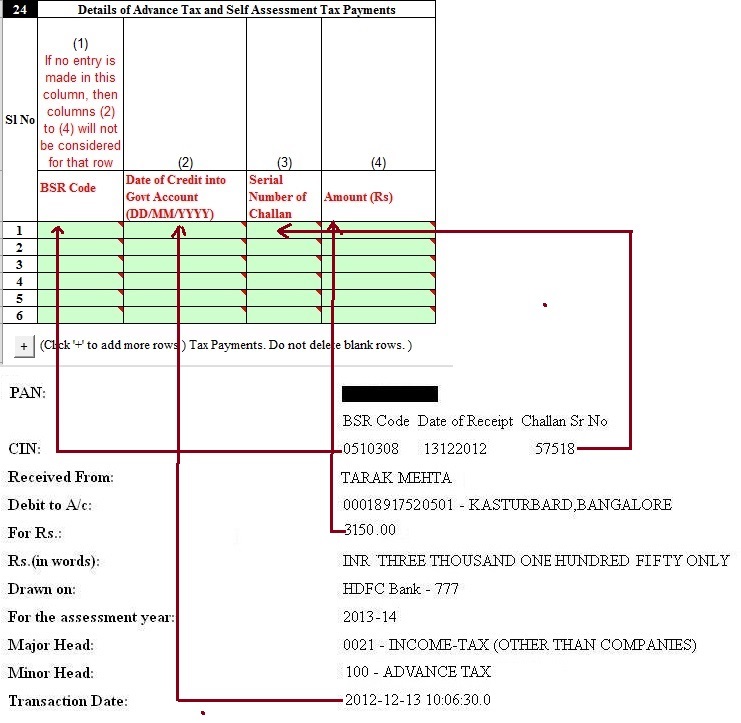

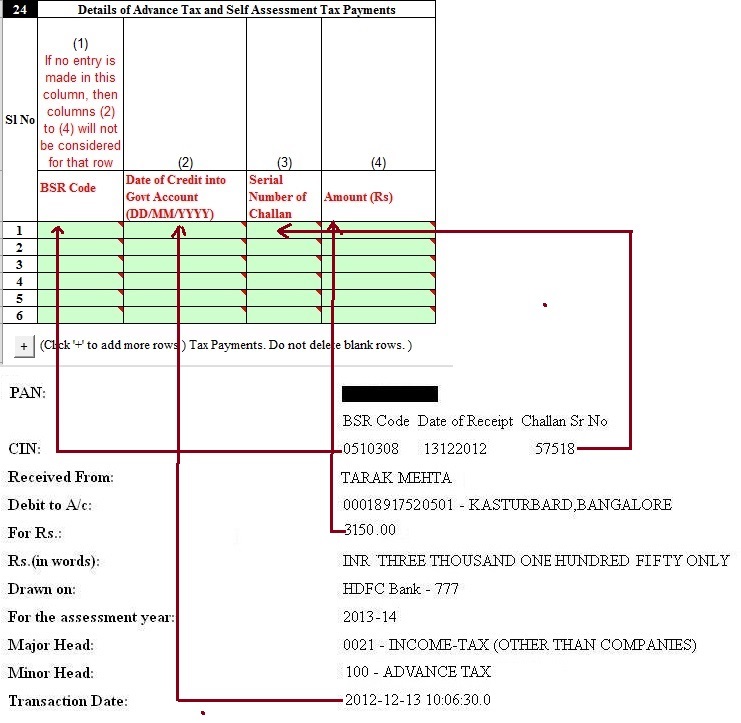

After paying revenue tax by means of Challan 280 what subsequent? Is your duty over. No. It is advisable present the tax paid in your ITR, In case you have paid Advance/ Self Evaluation tax by means of Challan 280 fill within the particulars in Tax paid and make it possible for your tax legal responsibility is 0 earlier than submitting the return as defined for ITR1 in our article Fill Excel ITR1 Kind : Earnings, TDS, Advance Tax and proven in picture under.

Associated Posts:

All About Earnings Tax

It’s mentioned “Earnings tax returns are probably the most imaginative fiction being written at the moment.”

Do you pay Advance Tax?